Macros, Markets and Munis

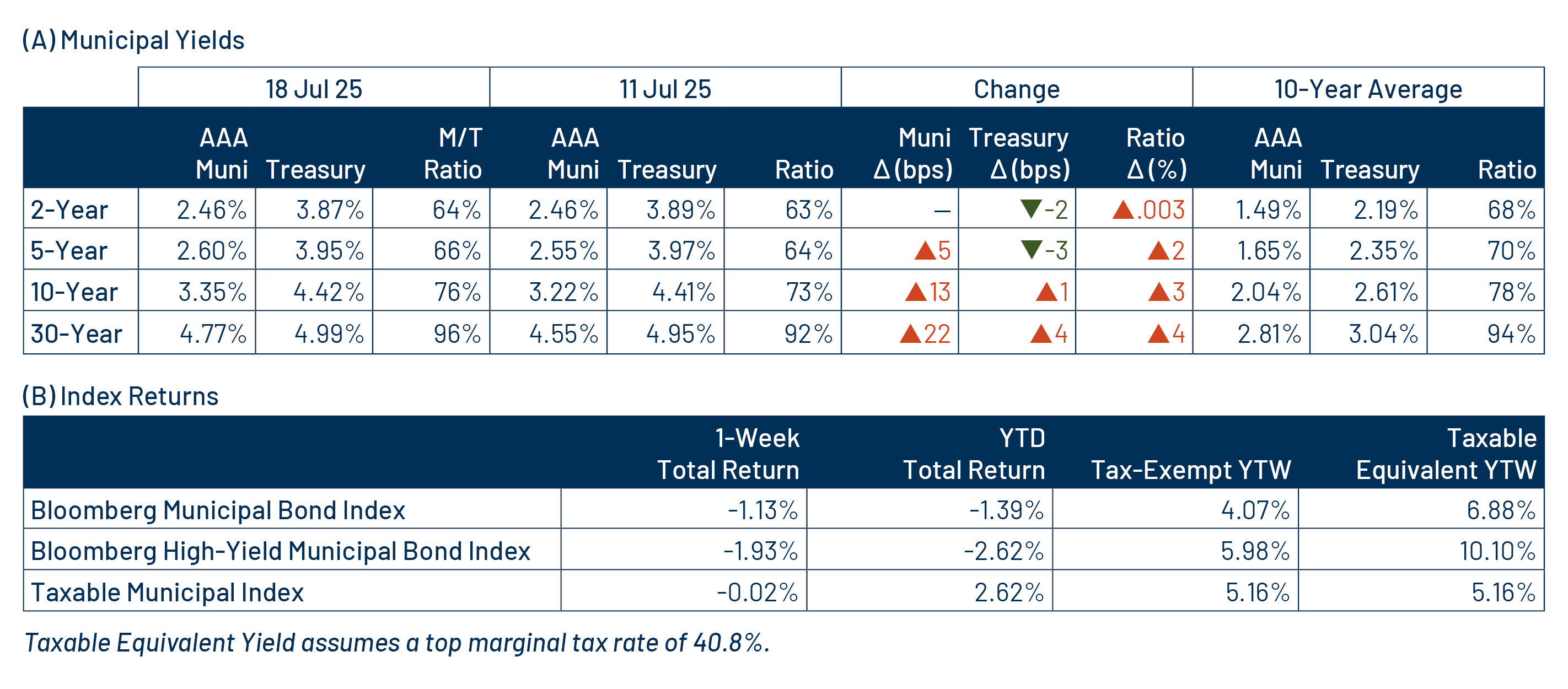

Municipals posted a steep selloff last week as fixed-income market volatility picked up on rhetoric around President Trump replacing Federal Reserve Chair Powell. From an economic data perspective, June CPI data was higher than expected (though readings excluding food and energy measures fell below expectations), retail sales were strong and consumer sentiment also beat expectations. All told, the Treasury curve steepened, with yields moving 2-3 basis points (bps) lower in short maturities and 1-4 bps lower in longer maturities. Municipals underperformed amid heavy supply data and outflows in longer duration municipal mutual funds. Meanwhile, technicals also weakened amid outflows and near-record supply. This week we highlight the elevated New York muni issuance of last week, which supports higher income opportunities within the state.

Muni Issuance Remained Elevated as Funds Posted Outflows

Fund Flows (down $225 million): During the week ending July 16, weekly reporting municipal mutual funds recorded $225 million of net outflows, according to Lipper. Outflows were driven by funds in the long-term category, which recorded $625 million of outflows. Short and short-intermediate categories recorded $244 million of inflows, intermediate funds recorded $156 million of inflows and high-yield funds recorded $34 million of inflows. Last week’s outflows ended the streak of 11 consecutive weeks of inflows and led year-to-date (YTD) inflows lower to $14 billion.

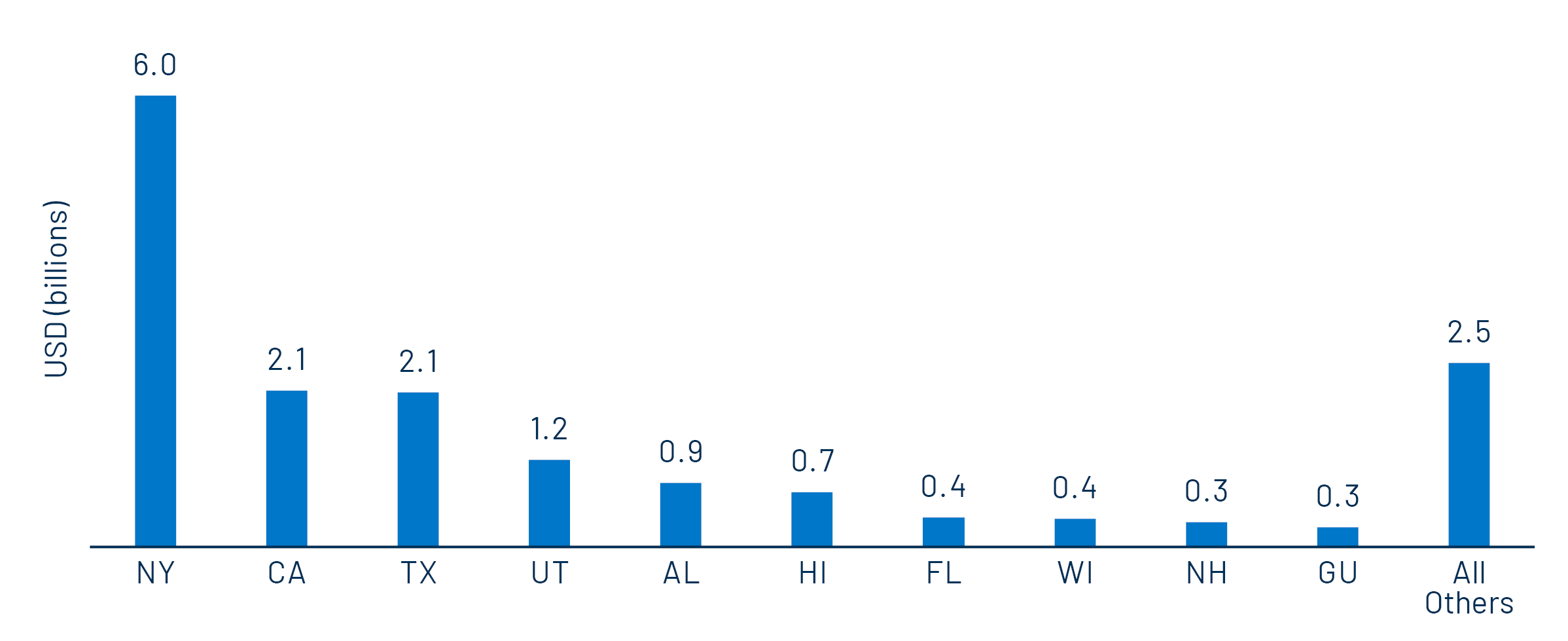

Supply (YTD supply of $305 billion; up 27% YoY): The muni market recorded $17 billion of new-issue supply last week, up 21% from the prior week. YTD new-issue supply of $314 billion is 26% higher from the prior year, with tax-exempt issuance up 27% year-over-year (YoY) and taxable issuance up 10%, respectively. This week’s calendar is expected to remain elevated at $13 billion. The largest deals include $1.5 billion New York City Transitional Finance Authority and $487 million Tarrant County Cultural Education Facilities Corporation (Texas Health) transactions.

This Week in Munis: Elevated NY Supply Improves Value Proposition

Last week’s $17 billion muni supply marked another groundbreaking week of issuance, countering typically quieter summer trends and representing the highest level of issuance this year. The calendar was largely supported by issuers within the state of New York, which comprised $6 billion of total supply during the week and was led by New York State Thruway Authority ($2.4 billion) and New York Transportation Development Corporation ($1.4 billion) transactions.

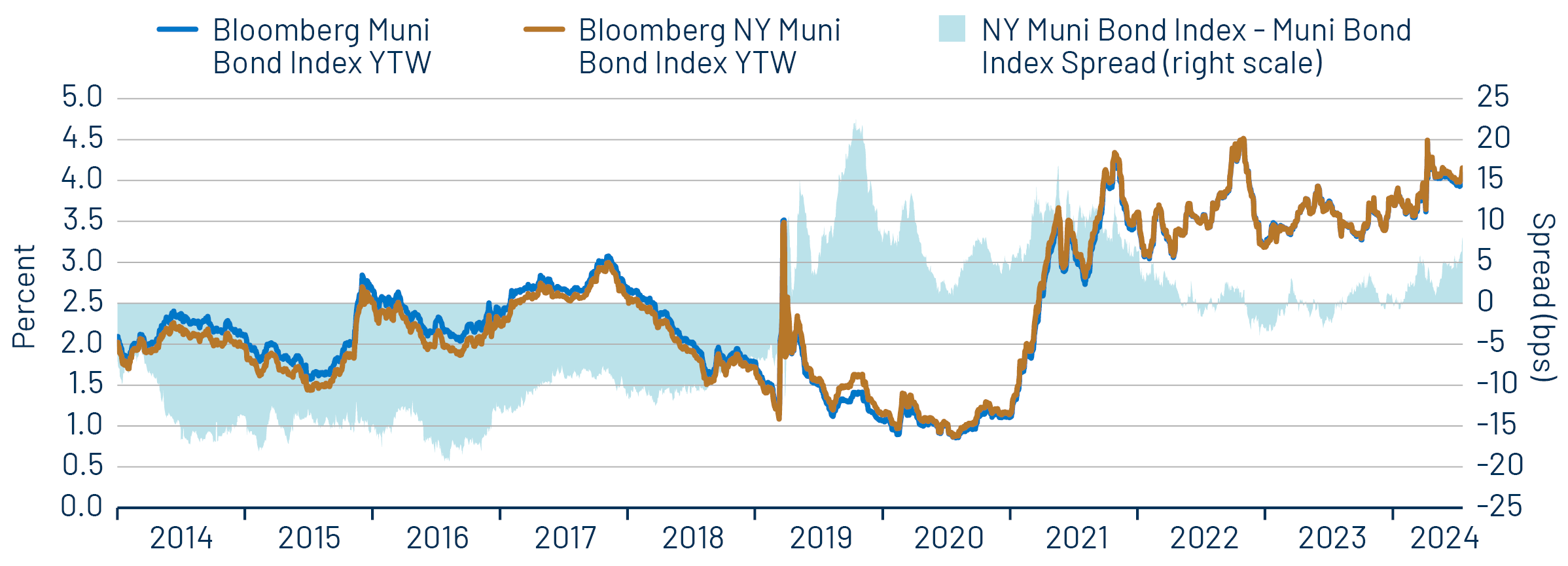

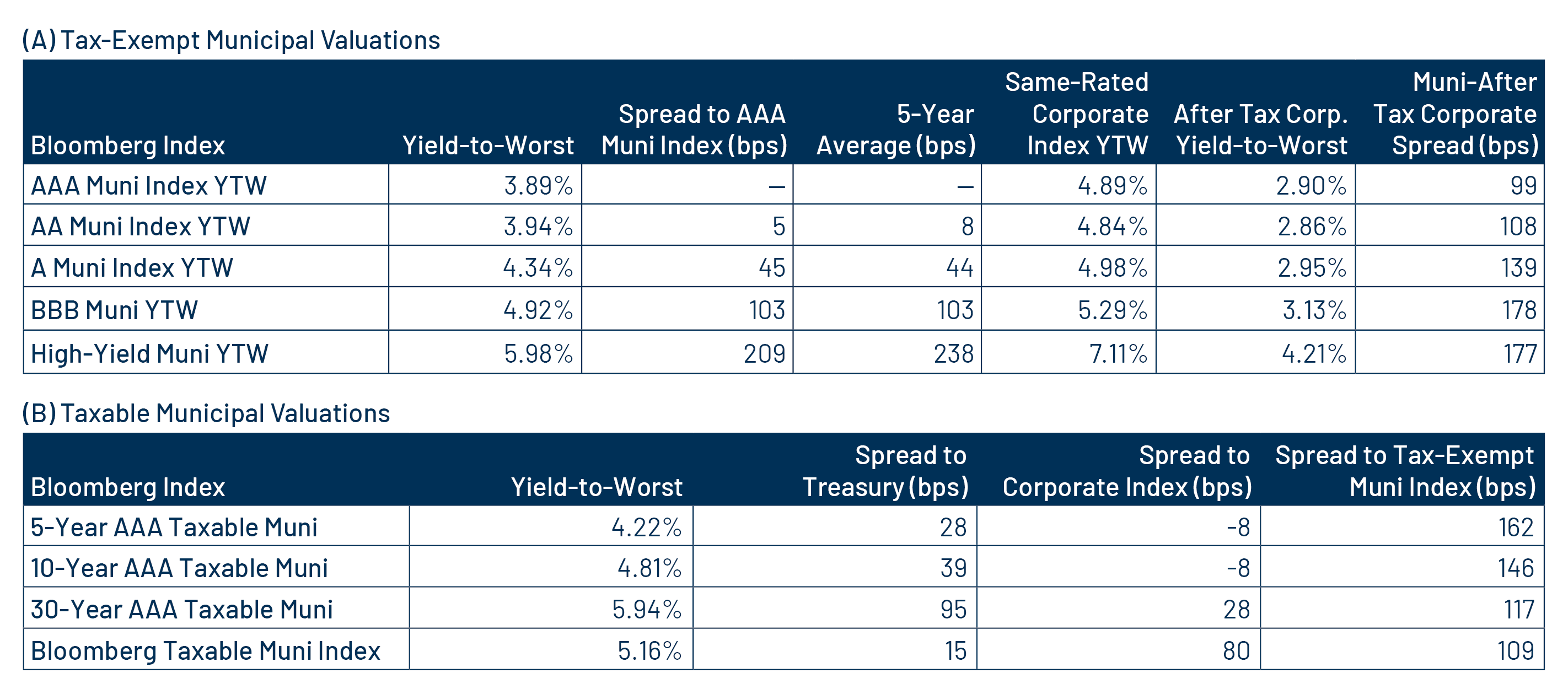

The higher supply levels have supported relatively attractive income opportunities within the New York debt complex. Prior to pandemic-driven market drawdowns in 2020, the average Bloomberg New York Municipal Index yield and associated income opportunities typically tracked lower than the national Bloomberg Muni Bond Index yield. This was largely attributable to relatively higher tax rates, which contributed to better after-tax relative value and in-state demand for New York securities. Following the pandemic-era market drawdowns, New York municipal yields have exceeded—and have remained higher than—national municipal yields despite the state increasing the highest marginal tax rate to 10.9%.

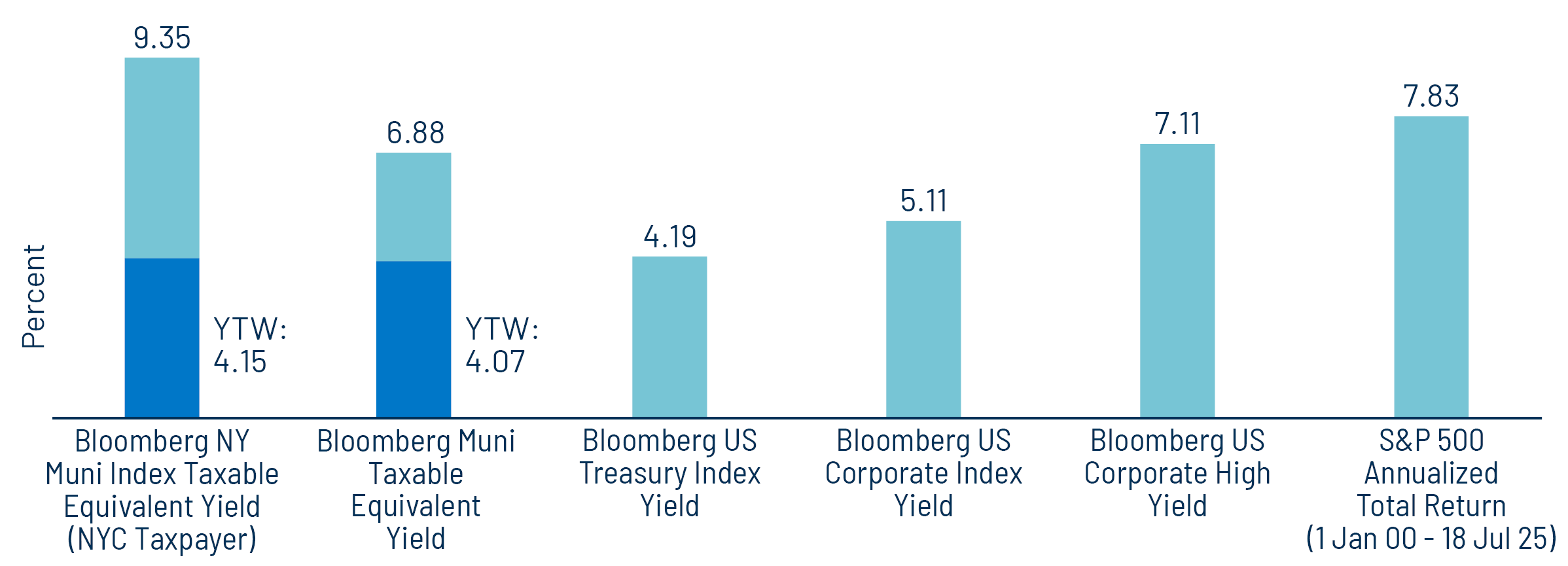

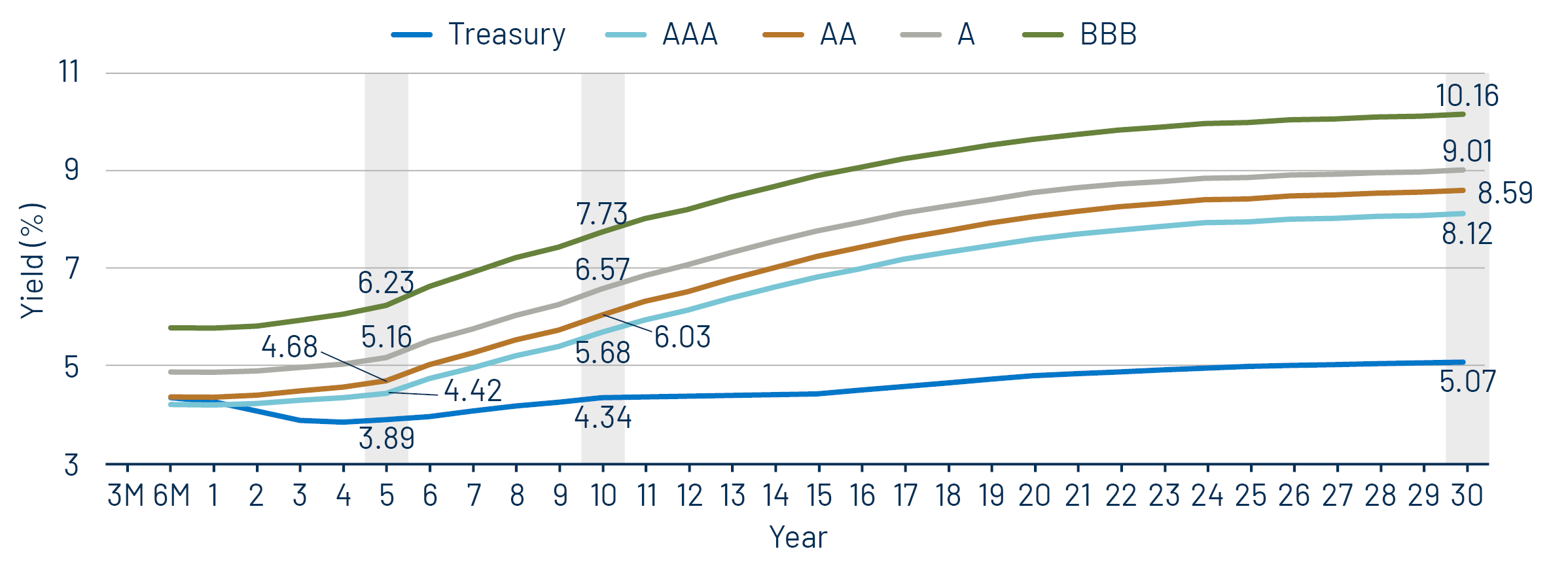

The spread widening that we have observed in the NY complex, along with increasing tax rates within the state, has led to a compelling after-tax relative value proposition for the debt complex. For top New York City taxpayers, the taxable-equivalent yield-to-worst of the investment-grade Bloomberg New York Municipal Bond index has reached 9.35%, well above other investment-grade fixed-income yield opportunities, surpassing more volatile high-yield corporate yields and rivaling long-term equity returns. As equity valuations have reached record highs, Western Asset believes New York munis could serve as a compelling diversification proposition for those taxpayers who can benefit from these attractive tax-exempt income opportunities.

Municipal Credit Curves and Relative Value

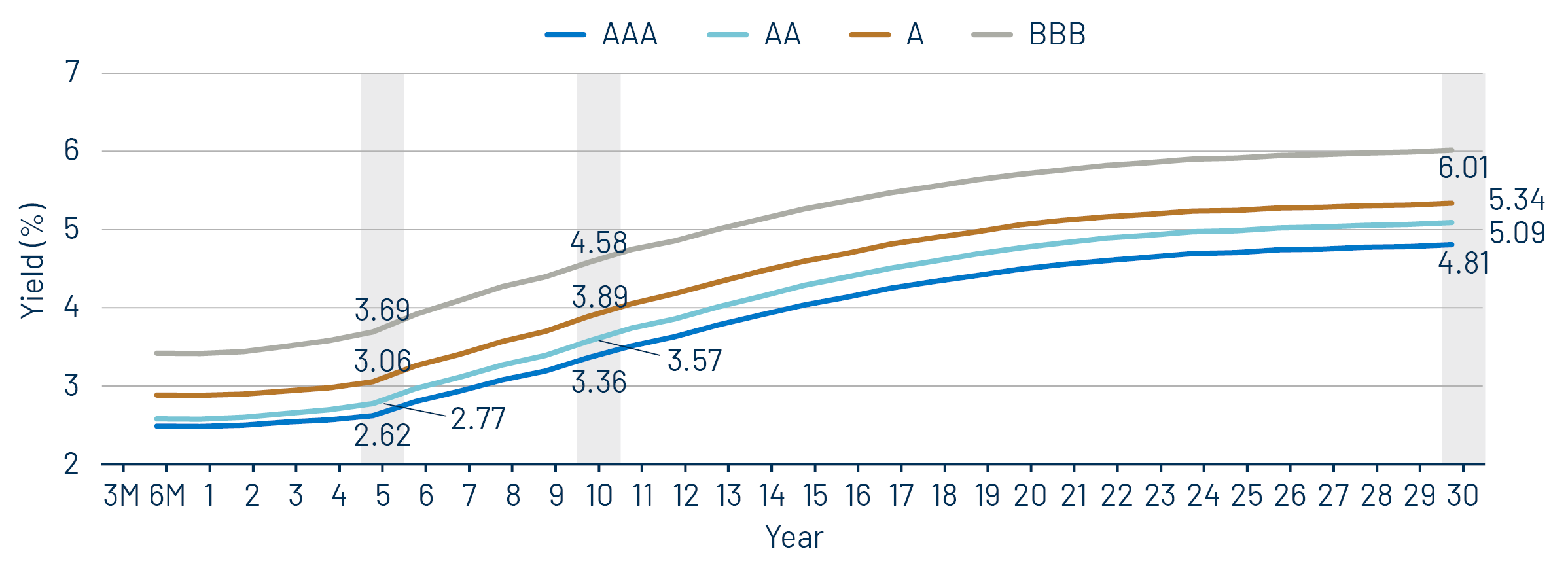

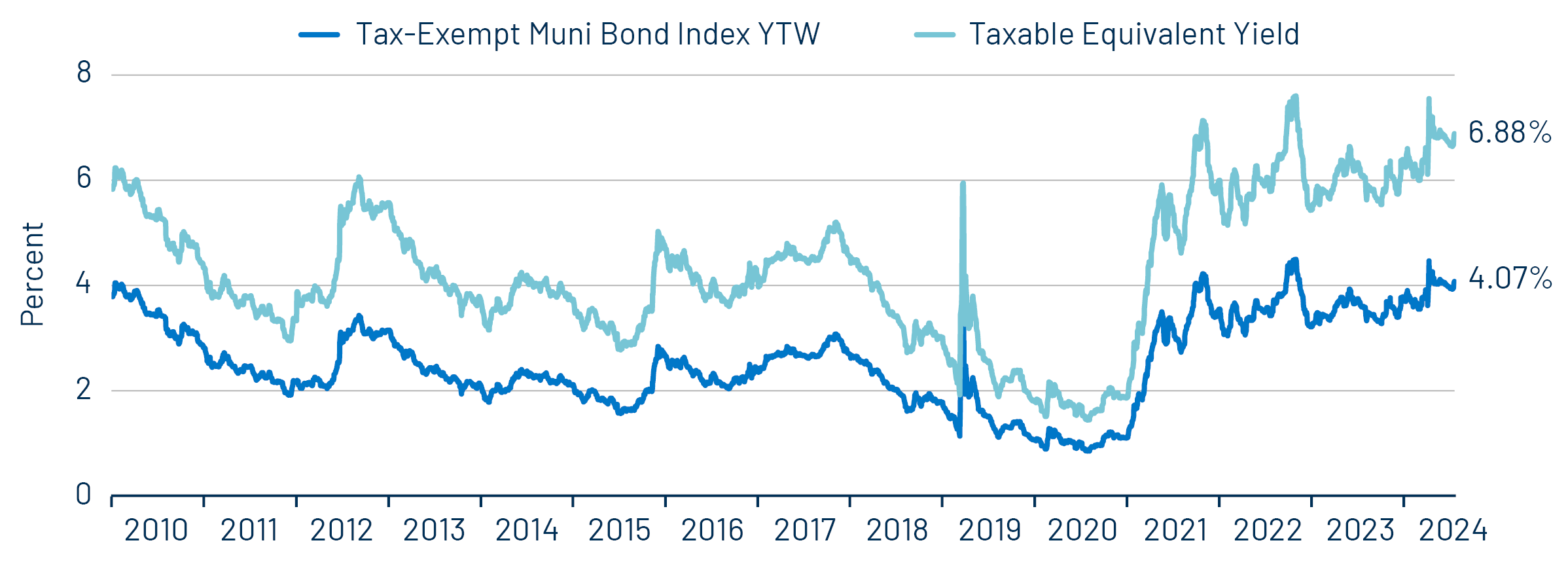

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

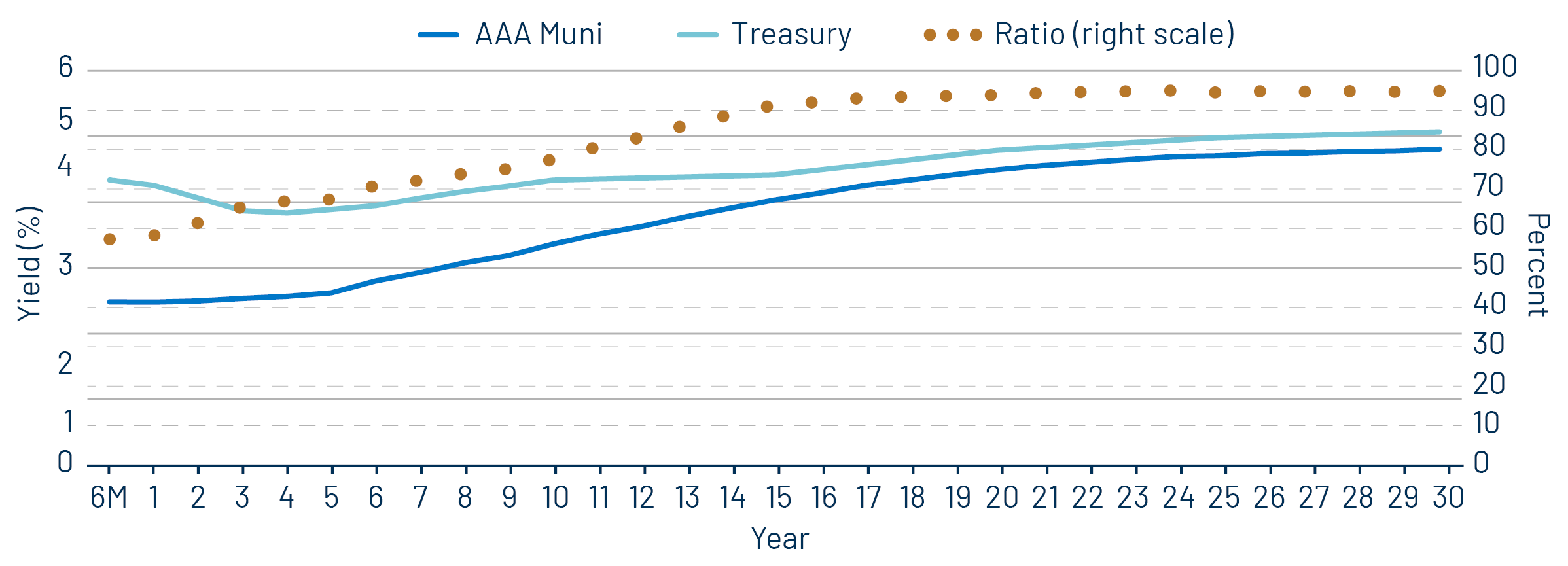

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

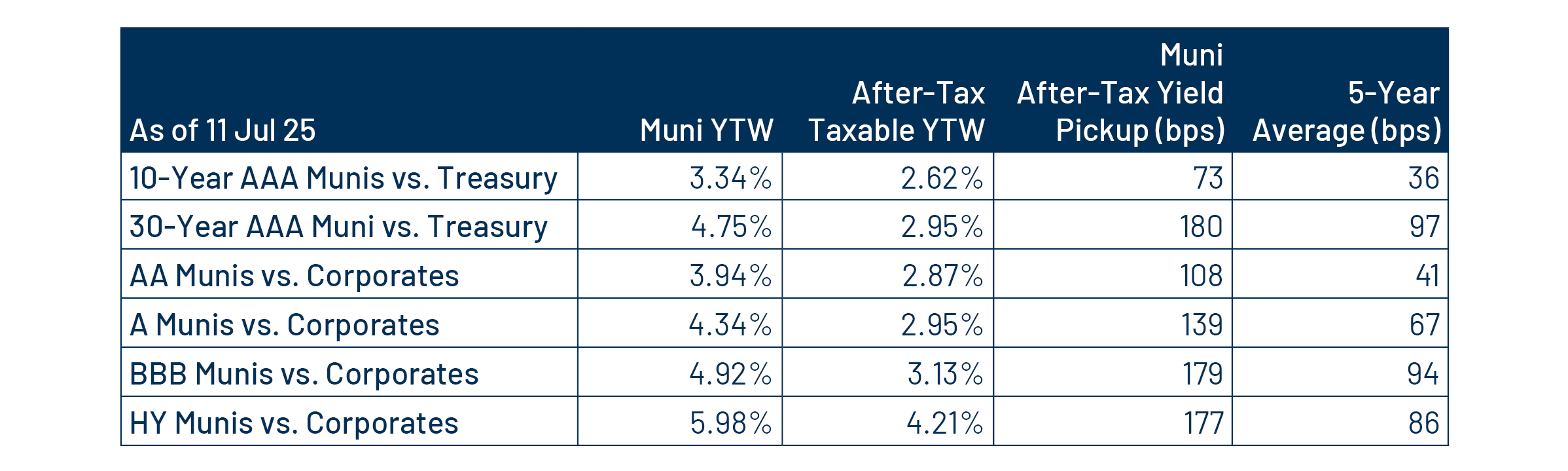

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.