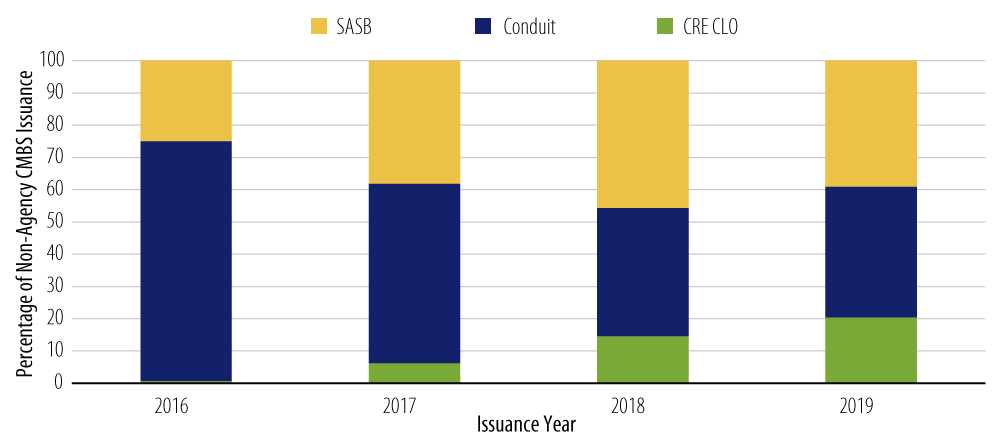

Over the last few years commercial real estate (CRE) collateralized loan obligations (CLOs) have moved from the fringes of the securitization market and now are entering the mainstream. Following a record year for issuance in 2018, issuance is 29% higher YTD in 2019 and poised to continue that growth trajectory following what is expected to be a light calendar through Labor Day. This couldn’t have come at a better time for some investors, as the issuance of traditional pooled commercial MBS (CMBS) transactions (conduit) has failed to meet expectations given that 2019 YTD total issuance is running behind last year’s pace, and is 35% lower than the 2013-2015 average. As a result, this emerging subsector now represents 20% of all private-label commercial mortgage issuance this year (Exhibit 1), and we expect issuance to continue growing.

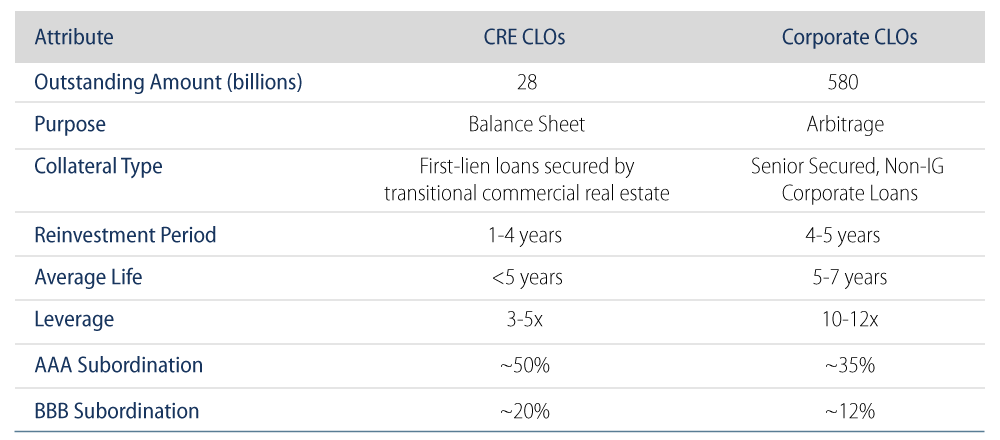

Although this growth has been an important theme for the broader market, the complexity of the sector and its emergent status require increased scrutiny. This has led some investors including Western Asset to approach the space with an abundance of caution. In essence, these transactions borrow “technology” from the corporate bank loan market that has a long and established history and cross it with small- and medium-balance transition commercial mortgages. Before the great financial crisis, these types of loans were either held on balance sheet by originators/investment banks or they were securitized as small portfolios/included in collateralized debt obligations (CDOs). Although structurally these deals are CLOs, there are a number of differences between them and corporate CLOs, most of which are detailed in Exhibit 2. The two most important differences are the respective sizes of the markets and the motivations for including the loans in a securitization. The size of the outstanding CRE CLO market is approximately 5% of its corporate cousin, which—although the former is growing strongly—does pose challenges to the transparency and liquidity of the securities in the secondary market and is a concern for Western Asset. However, the rationale for securitizing these assets in the first place and the differences in structure are skewed more positively in favor of CRE CLOs. For example, most CRE CLOs are issued by loan originators looking to diversify their funding sources and to lengthen the duration of their funding. On the other hand, corporate CLOs are issued primarily as arbitrage vehicles when market conditions accommodate. That is also one of the reasons why the amount of structural leverage in the CRE CLO transactions is on average less than half of what is found in corporate CLOs. Despite the differences in motivation, the credit enhancement levels for investment-grade rated bonds is nearly twice that of similarly rated CLO securities.

As part of our regular investment process, Western Asset’s Mortgage and Consumer Credit Team carefully monitors the issuance market in this growing sector. We also evaluate the credit, structure and anticipated liquidity of these transactions on a programmatic basis and will continue to do so. Now more than ever, the growth and complexity of this sector demands careful analysis and scrutiny.