Private-sector payroll jobs showed a 38,000 gain in August, but that gain was effectively canceled out by a -36,000 revision to the July private-sector payroll job estimate. Moreover, what August job gains did occur were centered in health care and social assistance, which saw a gain of 47,000 in August. Obviously, job gains were largely negative outside of health care as declines were registered in eight of the 13 major private-sector industry groups.

Yes, the downward revisions to previous data were much smaller than what we saw a month ago, but, again, even these smaller revisions were enough to effectively cancel out the reported August job gain.

Elsewhere in today’s report, average workweeks were flat, and average hourly earnings rose less than 0.3%, or at an annualized rate of 3.3% per year. The unemployment rate ticked up to 4.3%. The household survey showed an August gain in household jobs of 288,000, but this basically just offset the -260,000 decline that was reported for July. Household survey employment growth estimates vary wildly from month to month, which is why we focus on the payroll data and on private-sector payroll jobs.

The headline here is that everything in this report would be supportive of a rate cut at the Federal Reserve’s (Fed) next meeting, perhaps even of a 50-basis-point cut. So far today, US bond markets are acting accordingly.

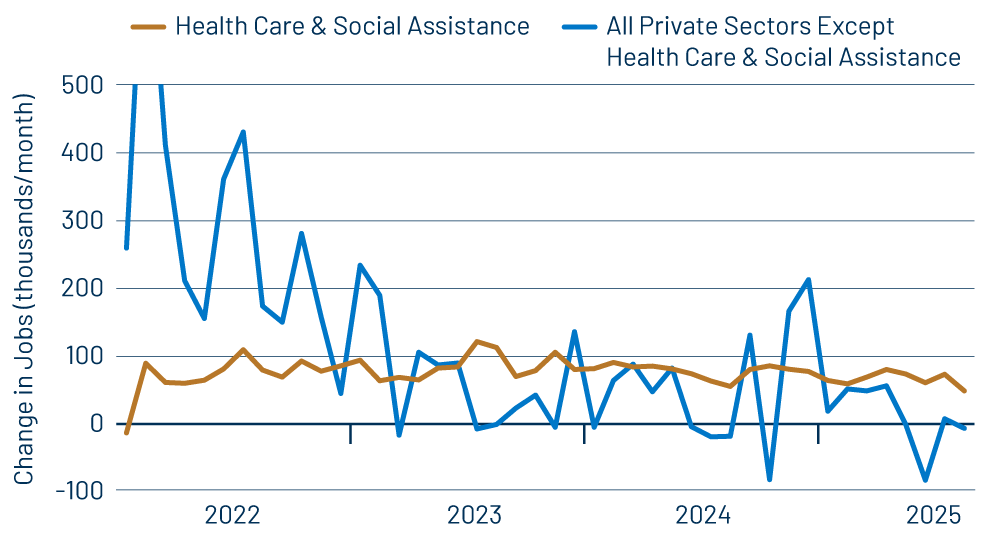

Perhaps the nicest thing we could say about today’s report is that it is mostly in accordance with trends seen over the past three years. For some months, we have been pointing out that most of the reported job growth has been occurring within health care and social services, and, as you can see in Exhibit 1, job growth elsewhere has been sporadic and slight since mid-2023.

True, the negative net gains (outside of health care) over the last three months are softer than what we had seen previously, but that may merely be an offset of the very strong gains reported for November and December 2024. There has been much discussion about the supposedly deteriorating quality of the job data in recent years, as the Bureau of Labor Statistics has dealt with staffing cuts and as fewer private-sector companies are responding to BLS employment surveys. The especially rocky job growth pattern (outside of health care) over the last year may become much smoother once benchmark-revised data are released next February, with a soft trend since early 2023 likely becoming more apparent.

These considerations are relevant only for the political blame game that will occur in Washington in response to these data. With regard to the financial markets and Fed policy, again, the signals are clear, and the Fed is most likely to respond.