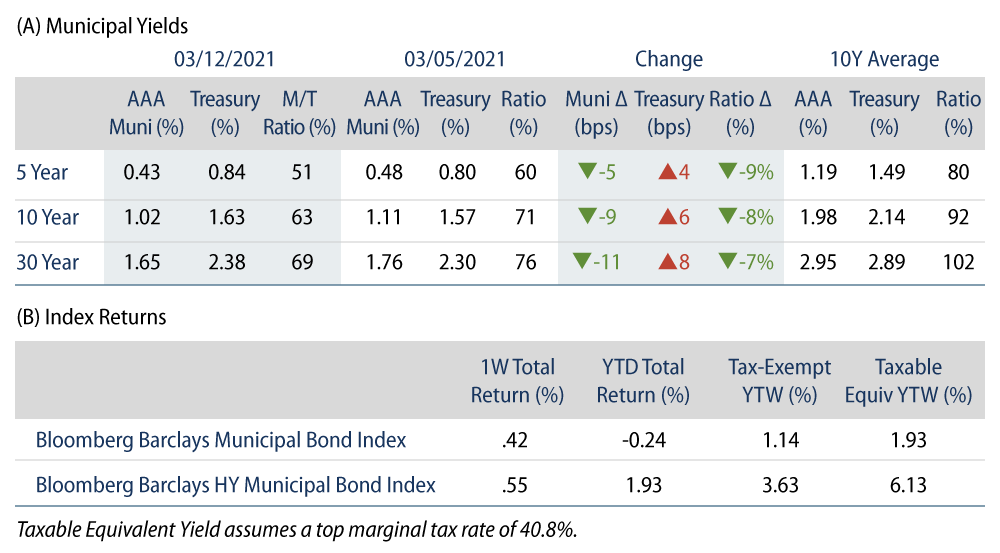

Municipal Yields Continued to Grind Lower Despite Rising Treasury Rates

US municipal yields moved lower despite rising Treasuries. AAA municipal yields moved 5-11 bps lower across the curve. Municipals outperformed Treasuries and Municipal/Treasury ratios declined 7%-9%. Muni fund flows turned back into positive territory. The Bloomberg Barclays Municipal Index returned 0.42%, while the HY Muni Index returned 0.55%. This week we provide perspective on Biden’s $1.9 trillion COVID-19 relief package and its impact on munis.

Technicals Strengthen as Fund Flows Turn Positive

Fund Flows: During the week ending March 10, municipal mutual funds recorded $1.1 billion of net inflows following the outflows observed last week. Long-term funds recorded $663 million of inflows, high-yield funds recorded $430 million of inflows and intermediate funds recorded $167 million of inflows. Year-to-date (YTD) net inflows stand at $29.3 billion.

Supply: The muni market recorded $10.1 billion of new-issue volume during the week, up 13% from the prior week. Total issuance YTD of $79.2 billion is in line with last year's levels, but tax-exempt issuance is trending down 4.5% year-over-year while taxable issuance is 11.3% higher. This week's new-issue calendar is expected to reach $11.2 billion, up 11% from the prior week. The largest deals include $2.3 billion Dormitory Authority of the State of New York (state personal income tax revenue bonds) and $1.3 billion state of Illinois transactions.

This Week in Munis: Munis Get Their Stimulus

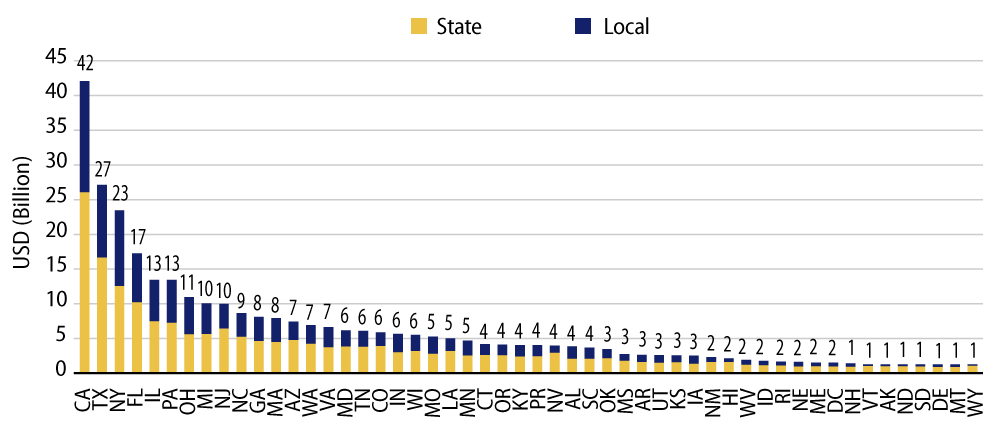

State and local governments finally received their hotly contested direct stimulus funding as Congress passed the $1.9 trillion American Rescue Plan Act relief package, which provides $350 billion of direct aid to states and local municipalities. States will receive $195.3 billion and local governments will receive $130.2 billion. The majority of state funds will be distributed based on the overall share of unemployment. From the local government perspective, counties will receive $65.1 billion, metropolitan cities will receive $45.6 billion, and small cities will receive $19.5 billion. Other municipal revenue sectors will also stand to benefit as the overall stimulus package targets health care, transportation, education and housing sectors.

The need for direct state and local aid was up for debate, as state revenues have fared better than originally anticipated, attributable to the economic impact of the unprecedented stimulus packages passed in 2020 that bolstered tax collections. The state of California, which initially projected a $54 billion two-year deficit due to the pandemic, is now projecting a $15 billion surplus for the current fiscal year.

While revenues proved better than initially feared, not all states are impacted by the pandemic equally and budget stress is still evident in the declining state and local payroll figures. State and local employment is still down 1.4 million from pre-pandemic highs, which should continue to constrain domestic and regional growth.

Rating agencies are also taking note, as the state of Illinois once again staved off a high-yield rating downgrade ahead of this week's deal. Moody's affirmed the state's BBB- rating while removing a negative watch, and Fitch affirmed its BBB-/negative rating citing that the state's revenues have exceeded enacted budget expectations and stimulus measures that “may provide an immediate boost to state's fiscal resilience.” Moody's also upgraded the Chicago Board of Education's rating to Ba3 from B1, citing “softening of revenue sources is offset with a very sizable infusion of federal funds from several rounds of pandemic relief aid.”