Stronger, Safer, Simpler: The Investment Case for Banks a Decade After the Crisis

Executive Summary

- A full 10 years after the financial crisis, the global bank regulatory jigsaw puzzle is nearly complete.

- Global bank regulation remains a key positive pillar for credit investors.

- “Lower-risk banking” business models are firmly entrenched.

- Bank managements, investors, regulators, rating agencies and politicians will reward banks as they return to basics with higher-quality earnings and less casino-like behavior.

- A meaningful rollback of regulations is unlikely, either in the US or globally, but expect to see existing rules applied with a lighter touch.

- We believe these reasons continue to warrant a meaningful overweight to banks globally with a preference down in the capital structure for the strongest US and European banks.

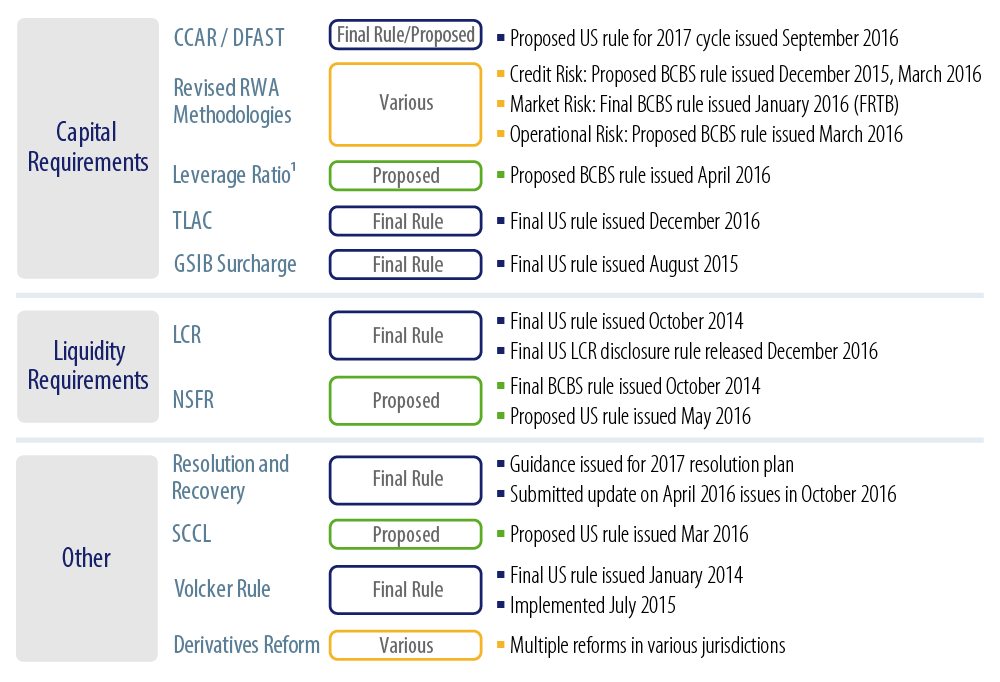

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

Current Regulatory Jigsaw Puzzle

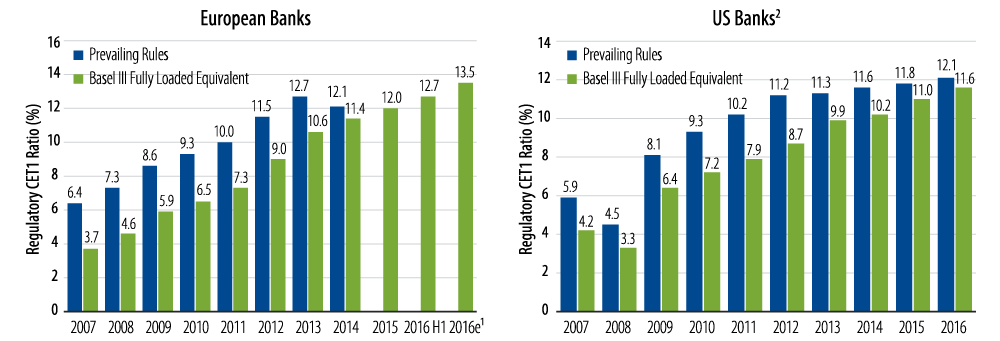

Stronger: Significant Improvement in Capital Levels and Liquidity

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

Evolution of CET1 Ratios

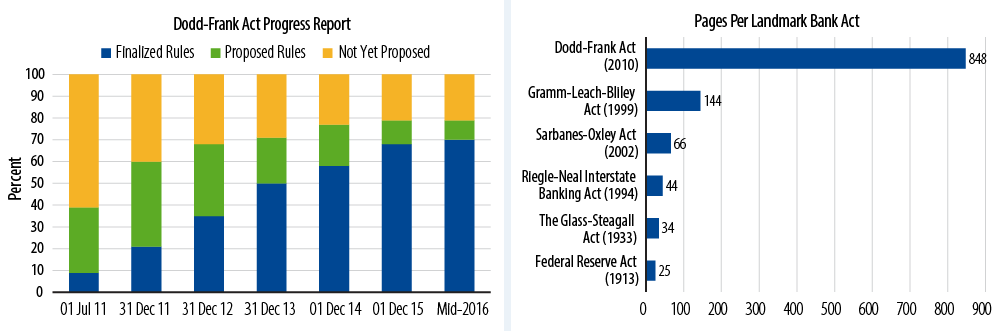

Safer: Judicious Supervision and Tightened Regulatory Framework to Lead to Lower Failure Rates

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

Case Study

Banco Popular: Moving from Theory to Practice

On June 7, 2017, the Single Resolution Board, the authority tasked with resolving failing banks in the eurozone, announced that it was taking resolution action against Spanish bank Banco Popular which involved the transfer of ownership of the bank to Banco Santander for a nominal €1. This followed the determination by the European Central Bank (ECB) that Banco Popular was “failing or likely to fail,” driven in particular by “the rapidly deteriorating liquidity situation” of the bank. In our view, it was this escalating liquidity crunch that led to resolution action being taken midweek, rather than over a “resolution weekend” as everyone has come to expect.

Of the resolution tools available, the authorities chose the “sale of business tool” which “should enable authorities to effect a sale of the institution or parts of its business to one or more purchasers without the consent of shareholders,” as stated in the Bank Resolution and Recovery Directive.

As a result, all of Banco Popular’s existing equity, its AT1 issuance and its Tier-2 bonds were all effectively wiped out by being written down to zero. Senior obligations were being kept whole and became obligations of Santander. From the authorities’ point of view, this resolution action successfully secured the continuation of the critical functions of Banco Popular—retail and small and medium enterprises (SME) deposit-taking; SME lending; and payment and cash services—as well as avoiding adverse effects on financial stability that would arise from a disorderly collapse or even a standard corporate liquidation. As such, we see the case of Banco Popular as a successful application of the rulebook in practice.

Simpler: Incentivized by Regulation and Investors Rewarding Simpler Business Models

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

Regulatory Jigsaw Puzzle and Journey Back to Basics Nearing Completion

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

Bulk of Regulatory Rules Now Finalized

Risks of Meaningful Rollback in Regulation Overstated

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

Improved Conditions Not Yet Captured in Ratings: Positive Ratings Migration Expected

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

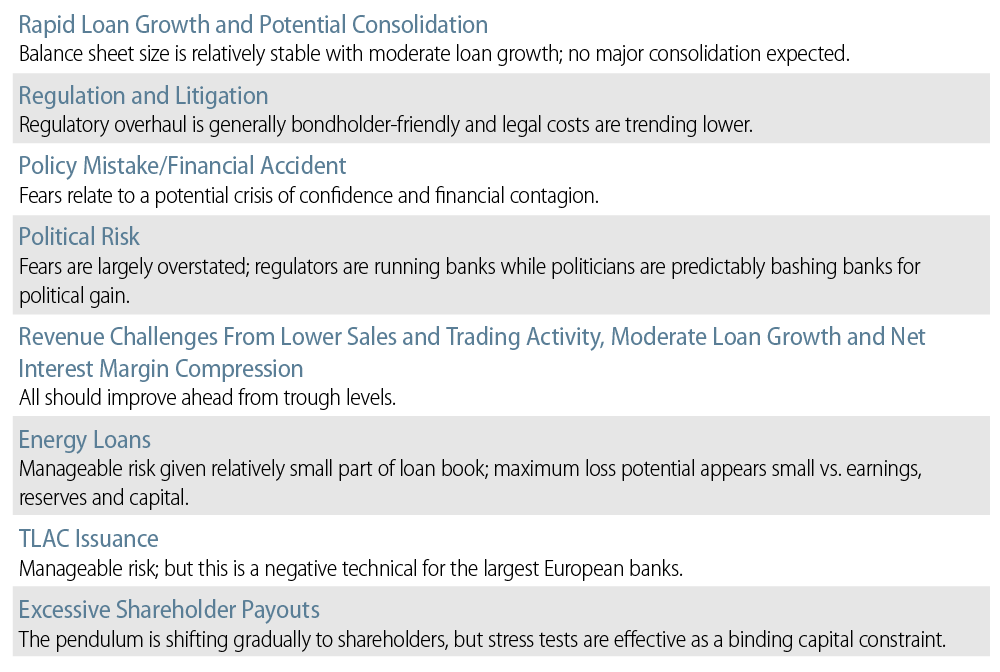

De-risked Does Not Mean No Risk

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.

“It’s the Economy, Stupid” ~James Carville, 1992

Economic Recession—Major and Most Important Risks for Banks

Investment Conclusion

It was 10 years ago this month that we saw the start of a significant widening of spreads in bank bonds and the corporate credit markets more generally. Since then, bank regulation globally has played a critical role in transforming the business model from a casino-like venture into a less volatile and more profitable utility-like industry. Not surprisingly, after a 10-year crusade by regulators, we now believe that the regulatory jigsaw puzzle (Exhibit 1) is largely complete as lower-risk banking business models are well entrenched. In other words, regulators have achieved their two primary goals of ensuring another financial crisis is avoided, and shifting losses away from taxpayers and depositors to investors upon bank failure.

Regulators have learned painful lessons that rapid balance sheet growth and acquisitions tend to make banks much riskier, and that management teams will inevitably be tempted to find loopholes in the next series of Basel rules.

In this note we explain why we believe these painful lessons have made banks stronger, safer and simpler—and therefore more compelling from an investment standpoint.