Municipal market returns grinded higher last week, supported by strong flows into municipal mutual funds and seasonally high coupon and principal reinvestment which offset an elevated calendar. This week we take a deeper dive into jobs data associated with COVID-19 economic impacts to assess varying degrees of austerity at the state and local levels.

The Muni Market Posted Positive Returns Last Week

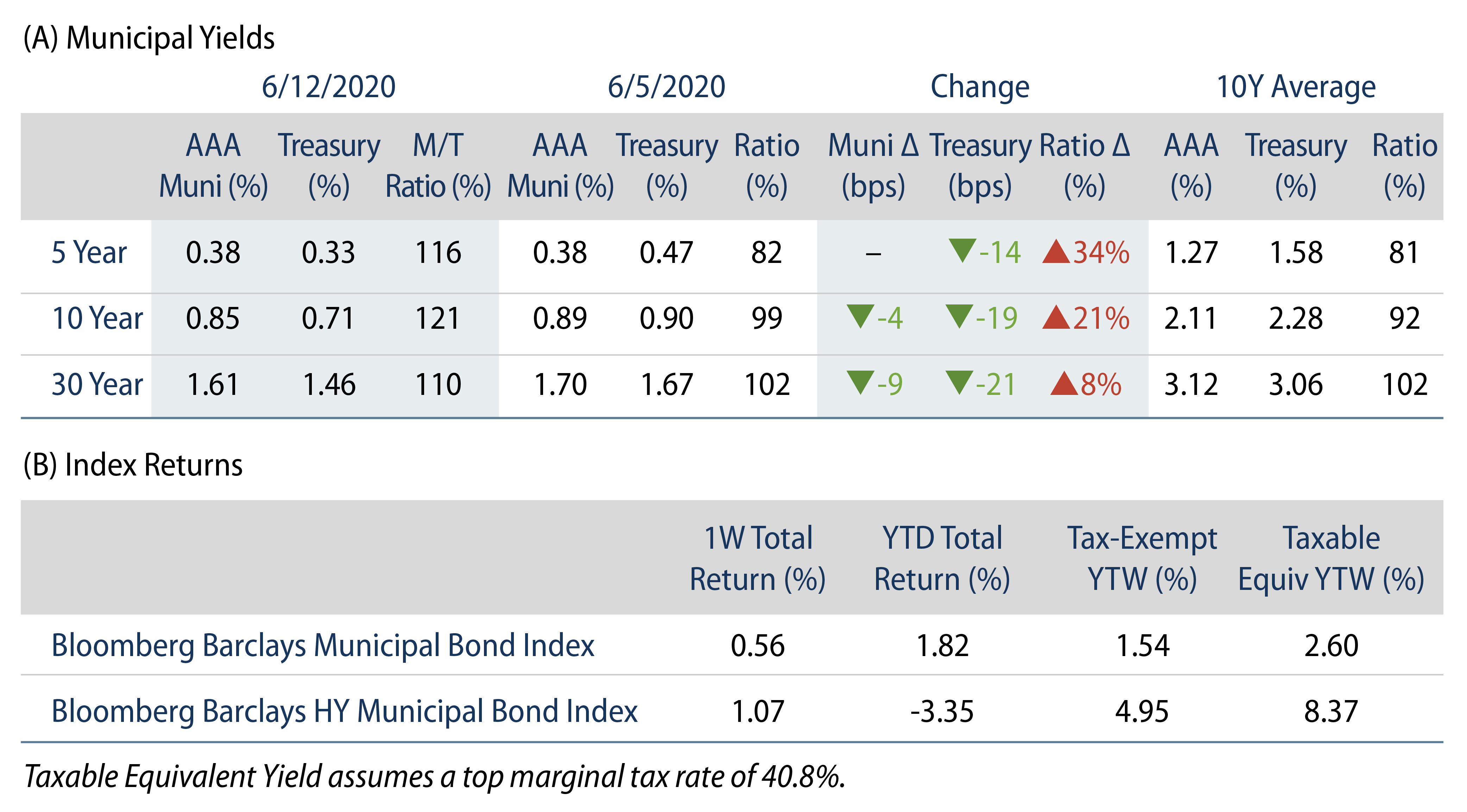

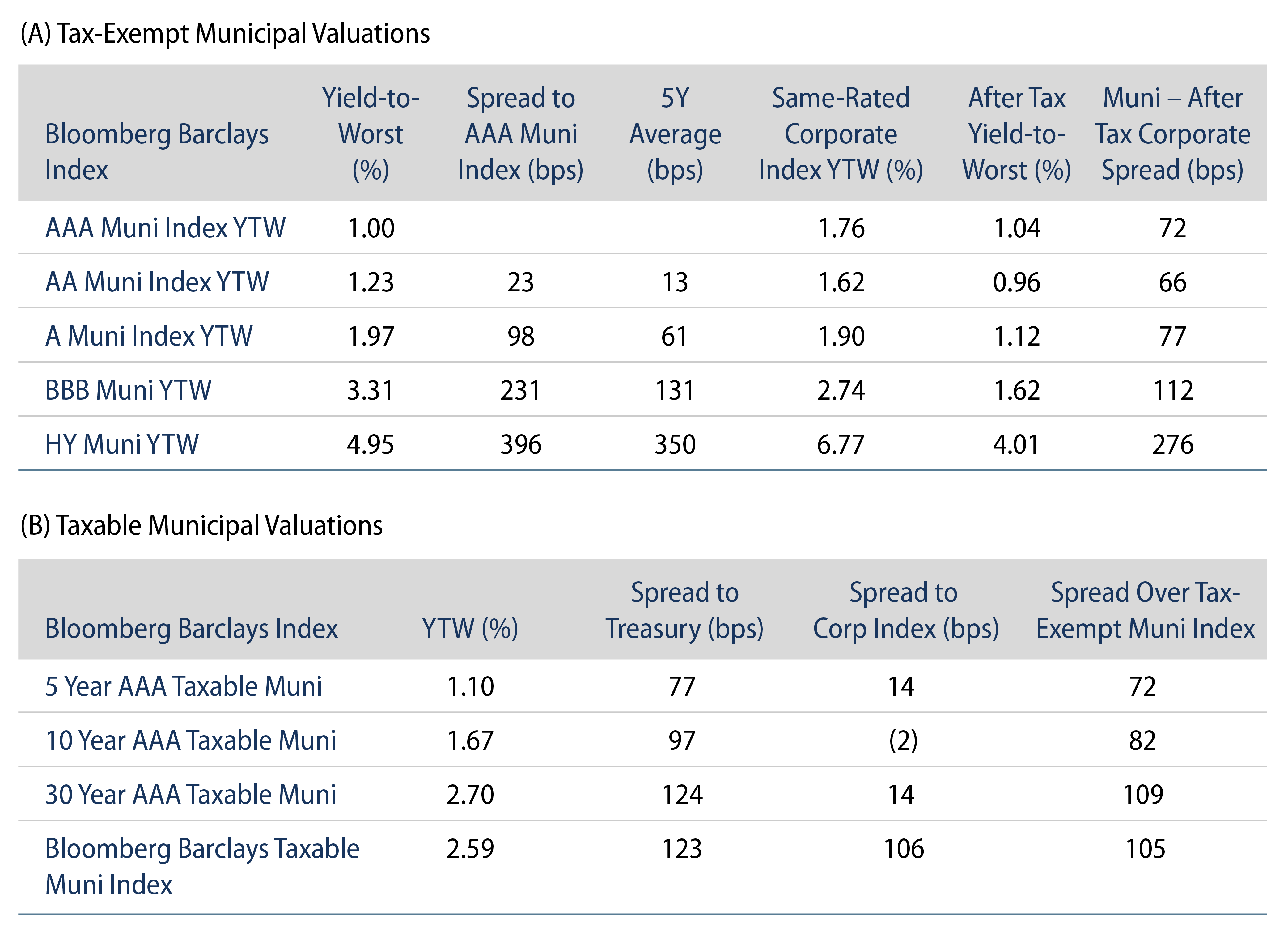

AAA municipal yields moved lower in intermediate and long maturities, supported by a rally in Treasury rates and robust fund flows. The Bloomberg Barclays Municipal Index returned 0.56%, while the HY Muni Index returned 1.07%. The outperformance in Treasuries resulted in increasing Muni/Treasury Ratios, particularly at the short end.

Muni Technicals Strengthen, Supported by Robust Fund Flows

Municipal mutual funds reported $2.8 billion of inflows, a fifth consecutive week of inflows. Long-term funds recorded $2.0 billion of inflows, HY funds recorded $572 million of inflows and intermediate funds recorded $1 billion of inflows. Year-to-date (YTD) municipal fund net outflows now total $11.5 billion. In addition to robust fund flows, the municipal market typically sees seasonally high coupon and principal payments in June and July, which can drive reinvestment into the asset class.

The elevated municipal fund inflows and coupon/principal reinvestment offset an elevated supply calendar. The muni market recorded $11.3 billion of new-issue volume last week, up 10% from the prior week. YTD issuance of $173 billion is 17% above last year’s pace, primarily driven by taxable supply, which is over 3x that of last year’s levels while tax-exempt supply remains below last year’s levels. We anticipate an approximate $12 billion calendar next week, led by $1.9 billion from the New York State Urban Development Commission and $794 million in taxable Texas Transportation Commission transactions.

This Week in Munis: Muni Payrolls Decline, Highlighting Austerity

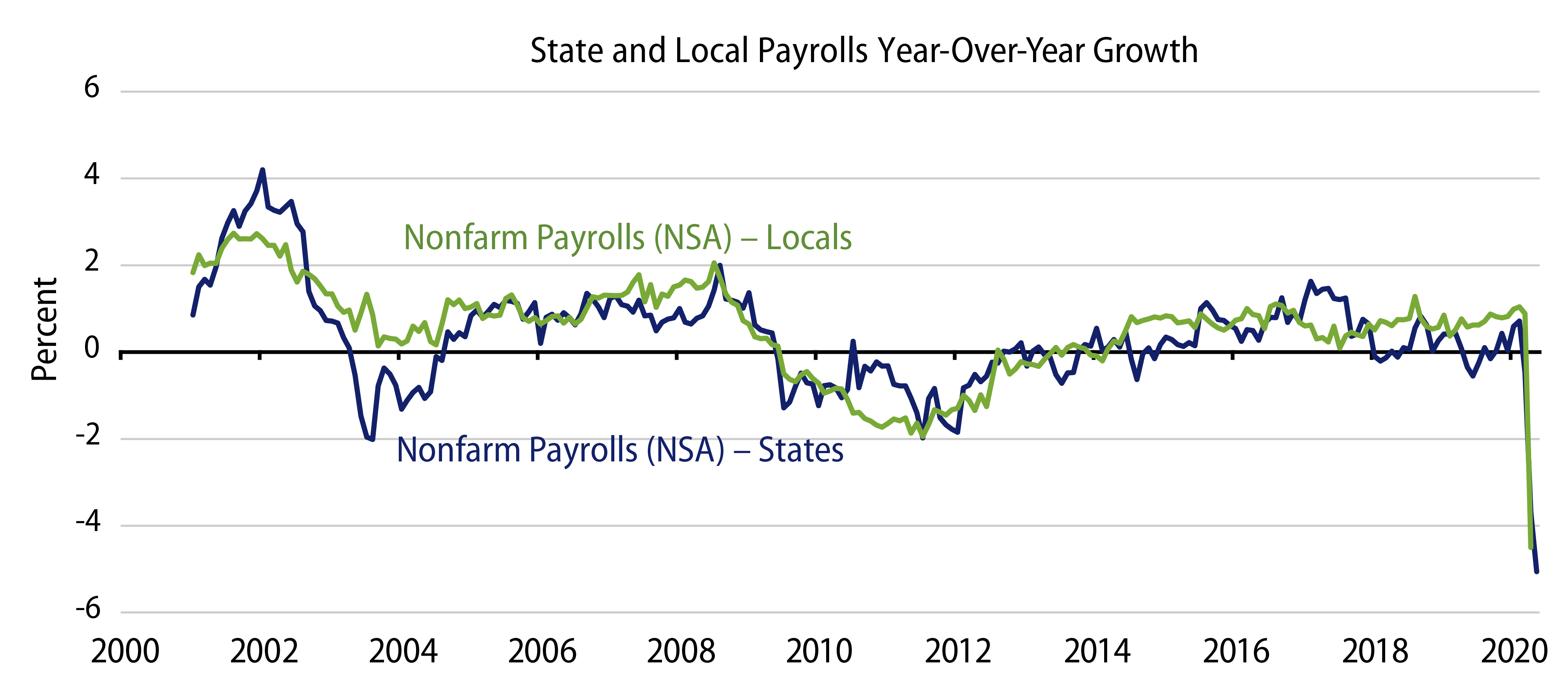

Following the better-than-expected jobs report released on June 5, this week we are highlighting state and local payroll declines that we have observed across the nation. As the economic impact of COVID-19 roils state and local finances, austerity comes into focus. Given state and local financial disclosures are frequently dated, Western Asset’s credit research team utilizes many real-time tools to assess changing credit conditions, one of which is monthly state and local payroll reports released by the Bureau of Labor Statistics (Exhibit 1).

In May, state and local payrolls declined 662,000 to 18.6 million, down 3.6% month-over-month. Considering payroll declines in March and April, states and local municipalities reduced employment by approximately 1.6 million individuals, which is approximately 7.9% below February highs, and steeper than prior recessions. Looking at the state-level detail as of April 30, Michigan, Vermont and Hawaii observed the largest payroll declines, consistent with the manufacturing and tourism strain in those economies.

While not great for growth (state and local spending accounts for approximately 14% of GDP), spending reductions and payroll cuts are what we have seen from states and locals to meet their obligations in the past, and what our base case calls for going forward. However, we remain cautious on local general obligations and downstream entities that could receive lower state funding due to budgetary stress.