Headline durable goods orders declined in April by 1.3%, on top of a 0.3% downward revision to the March level. However, excluding transportation equipment, new orders for other durable goods registered a 1.0% gain on top of a 0.4% upward revision to March. We usually focus on durables excluding transportation equipment, because of the extra volatility of the transportation sector, and that focus is especially relevant presently given problems in the auto industry related to a shortage of microprocessors.

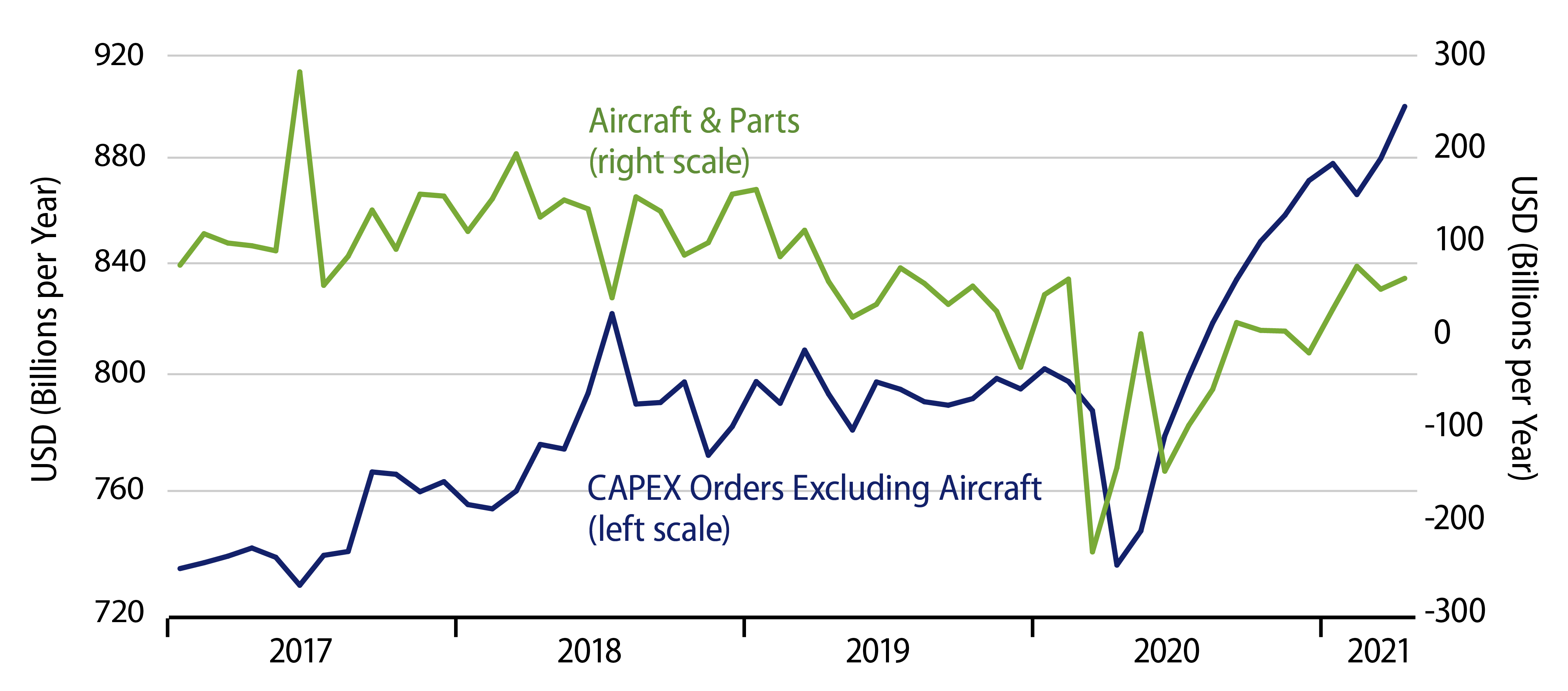

Digging yet deeper, new orders for capital equipment excluding aircraft rose 2.3%, offset only slightly by a 0.2% downward revision to March. Meanwhile, new orders for aircraft also rose in April and have held a decently positive level over the last three months, after languishing in negative territory for most of 2020. (Negative new orders means that order cancellations exceed new orders posted.)

Our forecast line has been that both manufacturing and homebuilding had more than fully recovered from the Covid shutdown as of the end of last year, so that further growth in those sectors in spring 2021 and after would be minimal or even negative. That line has proven true lately for homebuilding, and the data through March had suggested a similar topping out in manufacturing activity. Indeed, industrial production data for April indicated slightly negative growth in factory output since January.

However, the new orders data now show continued growth in factory orders. While this continued growth is counter to our forecast, we’re glad to see it given the nondescript performance the factory sector turned in during 2018 and 2019.

Then again, with the new orders data giving such different readings from those of factory output and factory payrolls, there is some doubt as to which sets of data are presently giving the more accurate picture. Meanwhile, though GDP is described as a measure of output, it is actually calculated from spending data, so yes, the new orders data (for capital equipment) will be what is reflected in GDP data for 2Q.