Real GDP grew in 1Q24 at an annualized rate of 1.6%, while GDP inflation came in at 3.1%. That GDP growth rate was substantially below expectations that had centered in the 2.5% to 3.0% range. Consumer spending grew at a healthy 2.5% rate, but that was below the 3.5% rate that typified market forecasts.

Still, the big drivers of below-forecast growth were foreign trade and inventories. Foreign trade had looked to be a slight drag on 1Q24 growth. Instead, it reduced growth by a full percentage point. Similarly, inventory investment had looked to be a slight add to growth. Instead, it provided a drag of about a half a percentage point. The one sector coming in above expectations was capital spending, with most of the gains there driven by ''intellectual property'' development, aka R&D.

With regard to inflation, GDP inflation rates have been fluctuating around a 2-handle rate for the last year. Both 2Q23 and 4Q23 saw GDP inflation of 1.7%, while 3Q23 and 1Q24 saw rates of 3.3% and 3.1%, respectively. The average for the last four quarters came in at 2.4%. The Federal Reserve (Fed), of course, targets the consumer component (Personal Consumption Expenditures, or PCE) of GDP inflation. That measure has fluctuated similarly to GDP prices and shows a 2.6% rate over the last four quarters, coming in at a 3.4% annualized rate in 1Q24.

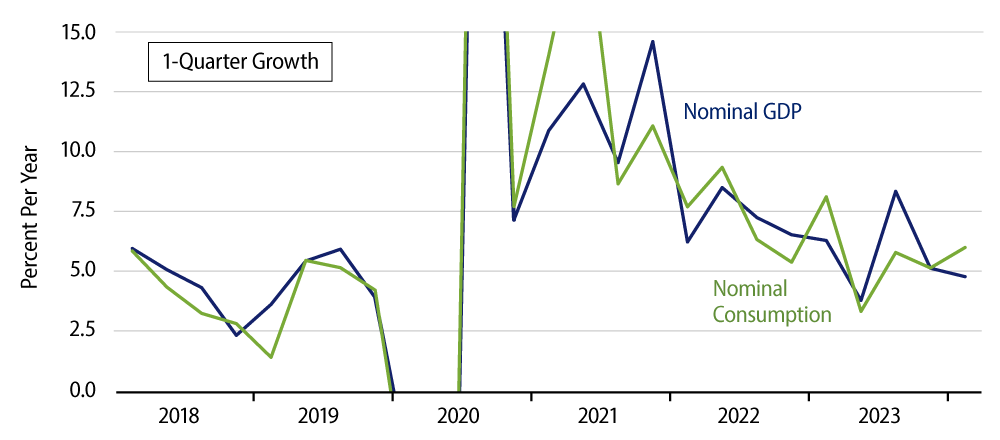

Our take has been that despite all the hubbub about the economy’s strength, nominal GDP growth has been decelerating steadily, an indication that Fed tightening is biting at least to some extent and that post-Covid tailwinds for the economy are flagging. We think this decelerating trend is the dominant factor that will keep inflation trending lower. While 1Q24 inflation was disappointingly high, the decelerating trend in nominal GDP is still in place, and we believe the inflation data will look better—that is, lower—in months to come.

Real GDP growth is a bit more puzzling. Again, despite the below-expectations 1Q24 print, consumer spending growth was still substantial, and it is questionable whether the ''drag'' factors of 1Q24—foreign trade and inventories—will continue as such in coming quarters. We think consumer spending and construction activity will moderate, but that is an expectation and not something in place in the data to date (although nonresidential construction spending did moderate in 1Q24).