Price growth in the US housing market has decelerated in recent months after facing increased headwinds of reduced affordability and higher mortgage rates throughout the latter part of 2018. We would argue that while wage growth is healthy, the previous above-trend growth rate of housing prices was not sustainable, and a fall to a normalized level is in line with US GDP. But as always in real estate, location matters.

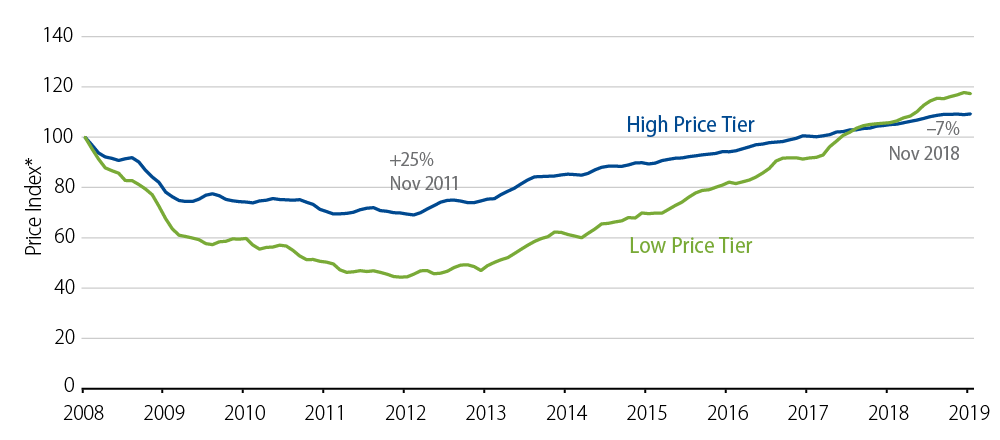

Price trends will vary based on supply, demand, price level and geographic location. In the early phase of the housing recovery (2008-2013) high-end home prices fared better than those on the lower end. Large urban centers and coastal areas also outperformed central regions and suburban neighborhoods.

As the economic recovery progressed and job creation over recent years has improved, we are seeing an environment where household formations are increasing. First-time buyers are generally looking for homes at the lower price points and there’s a trend back to suburban neighborhoods.

High-tax areas in the Northeast and Coastal West are likely to see slower price appreciation due to factors such as low affordability and new tax laws (e.g., SALT caps). Higher-end home prices will likely suffer more than their lower-end counterparts due to the disproportionate effect of the tax changes affecting high earners and more highly taxed properties.

Nationwide we expect home price growth to moderate over the coming months to a sustainable 2% to 3% annual growth rate as overall supply constraints remain intact and demographic trends continue to be positive for single-family ownership. Trends that favored the coastal areas and high-end home prices in the early part of the recovery have stalled. Now, parts of the country that had previously lagged are likely to benefit along with lower-end home prices. When looking for value, picking the right spots in the market at the right time and having the right investment approach matters.