Interest rates in the US recently have become a little more interesting following the dovish pivot in Fed policy leading to a rate cut in June 2019, the first of its kind since the height of the financial crisis in 2008. For investors in money market funds, this environment of higher-than-average interest rate volatility leads to the fundamental questions: how do managers think about rates and how do their views impact their funds’ investors?

Money market funds are often viewed as a commodity, useful but—at times—indistinguishable from one another outside of the amount of interest paid to investors. Yes, there are characteristics such as ratings, size and domicile which need to be considered when selecting a money market fund, but what about a fund’s portfolio? Which issuers are being invested in? What type of investments are being made? These properties may be considered by more detail-orientated money market fund investors, but one area that is commonly overlooked is interest rate risk.

Money market funds have become one of the most regulated instruments of the asset management industry. Many investors in these types of funds expect their cash to be available in full, on any given trading day and with limited notice. For these reasons, regulators who oversee money market funds have placed rigorous restrictions on the risk that fund managers can take by limiting important factors such as weighted average maturity (WAM) and weighted average life (WAL). The difference between these two measures is how floating rate notes are treated; WAM looks to the next reset date (normally one to 90 days) whereas WAL looks to the final maturity (up to 397 days). Money market funds are designed to be low risk and, as a result, these restrictions create fairly narrow bands that managers are permitted to operate within. For example, a prime money market fund in the US is limited to a WAM of up to 60 days and a WAL of up to 120 days.

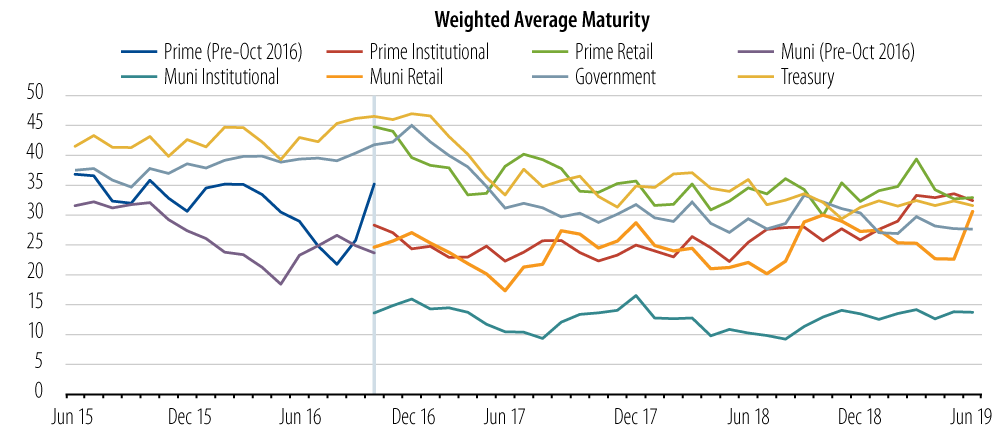

The reality, however, is that most prime money market fund managers will tend to be much more conservative than this. For example, since the SEC money market fund reform was rolled out in October 2016, the WAM of US prime money market funds has ranged between 20 and 35 days (Exhibit 1) while the WAL of US prime funds has ranged between 30 and 60 days (Exhibit 2).

There are many factors that will determine the WAM and WAL positioning of a money market fund, but the key drivers are 1) liquidity requirements, 2) the availability of underlying investment maturities and 3) the interest rate and yield curve outlook of the manager. All of these considerations need to be balanced together in order to structure the fund portfolio with the aim of meeting all investor needs collectively.

However, as an individual investor, how can you use these measures to help evaluate a money market fund? For example, what does it tell you if, in a rising-rate environment, a fund has a higher—or longer—WAM and higher yield compared with the fund peer group? What does it tell you if rates are expected to fall? The answer is that it is imperative to align your interest rate outlook with the positioning and view of the money market fund manager.

Money market funds tend to be managed to a buy-and-maintain approach; namely all investments are made with the intention of holding them to maturity unless there is a significant credit concern. Selling a security before its maturity runs the risk of realizing a gain or loss, which money market funds have limited ability to absorb. This means that a fund with a longer WAM/WAL has effectively locked in the interest rates for the underlying investments, on a weighted-average basis, for a longer period of time compared with a fund that has a shorter WAM/WAL. This is a good thing if rates are expected to fall, but less ideal if rates are expected to rise as the fund will hold back reinvesting in the higher rates when they become available in the market. This relationship was demonstrated by the most recent Fed rate hike on Dec 19, 2018. 62% of the prime money market funds that had a lower-than-average WAM compared with peers at the start of December 2018 had increased their yield ranking (compared with peers) by the end of the month. Similarly, 71% of the government money market funds that had a lower-than-average WAM compared with peers at the start of December 2018 had increased their yield ranking compared with peers at the end of the month.

1

A money market fund manager should have a clear picture of where they expect short-term investment rates to go and why they expect them to go there. Only with a comprehensive explanation of the interest rate outlook, tied to a view of the macro economic environment and market technicals, can a potential investor judge whether these are aligned with their own view. Getting that view right can have a meaningful impact on the yield of the money market fund in an environment where every basis point counts.

1Source: Crane Data, Money Fund Intelligence November 2018 and December 2018