Data released today by the Census Bureau showed a deterioration in foreign trade for the US in April, that is, a large decline in exports opposite a sizable increase in imports. In nominal terms, exports declined by -5.3% month-over-month while imports rose 2.1%, and the annualized trade deficit rose from -$990 billion in March to -$1,165 billion in April. In inflation-adjusted terms, exports fell by -5.6%, while imports rose by 2.4%.

If you compare the nominal and real changes in exports and imports, you’ll notice that overall export prices rose 0.3% in April, while import prices declined by -0.3%. Both export and import prices were generally declining in the last half of 2022. So far this year, import prices have continued to decline, while export prices have generally stabilized (with the April increase in export prices about offsetting a decline in March).

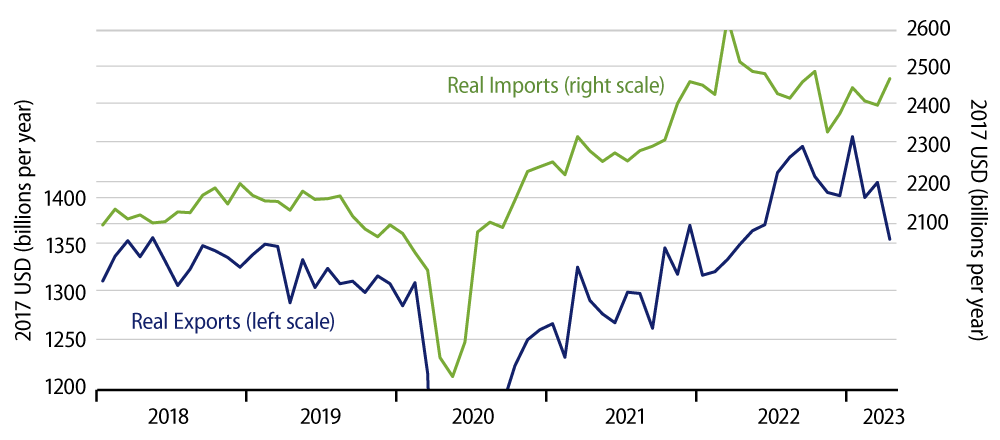

Within the trade flows, exports and imports of food and oil are especially volatile. Thus, the accompanying chart looks at real foreign trade flows excluding food and oil. As you can see there, it appears that US exports peaked last November and have been experiencing an uneven slide since then.

That is, the trend is clearly down, but periodic bounces and plunges can make that downtrend a little less clear in any given month. It looks to us as though the April decline is overstated, but the trend there, again, is pretty clearly downward. The post-Covid reopening drove a strong rebound in foreign trade flows, and it appears foreign buyers “restocked” various elements of US production, so that export flows have pulled back recently, now that the restocking is apparently done and even before any serious slowing in economic growth abroad.

As for imports, these two surged post-Covid and have also “regrouped” recently. However, rather than continue to trend lower as have exports, imports have essentially stabilized, with the April increase likely a random blip within a generally flat trend.

If we are right in these readings, and exports continued to trend lower while imports are generally flat, foreign trade would begin to exert a steady drag on US growth, similar to the situation prior to Covid, when the US trade deficit moved steadily to the “down” side (that is, a continually larger trade deficit).

So, in a sense, the April data are a return to normalcy. The trade deficit rose especially sharply in April, and we would not expect such a rate of change to persist. However, when more “normal” trade flow patterns emerge, the path of the US trade deficit is likely to be to the downside (again, larger deficits).

Thanks to a January spike in exports—which was later reversed—foreign trade provided a substantial boost in 1Q23. It is likely to provide a much larger drag in 2Q23, before reverting to a pattern of smaller drags.

As for the “excluded” items, food and oil, food exports and imports are extraordinarily volatile, but both have been trending lower in recent months. Both oil exports and imports have been trending higher, with oil exports extremely volatile month-to-month.