“If you can keep your head when all about you are losing theirs, you’ll be a man my son.” ~Rudyard Kipling

“When everyone is thinking the same, no one is thinking.” ~George Patton

Data released today showed a 0.4% decline in consumer spending, a 1.1% decline in personal income and an 11.0% decline in new-home sales, all for November. We’re guessing that these news items will intensify the media drumbeat proclaiming a sputtering economy. However, we are going to invoke our inner Kipling and Patton and repeat the conclusion that the economy is doing fine for the most part, other than those few sectors impeded by government shutdowns.

For each of these indicators, upon looking through extraneous components that we typically abstract from, the November data looked reasonably good. Yes, growth has slowed—it had to!—from the blistering rebound pace of the summer. However, the recovery continues.

Exhibit 1 shows the details of consumer spending. “Underlying” spending on goods indeed declined in November, but, as was the case with retail sales, November levels remained above the trend lines in place prior to Covid. For a while in the summer, consumers restocked, spending at unsustainably high rates in order to make up for purchases not accomplished during the spring shutdown. That restocking has run its course, but ongoing goods-spending levels remain firm.

As for services spending, the headline number was held down by a 10.6% decline in utilities spending, driven by unseasonably warm weather in most of the country, and by a 5.2% forced decline in restaurant spending. We typically abstract from these components on account of their volatility. Net of these, “underlying” consumption of services rose a healthy 0.3% in November on top of a +0.4% revision to October’s level. Services spending is still well below pre-Covid trends, but that largely reflects ongoing strictures in such sectors as hotels, recreation venues, air travel and health care.

Within personal income, private-sector wage income rose a healthy 0.5%, with a slight upward revision to October. Headline personal income was held down by waning government benefits and by a 5.4% decline in proprietors’ income, presumably largely reflecting restauranteurs. Even with said declines, total personal income and proprietors’ income were still above their pre-Covid trend paths.

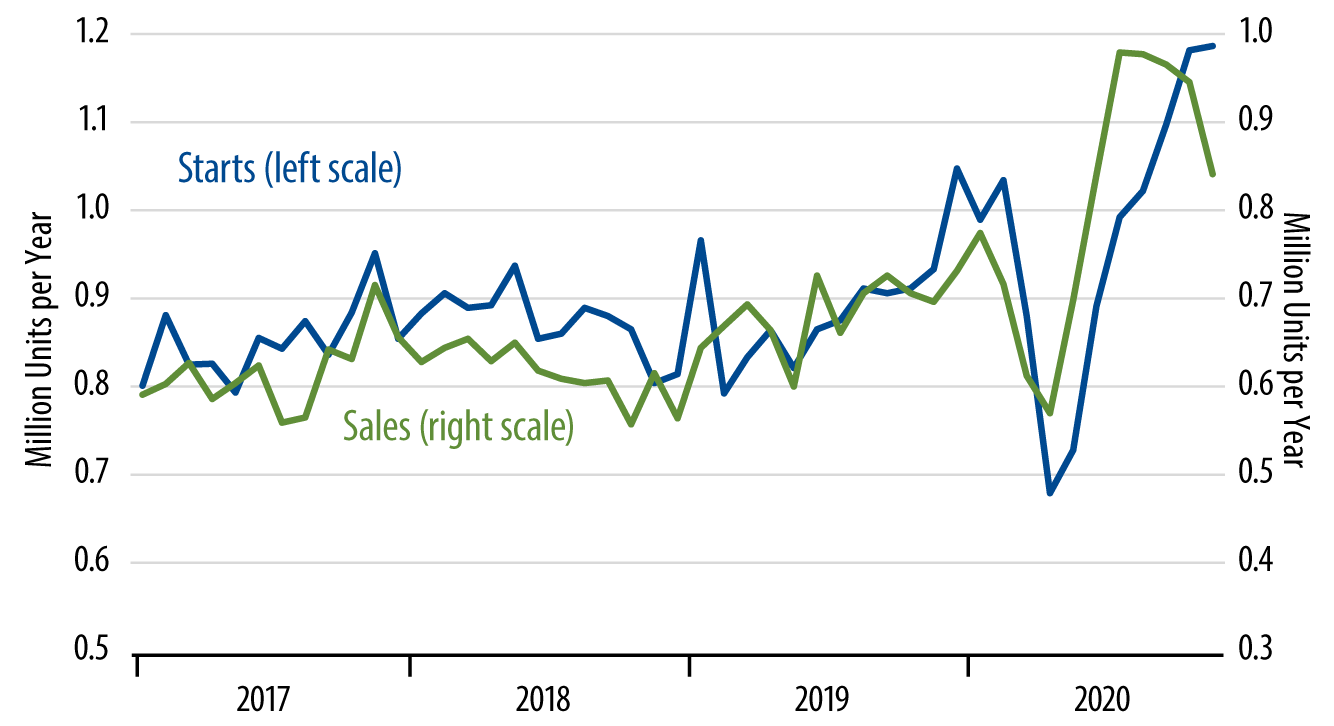

Finally, the decline in new-home sales came off extremely elevated October sales levels and still left November home sales levels 22.7% above the average level for 2019. For all of 2020 to date, new-home sales are up 19.0% from 2019, after three years of only tepid growth. It would be foolish to interpret the home sales data as indicating anything other than an ebullient housing market. Merely to catch up with the torrid new-home sales pace of the last six months, construction spending will have to continue to rise strongly for quite a few more months.