Municipals Post a Second Consecutive Week of Negative Returns

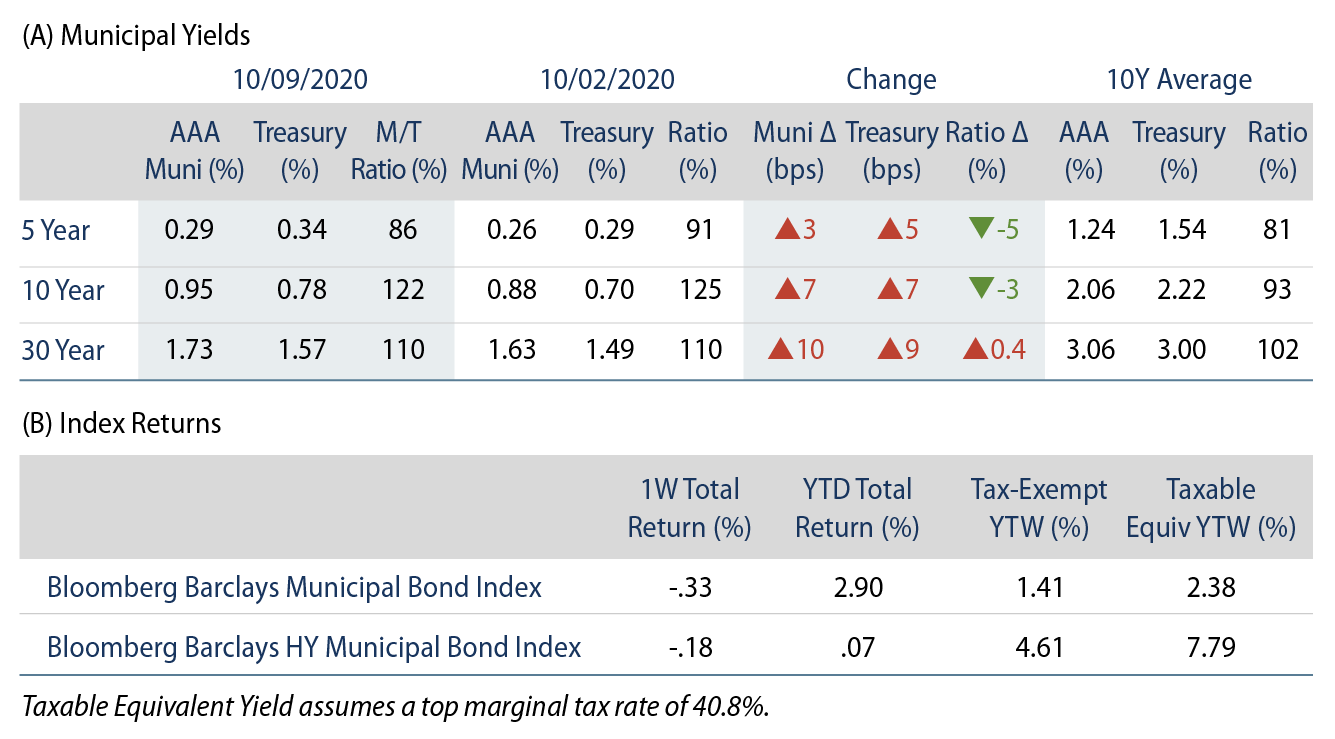

Municipals posted negative returns as yields moved higher in sympathy with Treasuries. AAA municipal yields increased approximately 3-10 bps across the curve, following Treasuries higher. The Bloomberg Barclays Municipal Index returned -0.33%, while the HY Muni Index returned -0.18%. This week we explore growing global interest for taxable municipals.

Municipal Mutual Fund Inflows Turn Positive

Fund Flows: During the week ending October 7, municipal mutual funds recorded $1.7 billion of net inflows, concentrated in long-term and high-yield fund complexes, according to Lipper. Long-term funds recorded $840 million of inflows, intermediate funds recorded $61 million of inflows and high-yield funds recorded $349 million of inflows. Municipal mutual fund net inflows YTD total $23.7 billion.

Supply: The muni market recorded $16.1 billion of new-issue volume last week, up 40% from the prior week and marking the largest week of new-issuance this year. Issuance of $363 billion YTD is 29% above last year’s pace. Taxable municipal issuance remains over three times higher year-over-year while tax-exempt issuance is relatively unchanged. We anticipate another heavy week of issuance this week with approximately $14 billion of scheduled new-issue volume. The largest deals include $3.2 billion California Infrastructure and Economic Development Authority/Nevada Department of Business (Brightline West) along with $1.5 billion Alabama Public School and College Authority transactions.

This Week in Munis: Growing Global Interest

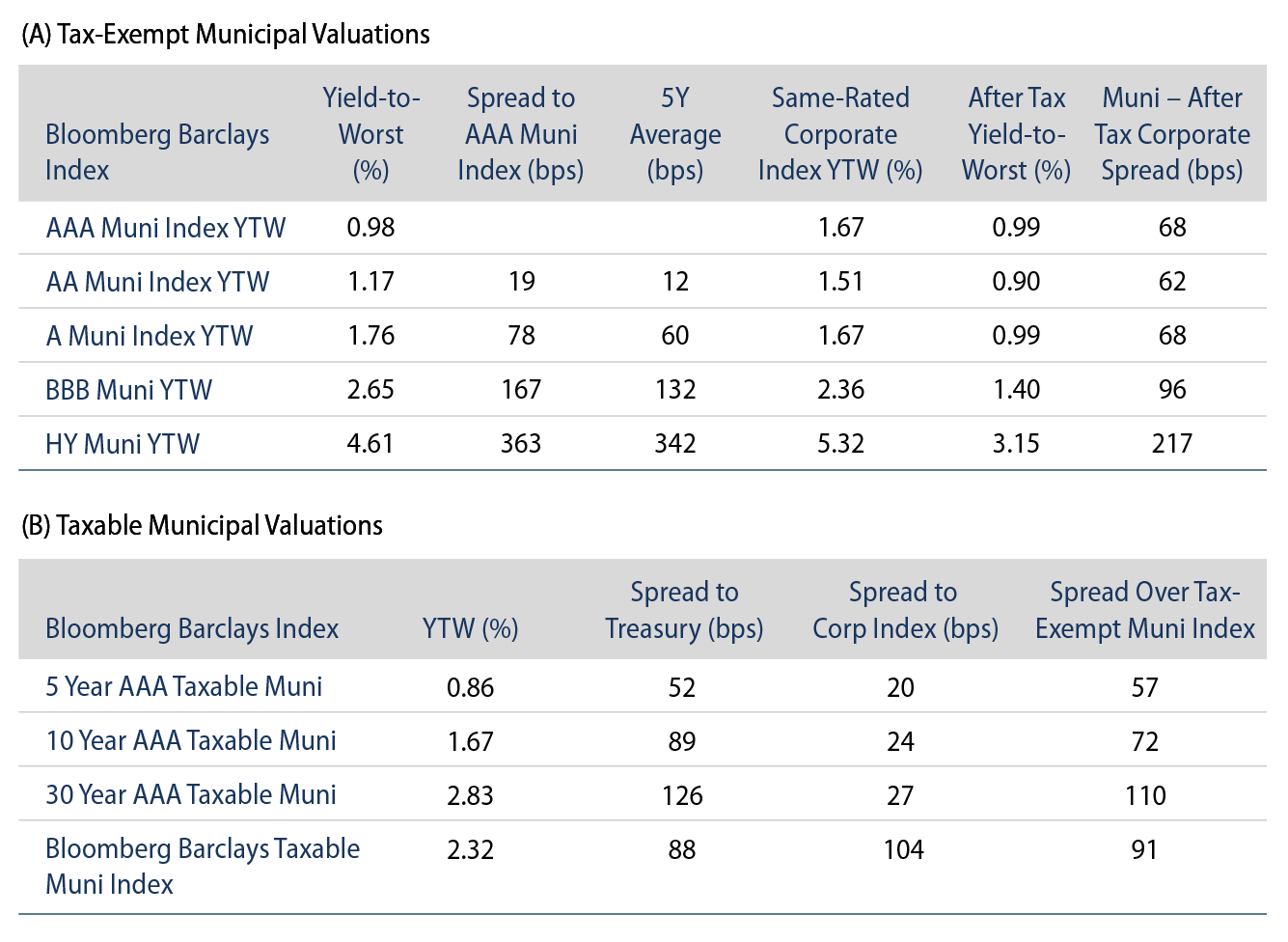

Demand for long duration, high quality taxable assets has more than offset the deluge of taxable municipal supply observed this year. As of October 9, the Bloomberg Barclays Taxable Municipal Index performance has posted favorable returns of 8.06%, outperforming the Bloomberg Barclays Aggregate of 6.55% and the Bloomberg Barclay’s Tax-Exempt Municipal Index return of 2.90%.

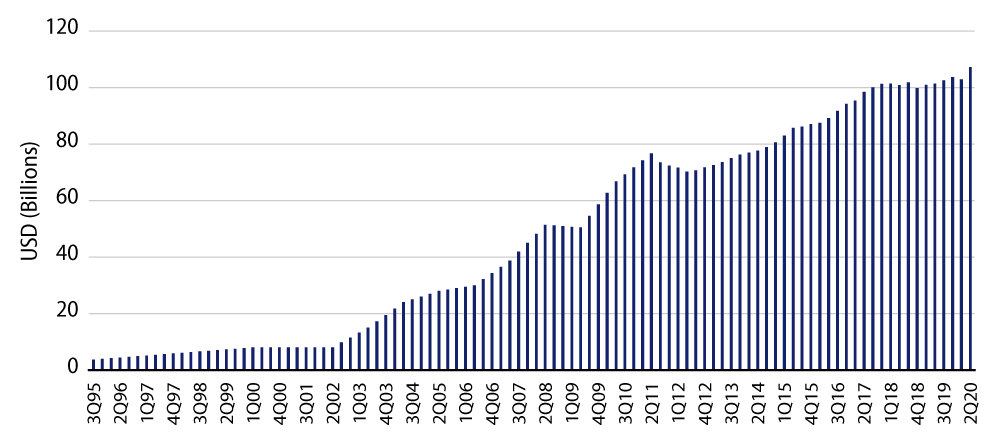

A primary source of this demand derives from growing global interest in municipal securities. In a world of low-to-negative yields for high quality government issues, paired with declining hedging costs for US-domiciled debt, the relative value for high quality tax-exempt municipals has increased for global investors. According to the September 2020 Federal Reserve Financial Accounts Report, non-domestic holders of municipal securities increased $4.4 billion, or 4.2%, in 2Q20, to $107 billion, as global investors sought value in taxable municipal debt versus other longer duration high quality global fixed-income assets.

We expect increasing global interest in taxable municipal debt to persist for three primary reasons:

- The liquidity features and structural considerations of taxable municipals can offer better risk-adjusted spread and diversification opportunities versus similar quality corporate and governmental assets.

- This risk-adjusted value proposition can strengthen for global banks and insurance companies, which could benefit from favorable regulatory treatment and capital charge benefits associated with infrastructure and sub-sovereign investments.

- Finally, as global interest in ESG investments continues to intensify, we expect an increased international recognition of the environmental and social benefits municipal bonds have long provided. Just last week, The Public Utilities Commission of the City and County of San Francisco listed the first taxable municipal bond to be included on the London Stock Exchange. The bonds were labeled as Green Bonds for the refinancing of previously issued bonds that had been sold to promote projects related to drought mitigation efforts and environmental initiatives.

As the US continues to see stubbornly high unemployment and is facing another potential prolonged economic recovery, we believe infrastructure investment—partially supported by taxable municipal debt—can meet growing domestic investment needs while fulfilling growing foreign appetite for long duration, high quality income.