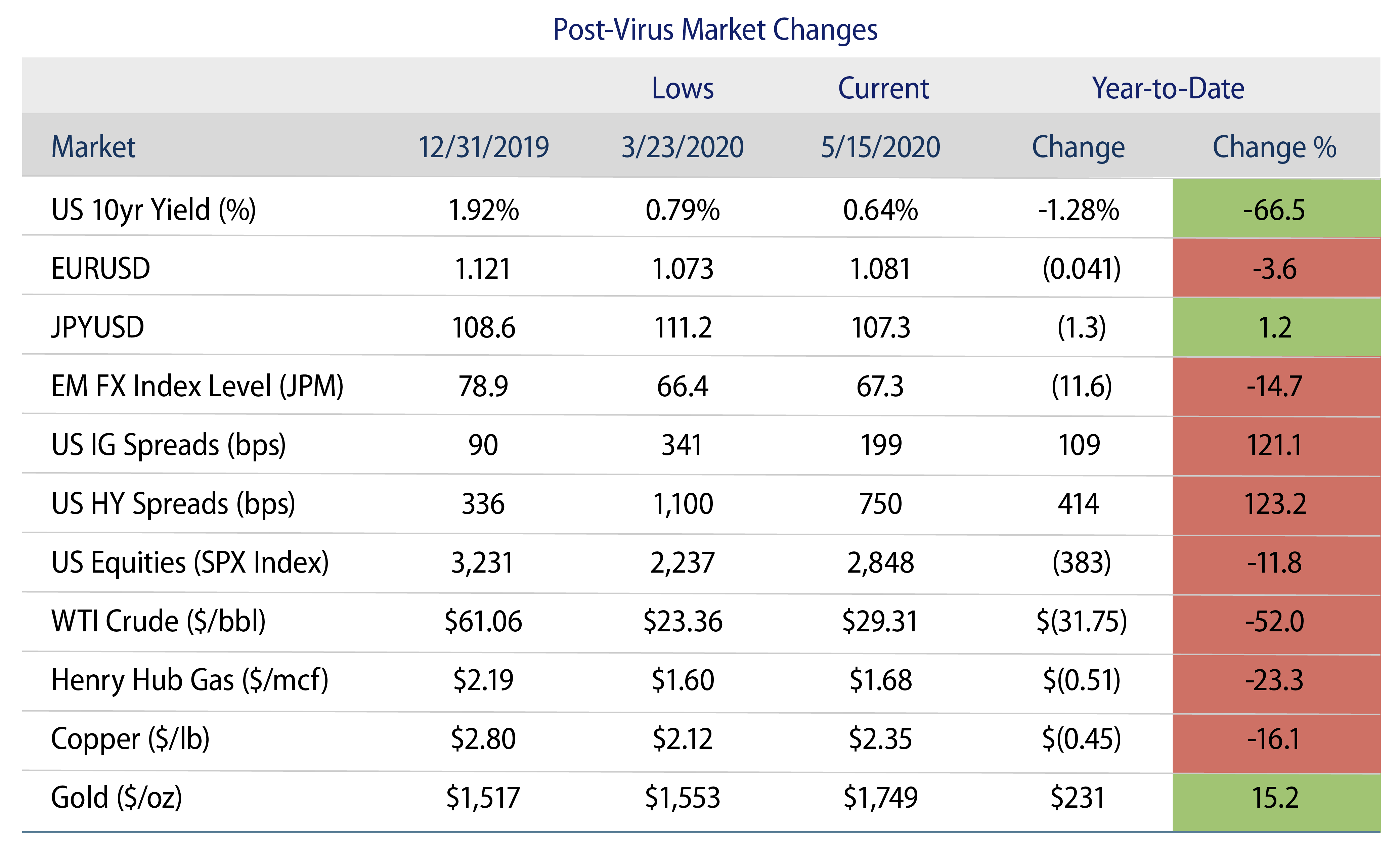

Lately, clients have been asking which asset class offers the best return prospects over the next 12-18 months: equity or credit? This is a fair question. We’ve seen a decent recovery across most market segments since the depths of March. Equity and credit markets, in particular, appear to have much more room to run, especially when compared to year-end 2019 levels (Exhibit 1). But, while we’ve seen steep declines in some asset classes, this is not a typical financial crisis. We’re in the midst of a devastating public health crisis that has deeply affected governments, corporations and households worldwide, with the road to recovery still uncertain.

We recognize the powerful allure of buying equity at these levels given its historical record for outperforming credit following major selloffs. However, we don’t believe this is the time to make investment decisions based on a belief that we’re headed back to a pre-COVID-19 way of life. That view simply underestimates the gravity of the time we’re living in and what the world may look like a year from now.

Bear in mind that the latest equity market correction was not only deep, but it was also the fastest on record. That speed dynamic, combined with an equally record-breaking response by policymakers, is what quickly turned market “fear” into “greed” and ultimately sparked the sharp rebound in the days that followed. While the rally across equity and some segments of the credit market put investor sentiment back on more stable footing, we believe the rebound was primarily stimulus-driven. Now the hard part begins as some countries and states in the US look to ease lockdown restrictions and as we await more progress toward the development of a vaccine.

Per our 2Q20 Global Outlook, we expect a steeper economic downturn than we saw during the early quarters of the 2008 global financial crisis (GFC), with signs of a modest recovery taking hold in the second half of 2020. However, there are still risks to this forecast. For example, further mutations of the virus could make it harder to defeat. Furthermore, should business reopenings stall or move backward, or should the crisis deepen or extend further into 2021, the potential for permanent damage to consumer and corporate balance sheets increases.

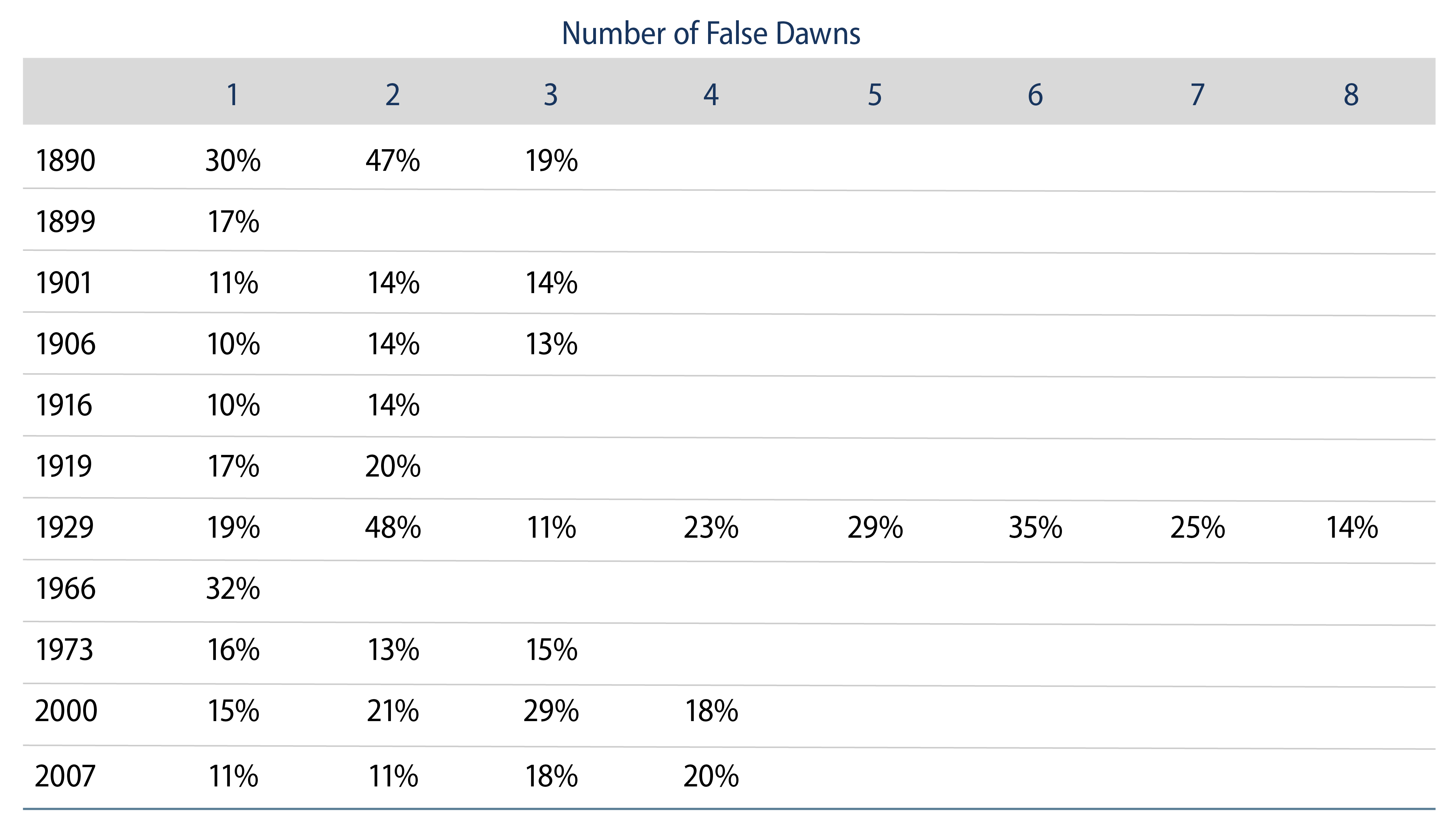

There’s also the possibility of experiencing multiple “false dawns” or dead cat bounces—measured as the maximum rise from a low point that was later breached once again—on the road to recovery. As highlighted in Exhibit 2, in most periods when the market fell by at least 25% there were rebounds of at least 10% on several occasions along the way to the bottom.

With this backdrop in mind, portfolio diversification is essential. Plenty of total return opportunities currently abound, but the range of future economic outcomes is wide. Therefore, protecting portfolios against drawdown risk should be the main focus. And here we would advocate maintaining an allocation to credit in any broad investment portfolio for its more defensive characteristics and ability to play a meaningful role in generating steadier, long-term total returns.

Granted, coupon levels on corporate credit have drifted lower over the past years on the back of sustained central bank policy accommodation. However, government bonds continue to offer low to negative yields. And the impact of the COVID-19 crisis on revenues and earnings is now forcing many companies to drastically cut their equity dividends to stockpile cash and fortify balance sheets. With equity challenged not just by the fundamental outlook, but also by technical headwinds (e.g., less buyback activity), we see credit markets—specifically corporate credit (in US dollars, euros and sterling), bank loans and structured credit—as offering investors the potential for compelling returns given today’s elevated spreads and our expectation for a low-interest-rate environment for the foreseeable future.

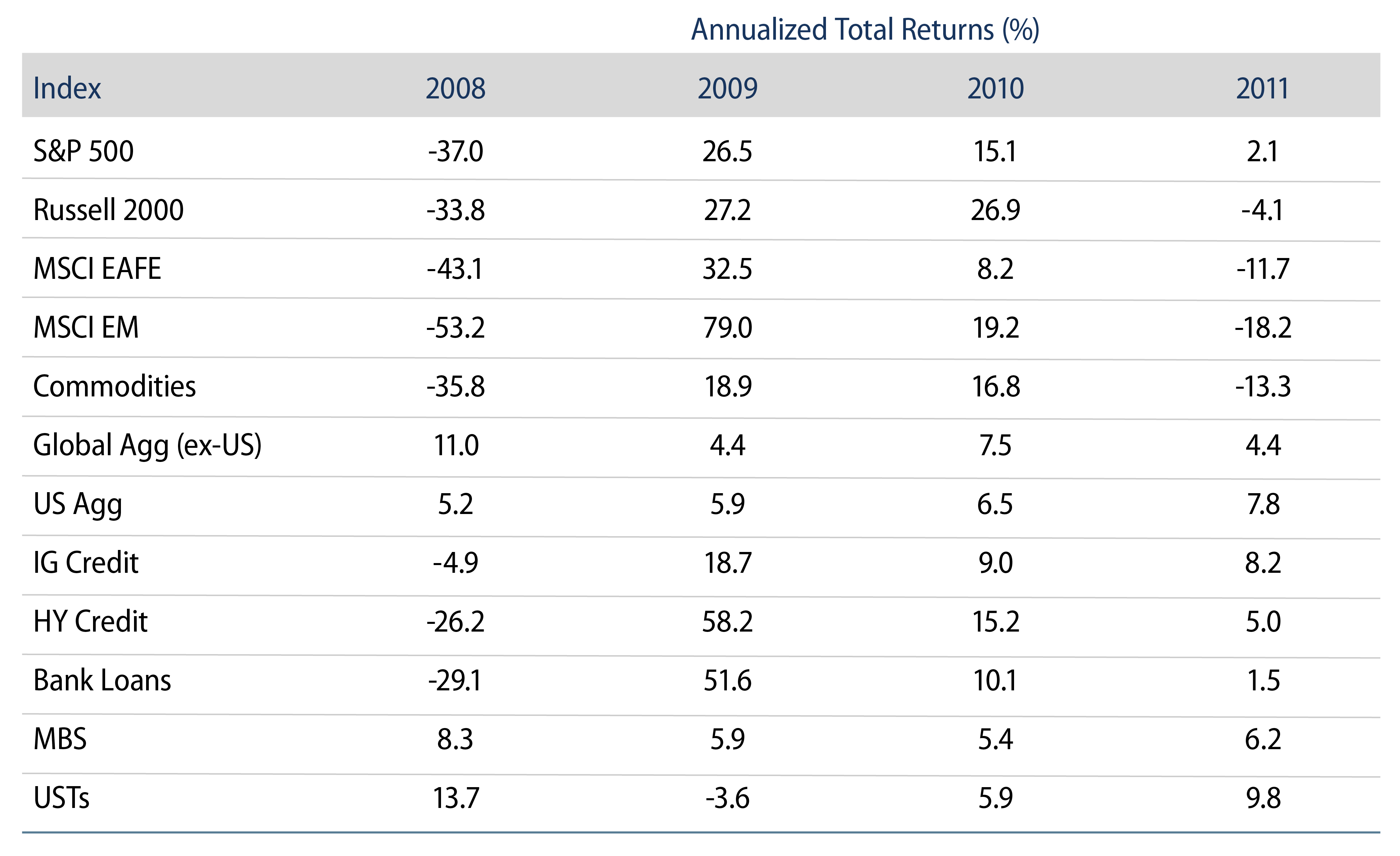

Exhibit 3 features a table of post-GFC performance results across various asset classes, which underscores the ability of credit to keep pace with (and in some cases exceed) equity market recoveries.

We have no doubt that the news flow over the next 12-18 months will be choppy; incoming global economic data, ongoing US-China trade discussions, the path of oil prices and the upcoming US presidential election—all of these will dust up periods of market volatility. As noted in our 2Q20 Global Credit Monitor, we will likely see more ratings downgrades, fallen angels and defaults across credit markets, especially in stressed sectors such as energy and retail. But with credit spreads near historical highs, we see a prime opportunity to exploit sector and issuer-level price dislocations and build up our exposures in those issuers that can endure and rebound sharply as spreads begin to normalize. History has shown that whenever credit markets unhinge, the period that follows offers investors outsized returns for the taking just as long as investors are able and willing to strike while the window is open.