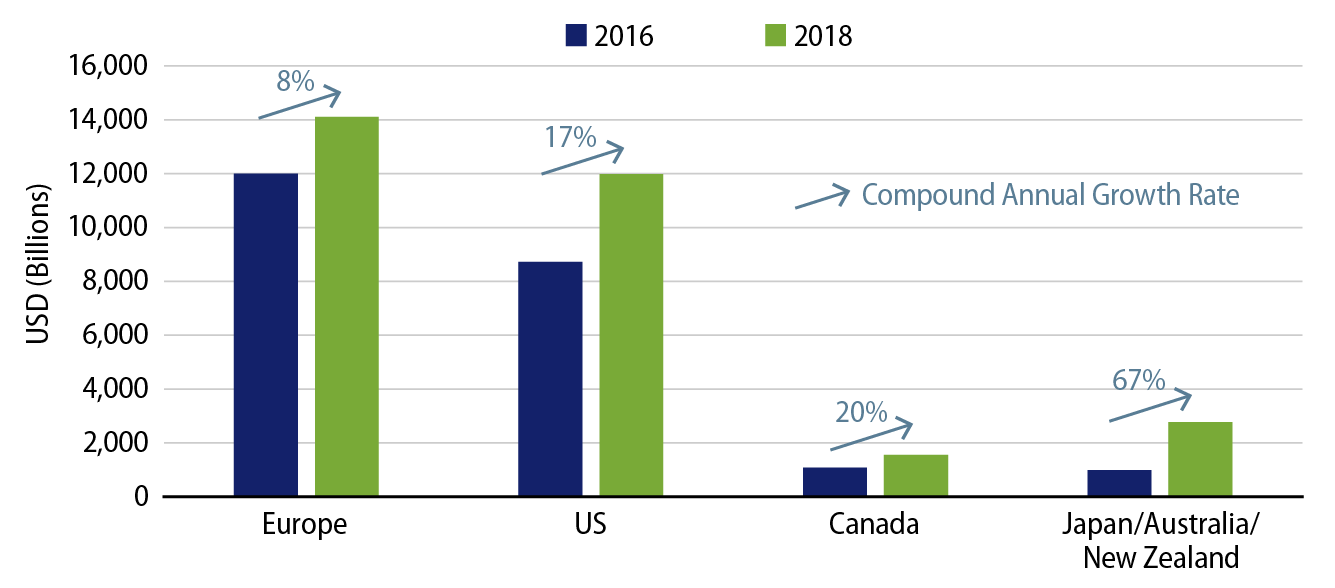

ESG assets have grown significantly (see Exhibit 1), with US sustainable investments totaling $12 trillion at the end of 2018. This acceleration in ESG investing has not gone unnoticed by federal agencies, given the intersection between ESG, investment regulations and climate policy. With Election Day quickly approaching, here we discuss the potential implications of Biden and Trump victories for ESG investors.

Investment Regulations

In June, the Department of Labor (DOL) ignited ESG market participants when it issued a Notice of Proposed Rulemaking titled “Financial Factors in Selecting Plan Investments.” The DOL’s previous guidance had allowed 401(k) plan fiduciaries to include ESG funds as investment options if their risk-adjusted returns were expected to be similar to those of non-ESG alternatives. The rule proposed in June would constrain fiduciaries to considering “economic risks or opportunities that qualified investment professionals would treat as material economic considerations under generally accepted investment theories” when evaluating ESG funds. Further, it would require fiduciaries to document thoroughly their rationale for selecting ESG funds, and prohibit fiduciaries from designating ESG funds as Qualified Default Investment Alternatives.

Feedback submitted during the comment period (which the DOL limited to 30 days rather than the usual 60) was overwhelmingly negative, with 95% of the 8,737 comments highlighting contradictions among the rule, standard market practices and investor preferences.1 Demand for ESG 401(k) options has exceeded supply; over two-thirds of investors surveyed by Wells Fargo expressed interest in allocating to an ESG fund,2 yet only 2.8% of plans offered an ESG option in 2018.3

The SEC has also turned its attention to ESG investing, though from a perhaps more agnostic perspective. In March, the SEC requested feedback on whether the “Names Rule” (Rule 35d-1 under the Investment Company Act of 1940) should apply to investments characterized as ESG or sustainable, ostensibly to protect investors from “greenwashing.” In May, the SEC Investor Advisory Committee recommended that the agency establish requirements for SEC-registered issuers to make standardized ESG disclosures. And in June, Regulation Best Interest, which requires broker-dealers to consider factors such as product costs and competing options when making investment recommendations to retail clients, went into effect. How this standard will apply to and affect ESG investments remains unclear.

Under a second Trump term, we expect these agencies would maintain their current negative stance on investor usage of ESG funds. A Biden administration would likely be more constructive in its treatment of ESG, particularly in light of Biden’s climate agenda, which we discuss next.

Climate Policy

While environmental considerations have long been a focus for ESG investors, interest in climate issues has become more mainstream in recent years. In his inaugural campaign, President Trump pledged to establish energy independence, deregulate oil and gas, and rejuvenate the coal industry. Once elected, Trump withdrew the US from the Paris climate accord and rolled back 100 environmentally oriented rules and regulations.4 Trump has not announced any climate-related plans for his second term, and would likely continue with his current agenda if re-elected.

In contrast, Biden has emphasized climate strategy as one of his key platforms. A Biden administration would aspire to reach net zero carbon emissions from the power sector by 2035 and to reach net greenhouse neutrality by 2050 through its $2 trillion “Clean Energy Revolution” infrastructure plan. Biden is also reported to be considering the creation of a new cabinet-level position and a White House office dedicated to climate issues.5

If Biden is elected, how he would convert these plans into reality depends on several unknowns, including the Senate-House balance. But it is reasonable to assume that the US would rejoin the Paris Agreement and that many of the Trump administration’s executive orders and regulations would be rolled back. ESG investors would likely view these developments as positive.

Regardless of the election outcome, we expect that ESG investing will continue to flourish, as many global investors have come to view ESG as the standard, not just an option. At Western Asset, we view ESG not as a political matter but as a fundamental investment tool, and will continue to integrate ESG considerations into our investment process to achieve better risk-adjusted returns for our clients.

- 1https://www.ussif.org/Files/Public_Policy/DOL_Comments_Reporting_FINAL.pdf.

- 2Wells Fargo/Gallup Investor and Retirement Optimism Index survey, April 2020, https://www.businesswire.com/news/home/20200416005148/en/Wells-Fargo-Investors-Information-Sustainable-Investing. 28% of investors surveyed by Wells Fargo said they would definitely include ESG funds in their 401(k) allocation if made available, while 41% said they probably would. Furthermore, 69% of those surveyed believe that such funds can deliver market performance, while just 24% think they will underperform.

- 3https://www.wsj.com/articles/401-k-s-could-become-even-less-welcoming-to-esg-funds-11601840714.

- 4“The Trump Administration Is Reversing 100 Environmental Rules. Here’s the Full List,” July 15, 2020, https://www.nytimes.com/interactive/2020/climate/trump-environment-rollbacks.html.

- 5https://www.bloomberg.com/news/articles/2020-10-07/biden-considering-new-white-house-office-on-climate-change?sref=y2G81i2m.