Private-sector payroll jobs rose by 232,000, with a tiny, +3,000 revision to the February estimate. There was also a slight increase in the average workweek and modest gains in hourly wages.

This was easily the cleanest jobs report we have seen since 2022. There were no big downward revisions to previous months’ estimates, such as had characterized almost every monthly report since early-2023. Similarly, there were no offsetting declines in average workweeks so that total hours worked showed a nice increase. Finally, the household survey showed a job gain even larger than did the payroll survey, after household survey employment had been essentially flat for the previous nine months.

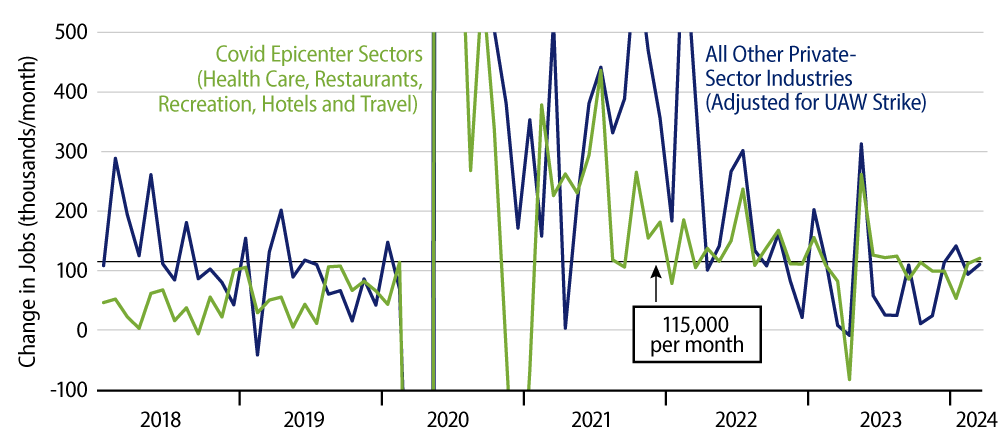

As you can see in the chart, it was the case that Covid epicenter sectors (health care, restaurants, recreation, travel and lodging) showed most of the job growth, as those sectors still struggle to return to the staffing levels seen prior to the Covid shutdown. However, as you can also see in the chart, the rest of the economy showed nearly as much job growth as did the Covid sectors for the fourth month in a row, after these other sectors had seen hardly any job growth in the summer and fall of 2023.

Average hourly earnings for all workers rose 0.3% in March, after a 0.2% gain in February, so that the average annualized rate of change in this series over the last three months came in at 4.1%, just above the 3.5% rate that the Federal Reserve (Fed) has professed is consistent with its inflation targets. Another wage measure covers only production workers, those that actually get paid by the hour. That measure rose 0.2% in March, after a 0.3% increase in February, and has shown a 3.8% annualized rate of increase over the last three months.

Late last year, we thought that the constant downward revisions, the declines in workweeks, and the concentration of job growth in Covid-afflicted sectors combined to make the payroll data a lot soggier than what the headline job growth alone suggested. We can’t sustain that position with respect to recent months’ data.

Total hours worked are still growing at only about the same pace as we saw pre-Covid, once the last few months are taken together. Similarly, there does appear to be a decelerating trend in wages. So, clearly there is nothing in the data overall that would push the Fed to renew its tightening efforts. However, there is also nothing in the present data to push them to an earlier rate cut than recent Fed comments have suggested.