Real GDP rose at a 4.0% annualized rate in 4Q20. This is somewhat below consensus expectations that were clustered in the high-4% to low-5% range. It is way below what folks were talking about just six weeks ago, when various forecasters were looking for as much as 11% growth.

What happened? Well, renewed shutdowns hitting restaurants and related leisure sectors were a big part of the shortfall. However, it was also the case that consumer spending on merchandise pulled back a bit, a development that many analysts see as a sign of weakness, but that we interpret as an inevitable pullback from unsustainably high consumer spending levels in the summer.

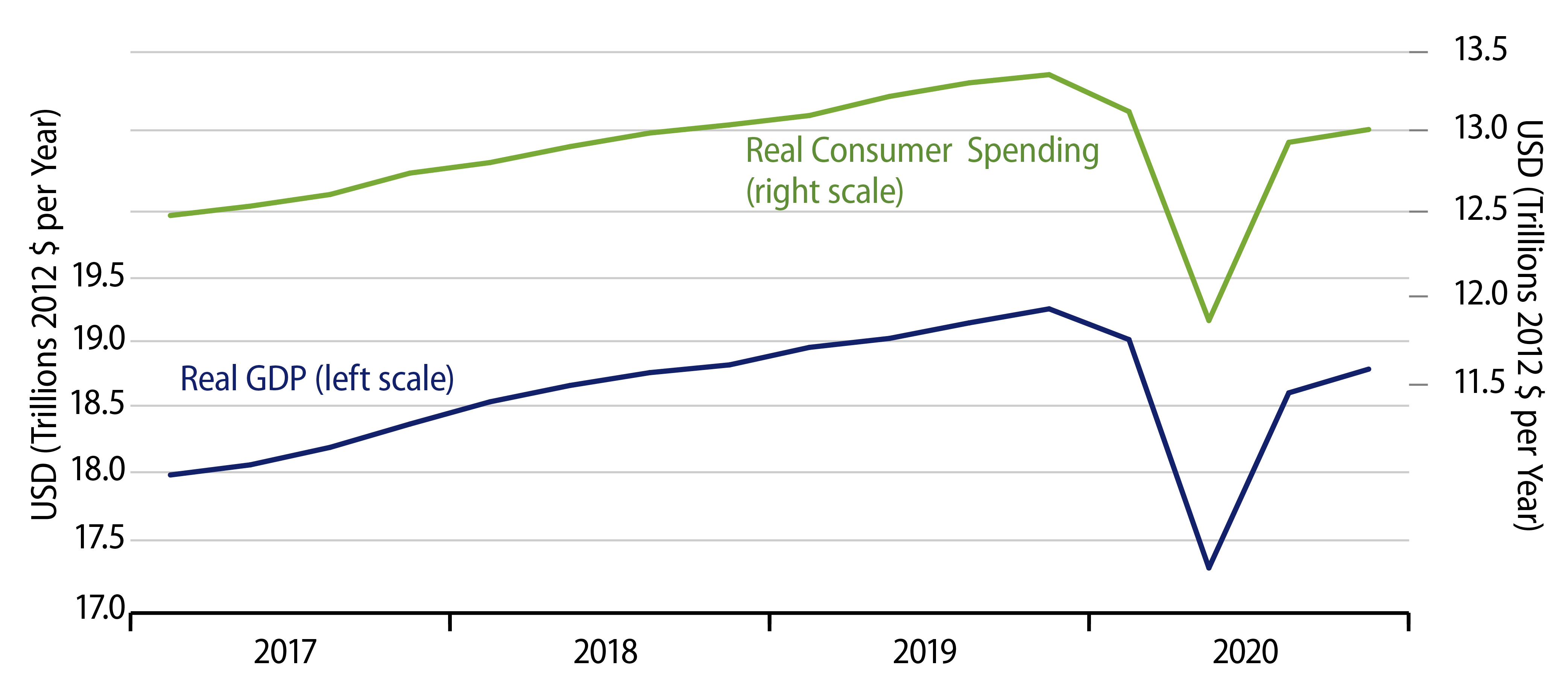

For 2020 as a whole, GDP fell 2.5%. In annualized 2012 dollar terms, the decline was $474 billion, $350 billion of which came from consumer spending. Within consumer spending, purchases of merchandise were actually up sharply from 4Q19, even while they were down slightly from 3Q20.

Again, we take this fact as indicating not weak spending, but rather a pullback toward sustainable levels. Consumers were restocking merchandise in 3Q20—and, to a lesser extent, in 4Q20—after enforced abstinence during the spring shutdown. So, there was nothing weak about 4Q20 spending levels on merchandise.

The problem was on the services side, where shutdowns are still constraining spending. Thus, services consumption in 4Q20 was down 6.8% from 4Q19, led by a 25.1% drop in travel spending and a 21.3% drop in spending at restaurants and hotels/motels.

Some other sectors of the economy showed a better tone than the -2.5% GDP change on the year might suggest. Thus, residential construction showed a whopping 13.7% increase in 4Q20 over 4Q19, and business investment in equipment and intellectual property (R&D) was also up on the year on net, though business construction was down.

For both residential construction and business equipment investment, as with consumer spending on goods, there was likely still some catching up in 4Q20 from activity forcibly prevented in 2Q20. Thus, we are likely to see some pullback in these sectors as we get into 2021, as pent-up demand is sated.

Then again, as Covid cases continue to decline and widespread Covid vaccination occurs, the service sectors should rebound substantially this year. In order merely to return to pre-Covid trend paths, real GDP would have to grow by 6.7% in the four quarters ahead. We believe this is possible, perhaps inevitable.