Municipal Yields Moved Lower, Defying the Treasury Selloff

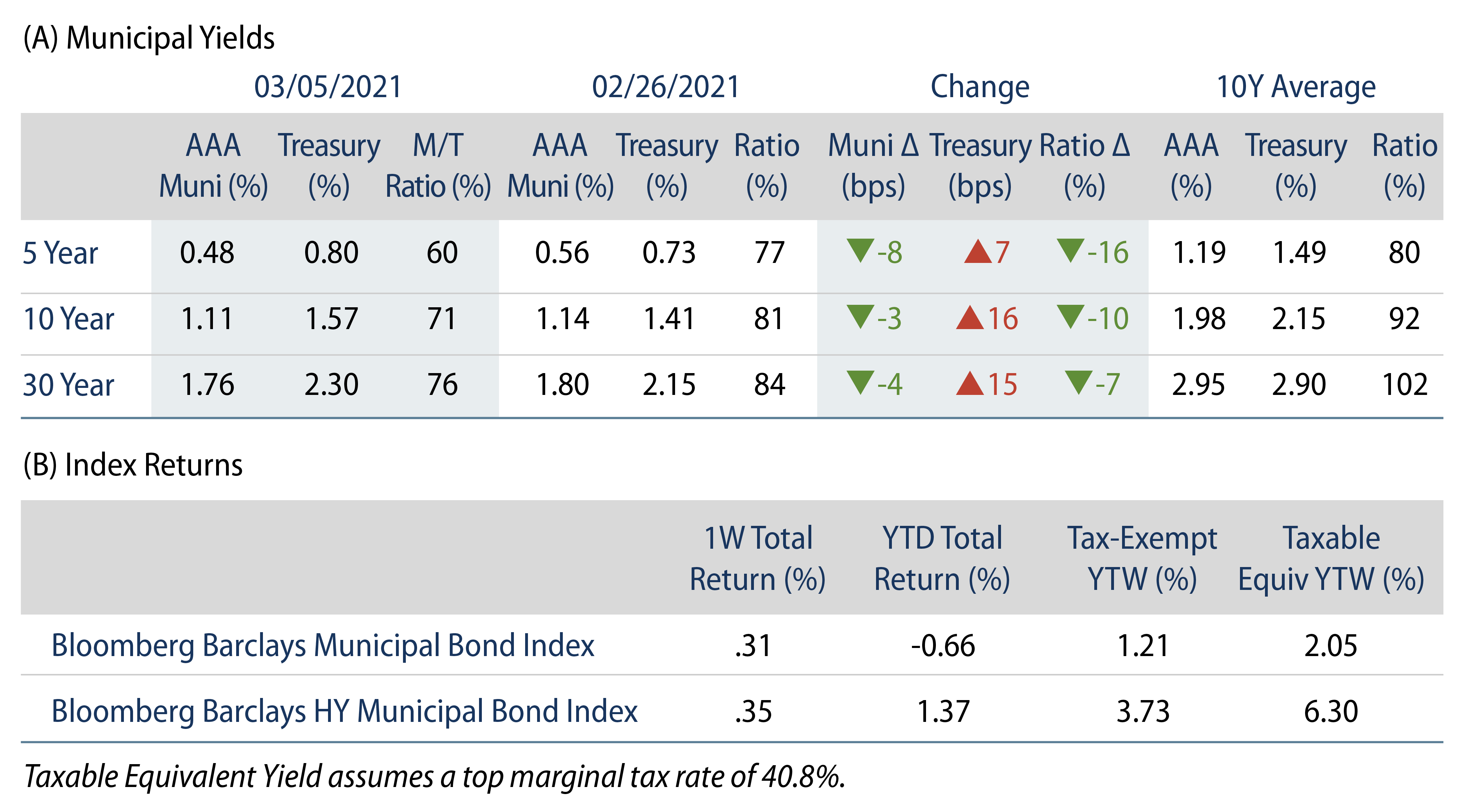

US municipal yields moved lower across the curve, despite the Treasury selloff. AAA municipal yields moved 4-8 bps lower across the curve. Municipals outperformed Treasuries and Municipal/Treasury ratios retreated back under 80%. Technicals weakened as municipal fund flows turned negative, though new supply remained limited. The Bloomberg Barclays Municipal Index returned 0.31%, while the HY Muni Index returned 0.35%. This week we examine the aftermath of the Texas winter storms.

Market Technicals Weaken as Municipal Fund Flows Turn Negative

Fund Flows: During the week ending March 3, municipal mutual funds recorded the first week of outflows in over 17 weeks, totaling $605 million, according to Lipper. Long-term funds recorded $667 million of outflows, high-yield funds recorded $722 million of outflows and intermediate funds recorded $69 million of inflows. Year-to-date net (YTD) inflows stand at $26.3 billion.

Supply: The muni market recorded $9.3 billion of new-issue volume during the week, down 9% from the prior week. New issuance YTD of $69.5 billion was down 3% year-over-year (YoY), and tax-exempt issuance was down 8% YoY. This week’s new-issue calendar is expected to reach $9.3 billion, in line with the prior week. The largest deals include $1.9 billion state of California and $573 million New York City Municipal Water Finance Authority transactions.

This Week in Munis: Texas Storm Fallout

Texas municipalities continue to grapple with the aftermath of the severe winter storm that deactivated nearly half of the state’s power-generating facilities, impacting approximately 4.5 million Texas residents who faced widespread blackouts and water shortages.

Texas utilities primarily operate within a deregulated in-state market, and as the electricity shortage drove natural gas and electricity prices higher, significant pressure was placed on municipal utilities across the state. Brazos Electric Power Cooperative Inc. filed for bankruptcy citing $1.8 billion of debt owed to ERCOT, the nonprofit that operates most of the state’s electric grid. The San Antonio City Public Service system also cited $1 billion in charges attributable to the severe weather event, and was subsequently downgraded from AA+ to AA- by Fitch, which maintains a negative outlook on the credit.

Some Texas municipalities that depend on utility transfer revenues could also be negatively impacted from the increased cost pressures. Just last week, the City of Georgetown announced plans to issue a $48 million 10-year bond to term out the costs associated with the storm.

Despite the near-term operating stress, municipal electric utilities within the state tend to have strong liquidity profiles and generally have the ability to pass energy costs to consumers through rate increases. However, the recent credit stresses underscore the value of independent credit analysis within municipal portfolios. We also anticipate that February’s events will lead to increased consideration of climate resiliency measures as part of utilities’ longer-term capital plans, which could lead to re-leveraging of the sector, but could also create opportunities for ESG-oriented investment.