The Consumer Price Index (CPI) declined 0.1% in May, with the core CPI declining by the same amount. These slight declines were a moderation from the sharper declines seen in March and April, when the COVID-induced economic shutdown was first taking effect. We have seen an apparent bottoming of economic activity in May, and the CPI news is in line with that.

Where have prices declined on net over the last three months? Besides the obvious area of gasoline and other fuels (down 16.8% over March-May), we have also seen noticeable declines for apparel (-8.8%), most types of furniture (-1.8%), recreational commodities (-1.7%, sporting goods, toys, books, etc.), personal care commodities (-0.6%, toothpaste, hair spray, etc.), transportation (-9.9%, fares and car rental), and hotel rooms (-14.7%). At the same time, there have been net price increases for food (+2.5%), alcoholic beverages (+1.6%), shelter (+0.8%), medical care (+1.6%), appliances (+0.5%) and other household equipment (+1.8%).

The price increases for recreational services are surprising, given that recreation, passenger travel, accommodations and food service have been hit so hard by the shutdown. As already stated, prices for travel and accommodations have declined fairly sharply. For food services, their product costs have risen, so one would not expect big declines there. However, with most theaters and sports venues closed and with prices for recreational equipment declining, the 3.3% non-annualized increase in costs of admission over the last three months is a surprise.

Still, across the range of a complex economy such as ours, there are always going to be surprises. Generally, what happened in May is that price declines moderated for those sectors (listed above) that have seen declining prices. Did price increases intensify in May for those sectors raising their prices? No, they didn’t.

The May “moderation” in the CPI does not look anything like a transition from deflation to inflation. Rather, again, with the contractionary effects of the shutdown waning/peaking, it looks like downward pressures on prices in most sectors are also waning.

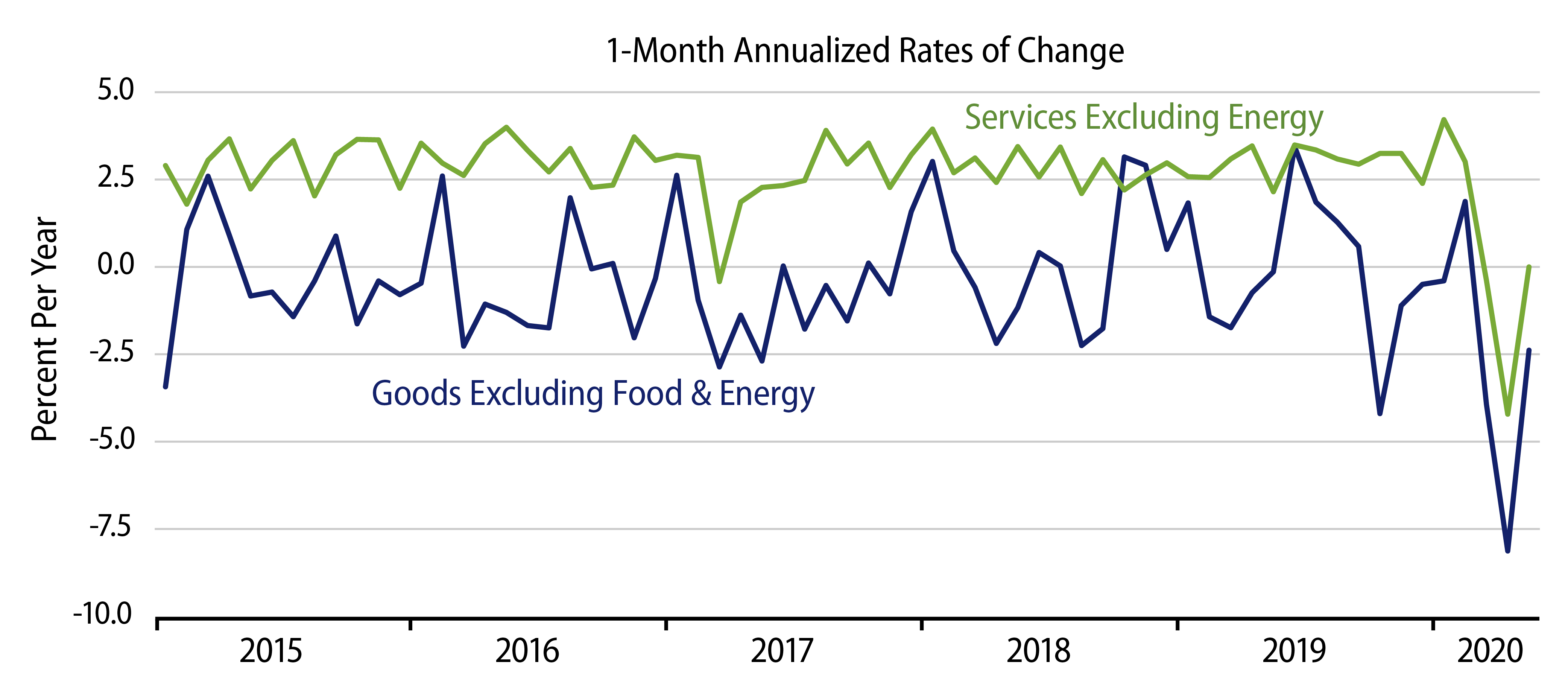

In the chart, you can see declines in prices for both commodities and services over recent months. The truly extraordinary thing about the recession of the last three months has been the dramatic hit to the usually tranquil service sector. This shows up clearly in the CPI data here.

Will the Fed’s recent aggressive action stir higher inflation down the road? Our answer is a provisional “no.” What has been called Fed stimulus is actually just accommodation of a tremendous demand for precautionary balances by businesses. So, for now, the Fed’s actions have merely staved off a more severe deflation rather than generated inflationary pressures. However, that can change, and someday the Fed may have to put the proverbial toothpaste back into the tube.