Over the past few years, the US health care legislative agenda has been focused on lowering overall health care costs by improving price transparency and reducing the cost of high-priced prescription drugs. Drug pricing reform has been at the center of the public debate going into the election and we see this topic as a high-profile issue next term under either administration. While both parties share the common goal of lowering drug costs, there are stark differences in their plans; we see more downside risks for credit investors under a “Blue Wave” victory.

Rising Drug Costs

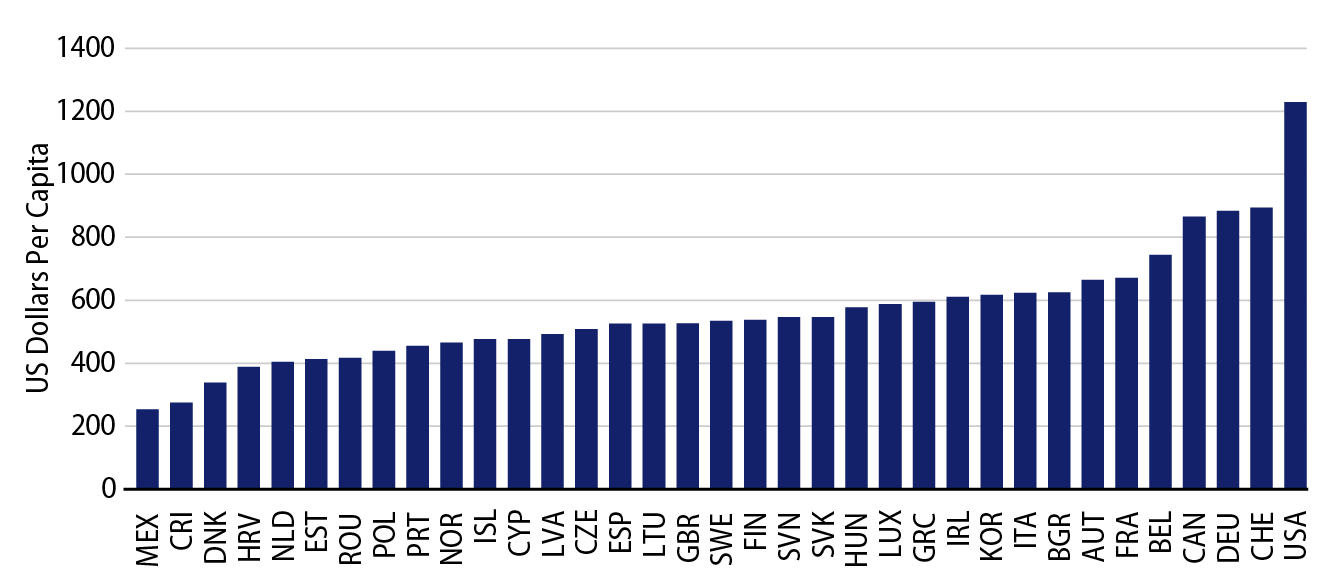

The US pays more for prescription drugs than any other country. According to the Organization for Economic Cooperation and Development, the US spent $1,229 per capita in 2018, a figure that is well above that of any other high-income country.

According to the Centers for Medicare & Medicaid Services (CMS), total US prescription drug expenditures totaled $335 billion in 2018, of which 42% or roughly $141 billion was tied to Medicaid and Medicare. Based on CMS projections, prescription drug expenditures for these two programs are expected to grow at a compound annual growth rate of 6% through 2028, outpacing inflation by a factor of almost 3x.

Biden’s Drug Pricing Agenda

The Biden-Sanders Unity Task Force, which includes current and former legislators and public officials, laid out the following objectives to describe the Democratic drug pricing agenda:

- Empowering Medicare to negotiate prescription prices directly for all public and private purchasers;

- Limiting launch prices through external reference pricing;

- Capping price increases at the rate of inflation;

- Allowing drug importation to create more competition;

- Addressing anti-competitive tactics that limit generic entry;

- Capping out-of-pocket drug costs for seniors and ensuring effective treatment for chronic health conditions are available at little or no cost; and

- Eliminating tax breaks for prescription drug advertisement.

Biden’s reform proposals include the objectives as outlined in the House Bill entitled the “Elijah E. Cummings Lower Drug Costs Now Act” (H.R. 3). One of the more controversial provisions of this bill involves language that would allow Medicare to directly negotiate prices for the Medicare Part D program and require Health and Human Services (HHS) to negotiate the prices of at least 25 brand-name drugs in 2023 and at least 50 drugs in 2024 and beyond. Republicans have historically resisted this concept due to a philosophical difference; they believe pricing should be governed by a market-based approach.

Trump’s Drug Pricing Agenda

Lowering drug costs has been a signature campaign promise by President Trump and he has repeatedly accused the industry of “getting away with murder.” Debate over drug pricing reform was active the past couple of years and appeared to be gaining some momentum before the COVID-19 pandemic hit. The Trump administration opposed the passage of H.R. 3, noting it would “undermine access to lifesaving medicines,” citing the statutory plan permitting direct negotiations with HHS. The Trump Administration noted that it “strongly prefers the Prescription Drug Pricing Reduction Act of 2019, which was reported out of the Senate Finance Committee on a bipartisan basis.”

Over the past few months, President Trump signed the following executive orders (EOs), which also reflect his view for drug pricing reform:

- Most Favored Nation: Requiring Medicare to use a “favored nations” clause in purchasing pharmaceuticals in Medicare Part B and Part D, to purchase at the lowest price from a list of countries that have a comparable per-capita GDP.

- Drug Importation: Allowing states, wholesalers and pharmacies to import pharmaceuticals from foreign countries.

- Rebate Rule: Requiring rebates to be passed directly to patients within Medicare.

- 340B: Requiring community health centers to pass 340B savings on insulin and EpiPens directly to patients.

- Boosting Domestic Drug Production: “Buy America” provision mandates on federal purchases of certain medical supplies and equipment deemed essential.

While recently signed, these EOs will not have an immediate impact, as any demonstration project related to Medicare reference pricing would not be able to start until mid-2021 at the earliest when taking into consideration the typical timeline for HHS rulemaking. As a result, we believe these EOs will be much more impactful next year if President Trump is re-elected.

The Political Landscape

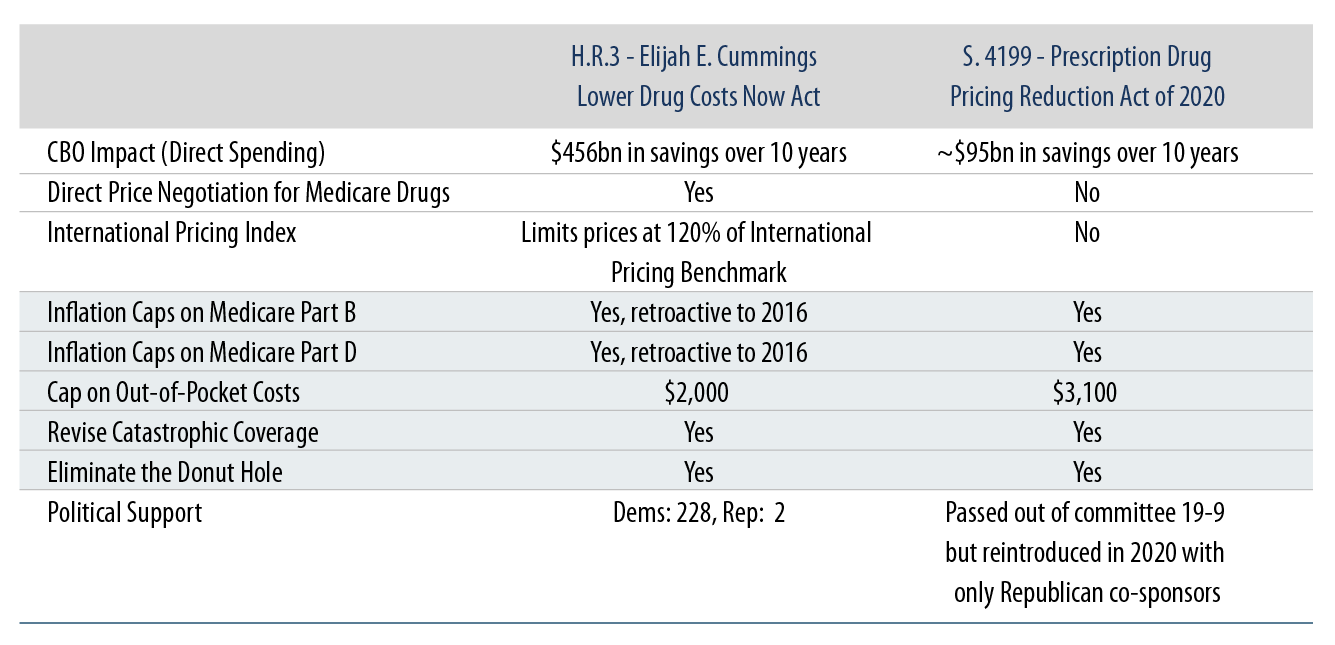

Exhibit 2 summarizes the main provisions from H.R. 3 and the Prescription Drug Pricing Reduction Act of 2020 (S. 4199), which was originally introduced by Senate Finance Committee Chairman Chuck Grassley (R-Iowa) and ranking member Ron Wyden (D-Ore.). Measures with bipartisan support include Medicare Part D benefit redesign, limiting Parts B and D drug price increases to the rate of inflation and capping out-of-pocket costs for seniors.

We believe H.R. 3 has a greater chance of becoming law if Biden wins the presidency and Democrats maintain control of the House and also gain seats in the Senate. We also highlight that Biden’s broader health care agenda (i.e., ACA and Medicaid expansion) looks to H.R. 3 as a major funding vehicle, with the CBO estimating the price negotiation provisions lower spending by almost $456 billion over 10 years. Under a divided government, Biden would likely take on a similar strategy to Trump’s in relying on EOs to push through any drug pricing reform agenda, but we would not rule out the possibility of using S. 4199 as a starting point to resume the debate.

Framing the Pharmaceutical Industry Exposure

Based on CMS data, government programs represent ~40% of total domestic prescription drug expenditures. With the pharmaceutical industry generating almost half of its revenues in the US, we can infer sales tied to US government payers represent ~20% of total industry-wide global revenues. With this level of revenue exposure at risk of being repriced due to drug pricing reform, manufacturers may need to reevaluate their drug pricing policies after any passage. We see large, diversified drug manufacturers having the financial flexibility to mitigate effectively any adverse impact from drug pricing reform and see branded pharmaceutical companies with high product concentration more at risk.

Passage of H.R. 3 could introduce downside risk to investors in the sector and we would expect to see negative ratings actions taken by the rating agencies, and the potential for a more negative ESG ratings trajectory if manufacturers resort to pricing strategies that attempt to offset the impact. Manufacturers would be able to at least partially mitigate the effects of this proposal by limiting the pricing differential between the US and foreign countries by either raising prices in other countries or by market repositioning (i.e., targeting geographies that have high enough prices). For drugs without average international market prices, manufacturers may also be able to partially compensate the effects with higher launch prices for new drugs in the US. We are also mindful that the savings tied to the passage of H.R. 3 would likely fund an expansion of health care coverage in the U.S. and that the incremental volumes would offer an offset to the drug pricing headwinds for the sector.

Under a Blue Wave sweep by Democrats, we are focused on the composition of the Senate, as an overwhelming majority would pose the risk of more aggressive reform for the sector (i.e., patent laws, exclusivity provisions, Medicare formulary reform, etc.), which in turn could threaten the slope of the drug price erosion curve even further. The pharma lobby will also be active as well, having spent more than $120 million in 2019 alone funding over 450 lobbyists to oppose these sweeping proposals that seek to lower prescription drug prices. In addition, the market will be watching to see if lawmakers can strike the right balance and alignment with the pharmaceutical industry so that the level of R&D spending and pace of innovation is not materially impacted by these reforms.

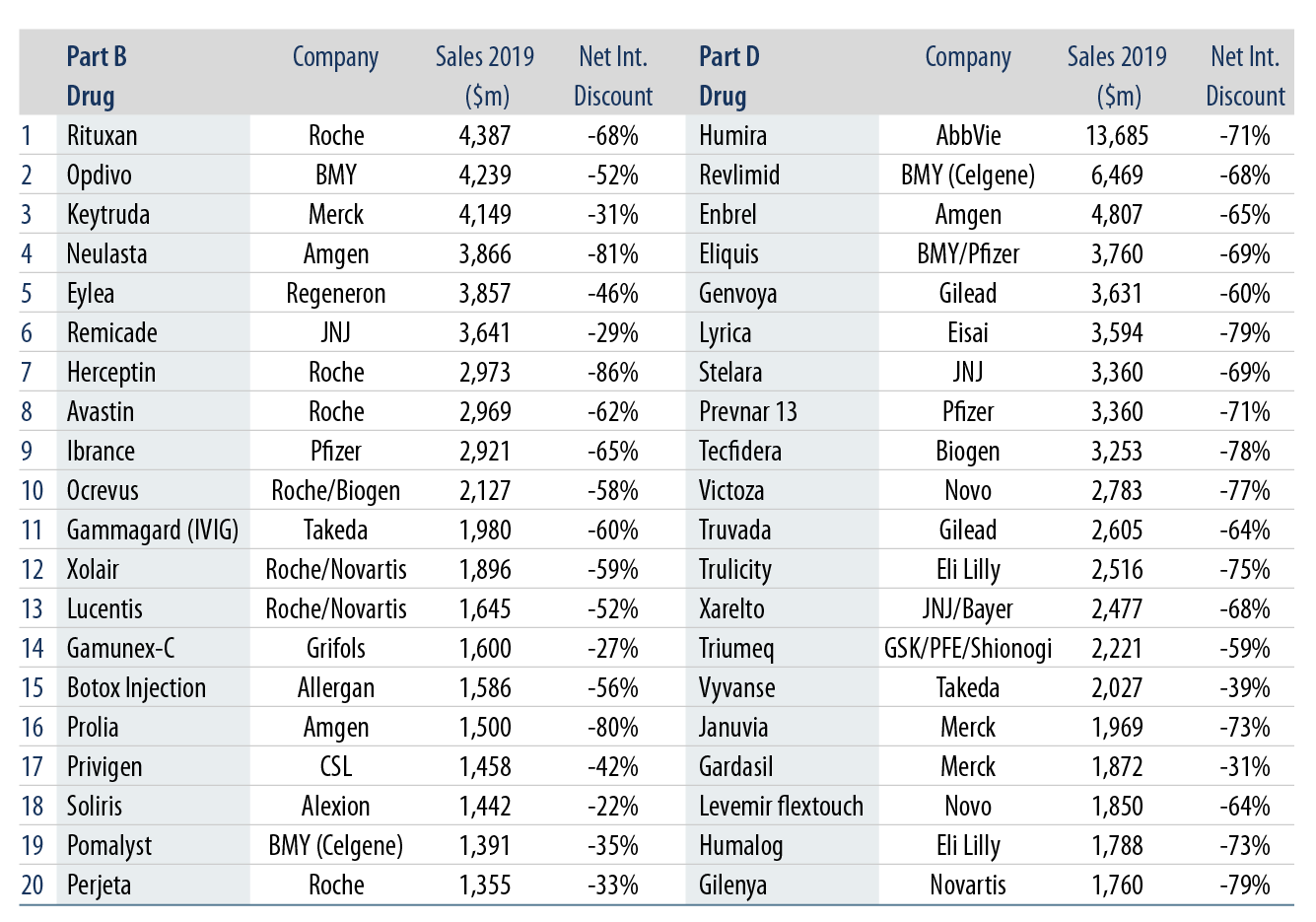

From a credit perspective, we do not see a material shock for the high-yield pharmaceutical companies under our coverage universe; instead, we see more of an impact on select investment-grade pharmaceutical companies given their dollar exposure to the top Medicare Part B and D drug programs. Exhibit 3 summarizes the top 20 Medicare Part B and Part D drug spends during 2019 and Credit Suisse estimated the associated net international discount when applying the average prices in the UK, France and Germany.

In terms of positioning within the sector, we look for credits with solid free cash flow profiles, visible deleveraging potential, growing product diversification, downside protection via value derived from stable business lines and bonds with credit enhancements through structural seniority and/or covenant protection. We also view favorably names that can benefit from volume leverage due to an acceleration of generic drug approvals (particularly with exposure to contract research organizations and life sciences) and an expansion of health care coverage in the US under a Blue Wave victory (select specialty pharma and generic manufacturers).