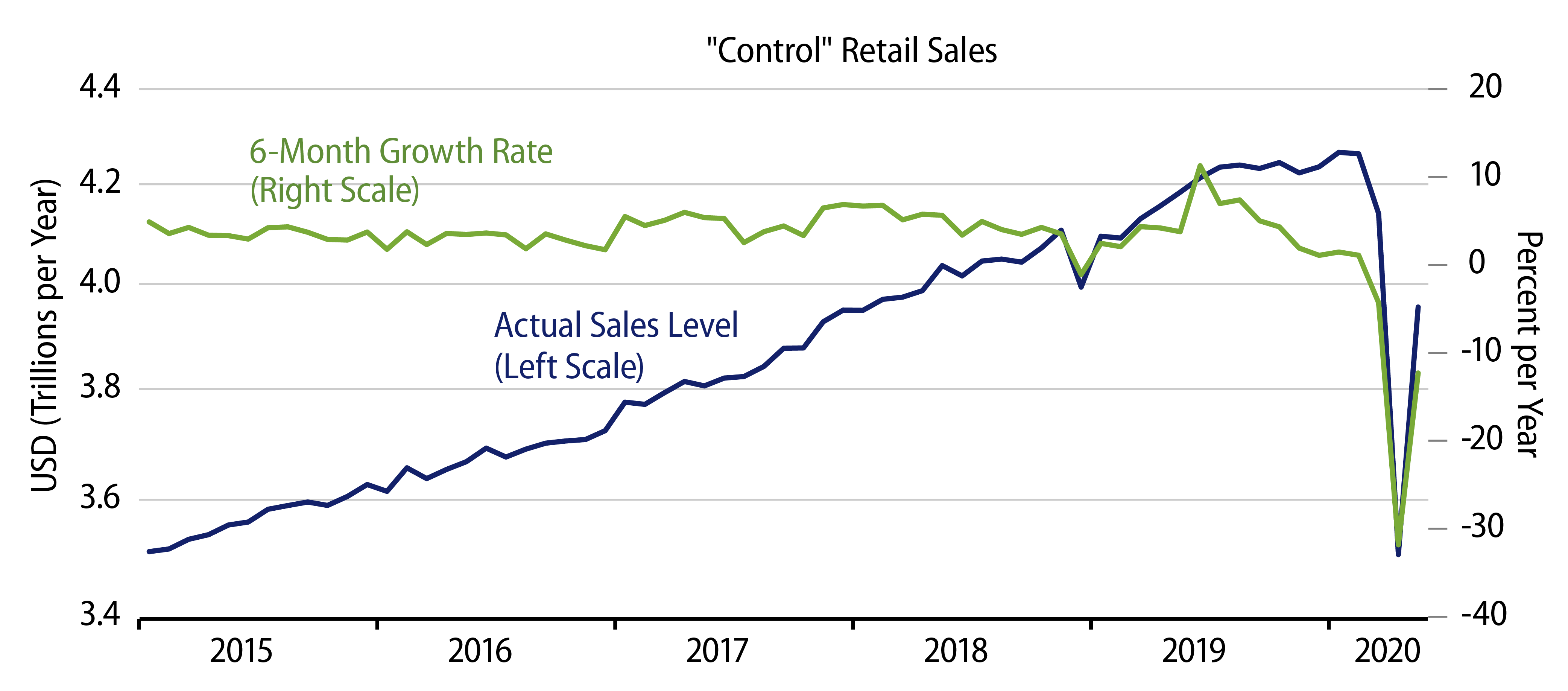

Retail sales registered a 17.7% gain in May, with April’s sales revised up by 2.1% from the level announced a month ago. We focus on a “control” sales measure that excludes sales at vehicle dealers, service stations and building material stores. That measure rose 12.9% in May, with a 2.3% upward revision to April. Most Street analysts track a control measure that also subtracts restaurants. That measure rose 11.0% in May.

Keep in mind that the announced May gains are exaggerated by the size of the declines that preceded them in March and April. Thus, even with the May gains and April revisions, total retail sales are still down 7.9% from their February level, while our control measure is down 7.2%. That 3-month net decline in control sales annualizes to a -25.9% rate of change from February through May. So, it is fair to say that the May sales gains, while welcome news, mark only a beginning to the recovery from the COVID shutdown.

That recovery was most evident in a few sectors. Thus, motor vehicle sales rose 46.2% (non-annualized) in May, bringing them nearly back to February levels (down “only” 7.4% from February, after a 36.7% plunge in March and April). Sporting goods, hobby, and music stores enjoyed an 88.2% sales increase in May, bringing them above February levels. Nonstore (online) retailers, of course, also benefited. Their sales actually rose 15.0% during the March/April COVID shutdown, and they increased 9.0% further in May.

Other sectors show less buoyant May gains. Drug stores and related businesses saw only a 0.4% May sales gain, following a 10.4% decline in March and April. Miscellaneous store retailers (florists, specialty stores) saw a 13.6% sales increase in May, but that left them 27.5% below February sales levels. Much of the same pattern occurred for clothing and furniture sales (down 23.8% and 63.3%, respectively, from February).

Probably most disappointing were restaurant sales. While especially hard hit by social distancing, etc., restaurants had resorted to curbside, takeout, and delivery service. As mentioned two weeks ago, the sector boosted employment by 1.3 million in May. Consequently, we were hopeful for a very buoyant May sales gain. Sales there did increase 29.1% in May, but April was revised lower by 7.5%, and the May restaurant sales were still down 40.9% from February.

Restaurants are one of five service sectors hit especially hard by the shutdown: restaurants, hotels, passenger travel, recreation, and medical care. They are the only one of these included within the retail sales report. With the flexibility restaurants have displayed in shifting to out-of-store service, we were hopeful the sector would point the way to a service-sector rebound sharper than the consensus is expecting. Today’s retail report did not provide confirmation of that expectation.

Once again, the sales gains announced today are a good start, and it only is to be expected that some sectors will rebound faster than others. Goods-producing and goods-selling sectors will likely quickly rebound back toward February operating levels. We are still hopeful for the hard-hit service sectors, but we are going to have to see better data for them in May and June than is suggested by today’s results for restaurants.