Executive Summary

- The paradigm of long-term EM debt investing remains intact, as fundamental improvements reassert themselves, albeit with greater differentiation across countries.

- While a Chinese soft landing scenario is supportive of EM technicals, EM local debt will unlikely be based narrowly on a monolithic theme of Chinese demand for commodities going forward.

- The case for investing in EM local debt is compelling, given the diversification benefit and valuation appeal.

The experience of investing in emerging markets (EM) local debt during the period from 2013 to 2015 was analogous to that of peeling an onion. It was not for the faint of heart; as layers were removed, it was a constant battle to hold back tears. Investors during that period truly experienced a “perfect storm.”

The first wave was induced by the Federal Reserve (Fed) in mid-2013, when it took a more hawkish tone in its communiqué. The waves that followed accentuated the market downdraft and left global investors clamoring for US dollars. Escalating geopolitical tensions in Russia and a progressive unfolding of corporate scandals in Brazil have cost the two countries their investment-grade sovereign ratings. Slower growth in China translated to a prolonged slump in commodity prices affecting the current accounts of most EM countries. Finally, to make matters worse, a move by Beijing to adjust the Chinese yuan (CNY) in August 2015 stoked hard landing fears in China.

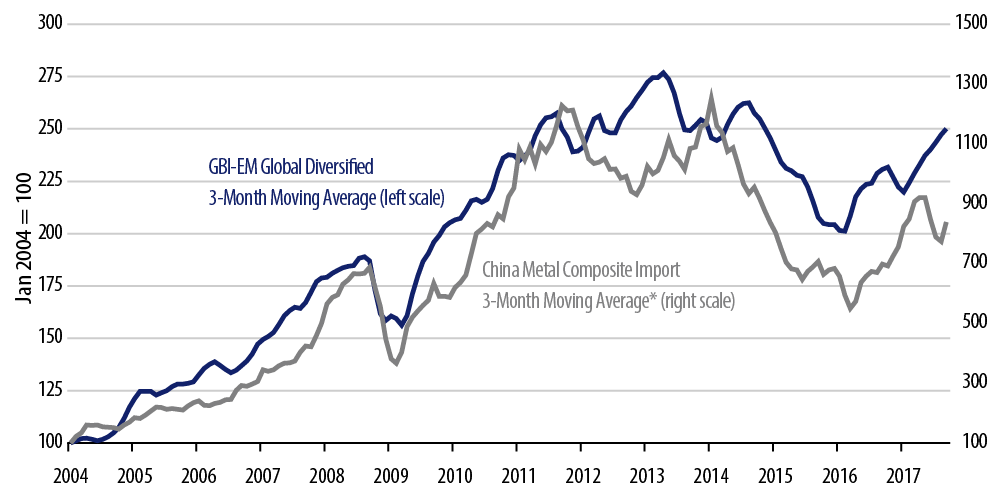

The cumulative impact on EM local bonds is evidenced by its longest losing streak since its inception as a mainstream asset class at the turn of the millennium. Using the J.P. Morgan Global Bond Index-Emerging Markets Global Diversified (GBI-EM GD) as a reference benchmark, EM local debt posted three consecutive calendar years of negative absolute returns, at an annualized -10% between 2013 and 2015. The dismal returns defied the familiar narrative of fundamental improvements across the EM complex, a paradigm upon which the very basis of EM investing rests. Indeed, this marked a stark contrast with the experience in the preceding decade, when the Index nearly tripled in value (Exhibit 1).

Historically High Correlation Between EM Local Debt and China

Looking back, one primary source of EM volatility can be traced to China’s outsized, infrastructure-led GDP expansion following its World Trade Organization accession in 2001. Within a decade, Chinese GDP quadrupled in size, thanks to massive infrastructure construction that helped catapult the economy to the league table of the world’s ultra-large economies. This had at least two major implications on EM.

First, China helped fuel a global commodity boom that brought EM countries to the world’s center stage. So relentless was China’s demand for primary imports that trade and fiscal balances in some commodity-reliant Latin American countries flipped from deficit to surplus. One unintended consequence, however, was the failure of some policymakers to attribute the macro tailwinds to exogenous demand-side factors. More damningly, this likely had an effect of diluting the urgency and incentive for these countries to pursue domestic structural reforms.

Second, given limited foreign access to onshore opportunities in Chinese markets, portfolio flows were inadvertently diverted to local markets of its key EM beneficiaries, primarily in Latin America, in the years prior to 2011 (Exhibit 1). This trend was reinforced by dislocations in developed markets during the 2008-2009 global financial crisis. The resulting build-up in EM exposure in prior years by strategic and short-term players alike as a proxy to express the Chinese growth provided the technical froth for a sharp retracement.

We are now in the midst of a rally in EM local debt with calendar 2016 and YTD calendar 2017 (through October 2017) posting healthy 9.9% and 11.06% total returns, respectively. Looking forward, the issue is whether the traumatic experience we went through during 2013 through 2015 should be viewed as sufficient proof that the basis for EM investing was flawed. We are clearly not in this camp. We believe that EM local debt still has legs to run further into 2018 for a few reasons.

- Chinese Soft Landing: Regarding the medium-term growth trajectory in China, Western Asset is firmly in the soft-landing camp, and anticipates annual growth to moderate toward 5%-6%. The transition path from a manufacturing-based to a services-based economy will undoubtedly be bumpy. However, China’s profound influence on international commerce and financial markets will continue to be felt. In world trade, China is morphing from a producer to a consumer. The official inclusion of the CNY in October 2016 as the fifth currency in the International Monetary Fund Special Drawing Rights (SDR) basket has marked an important step in its multi-year effort to liberalize the capital account. We believe the possibility of future inclusion of CNY-denominated debt in key benchmarks will have a salutary effect on EM local debt as a whole.

- Technical Strength: A shake-out of “tourist” players as a result of the negative publicity surrounding EM suggests an improved technical foundation of the investor base. With G3 central banks maintaining an accommodative bias, we believe the ground is ripe for a resurgence of interest by dedicated and crossover investors, in the context of substantive cutbacks of prior exposure. For long-term institutional investors, including sovereign wealth funds, EM local debt offers a distinctive benefit of portfolio diversification. Moreover, valuations are attractive. Currently, the GBI-EM GD yields 5.18% and has a duration of less than five years.

- Secular Underpinnings: Admittedly, significant fundamental challenges have surfaced in some EM countries. Nonetheless, we believe the paradigm of fundamental improvements in EM countries remain intact, and view the correction in asset valuations as transitory. The needed shift in paradigm is that investors should no longer view EM local debt as a “sure win” proposition as some may have done prior to the taper tantrum in May 2013. The maturation process for EM countries is evolutionary, and the pace of socioeconomic progress can vary drastically from one country to another. The need to differentiate long-term credit stories among the highly diverse universe of EM countries based on their individual merits is therefore of paramount importance. Put differently, EM local debt will no longer be based narrowly on a monolithic theme of Chinese demand for commodities going forward.

As active managers, we view the heterogeneity of the asset class as a strength, not a flaw. We believe this creates a unique opportunity set to earn attractive returns, particularly given the current underallocation by long-term strategic investors. In further evaluating its appeal, we would avoid either extreme of eternal optimism or perpetual pessimism.

Returning to the onion analogy, although they may occasionally cause tears, onions are an extremely versatile and critical ingredient in a wide variety of international culinary dishes. Properly selected, we believe an allocation to EM local debt fits into the fundamental conviction of the most discerning of investor palates, given the rising strength of EM countries over a long-term investment horizon.

Note that this paper is an update to a version originally published in April 2016.