Eurozone Outlook: Growth, Inflation and the ECB

Executive Summary

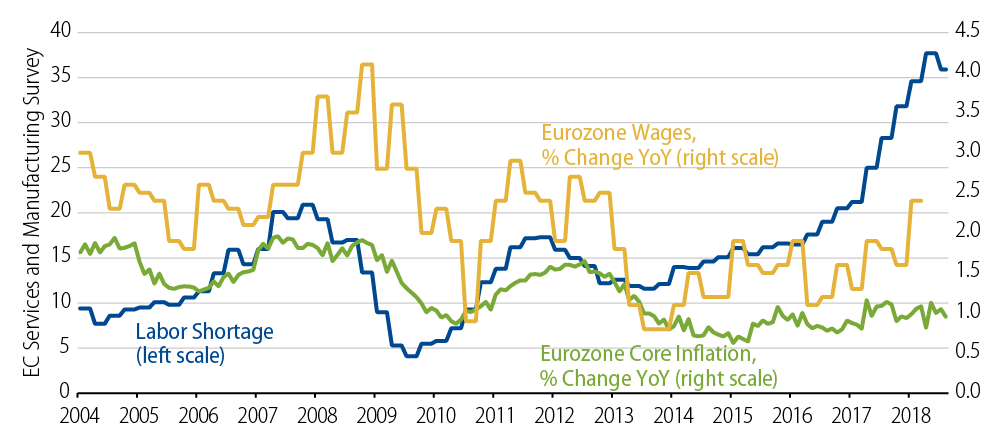

- Substantive supply backlogs/labour shortages and better than expected growth have contributed to a better wage picture in the eurozone.

- We expect core inflation to move higher from 1.0% to 1.3% by the end of the year, with headline inflation remaining around 2.0%.

- In the medium term, we expect core inflation to grind higher and reach around 1.5% with upside risks.

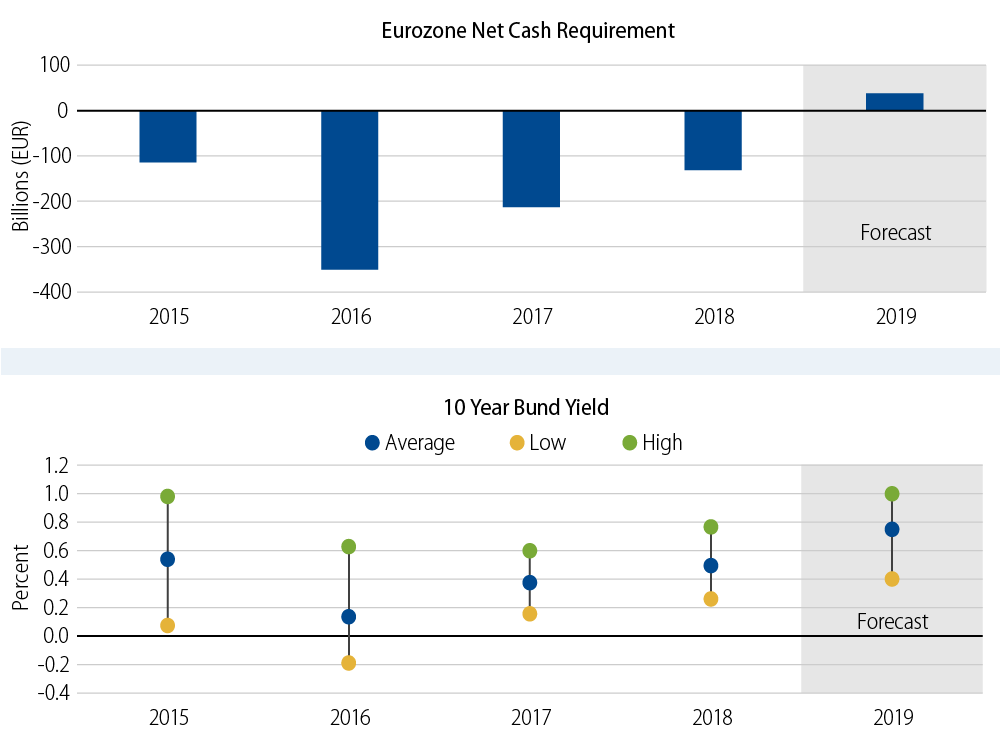

- For 2018, the net supply after PSPP is circa -€131 billion, so the combination of coupons, redemptions and PSPP has been greater than the gross supply of eurozone bonds to the market. This situation is set to change and become positive in 2019.

- The market is pricing in a very shallow path of rate hikes. If our estimate for rising core inflation versus market expectations is right, the market could quickly start to expect a steeper path of rate increases.

This note describes our current outlook for the eurozone and includes an analysis of economic growth, inflation and expectations for European Central Bank (ECB) policy. We explore how these factors influence our strategic underweight duration stance in core European bonds.

Macroeconomic Outlook

Economic Growth

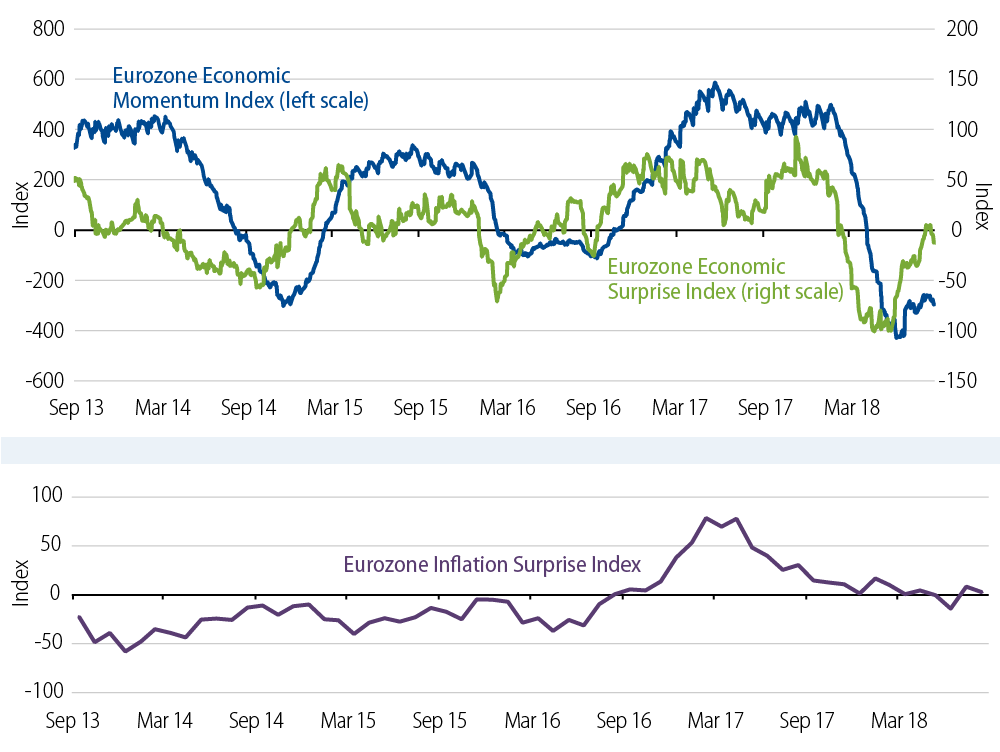

The positive eurozone growth dynamic that started in the summer of 2016 fell back sharply in early 2018. At the end of 2017, the “shock” effect of the eurozone economy growing above trend for longer than expected unrealistically raised expectations that this would continue at the same pace into 2018. When the growth data turned lower, therefore, the impact versus expectations was much greater than normal to the downside. In addition, there have been substantive supply backlogs/labour shortages in the eurozone (Exhibit 1) and better than expected growth has pushed against capacity constraints, particularly in Germany. This is in part behind the better wage picture, with eurozone negotiated wages rising from 1.8% in 1Q18 to 2.2% in 2Q18—a theme the European Central Bank (ECB) has latched onto in recent publications. Economic surprise indices have picked up markedly from a nadir in the summer and these tend to lead the hard data by around three months. Interestingly, although inflation surprises have moderated somewhat, they have stayed positive over this weaker growth period. Overall, we expect growth of around 2.0% for 2018 and 1.8% for 2019.

Eurozone Labour Market and Inflation

Eurozone Economic Surprise Index and Eurozone Economic Momentum Index

Inflation

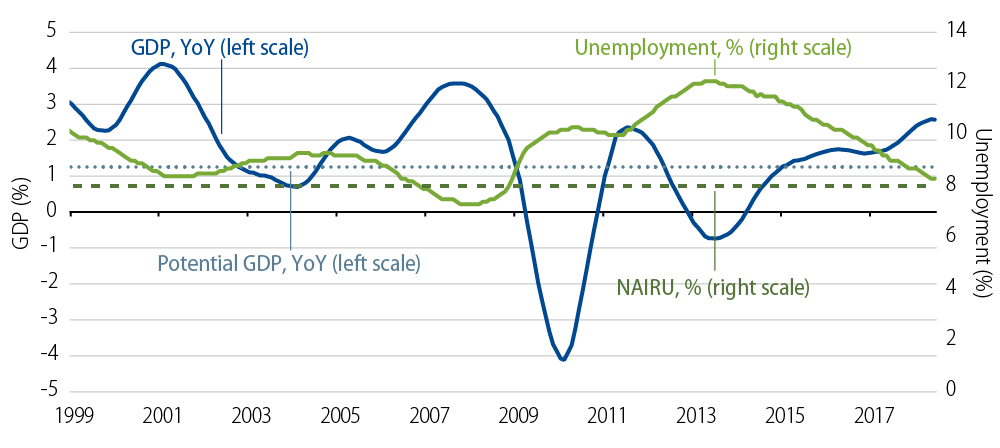

We expect core inflation to move higher, from 1.0% to 1.3% by the end of the year, with headline inflation remaining around 2.0%. The above-trend growth we saw in 2017 combined with underinvestment has slowly begun to diminish the spare capacity in the eurozone economy.

Eurozone Output and Unemployment

Approaching year-end 2018, base effects from the Italian education services and German auto insurance components will add around 0.10% to core inflation, while at the same time, sharp inflation declines from October 2017 will drop out of the year-over-year (YoY) numbers. In addition, second-round effects from stronger oil prices and some wage-price pass-through are expected to impact prices later in the year. Exhibit 3 illustrates how labour shortages have tended to lead wages and core inflation over time.

In the medium term, we still expect core inflation to grind higher and reach around 1.5% with upside risks, but our view remains below the ECB forecasts of 1.6% in 2019 and 1.9% in 2020. The ECB’s core inflation forecast two years forward has, on average, been 0.50% too high over the last three years. More importantly, the 1year1year forward market (one year inflation one year forward) is pricing core inflation between 1.3% and 1.4%, so we are marginally more positive in our inflation expectations than the market’s currently pricing. One of the main reasons for the prolonged period of low eurozone inflation has been the divergence between core and periphery countries services price inflation; this has also begun to normalize and is a key part of the higher core inflation expectations. In the central bank’s most recent press statement, ECB President Mario Draghi said that the ECB projects significantly stronger core inflation.

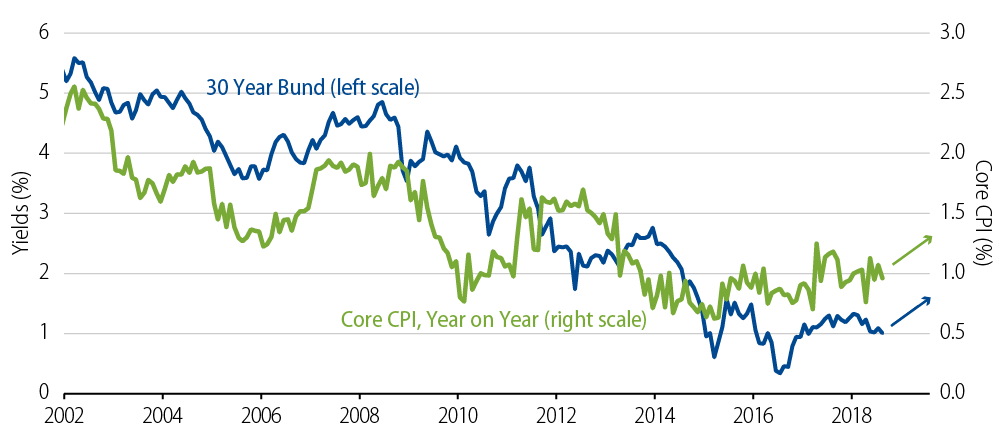

Eurozone Core Inflation and Bund Yields

Policy Implications

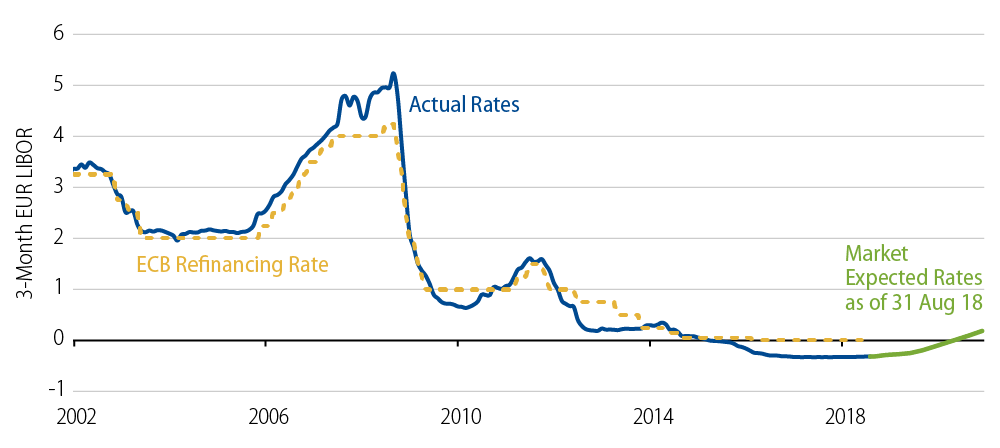

The ECB has set out its intent in terms of Private Sector Purchase Programme (PSPP) reductions to €15 billion per month in September and a data-dependent reduction to zero by the end of the year. The ECB has been purposely ambiguous regarding the timing of its first rate hike signal by using the language “through the summer of 2019,” and seems happy with the market pricing in a small initial move higher in rates by 4Q19. This guidance is essentially data-dependent, which is unusual for the ECB; previously the central bank would never pre-commit to a rates path, instead standing by its mantra that “every meeting was live.” This has clearly reduced market volatility and probably means that the next swathe of ECB meetings into early 2019 will generate less market directional moves. Likely discussions will be around the growth outlook, especially with reference to the impact of trade wars and potential smoothing of monthly bond purchases and/or perhaps purchase of more long-dated bonds with the re-investment flows. Our feeling is that the ECB has become more comfortable with the inflation outlook, and is currently focused more on positive wage formation. Right now the most likely candidate (by a slim margin) to replace President Draghi as ECB president is Erkki Liikanen, a close confidante of Draghi who coined the phrase “patient, persistent and prudent.” Should this replacement come to fruition, we would anticipate little change in overall direction.

Euro Rates

Market Technicals

Supply Dynamics

Clearly, the aforementioned macro arguments and economic and inflation expectations warrant a 10-year German bund yield higher than 0.40%. ECB bond purchases have been a large factor explaining the gap between the macro outlook and market pricing, but we believe this is set to change. Currently we consider bond supply one of the most important variables to monitor. The chart below shows the Net Cash Requirement (NCR) for the eurozone bond market. This is calculated by taking gross supply less coupons and redemptions and PSPP activity—both outright purchases and reinvestments.

Net Cash Requirement for Eurozone Bond Market

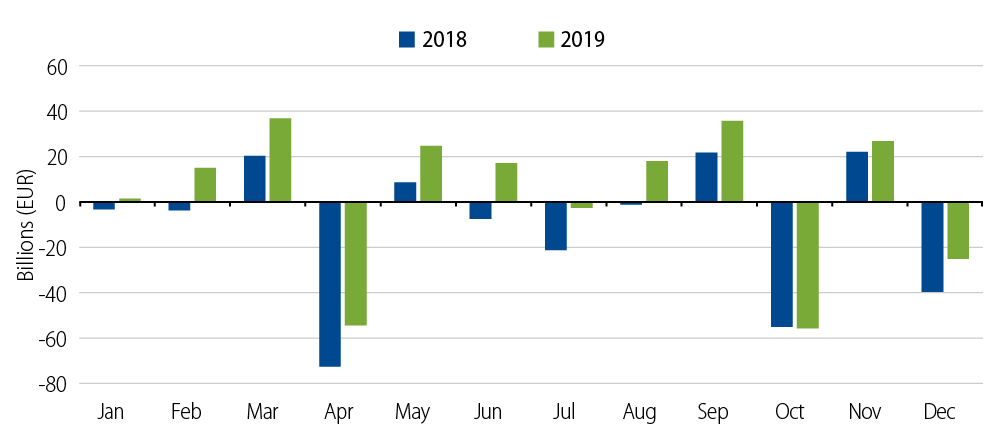

For 2018, we estimate that the net supply after PSPP is circa -€131 billion, so the combination of coupons, redemptions and PSPP has been greater than the gross supply to the market. This means the market not only had to take down any net supply, but has also faced a shortage of high quality government bond paper. This situation has been in existence since the onset of quantitative easing (QE). But, it is all set to change in 2019 as we estimate net supply after PSPP re-investments will be around €38 billion, equivalent to a swing of around €170 billion. Exhibit 7 shows the monthly net supply after PSPP activity in 2018 and expected levels in 2019.

Monthly Net Supply After Public Service Purchase Programme

We believe that all other things being equal, the supply backdrop has a strong relationship with the movement of bund yields. For example, seasonally we have seen bund weakness from mid-October into mid-November as the market has to take down more net supply; likewise, we have seen bund strength from mid-November into early-December as the supply pressure eases and the ECB tends to increase its daily asset purchases early in December due to holidays. Looking forward, net supply in 4Q18 is estimated to be -€73 billion versus +€53 billion in 1Q19. This is one of the largest quarter-over-quarter swings that has been observed and we expect that it will correspond with higher bund yields.

Market Positioning

We believe the market has generally been trading from the “short side” over 2018. The cost of buying downside protection (yields higher) is still much greater than buying upside protection (yields lower), and this points to a short base. Positioning surveys also corroborate this view, although currently positioning is less short/active than it has been over the bulk of 2018. A lot of short positions appear to have been covered during the Italian spread widening and the ECB’s data-independent forward guidance through the summer of 2019.

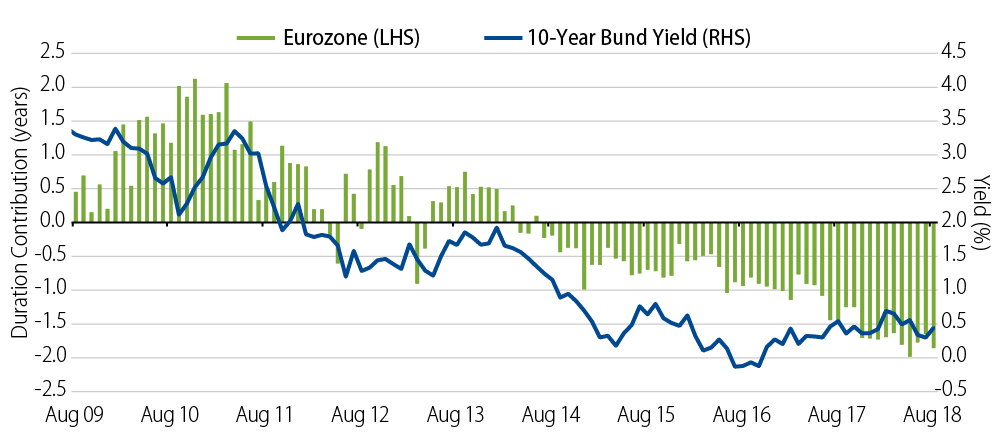

Historic Eurozone Duration Positioning and 10-Year Bund Yields

Base Case Scenario

Much as with our inflation view, we expect a slow move upward in bund yields. The reduction in PSPP from €30 billion to €15 billion at the end of September should have limited impact as reinvestments are typically high in October, but we expect yields to move higher into November when we also expect a rise in core inflation combined with net positive supply. December typically sees lower yields initially but the market will begin to look forward to the significant pick up in net supply in 1Q19. The glide higher in yields we expect will likely be buffeted by risk events such as the Italian budget negotiations, rising protectionism and Brexit volatility. Given the short base and low levels of volatility, these rallies can often be overdone in terms of scale. We will continue to tactically adjust the core underweight in eurozone duration around these different events. While we don’t expect the ECB to necessarily bring forward the timing of the first rate hike, the market is pricing in a very shallow path of rate hikes (with the first full hike of 20 basis points not expected until the end of 1Q20). If our estimate for rising core inflation versus market expectations is realized, we believe the market could quickly start to expect a steeper path of rate increases. Consequently we believe this would also support higher bund yields.