So much for fears that the US consumer is foundering. Retail sales rocketed higher in January, with headline sales up 5.3% from December, and so-called control sales measures up 6.0% to 6.2%. Similarly sharp January gains were registered by every major component of retail sales. This writer cannot remember any monthly release that showed such uniformity of monthly changes.

As for the aforementioned fears, just a month ago various analysts were fretting that consumer spending was slowing down, presumably due to the waning of federal aid. In contrast, our reading was that sales were merely going back to sustainable levels, as shoppers were “double-dipping” in summer and fall, satisfying current needs and also buying merchandise not purchased during the spring shutdown.

Today’s news kills the fears. However, it doesn’t directly vindicate our story, as our explanation wouldn’t have predicted the extremely strong gains announced today. Instead, the best explanation we can offer for the extremely strong January gains—and much of the November/December declines—is that seasonal shopping patterns have been disrupted by the pandemic.

Government data are seasonally adjusted to reflect “normal” past experience. The dominant seasonal event for retailers is the Christmas shopping season, and the Census Bureau’s retail sales data are adjusted to smooth out the effects of extremely large sales gains over October-December followed by extremely large sales declines in January.

The declines in adjusted sales reported for October-December actually reflected (hid?) sharp sales gains before seasonal adjustment. Similarly, the 5% to 6% sales gains reported today for January reflect (hide?) 17% declines before seasonal adjustment. Yes, an unadjusted January decline in sales of only 17% is an extremely strong result relative to past history. Again, our contention is the pandemic altered shopping patterns, understating the strength of spending last fall, and overstating the strength in January.

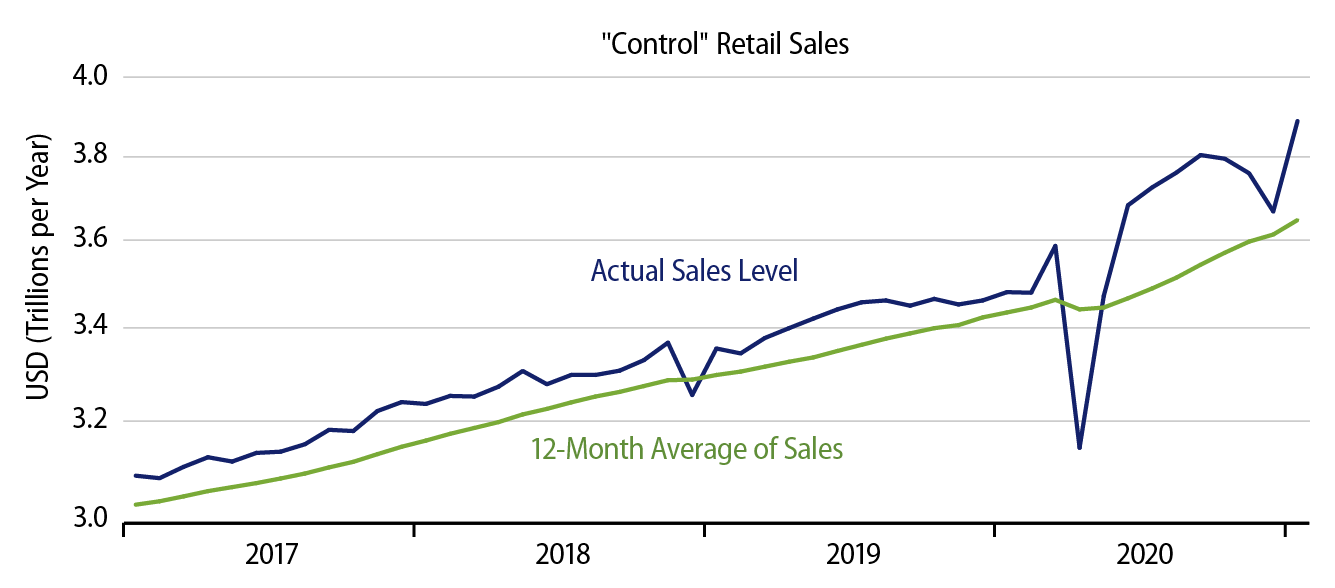

Hopefully, Exhibit 1 allows you to see through all this noise. It shows both monthly movements in control sales as well as a moving 12-month average of sales. The monthly data show all the short-term ups and downs from the shutdown(s), reopening(s), then the Covid Christmas.

Notice that beneath all these swings, the 12-month average of sales has been above its pre-Covid trend even since last September. In other words, shoppers bought enough merchandise over the summer to MORE than make up for all the shopping not done during the shutdown. And even with the reported declines in sales in 4Q20, the 12-month average has continued to move further above those pre-Covid trends over recent months.

Again, there never was really any consumer weakening late last year, and the January news obliterates those fears. In fact, the data through January completely kill any case for further government stimulus … or at least they would if policy were driven by real-world facts.