Municipal Yields Held Steady

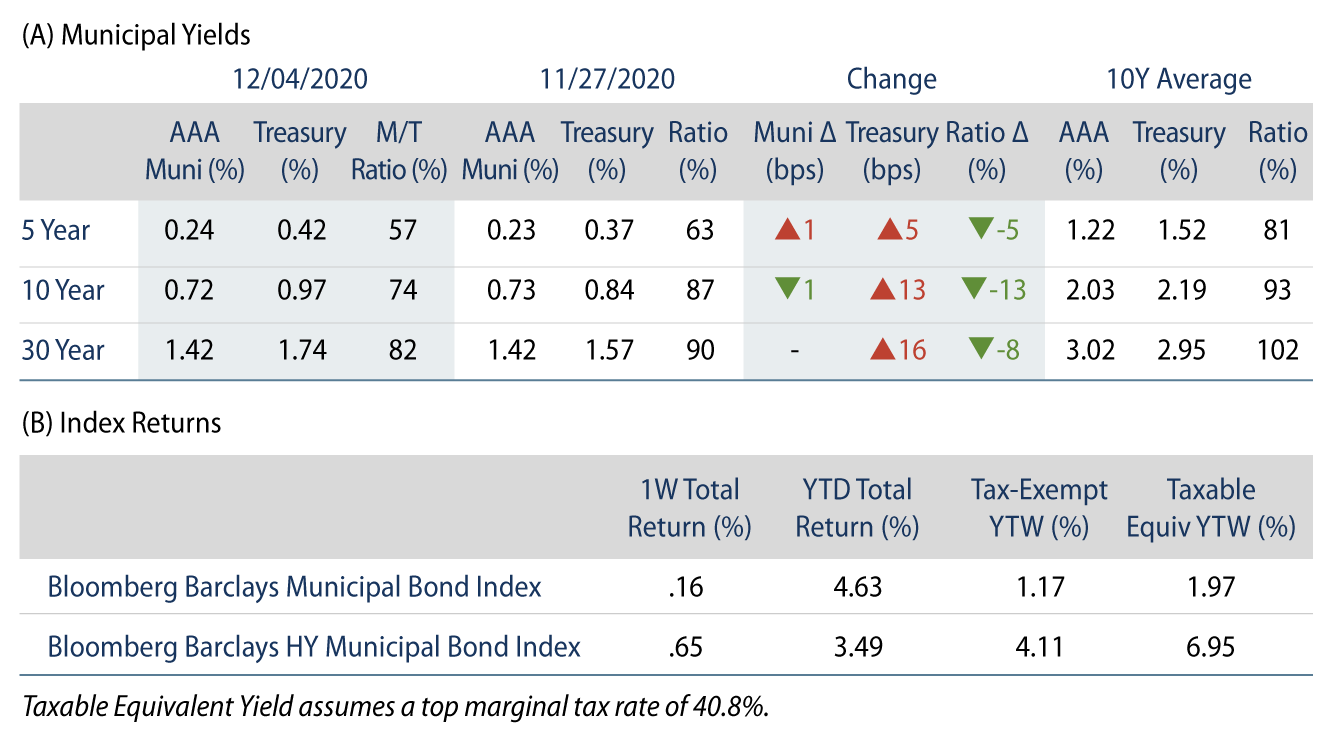

Municipal yields were generally unchanged during the week. Municipal supply remained elevated. AAA municipal yields were mostly unchanged, moving 1 bp higher in short maturities, and 1 bp lower in intermediate maturities. The Bloomberg Barclays Municipal Index returned 0.16%, while the HY Muni Index returned 0.65%. This week we discuss how Chicago just passed a $12.8 billion budget, closing its $1.2 billion shortfall.

Municipal Supply Remained Elevated as Inflows Continued

Fund Flows: During the week ending December 2, municipal mutual funds recorded $201 million of inflows, according to Lipper. Long-term funds recorded $128 million of inflows, intermediate funds recorded $18 million of inflows and high-yield funds recorded $57 million of inflows. Municipal mutual fund net inflows YTD total $33.2 billion. The 10-year Muni/Treasury ratios declined below 80% for the first time since February.

Supply: The muni market recorded $9.2 billion of new-issue volume. Issuance of $444 billion YTD is 19% above last year’s pace, mostly driven by higher taxable issuance, which remains 132% above last year’s levels. This week’s new-issue calendar is expected to increase to $10.2 billion (+11% week-over-week). The largest deals include $1.4 billion Puerto Rico Aqueduct and Sewer Authority and $1.2 billion Commonwealth of Massachusetts transactions.

This Week in Munis: Chicago’s Budget Highlights Pandemic Challenges

The Chicago City Council passed first-term Mayor Lori Lightfoot’s $12.8 billion budget that addresses a $1.2 billion operating fund shortfall largely attributable to the impact of the pandemic. The budget passed 29-21 as the mayor earned the necessary votes by increasing spending for violence prevention and eliminating planned layoffs and furloughs for certain union workers.

The budget features a variety of new revenue items, including a $94 million property tax hike and a $0.03 per gallon increase in the gasoline tax. From the expenditure side, the budget relies on $1.7 billion of debt service savings from significant debt refinancing, a controversial effort to continue to extend obligations and potentially exhaust the borrowing capacity of the city’s sales tax securitization lien. The budget also calls for a $30 million draw on reserves.

While 2020 was widely viewed as a recovery opportunity, COVID-19 further exposed the vulnerability and legacy structural challenges of the city that continues to grapple with population declines and increasing fixed costs associated with rising pension contributions. The breadth of solutions applied within the budget is encouraging and underscores the city’s flexibility and resilience. However, sustainable structural reform remains a forward-looking obstacle that we expect municipal investors will have to contend with over the secular horizon.