Municipals Yields Moved Higher During the Week, Underperforming USTs

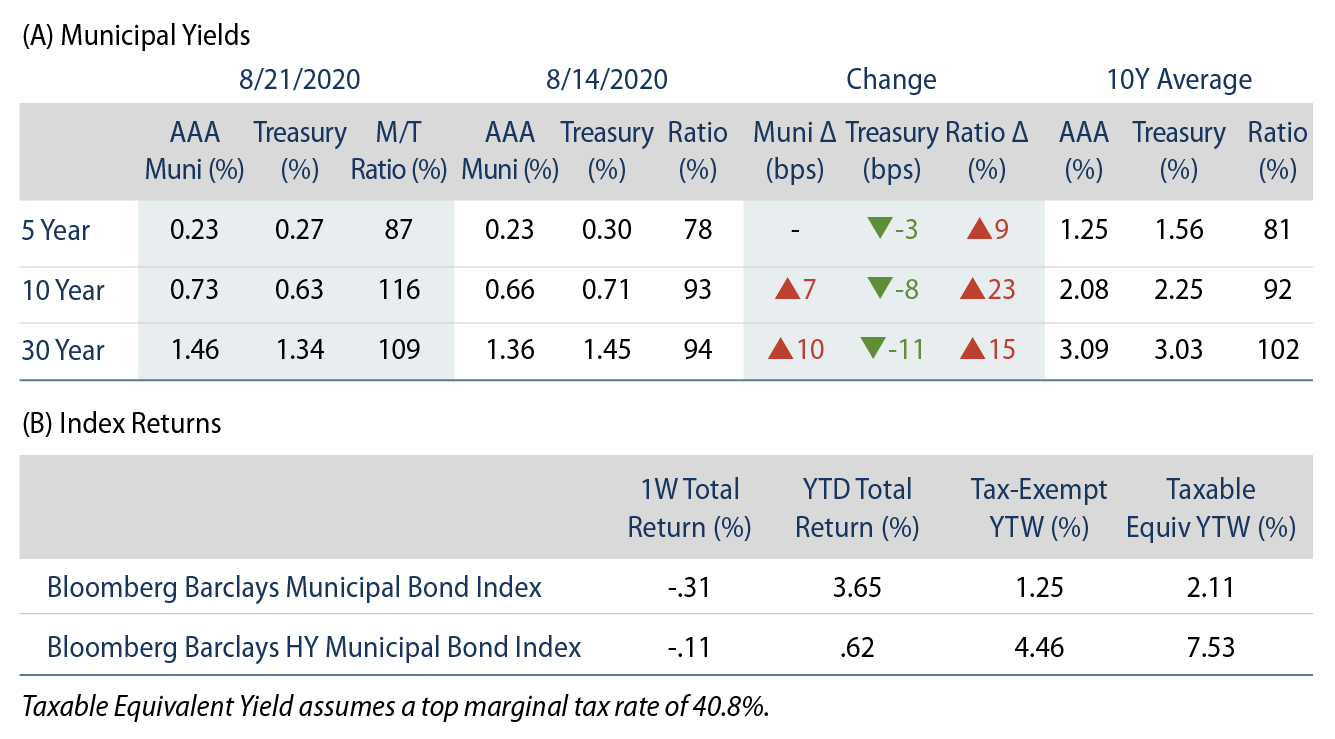

AAA municipal yields moved 7-10 bps higher during the week, underperforming USTs. The Bloomberg Barclays Municipal Index returned -0.31%, while the HY Muni Index returned -0.11%.

Technicals: Strong Fund Flows Meet Elevated New Issuance

Fund Flows: During the week ending August 19, municipal mutual funds reported a 15th consecutive week of inflows at $1.8 billion, according to Lipper. Long-term funds recorded $1.0 billion of inflows, high-yield funds recorded $217 million of inflows, and intermediate funds recorded $274 million of outflows. Municipal mutual fund net inflows total $13.2 billion, YTD.

Supply: The muni market recorded $13.7 billion of new-issue volume last week, up 32% from the prior week. Issuance of $279 billion YTD is 27% above last year’s pace, primarily driven by taxable issuance, which is up 277% from last year’s levels and comprises 27% of YTD issuance. We anticipate $10.9 billion of new-issue volume this week (-20% week-over-week), led by $1.4 billion New York City General Obligation and $1.3 billion New York Transportation transactions.

This Week in Munis: MTA Turns to the Fed

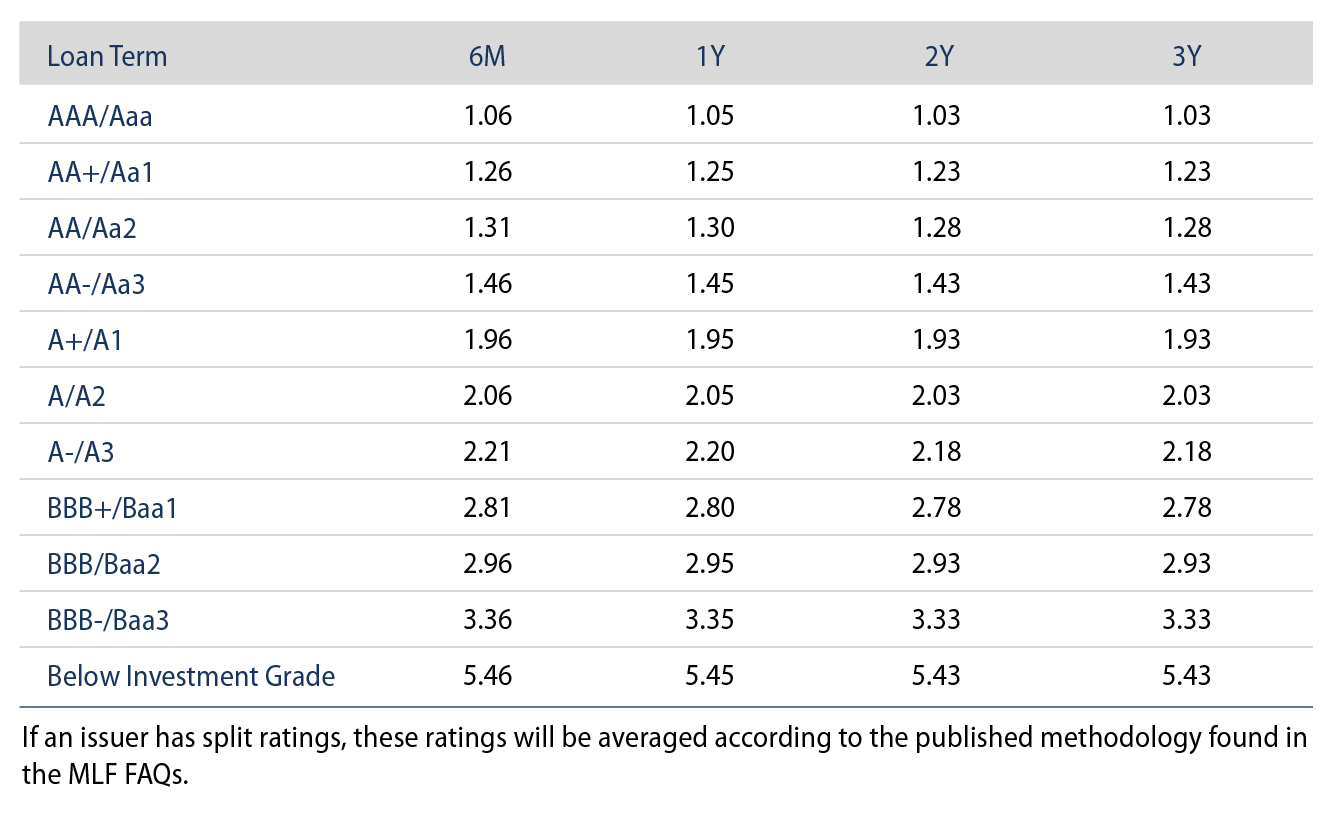

During recent months, the Fed has expressed continued willingness to ease borrowing costs for state and local governments during the COVID-19 crisis. The Fed has relaxed the initial standards to access the $500 billion Municipal Liquidity Facility (MLF) direct borrowing program launched in April, from reducing the population requirements to expanding eligibility beyond traditional government borrowers to include revenue-backed entities.

Given the recent strength in the municipal market, traditional municipal issuers have found better value in borrowing from the new-issue market than from accessing the Fed. Up until last week, the State of Illinois was the only issuer to access the Municipal Liquidity Facility since its inception, as the state borrowed $1.2 billion from the facility in June.

On August 11, the Fed further incentivized issuers to access the facility by lowering borrowing spreads by 50 bps. For an AA municipal credit, the one-year borrowing rate declined 28% from 1.80% to 1.30%. This week, the MTA took full advantage of these lower borrowing costs, accessing the facility to borrow $450.7 million at a 1.92% rate, saving 85 bps from what the new-issue market offered the struggling transit authority.

For stressed municipalities with cash needs, the MLF can provide funding relief and extend any near-term liquidity challenges to the medium term, but it is not a forgivable loan nor will be a cure for structural challenges for some municipal entities. Considering currently low nominal borrowing rates, debt service costs are less critical than direct aid needed to weather revenue shortfalls associated with COVID-19. From a policy perspective, we are more focused on the bill currently circulating Congress to ascertain the degree of direct aid municipalities will receive and inform the level of austerity measures that will take place.