Executive Summary

- With the economy potentially in the late stages of an expansion phase of the credit cycle, Western Asset is closely monitoring economic activity for signs of a possible downturn.

- We are primarily examining five early warning indicators: economic growth, lending standards, bank asset quality, corporate profitability and average bond issuers’ financial metrics.

- Other contributing factors we watch include Fed actions and ongoing trade tensions.

- This expansion phase will end one day, but no trigger catalysts are currently in play nor do we see any on the near-term horizon.

At Western Asset we receive requests regarding our thoughts on the credit cycle almost every day. We published our opinions in a paper earlier this year titled, Where Are We in the Credit Cycle? In that paper we argued that credit markets remained squarely within the expansion phase. In this note, we provide additional insight describing the key indicators we monitor that could provide early warning signs of a downturn.

Five Early Warning Indicators

Western Asset follows developments daily across a wide range of issues that influence the macroeconomic environment. Here we will discuss what we see as the five primary indicators that merit particularly close attention. Certainly there are other factors, such as central bank policies and relevant political developments, that have the ability to change the direction of economic and credit conditions. To discuss all of the signals that could hasten a downturn would be a much larger undertaking. Rather, we narrow our focus here to concentrate on what we consider five key factors that have been historically very reliant predictors.

1. Economic Growth

Economic growth is a prerequisite to initiating and sustaining a credit cycle. However, downturns formulate when the economy overheats with both robust economic growth and increasing inflationary pressures. Typically the Federal Reserve (Fed) will initiate monetary policy (raising the fed funds rate) to temper growth in an effort to stabilize prices. When the Fed tightens too much, economic activity can be choked off to the point that a recession results, fostering an economic and credit cycle downturn. Today’s macroeconomic backdrop is one of moderate growth in both the US and abroad. Currently inflation and inflation pressures appear manageable, with Personal Consumption Expenditures (PCE) inflation remaining at or just below the Fed’s stated target rate of 2%. Moderate economic growth and low inflation should continue to foster the expansion phase of this credit cycle.

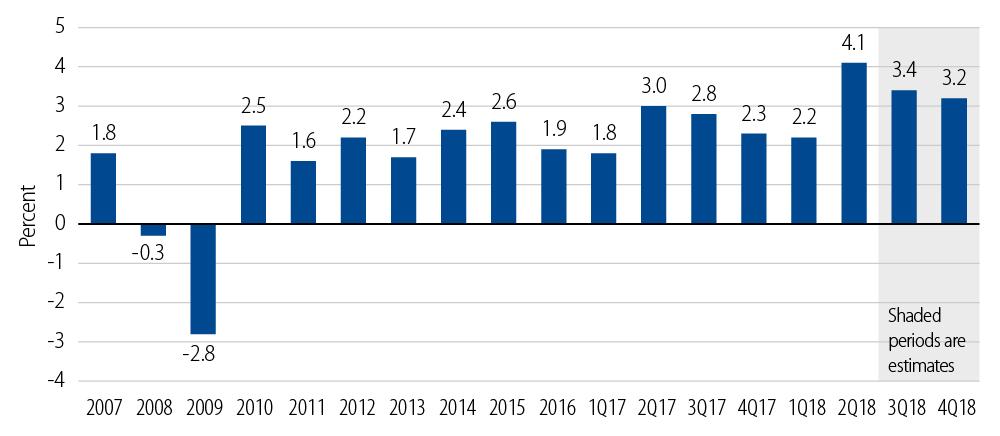

GDP Growth 2007-2018

As of 30 Jun 18

- Domestic and global growth continue at a moderate annual pace of 2.5%-3.0% for the US and 3.0%-3.5% for global growth, respectively (Exhibit 1).

- The inflation rate for advanced economies stands at 2.1%, approximating that of the US, which is 2.0%—well below the level at which the Fed initiated tightening in the three previous economic and credit cycle downturns (1990, 2001 and 2008) in an effort to battle rapidly rising inflation.

- Economic growth has averaged 2.3% over the past five years. In the five years preceding each of the three previous economic and credit cycle downturns (1990, 2001 and 2008), the average annual growth rate was 3.5%.

The Fed regularly conducts a survey of up to 80 large domestic banks as well as 24 US branches of foreign banks. The purpose of the survey is to give the Fed a read on the state of business lending in the country. When banks are optimistic about future prospects, lending standards are eased. Conversely, lending standards are tightened when economic prospects are seen as dim. Lending standards have traditionally been a very accurate indicator to help forecast credit cycle downturns in the past. Lending standards are currently following a favorable trend that supports a continuing expansion phase of the credit cycle. Key takeaways from the survey include the following:

- Standards and terms on commercial and industrial (C&I) loans to large and middle-market firms eased in the most recent survey, which covers 1Q18 (Exhibit 2).

- Standards have eased for C&I loans in each of the past five surveys.

Net Percentage of Domestic Banks’ Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms

The US banking industry is currently benefiting from strong and stable asset quality, reduced credit costs, lower tax rates and higher margins—all of which have contributed to record profitability. The banking industry is poised for ratings upgrades across the spectrum. Annual loan growth has slowed from a peak of 7% to a rate on par with nominal GDP growth of 4.9% year-over-year (YoY). Now in our 10th year of this expansion, it is reassuring to see banks being disciplined on loan growth. Bank asset quality signals a continuation of the expansion phase. Key bank asset quality factors include:

- The number of nonperforming loans fell in 1Q18 for the 31st consecutive quarter.

- The net charge-off ratio of 0.50% is 16 basis points (bps) from its all-time low and compares favorably with a 0.95% average since 1985 (Exhibit 3).

Noncurrent Loan Rate and Quarterly Net Charge-off Rate

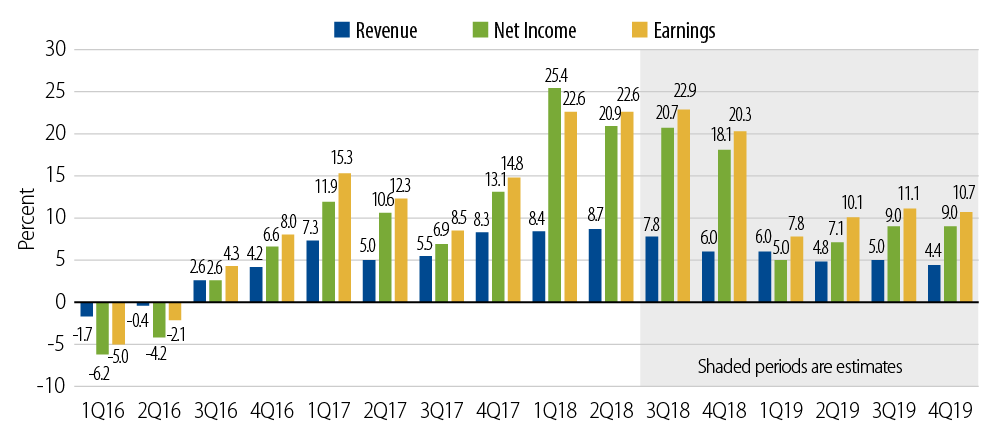

Corporate profitability has been strong and generally is expected to remain so for the balance of 2018 and to slow moderately in 2019. Most impressive is that all major components of the economy are expected to show positive growth, according to Bloomberg. Corporate profitability unequivocally favors a continuation of the expansion phase of the credit cycle. Key factors include:

- Tax reform has reduced corporate taxes and helped boost earnings.

- Double-digit revenue, EBITDA, earnings growth in 1Q18 (Exhibit 4).

- 2Q18 YoY earnings growth is expected to be around 20%.

S&P 500 YoY Growth Rates

The average issuer’s fundamental credit metrics appear to be in solid shape as corporations continue to demonstrate balance sheet restraint. We are mindful of the growth of the investment-grade credit market, particularly BBB issuance and lower-quality covenants in high-yield; however, strong earnings growth, generally conservative balance sheet management and moderate economic growth have contributed to financial metrics for the average issuer, validating our conclusion that the broad credit market is healthy. There are specific industries that have come under pressure (e.g., telecom/media, retail) but overall, financial metrics on average indicate that conditions favor further runway for the expansion cycle. Key factors on financial metrics include the following:

- While still slightly elevated from a historical perspective, leverage ratios have been in decline for the past five quarters.

- Liquidity metrics, earnings, interest coverage and EBITA margins all approximate all-time highs.

Risks That Could Derail the Expansion Phase

Except for the Treasury curve flattening meaningfully, there’s no significant indicator that a credit-driven recession is fomenting; without a recession there’s no chance of a credit downturn. That said, in addition to the indicators mentioned earlier there are other issues that bear close monitoring including but not limited to the following:

Fed Actions

There is a risk that the Fed will grow increasingly aggressive, tightening policy beyond simply “normalizing” rates. We estimate the terminal rate for fed funds of 3.00%. While we can’t discount the possibility that the Fed moves well above that level, given the information we have available today we assign a low probability to such an outcome. The Fed has embarked on raising short-term rates as part of its effort of unwinding its quantitative easing (QE) measures, not to fight a flare-up in inflation. Should wages or material costs or any other factor push up inflation meaningfully, the Fed’s mission could change. Asset managers such as Western Asset—with large teams of credit analysts that communicate regularly with companies upon whom they are responsible for conducting thorough fundamental credit analyses—could become alerted to these cost pressures and make the appropriate adjustments to strategy early in the game. If Western Asset received such information, the Firm would not wait for an indication that the Fed’s mission had changed, but would immediately reassess our constructive view regarding the credit cycle.

Global Trade Practices

Escalating trade tensions and increasing tariffs also represent a risk to economic growth and by extension to the credit markets. Tariffs on a little less than $100 billion of Chinese goods and on imported steel and aluminum products from a number of countries have already been implemented and are expected to have a muted impact at this point. However, if as President Donald Trump has proposed, tariffs were to expand to include an additional $200 billion of goods from China and $350 billion of auto and auto parts from Europe, then the potential impact begins to move the needle. (For more details, please see our paper, Trade Wars in the 21st Century: Perspectives From the Frontline.) Tariffs on a meaningful chunk of the $600+ billion imported from NAFTA partners would most likely be a game-changer. Handicapping an escalation of trade tensions that result in implementation of additional tariffs would be challenging and we will continue to keep our ear to the ground regarding this important issue.

Learning From History to Help See Clearly Ahead

There have been three credit cycle downturns in the past 30 years, and each was associated with either a Fed that tightened policy too much, a bursting market bubble, or both. In our view, a Fed “normalizing” rates is not the same as a Fed hiking rates to rein in inflation (as was the case at the beginning of previous credit downturns). Irrational exuberance that resulted in the dot-com crash in 2000 and the housing collapse of 2007-2008 contributed to ushering in credit downturns. We do not currently see investor or corporate behavior that could be considered “excessive” or giving rise to a “bubble.” In short, we do not believe the conditions that were the catalysts to previous downturns are currently in evidence.

This expansion phase will end one day, but it won’t pass because of old age. There have to be catalysts and as of now, no trigger characteristic is in play nor do we see one on the near-term horizon. As an active manager, we continually modify positioning as events unfold and valuations adjust. We will continue to monitor the indicators mentioned here and source new indicators that may evolve. That said, absent any missteps by the Fed and implementation of tariffs on a larger scale, the expansion phase remains in place as of this writing and we expect it to remain so for the foreseeable future.