Real GDP grew at a 33.1% annualized rate in 3Q20. Context is everything, so let’s recount the various perspectives of this number. First, it is far and away the fastest quarterly growth rate ever recorded for the US. Then again, it follows far and away the sharpest quarterly decline ever recorded.

The arithmetic is such that a 33.1% rate of gain in 3Q20 does NOT fully offset the 31.4% rate of decline in 2Q20. [The arithmetic is that (1+33.1%)*(1-31.4%) < 1.] Rather, the 3Q20 level of GDP remains 2.2% below the 1Q20 level and 3.5% below the 4Q19 level.

By way of comparison, in 2Q09, at the trough of the recession triggered by the global financial crisis, GDP was down 4.0% from its previous cyclical peak (six quarters earlier). In other words, even after 3Q20’s torrid rate of growth, the economy is still below its 4Q19 peak almost as much as it was at the trough of the horrendous 2007-09 recession.

The final perspectives we’ll offer are the two we think most salient. Despite the gaping net decline in GDP still in place, there is no question that the economy’s recovery has been dramatically stronger than anyone would have ventured to guess. Back in May, nobody we know of was predicting 3Q20 growth anywhere north of 20%, and if anyone had been brash enough to predict 30-something percent growth, they would have been laughed down (shamed?). If this is not a V-shaped recovery, what is?

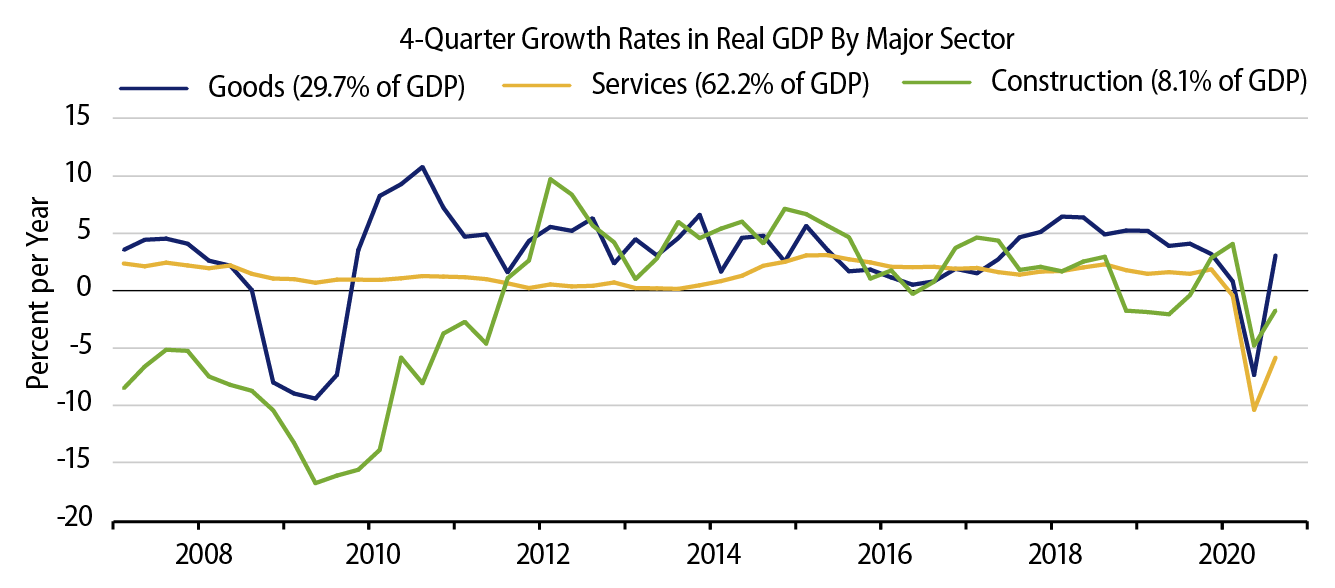

Furthermore, a glance within the components of GDP indicates that the recovery has been virtually complete wherever social distancing and continued shutdown have not gotten in the way. The goods sectors within GDP grew at a staggering 59.5% annualized rate in 3Q20, and the level of 3Q20 goods sector GDP was actually 2.3% above pre-Covid (1Q20) levels.

Construction GDP grew at a 16.4% annualized rate in 3Q20 and was within 2.1% of its pre-Covid levels. With pipeline problems inhibiting construction spending in 3Q20 and with new-home sales and starts remaining at elevated levels, construction GDP is sure to register even stronger growth in 4Q20.

The epicenter of weakness in the economy remains in services, where Covid strictures continue to inhibit. While services GDP rose at a nice 24.1% clip in 3Q20, that followed a 32.9% rate of decline in 2Q20 and left 3Q20 services GDP 6.3% below pre-Covid levels. Service sectors are likely to register another good growth rate in 4Q20. However, at the end of 2020, the remaining weakness in the economy is all but sure to be in these services sectors, and that weakness is likely to remain until vaccination or herd immunity allow a more complete reopening of such service venues as restaurants, theaters and resorts.

The threat of renewed shutdowns remains the biggest downside risk for the economy. From what we have read lately, “the science” would not support such renewed lockdowns, but the politics might take us there anyway.