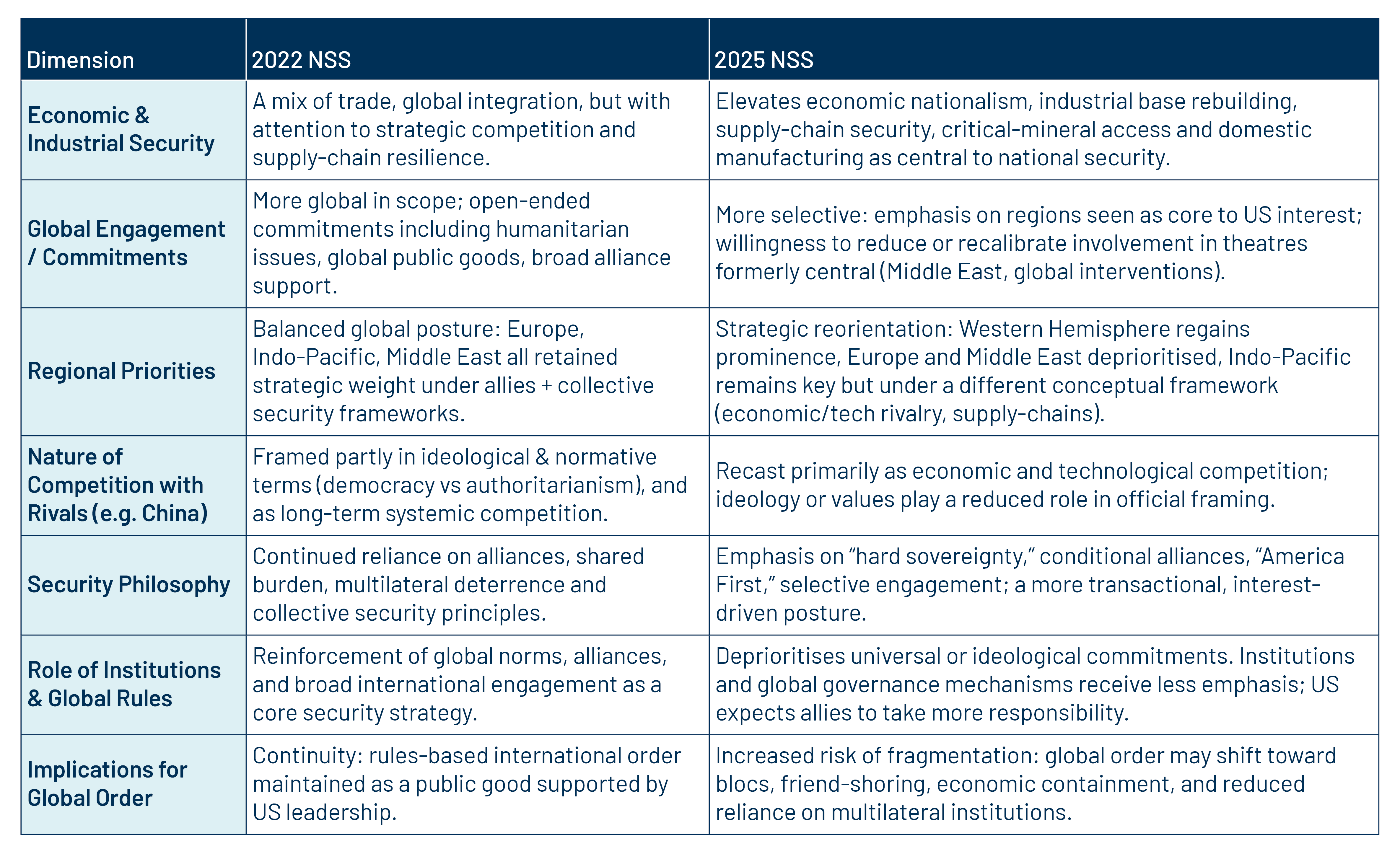

US National Security Strategy (NSS) reports rarely influence financial markets. They typically reaffirm long-standing US priorities such as military strength, alliances, trade and diplomacy, and most readers treat them as confirmation rather than signals of change. The 2025 NSS report breaks that pattern. It integrates foreign policy and economic policy into a single framework, presenting the US economy as the first layer of national defense and signaling a shift away from earlier strategies that treated economic integration as a stabilizing force.1

At the core of the new NSS is a push to rebuild domestic industrial strength. Manufacturing capacity, access to critical minerals, energy stability and technological leadership have become foundations of national power.2 The strategy argues the US cannot depend on global markets alone for reliable access to semiconductors, minerals and other strategic inputs. It calls for tighter coordination between government objectives and private investment. Tools such as targeted incentives, export controls and security screening help steer capital toward sectors that matter most for security.3 This is a notable departure from previous strategies that emphasized efficiency and global diversification as key sources of resilience.

This industrial strategy also shapes trade and financial policy. Trade deficits with strategic competitors are viewed as vulnerabilities because they weaken industrial capacity. Tariffs and trade measures shift from bargaining tools to instruments that shape supply chains.4 The NSS also highlights that US financial strength and the dollar’s global role depend on more than reputation. They require maintaining technological leadership, secure institutions and an economic base capable of attracting global capital. This logic extends into monetary and financial policy, where capital flows are described as closely tied to industrial capacity and technological competitiveness.

The strategy reorders regional priorities by ranking where interests are strongest. The Western Hemisphere sits at the top, with Latin America described as a key supply chain and resource partner supporting energy, minerals, manufacturing and migration stability. It becomes an economic buffer that reduces reliance on Asian supply chains.5 The NSS presents this realignment as overdue, arguing that geographic proximity, resource endowments and shared economic systems make the region central to long-term resilience and investment planning.

The Indo-Pacific region remains central, but with a narrower focus. China is described less as an ideological threat and more as an economic competitor that shapes global supply chains and strategic materials. The NSS calls for more balanced defense spending and broader risk sharing across the region. Allies including Japan, South Korea, Taiwan and Australia are asked to take on more responsibility, while the US retains a major role without offering unlimited guarantees.6 Analysts note that this reflects a shift from earlier strategies that emphasized ideological differences over structural economic competition.

In this NSS, Europe garners more direct language regarding the quality of its institutions, fragmented politics and long-term reliability than in past releases.7 The war in Ukraine is treated as a challenge that requires stability more than sustained US leadership. The message is straightforward. Europe must manage more of its defense and improve its competitiveness to retain support. The tone signals a recalibration focused on burden-sharing rather than disengagement.

Beyond Europe, the NSS is adopting a selective approach for other regions. The Middle East remains important for managing risks, protecting trade routes and cooperating on targeted issues rather than shaping overall strategic posture. This report emphasizes predictability over deep regional engagement, focusing on energy flows, maritime security and counterterrorism. Africa is approached through specific goals such as minerals, energy and conflict mediation, where outcomes influence broader competition. The strategy takes a sector-driven approach, elevating critical minerals, infrastructure links and conflict stabilization over broad diplomatic or governance initiatives.

International reactions reflect these adjustments. European officials immediately pushed back against language about migration and political stability.8 In contrast, Indo-Pacific governments responded cautiously. Many saw potential benefits for supply chain cooperation and technology partnerships, but also raised questions about whether US commitments would remain reliable during a crisis. At the same time, some global actors including Russia welcomed the changes, seeing the revision as more compatible with its own preferred global order.9 These reactions suggest that implementation of the 2025 NSS may require Washington to carefully navigate alliance cohesion and credibility in a more complex coalition environment.

If implemented, the NSS could reshape business decisions across several industries. Sectors tied to national resilience and advanced production, such as semiconductors, defense systems, energy infrastructure and mineral processing, stand to gain from government incentives and investment. Competition for rare earth elements used in batteries, electronics and advanced defense systems is also likely to intensify as firms diversify away from concentrated or politically sensitive sources. Conversely, sectors dependent on global efficiency may face new challenges. These include multinational manufacturing, aviation, high-tech supply networks and international financial services. Decisions about where to produce, invest and raise capital may increasingly depend on political risk and security standards rather than cost alone.

Emerging markets will gain importance, especially those with critical minerals, scalable energy projects or reliable industrial bases. Countries in Latin America, Southeast Asia and parts of Africa may move from being low-cost exporters to strategic partners in supply chain resilience. Investments in infrastructure and mineral extraction are likely to grow as governments and corporations compete to secure resources and production capacity. This dynamic also introduces new diplomatic considerations as countries with mineral endowments seek to leverage their position in global supply chains.

The broader takeaway is that the US is redefining the foundation of national power. The 2025 NSS prioritizes domestic capability, secure supply chains and strategic economic leverage rather than relying primarily on global institutions and broad commitments. If carried out at scale, this shift will influence trade flows, investment decisions and global supply networks well into the future.

ENDNOTES

1. The White House, 2025 National Security Strategy, December 2025; Council on Foreign Relations, “Unpacking a Trump Twist of the National Security Strategy,” December 2025.

2. Critical minerals for the US are natural resources essential to the economy or national security, whose supply chains are vulnerable to disruption and whose absence would significantly impact manufacturing, defense or energy technologies. Examples include cobalt, graphite, lithium, nickel, rare earth elements and platinum group metals.

3. Atlantic Council, “Experts React: What Trump’s National Security Strategy Means for US Foreign Policy,” December 2025.

4. CSIS, “The National Security Strategy: The Good, the Not So Great, and the Alarm Bells,” December 2025.

5. PwC, “Securing Sovereign Supply Chains for National Security,” December 8, 2025.

6. GMFUS, “The Trump Administration’s National Security Strategy,” December 2025.; The NSS is supposed to be issued annually, but in practice updates come only every few years. The last two releases were in 2022 and 2017.

7. Le Monde, “Europeans Stunned and Challenged by New US Security Strategy,” December 8, 2025.

8. ABC News, “Top EU Official Warns the US Against Interfering in Europe’s Affairs,” December 8, 2025.

9. Washington Post, “EU leader warns of US interference in Europe’s affairs as Russia praises Trump’s security vision,” December 8, 2025.