Health care remains a key topic heading into the presidential election, and the pandemic has drawn increasing attention to the gaps in our health care system regarding private insurance, government programs and varying levels of coverage. In this blog post we examine the potential changes to US health care coverage following the election. In short, if President Trump were to be re-elected, we see a largely status-quo environment for the industry. While President Trump has promised a “MUCH better, and FAR cheaper” replacement to the ACA, Republicans have not offered a comprehensive alternative plan. In the event of a Democratic sweep or “Blue Wave,” we see an expansion of health care coverage via existing platforms in the ACA and Medicaid, but the ripple effect that would be felt from these policy changes would likely be uneven across the health care industry.

Who Has Health Care Insurance Coverage in the US?

Roughly 90% of Americans have some form of health care insurance coverage according to data from the US Census Bureau. Almost half of Americans benefit from employer-sponsored coverage through their own job or from a family member. Another 18% of the population has coverage through Medicare, a federal program that covers seniors and some people with disabilities, while a further 18% have coverage through Medicaid, a joint state-federal program that provides coverage for low-income individuals. Roughly 9% of the population, almost 30 million individuals, have no insurance coverage at all.

The “Blue Wave” Health Care Agenda

Former VP Joe Biden’s vision for health care is to protect and build on the ACA “by giving Americans more choice, reducing health care costs, and making our health care system less complex to navigate.” In terms of expanding coverage, Biden estimates his plan will provide health care insurance to an estimated 97% of Americans by expanding coverage to low-income individuals.

In a joint effort by Biden and Senator Sanders to unify the Democratic Party around Biden’s candidacy, six joint task forces appointed by Biden and Sanders produced a 110-page policy wish list, offering a preview of the party’s progressive agenda. The Biden-Sanders Unity Task Force, which includes current and former legislators and public officials, supports the following key health care policies:

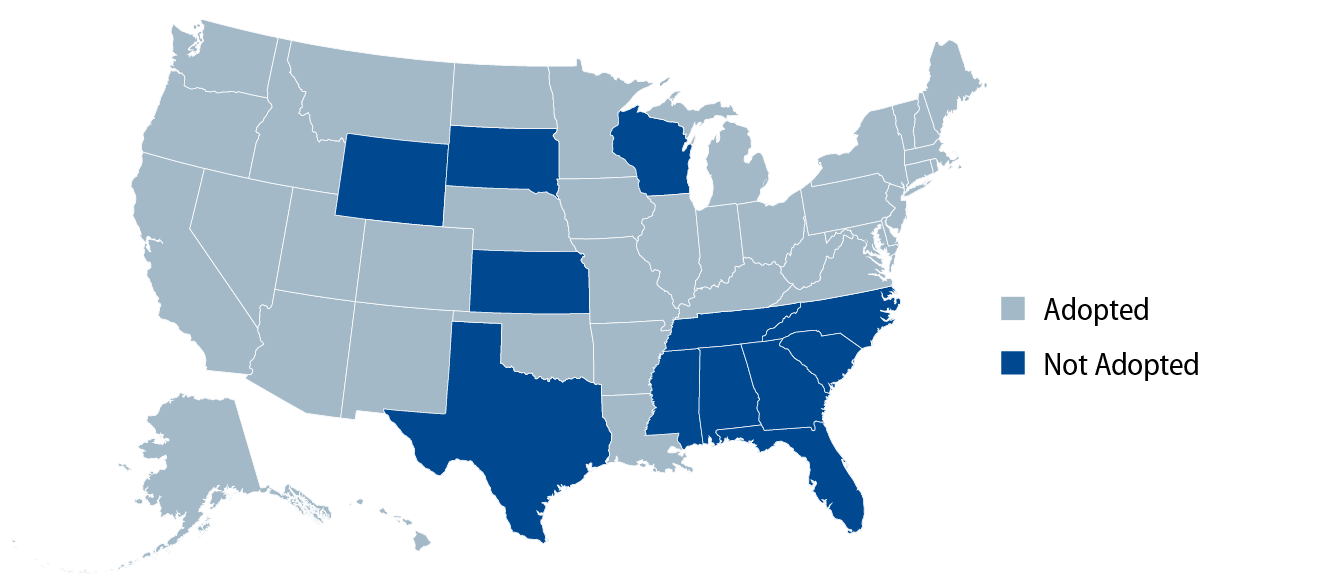

- Affordable Care Act (ACA): Biden aims to strengthen the ACA by reinvesting in ACA-exchange plan marketing and enrollment efforts, rolling back Trump-era regulations designed to undermine enrollment and Medicaid expansion. Biden has advocated coverage expansion for Deferred Action for Childhood Arrival (DACA) recipients, which could add up to 800,000 individuals to the ACA and allow undocumented immigrants to purchase unsubsidized coverage in the ACA marketplaces (as many as 12 million individuals). With more money allocated toward Medicaid expansion, increased exchange subsidies and premium-free insurance access for individuals in non-expansion states, these policies are positive for Medicaid and ACA exchange-levered credits. Exhibit 1 illustrates a summary of Medicaid expansion decisions by state.

- Public Option: The platform recommends “low-income people not eligible for Medicaid” should “be automatically enrolled” in the public option health plan “at no cost to them, and [they] may choose to opt out if they wish.” The plan will cover all primary care without any copayments and control costs for other treatments by negotiating prices with doctors and hospitals, just like Medicare. During the presidential debate, Biden emphasized that the Public Option offers health care coverage to those living in states that have not expanded Medicaid.

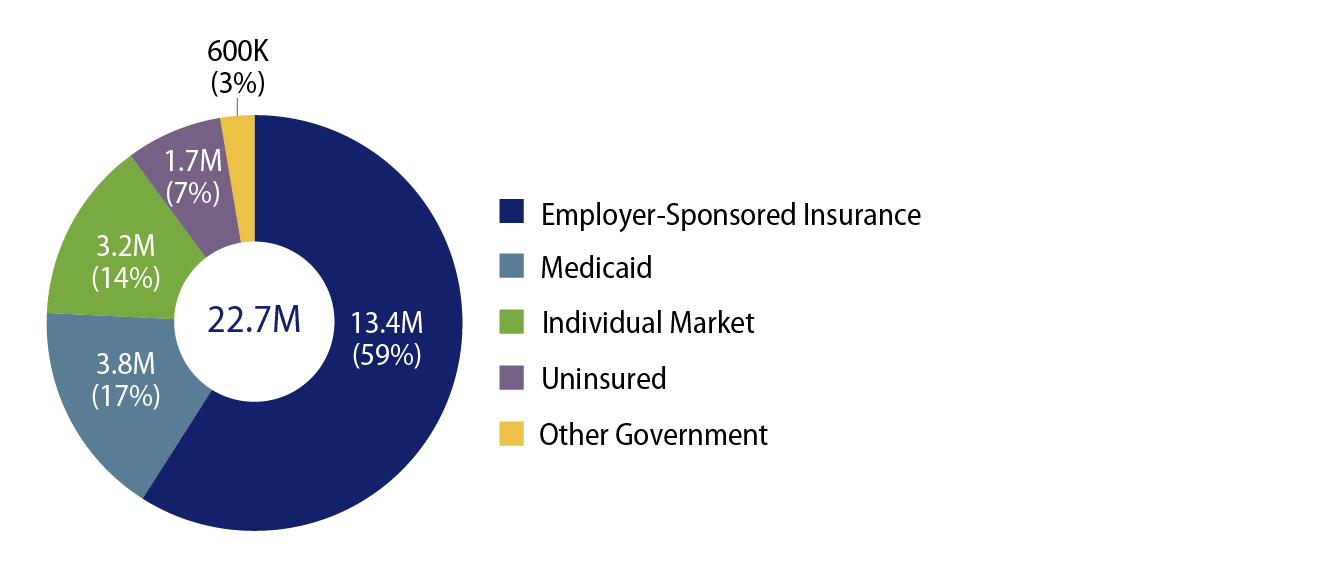

- Medicare Eligibility to Age 60 from 65: According to estimates by Avalere, lowering the Medicare eligibility age to 60 from 65 would expand coverage to nearly 23 million individuals, of which more than half (13.4 million) are currently covered by employer-sponsored insurance. Because Medicare pays lower rates than commercial insurance, the potential mix shift from this policy change could negatively impact hospitals and other providers in our coverage universe, particularly those who see a disproportionate share of profits from higher-margin, commercial reimbursement.

The Political Landscape

Under a divided government, if President Trump re-takes the White House, we see him continuing down the path of issuing Executive Orders tied to his health care priorities. Offering political upside for both parties, Trump could pursue a handful of issues with bipartisan support that might garner enough sponsorship to be enacted into law (i.e., drug pricing reform, surprise billing, etc.).

If Democrats capture a narrow majority in the Senate, we envision a political landscape that would limit aggressive legislation under a Biden presidency. If a “Blue Wave” overwhelms the Senate, investors may fear a more aggressive agenda on the horizon. Assuming the filibuster remains in place, Democrats would need to utilize the Budget Reconciliation process to advance any major health care legislation. Introduced and passed along party lines over the summer (notably after the Unity Taskforce recommendations were published), the House Patient Protection and Affordable Care Enhancement Act (H.R. 1425) is viewed as a good starting point for a “Blue Wave” health care agenda. Specifically, H.R. 1425 aims to lower health care costs, protect patients with pre-existing conditions, expand Medicaid and lower prescription drug prices. Notably, it does not include the Public Option nor does it contemplate changes to the Medicare eligibility age.

The other key item for Congressional debate will be the funding vehicle for a “Blue Wave” agenda. The Committee for a Responsible Federal Budget estimates the cost of Biden’s Health Care and Long-Term Care plans to be in the $1.0 trillion to $2.4 trillion range. Looking back to Obamacare, health care-related funding sources included a Medicare tax on high-earners, reduced payments to Medicare Advantage insurers, a tax on high-cost group health plans, a medical device tax and reduced growth rates in Medicare reimbursement to hospitals. While H.R. 1425 looks to use the drug pricing provisions of The Lower Drug Costs Now Act (H.R. 3) as a major source of funding (CBO estimates savings of $456 billion over 10 years), we would not rule out the potential for Democrats to also look to provider payment reform to fund their broader health care policy initiatives and simultaneously, to advance their goal of reducing health care costs.

The “Blue Wave” Ripple Effect

While we do not see a tidal wave of changes coming to the US health care system, the ripple effect following a “Blue Wave” election would likely be uneven across our health care coverage universe. If Biden can achieve his goal of 97% health care coverage in the US, we’d likely see positive ESG ratings momentum for select credits benefiting from an expansion of their social reach from these policies. Managed Care Organizations (MCOs) would likely see a mixed impact, with Medicaid managed care plans benefiting from greater coverage and Medicaid expansion, while others could see increased rate, membership and regulatory pressure. Hospitals and other providers would benefit from increased health care coverage through more subsidies and Medicaid expansion (i.e., higher volumes, improved receivables collection rates, etc.); however, we do see risks associated with the Public Option and lowering the Medicare eligibility to age 60, if these proposals were to gain more traction with the Democratic party.

While perceived to be limited in scope and perhaps not a priority for the Democratic party as noted above, the Public Option incorporates many disruptive elements and we can envision scenarios where broader consumer adoption of this plan could provoke a tsunami of changes to the health care landscape stemming from membership cannibalization on existing plans (ACA, employer-based health plans, etc.) and margin pressure for hospitals and other providers due to lower reimbursement rates. While the Public Option will be administered by CMS, over the longer term we see potential opportunities for MCOs and health care IT companies due to the lack of government infrastructure (i.e., third party administration functions).

In terms of tactical bias, Western Asset is positioned with a more cautious, defensive stance going into the election season. We have an up-in-quality bias, preference for names with visible credit catalysts and for avoiding those credits with leveraged CMS exposure. From our perspective, health care spreads have largely priced in a Blue Wave sweep and we will be patiently waiting for opportunities on the back of any risk reversal tied to budgetary, political and/or legal deliberation post the election.