Private-sector payrolls rose by only 6,000 in January. Further losses in shutdown sectors such as restaurants and entertainment were accompanied by slight declines in construction and manufacturing and only slight gains elsewhere. Previous months’ performances were marked down, with November now showing a gain of 359,000 jobs, compared to the previously announced 417,000, and December now showing a loss of 204,000, compared to the previous estimate of a 95,000 loss.

We should add that the benchmark revisions introduced into the data have little effect, especially over the pandemic episode of the past 10 months. The Bureau of Labor Statistics’ (BLS) initial payroll data are based on a survey covering only about 40% of all payroll establishments. After about a year, more universal data from payroll tax returns are incorporated into the data. So, the data available a month ago incorporated payroll tax return data through March 2019 and survey data subsequently. Today’s data incorporate payroll tax return data through March 2020 and survey data subsequently.

The revisions made only a slight, -9,000 (-0.007%) change to February 2020 payrolls. The March 2020 change was revised from -1.34 million to -1.62 million, but that -287,000 revision was then recouped over the following three months. So, apart from the March/April plunge being slightly sharper (-21.36 million instead of -21.17 million) and the May/June rebound being equally sharper (+8.15 million instead of +7.97 million), the revisions had essentially no effect on overall jobs counts.

The very slight 3,000 decline in construction jobs likely reflects seasonal issues. With winter weather effects, construction payrolls in December, January and February are extremely volatile. The 10,000 decline in factory jobs is somewhat more substantive, but factory production jobs declined only 2,000, and factory workweeks were up substantially, so that industrial production in manufacturing in January still probably rose substantially.

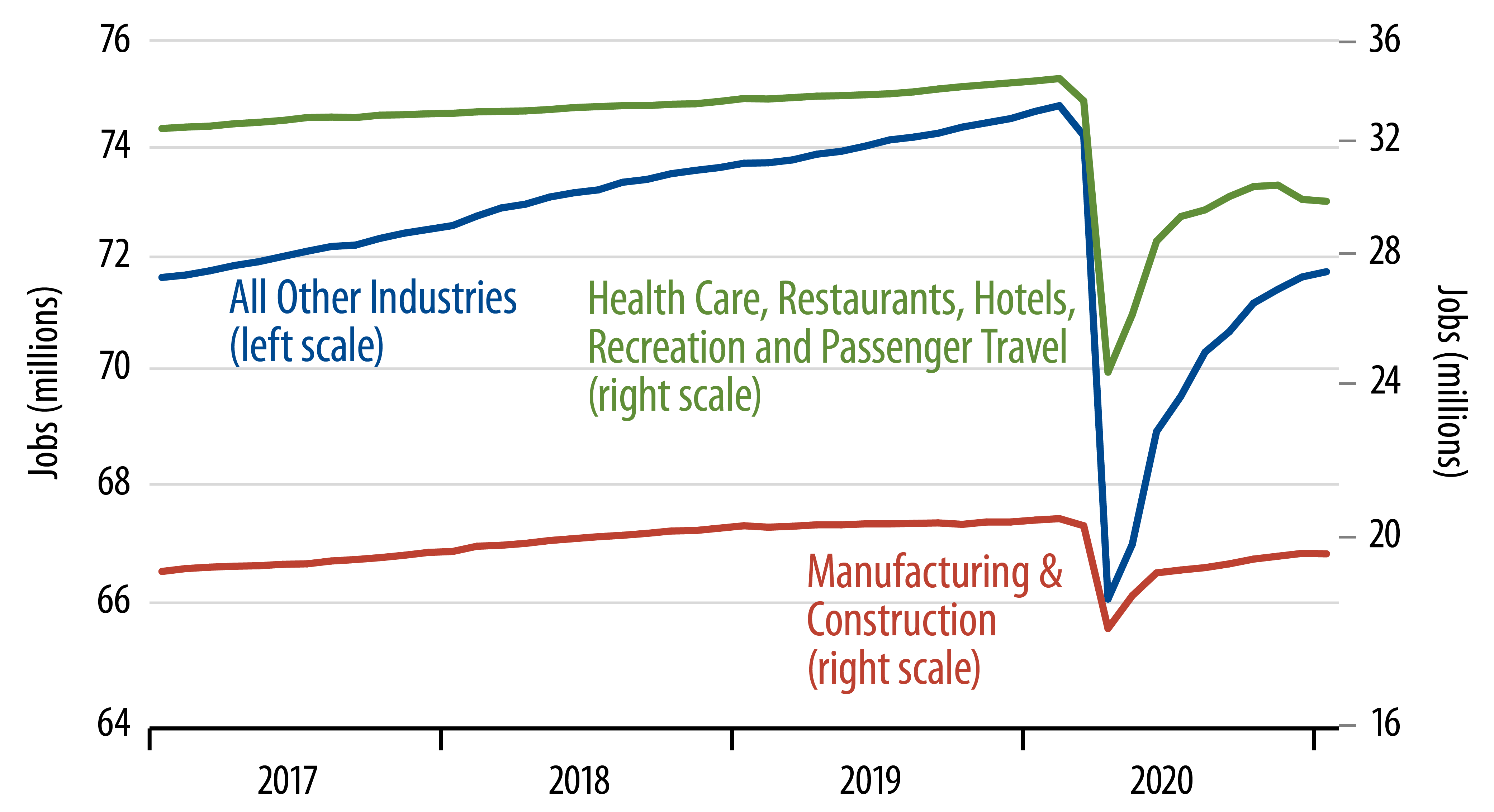

Meanwhile, the January job losses in restaurants, hotels, entertainment and passenger transportation clearly reflect the effects of renewed shutdowns, and these declines were much milder than what we saw in December. With shutdowns being now lifted in California and other states, it is likely that these sectors will see substantial job regains in February.

In other sectors of the economy, jobs gains were indeed disappointing, but still substantial (blue line in chart). There is reason to believe that all three of these segments of the economy will see better performance in February. And no, today’s data don’t establish the need for more stimulus from Washington. More effective would be a wider reopening of various service sectors.