Research - Webcasts

The Macro Opportunities strategy has had a successful track record over the years, navigating a variety of different market environments. However, the last year and a half have been challenging due to unusual market conditions, including two back-to-back years of negative returns in the Treasury space. The strategy has done well for investors with its EM positioning, which was not a consensus trade at the beginning of the year. Looking ahead, we believe central banks will begin to cut rates as inflation falls close to target. Despite challenges in China, we expect EM economies will be resilient. As a result, we have exposure in Mexico, Brazil, Indonesia and India.

Market Review

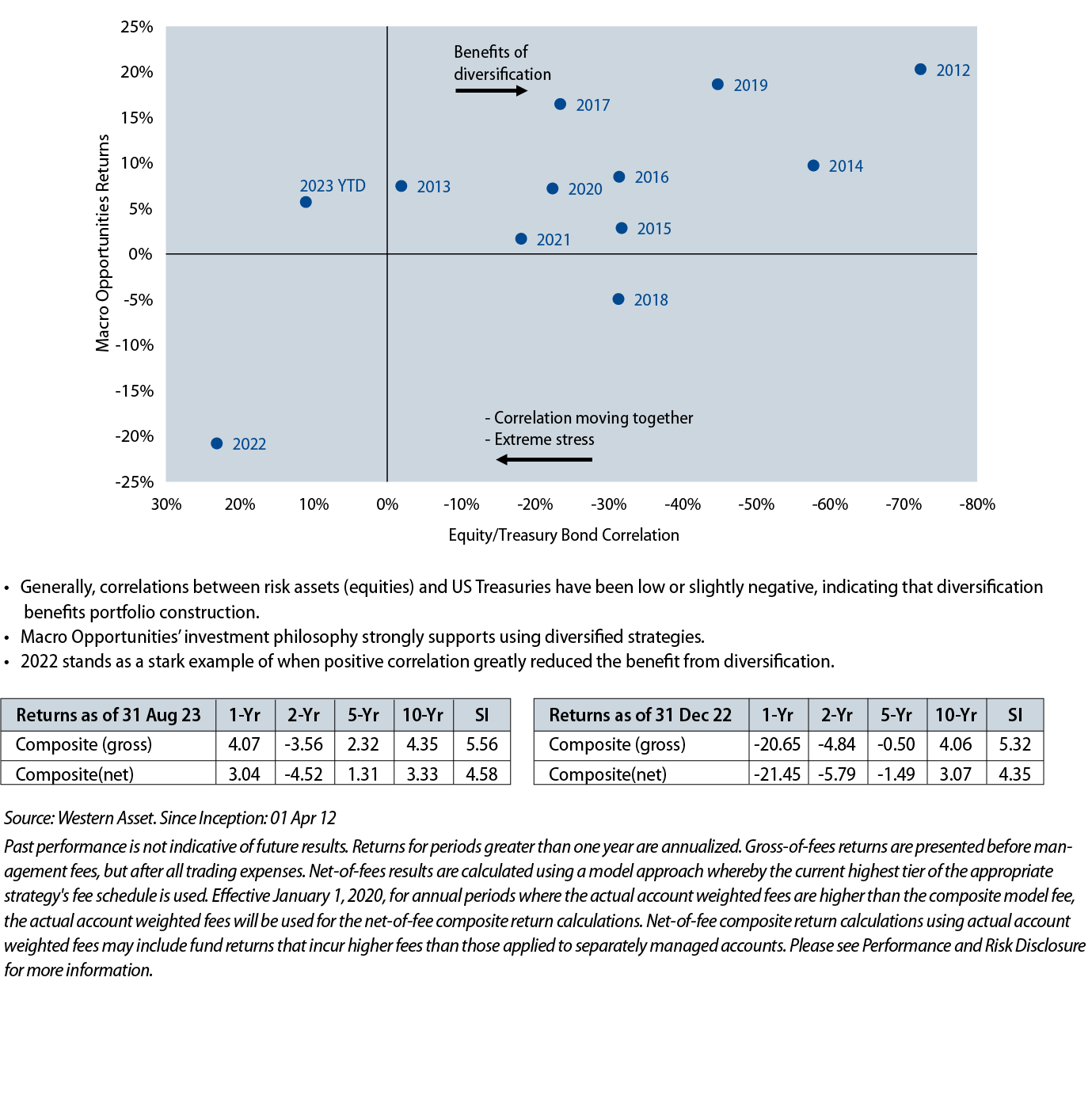

- The rapid rise in rates caused most asset prices to decline, pushing most correlations to be more positive.

- Temporarily, this greatly reduced the effectiveness of using diversified strategies.

- Negative returns in US Treasuries (USTs) and many risk assets in 2022 also resulted in increased volatility conditions.

- Correlations have become more normal in 2023, restoring the historical diversification benefit.

- Tailwinds that had been helping the strategy, such as moderate energy pricing, became headwinds this year and weighed on market sentiment.

- Job growth initially raised wage concerns, worrying markets, and could linger for longer than the Federal Reserve (Fed) initially believed.

- The regional banking stress we saw early in the year is complex but appears contained for now.

Inflation Outlook

- Supply-chain improvements and slowing demand should help to reduce inflation ahead.

- Tight monetary policy and a declining money supply will likely slow consumers, and serve to cool demand.

- Consumers show resilience but have dipped into savings built up during the pandemic.

- Wage growth is moderating after initial pandemic-driven spikes.

- Overall monetary policy from the Fed is quite tight based on real rates and balance sheet reduction.

Credit Markets

- Spreads have tightened significantly since 2020 pandemic-driven widenings.

- Fundamentals currently look good, including interest coverage ratios, low defaults and manageable near-term refinancing needs.

- Loan valuations look very compelling after spreads widened a lot versus high-yield.

- Investment-grade spread levels indicate security selection is better than broad beta exposure.

- We see attractive opportunities in financials in both investment-grade and high-yield (AT1) parts of the capital structure.

Emerging Markets (EM)

- EM should benefit from global growth rates, valuations, overall monetary policy easing (especially from EM central banks) and a weaker US dollar.

- Mexico and Brazil are cutting rates after hiking to control inflation.

- Commodity exporters and supply chain shifts should benefit Mexico.

- China faces challenges but we believe EM can still grow even amid a China slowdown.

Portfolio Positioning

- The strategy holds a long position in bonds on the view that as inflation falls in EM economies and if growth slows, then EM yields should also do well, not only USTs but also German bunds.

- We also hold overweights in investment-grade and high-yield credit, particularly in financials and industrials.

- We recently increased our allocation to agency mortgage-backed securities (MBS) within structured products.

- Our EM currency exposure is largest in Mexico, Brazil, Indonesia and India.

Q&A Highlights

- We believe that inflation will continue to decline, albeit slowly and unevenly. We also acknowledge the strength of the labor market.

- Our disinflation view could certainly be wrong given the uncertainties, but many indicators still point that direction.

- The Fed is unlikely to adopt an inflation target materially above 2% in the current environment, remaining focused on reaching the 2% target.

- The Fed should pause on further rate hikes to avoid overtightening and damaging the economy.

- Key positioning elements include overweights in the front end and long end of the US yield curve based on our outlook.

- While commercial real estate risks are serious, we believe they are manageable and isolated rather than posing systemic risk.

- There remain plenty of attractive opportunities in lower-rated segments of the corporate bond market, but we prefer higher-quality credits.

View the presentation slides.