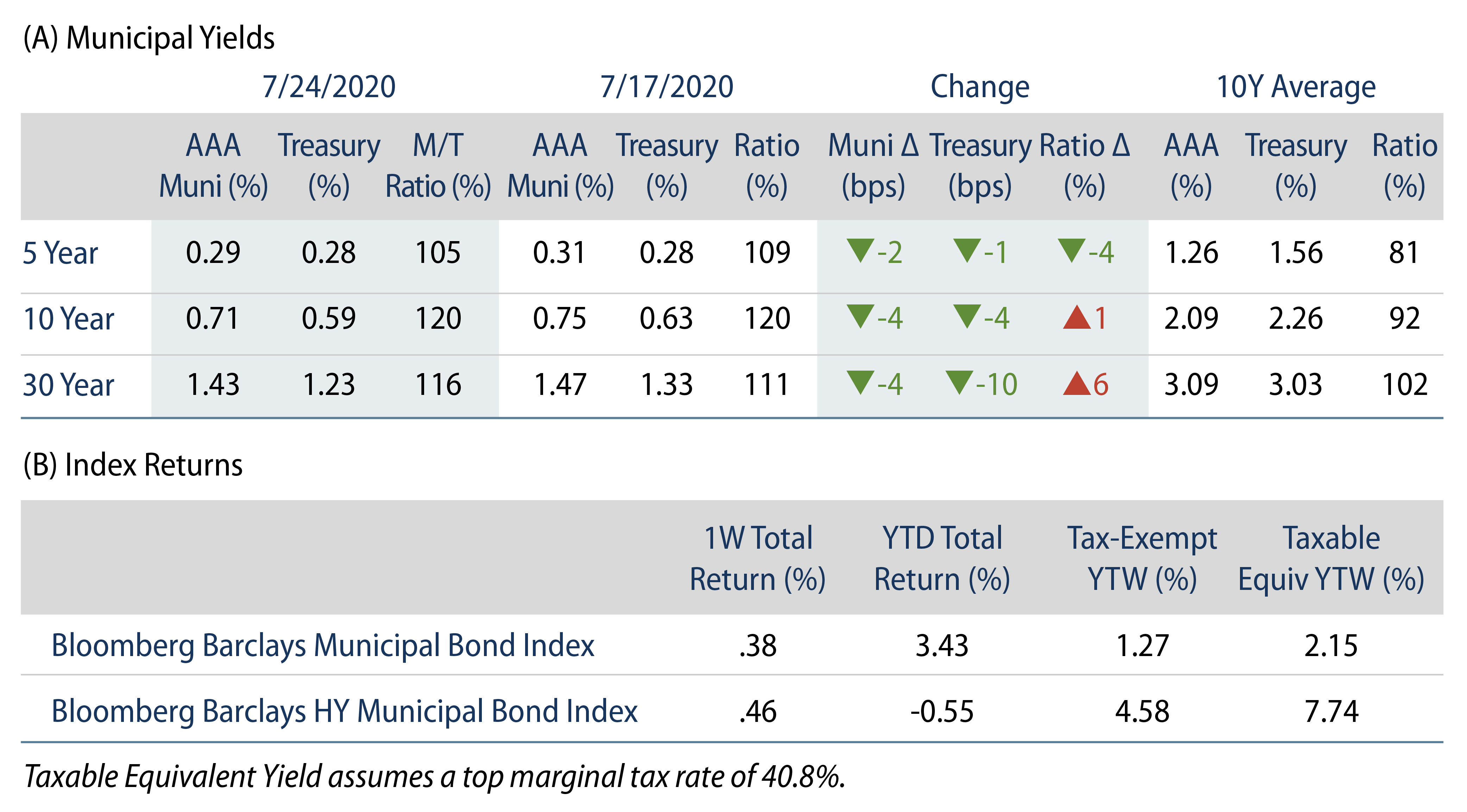

Muni Yields Continue to Grind Lower

AAA municipal yields moved 2-4 bps lower during the week, with longer-dated muni bonds underperforming Treasuries. The Bloomberg Barclays Municipal Index returned 0.44%, while the HY Muni Index returned 0.84%.

Technicals: 2020 Muni Fund Flows Turn Positive

Fund Flows: During the week ending July 22, municipal mutual funds reported an 11th consecutive week of inflows at $2.1 billion, according to Lipper. Long-term muni funds recorded $981 million of inflows, high-yield muni funds recorded $392 million of inflows and intermediate muni funds recorded $150 million of inflows. Municipal fund flows YTD are now positive at $1.3 billion.

Supply: The muni bond market recorded $10.3 billion of new-issue volume last week, down 32% from the prior week. Issuance of $239 billion YTD is 31% above last year’s pace, primarily driven by taxable issuance which is 354% above prior-year levels. We anticipate approximately $8 billion in new issuance this week (-21% week-over-week) in the muni bond market, led by a $1.1 billion DFW Airport taxable transaction and a $600 million Colorado State TRANS.

This Week in Munis: Federal Policy in Focus

Congress adjourned for the weekend without coming to agreement on the next stimulus package. Republicans were expected to propose a $1 trillion package, while the Democrats are still pushing for a $3 trillion bill. Democrats are seeking to boost municipal aid beyond the $150 billion provided by the CARES Act, and the draft Senate proposal released this week does not provide aid for states and local governments faced with an estimated $1 trillion revenue shortfall.

While seemingly far apart from the Democrats’ proposal, the Republican-proposed changes to federal funding for state and local governments appear likely. The most recent Republican Senate proposal is now calling for more flexibility for existing CARES Act funding to allow municipal governments to utilize aid previously limited to COVID-19 expenditures to cover revenue shortfalls. States must at a minimum share 50% of federal aid with local governments under the Republican proposal and must not add restrictions to the use of the funds beyond what the federal government has established.

While the Democrat and Republicans’ inability to pass a new stimulus bill this week is not entirely surprising, Western Asset believes the bills as proposed suggest that the new round of aid to municipal governments will be more generous and less restrictive than previous proposals, boosting municipal credits. Additionally, more aid to municipal enterprises such as hospitals will support revenue bonds, which Western Asset is overweight.