February foreign trade data released today by the Census Bureau show merchandise exports down, imports up and the trade deficit up commensurately. Since February 2021, the onset of the Covid pandemic, US real exports are down -8.0%, while real imports are up +8.2%.

Those statistics suggest that Covid has been a disaster for US foreign trade, but they don’t tell the whole story. In fact, foreign trade has recovered remarkably well for the most part. The weakness in US exports is confined to two components where the strength of our exports depends on the resilience and degree of openness of our trading partners, as well as on our own competitiveness.

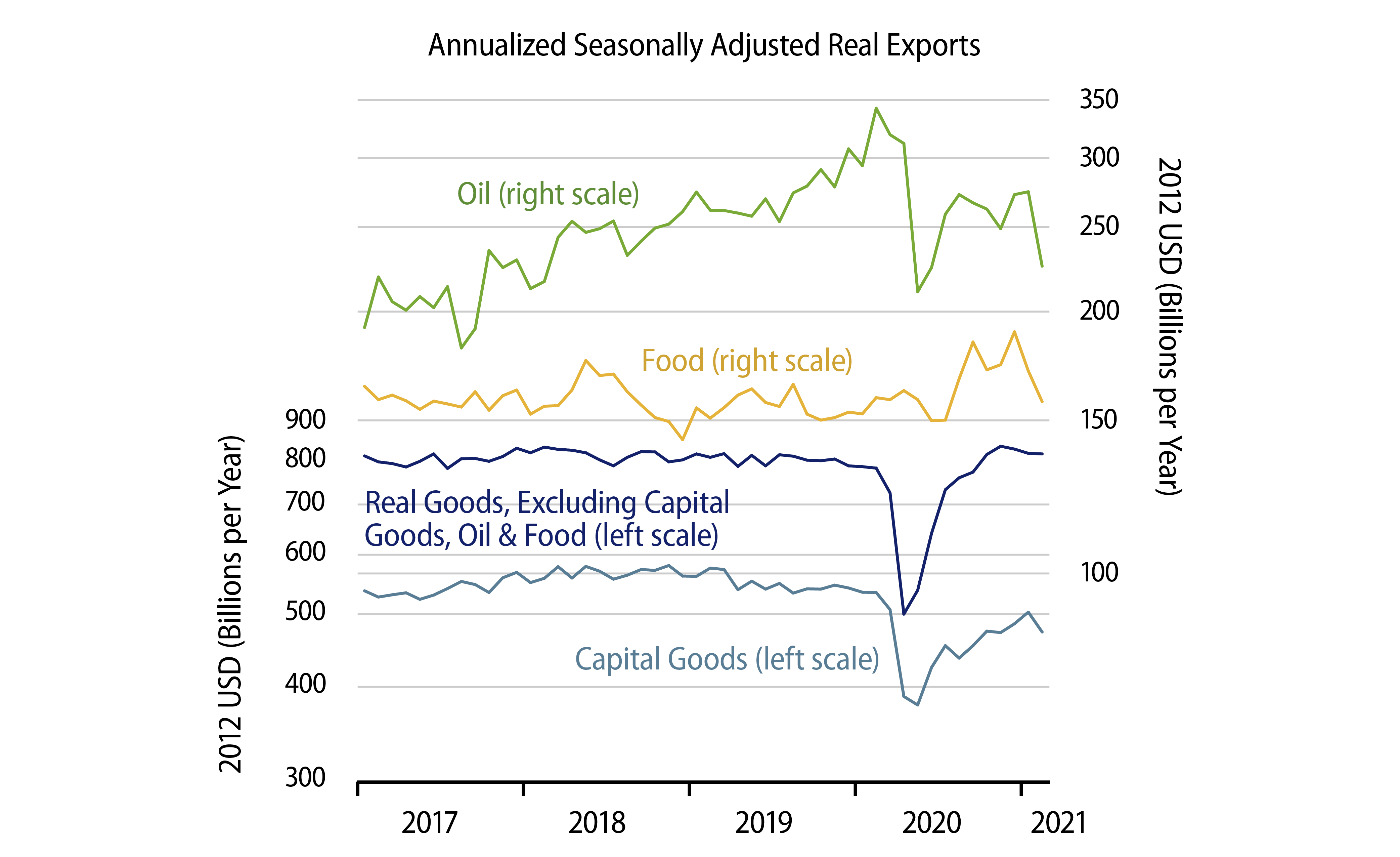

All the weakness in exports is in oil and capital goods. For other types of goods, exports have rebounded since the 2020 shutdown just as much as imports. You can see this in the accompanying chart, where we break down exports into capital goods, oil, food and all other goods. Note also in the chart that exports of food and oil are measured on the right scale and note the difference in magnitude of the two scales.

Exports of “all other goods” account for roughly half of total exports, and these actually bounced in late-2020 to levels higher than what was seen pre-Covid. Food exports are much smaller in magnitude. They, too, have more than fully recovered from Covid shutdown effects.

Capital goods exports are a bit less than 30% of total exports. They recovered somewhat in late-2020, but only to 89% of pre-Covid levels. Exports of oil have been weak throughout the pandemic experience. Notice also that capital goods and oil accounted for the bulk of the reported February export decline.

We’ll stipulate for the record that US imports of all these goods types have recovered to pre-Covid levels. The state of foreign trade flows is obviously dependent on the degree of openness across the societies of our trading partners, and across our own society. Our goods-producing and goods-selling facilities have largely been open since April 2020, and our imports of these have rebounded accordingly.

For our trading partners, they are producing goods, and their citizens are eating, and our exports sensitive to these activities have rebounded commensurately. However, with large swaths of Europe and elsewhere still in lockdown, travel and commuting—thus oil consumption—are down substantially. For these reasons, most likely, foreign producers have been slower to ramp up capital spending, and our exports of capital goods reflect this. Clearly, a fuller rebound in US exports requires a fuller reopening of our trading partners’ societies, but other than that, the foreign trade data do not seem to indicate any more serious defects in the current state of global foreign trade.