Performance Overview

Munis rallied in September.

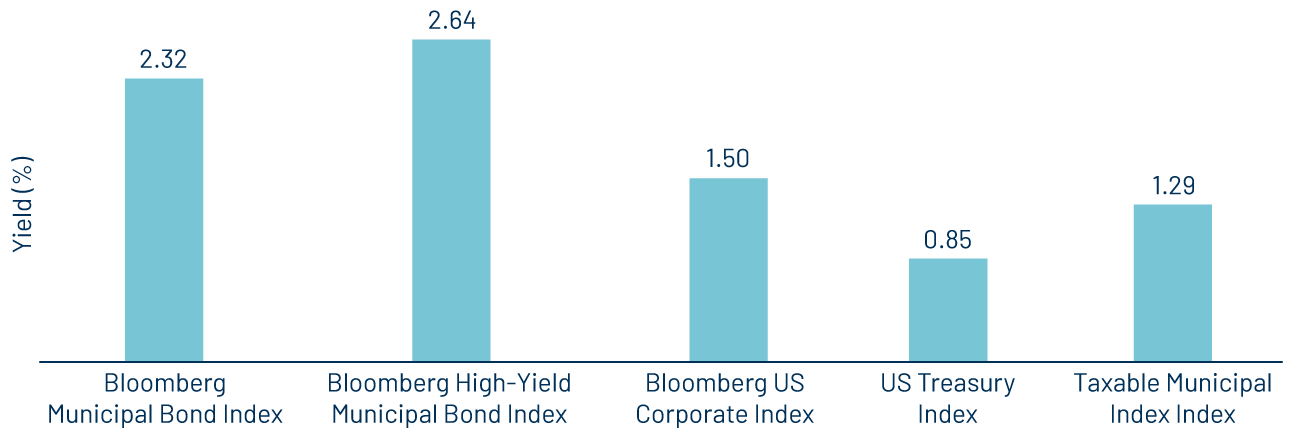

In September, fixed-income market sentiment was bolstered by expectations that the Federal Reserve (Fed) would continue to cut the fed funds rate. These expectations were reinforced by weak labor data early in the month, as August nonfarm payrolls increased by 22,000 jobs, down from the prior month and falling below expectations, along with weaker than anticipated inflation figures. After the Fed reduced interest rates at the end of the month, the positive sentiment partially abated as strong data emerged, including increasing home sales and upward revisions to GDP data. All told, Treasury yields moved lower during the month, and municipals outperformed amid improving demand conditions. The Bloomberg Muni Bond Index returned 2.32% during the month, leading year-to-date (YTD) returns higher to 2.64%.

Supply and Demand Technicals

Muni supply remains at a record pace this year.

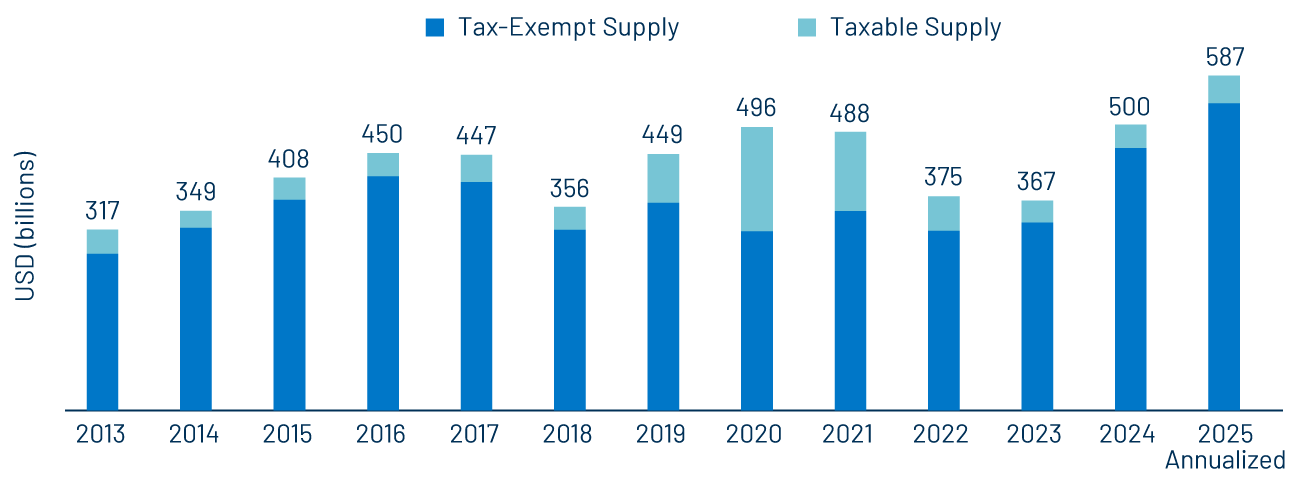

Municipal supply maintained an elevated pace in September. Total new-issue volume reached $49 billion, which is in line with September 2024 and August 2025 supply levels. YTD municipal issu- ance totaled $437 billion, 15% higher than the prior record-year levels. The YTD tax-exempt supply of $401 billion is 15% higher year-over-year, while the taxable supply of $36 billion is 17% higher than prior year levels.

Municipal demand remained robust, particularly for longer-duration municipals, as the Fed cut rates. Municipal mutual funds recorded $5.5 billion of net inflows, according to Lipper. Long-term funds led muni categories at $3.5 billion of net inflows, followed by high-yield and intermediate categories at $2.2 billion and $1.2 billion, respectively.

Fundamentals

Despite slower economic growth, state and local tax collections growth remains strong.

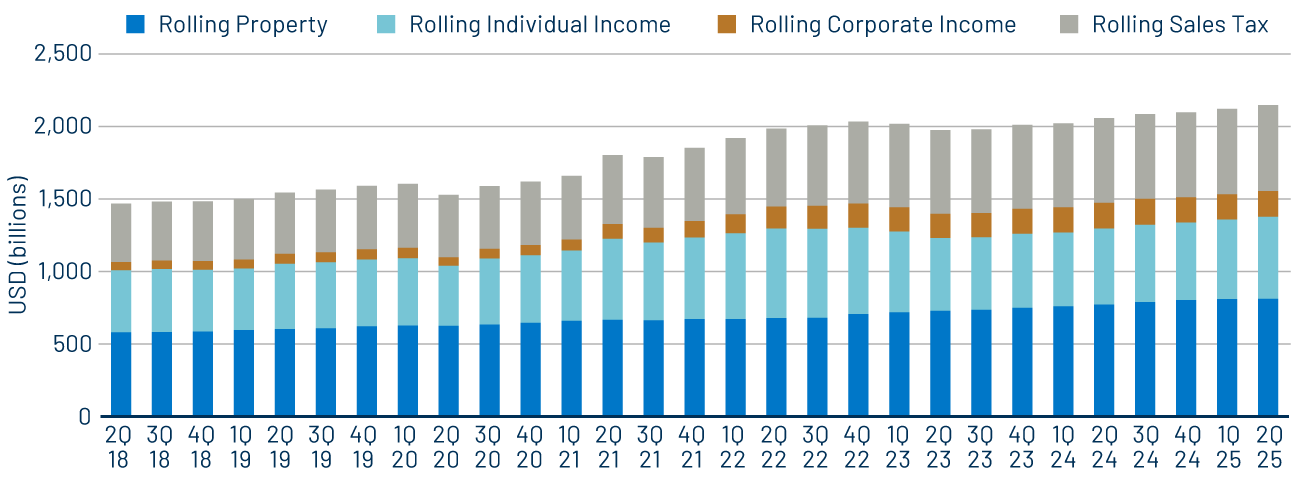

In September, the Census released 2Q25 state and local tax collection estimates, which coincided with the end of the fiscal year for most state and local governments. Second quarter major state and local government tax collections increased 5% from 2Q24 levels to $562 billion. The continued growth of state and local tax collections highlights the resilience of state and local revenues despite the lower economic growth trends observed earlier in the year. We expect a strong labor market and consumer spending to support tax collections and municipal credit conditions over the medium term. However, we expect the potential for tax collections to be more critical for budgets if federal spending reductions extend more broadly to state and local budgets.

Valuations

The long end outperformed as the curve flattened.

As the Fed telegraphed a rate cut in September, the municipal bond yield curve significantly re- versed the steepening observed earlier in the year. From September 1 to September 30, the AAA municipal yield curve 1-year yield rose 11 basis points (bps) to 2.30% while the 30-year yield fell 35 bps to 4.30%.

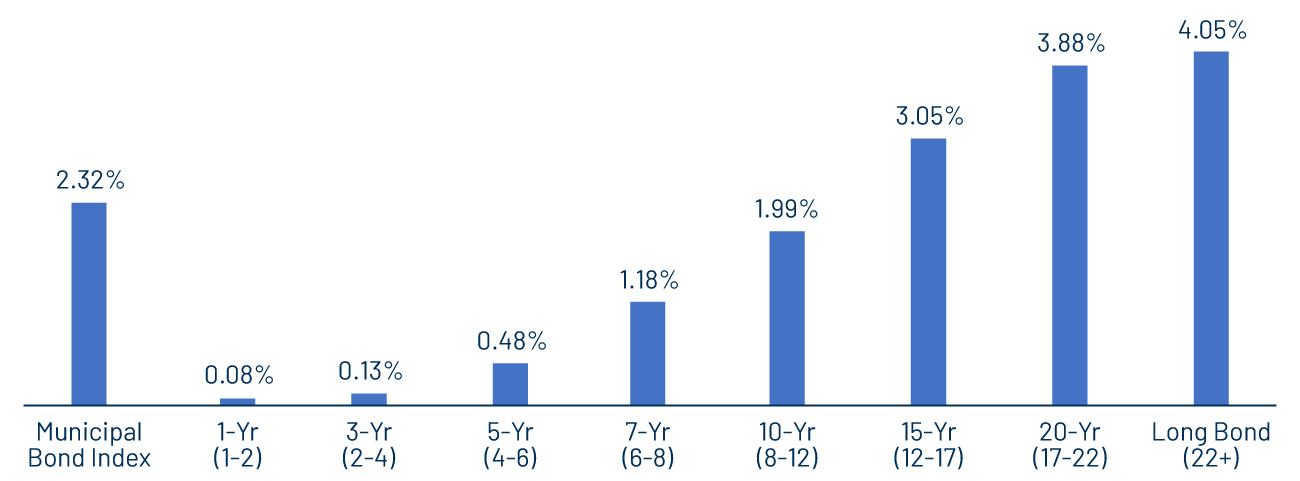

As a result of the curve flattening, longer maturities outperformed in September, with the Bloomberg Long Municipal Bond Index (22+ Year) returning 4.05%, retracing all the negative per- formance accumulated by the index this year. Meanwhile, the Bloomberg 1-Year Muni Bond Index significantly underperformed, returning just 0.08% during the month. The strong performance of longer-term munis is indicative of investors seeking higher income ahead of anticipated Fed rate cuts. Western Asset believes longer maturities continue to offer attractive relative value for long- term investors, considering elevated absolute muni yield levels and rolldown opportunities from the curve, which remains relatively steep versus taxable fixed-income markets.