The financial world is experiencing some unique and unprecedented circumstances. We are confronting a pandemic that took the US by surprise and has caused tremendous human and economic hardship. This exceptional external shock led to extraordinary monetary and fiscal policy coming to the rescue. The enormous scale of this stimulus, coupled with the anticipated increase in activity from the reopening of the economy, has markets now pricing in a robust reflationary outcome.

The reflation trade has found some further impetus over the last few weeks due to enthusiasm over more fiscal stimulus, improving news on the Covid front and optimism around the reopening of the US economy. These factors together with improving economic fundamentals and supportive monetary policy have pushed rates significantly off their lows. Inflation is in the forefront again and has become one of the biggest concerns for market participants. At Western Asset, we expect a benign inflationary environment over the longer run and struggle to see how the economy generates persistent inflation above the Fed’s 2% target. Anticipation of this inflationary impulse has pushed interest rates higher. We think that the bulk of this rise in rates may have played out as break-evens in the front end of the yield curve (2 to 5 years) are currently at or above the Fed’s target. But, this does not preclude the momentum in markets to push rates modestly higher.

The Fed has done a great job of getting inflation expectations up, but persistent inflation in the real economy may prove to be elusive. For rates to rise meaningfully higher, inflation will have to show up in the data for a “significant” time. Western Asset has correctly been on the optimistic side of the spectrum when it came to the growth prospects coming out of this recession. And, we do expect some pockets of short-term inflation, especially in commodities. But, it is not clear that this restart of activity will lead to sustained inflation. We see strong US growth in 2021 and 2022, but this does not automatically lead to higher inflation and interest rates. The Fed is anchoring rates in the front end and has clearly stated that it would look through any temporary bounce in inflation before needing to hike rates. What really matters to the Fed and the rate markets is what inflation looks like in late 2022 or early 2023, and the jury is out on where it will be then and whether it will be persistent.

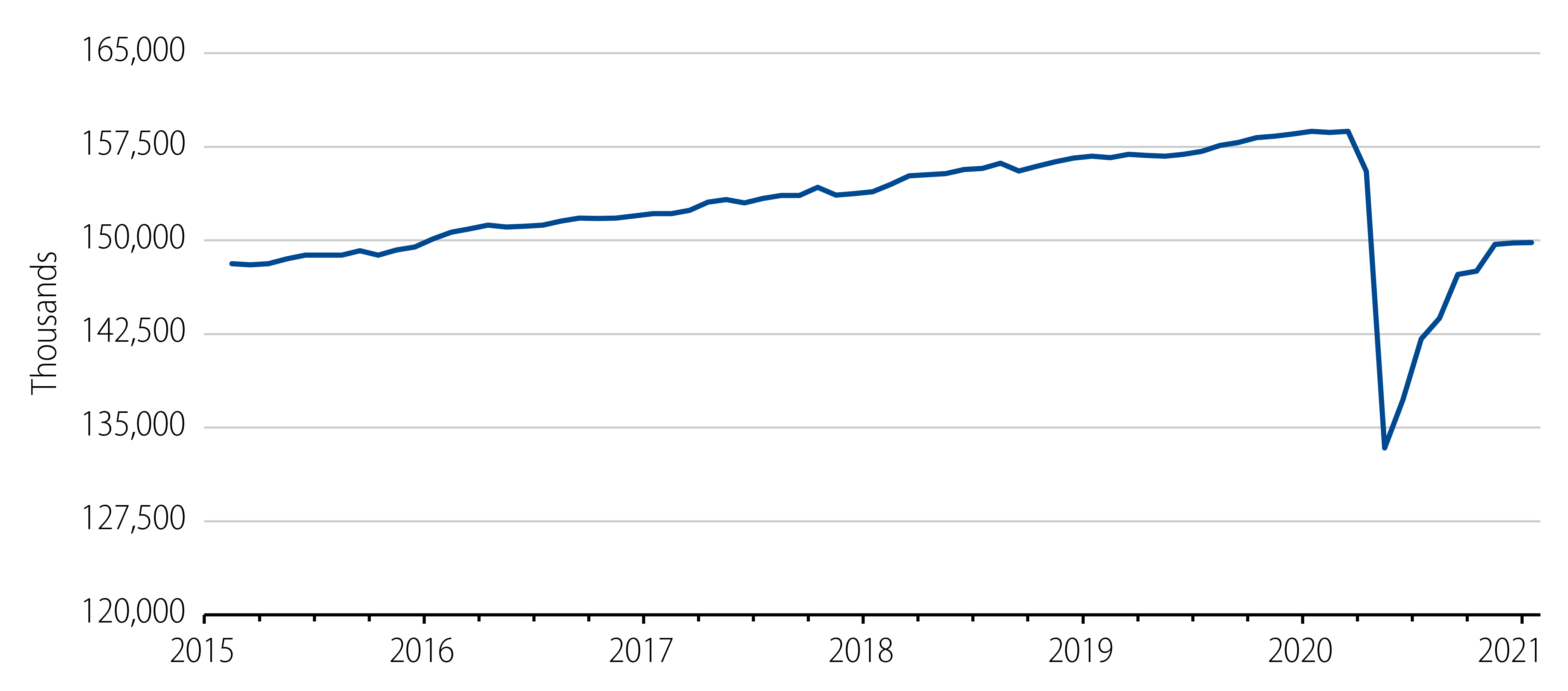

Given the structural environment we were mired in prior to the Covid recession and additional challenges that resulted from it, we struggle to see persistent or runaway inflation. Among these new challenges are the shift in the employment picture and our debt burdens. We still have 8.7 million fewer jobs than we had a year ago. Increasing labor costs are unlikely to push inflation higher. Additionally, our public sector debt has risen by more than $4.5 trillion, to the tune of 20% of GDP. This data will ameliorate as the economy reopens but it will constrain growth in the future.

Beyond these new dynamics resulting from the Covid recession we see additional structural headwinds to inflation:

- Inflation is a global phenomenon and its prospects globally are lower due to the pandemic;

- There remains tremendous slack in labor markets;

- Current evidence suggests that we are still in a liquidity trap with lending and credit creation struggling to pick up;

- Economic dynamism/velocity is low and developed markets are falling short in terms of productive investment-driven growth;

- Pricing power is difficult for corporations to harness over the long run as we are in an oversupplied world; and

- Advances in technology continue to suppress inflation.

Asset prices are higher and interest rates have moved up rapidly in anticipation of a reflationary environment. The market is now anticipating the Fed to deliver more than three 25 bps rate hikes in 2023. We think there is a lot of ground to cover before then. Any push higher in rates will need evidence of real inflation in the data.

This time is different due to the enormous and timely policy response. This time is different due to the nature of this recession. But, it is not clear that it will be different for inflation.