Consumer spending showed decent July growth and some upward revision to previous data, while the Federal Reserve’s (Fed) favored core Personal Consumption Expenditures (PCE) inflation measure showed a modest July bounce. Both the strong July growth and upward revisions for consumption were focused in spending on merchandise, in line with what the July retail sales report showed. Services spending remained lackluster. For the inflation data, PCE goods inflation subsided while services inflation flared in line with July CPI data; this was the opposite of what we had seen in preceding months.

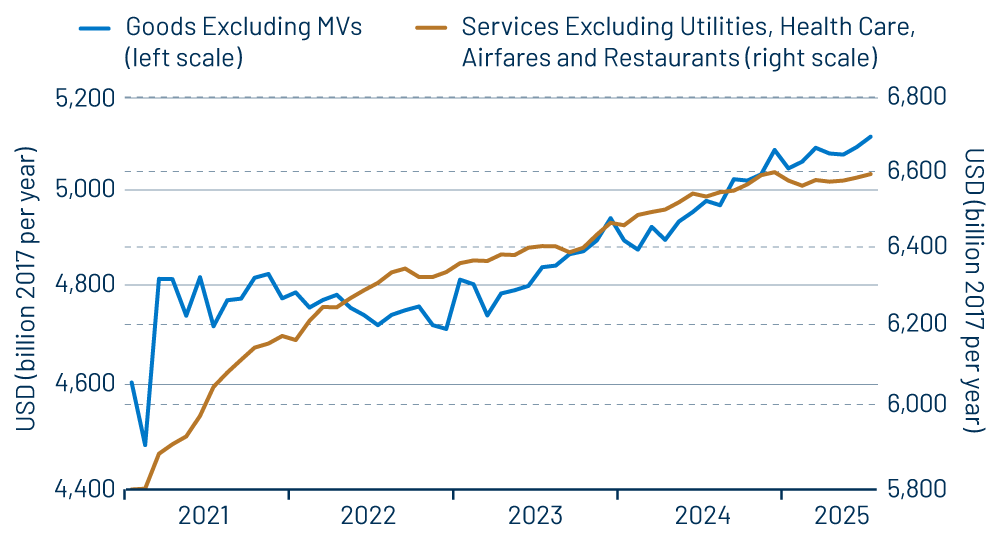

Exhibit 1 shows select (less volatile) components of real goods and services spending. The goods component showed a 0.4% July gain on top of a +0.3% revision to June data. On net, this measure shows fairly steady growth throughout this year, a better take than what the series showed a month ago, and only a modest slowing from last year’s pace.

For services, spending picked up slightly in recent months after a noticeable slowing early in the year. On net, year-to-date 2025 growth in services consumption is still markedly slower than what we saw in 2024.

As we have discussed in previous posts, this is exactly the opposite of what one would expect in response to tariffs. That is, tariffs mostly affect merchandise prices, not services prices. Therefore, basic economics would suggest some slowing in real spending on merchandise in response to tariff-related increases in goods prices, with services spending less affected.

Instead, merchandise spending has held up better than services spending this year. While the effects of tariffs on merchandise prices are clearly discernible, the details of the spending data suggest to us that something other than tariffs is also impacting consumer behavior.

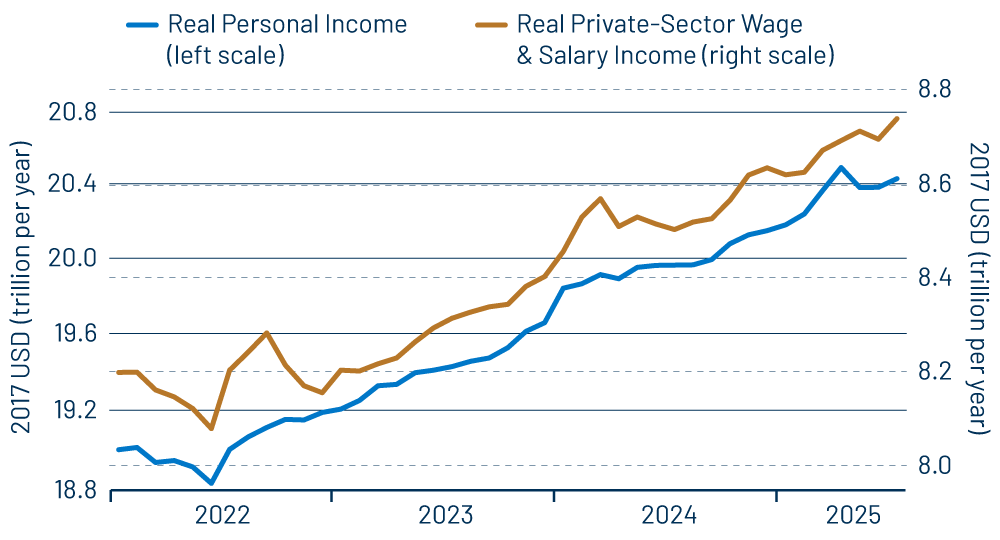

That “something other” does not seem to be softening income growth. As shown in Exhibit 2, real wage and salary incomes have been growing steadily this year despite the slowing in job growth. Total real incomes appear to have fallen back in recent months, but that is a distortion due to wild swings in benefit payments (mostly Social Security). Social Security benefits jumped sharply in April due to some legislated one-time payments but have since fallen back to more normal levels.

Net of these swings—looking at January through July—real total personal income growth also appears steady. Keep in mind that this steady income growth is occurring alongside various Fed officials’ fretting about a softening labor market. Bottom line, we see no problems with the income data that would be driving softer spending. And as discussed earlier, our view is that goods spending looks steady and decent in the latest data. The issues with consumer spending lie within the services components, and even these have shown some improvement lately.