Many investors may be wondering whether there is any value left in domestic fixed-income markets. While outright yields may look tight on a historical basis, we contend that spread sectors still provide attractive risk-adjusted returns relative to cash and government bonds. Indeed, there still exist a number of compelling risk/return opportunities for active managers to provide excess returns.

Australian Credit Recap

In April, markets bounced quickly in regions such as the US and Europe, where central banks committed to directly supporting credit markets. However, in Australia the Reserve Bank of Australia (RBA) fell short of this commitment and conditions remained highly challenged—although they eased somewhat in May following the RBA’s broadening of the REPO eligibility to include a broader range of corporate debt securities.

Turn the clock forward to September. Spreads on senior bank paper for the majors are now trading at tight spread levels not seen since prior to the GFC and the support for domestic credit markets continues to expand as the primary market issuance receives strong demand. A record low cash rate continues to drive investors toward credit as investors search for yield, improving liquidity markedly.

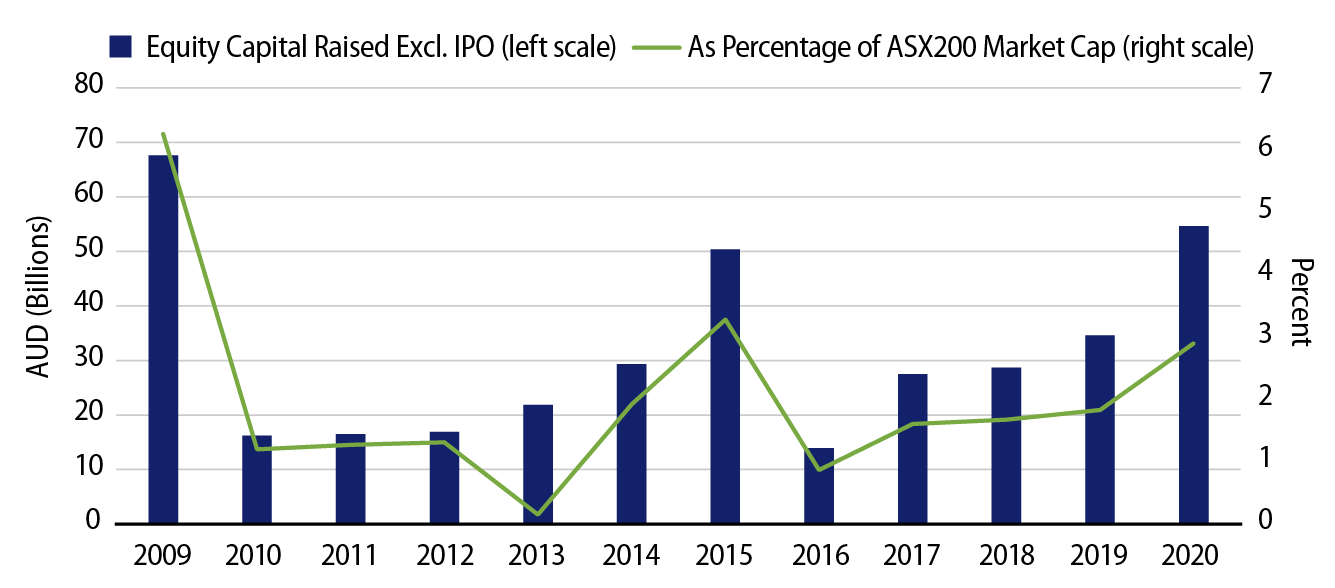

Corporate Treasurers have also acted decisively to mitigate the impacts of the virus on their balance sheets. Businesses raised liquidity to allow themselves to survive the forced shutdown of the economy. Most companies tapped lines of bank credit, and many listed companies issued equity at levels not seen since the GFC (BEN, NAB, NSR, NXT, QBE, QAN and more). Dividends were suspended and costs aggressively cut across the board in order to preserve cash. While slow to start, a growing number of Australian companies are issuing into the debt markets.

Relative Value Across the Banking Capital Structure

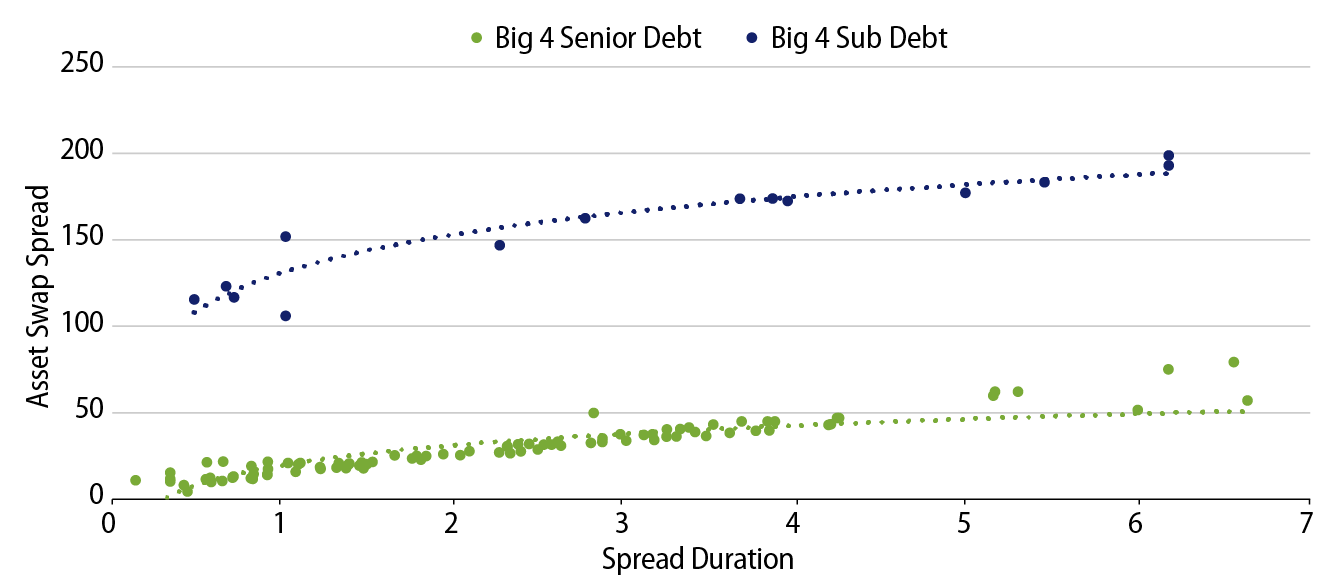

A combination of ongoing access to the Term Funding Facility (a rapidly growing deposit base as consumers and businesses hoard cash) and anaemic loan growth have left the banks with significant liquidity and little need to issue new senior debt to fund loan growth. Banks have not needed to issue senior debt since the onset of the crisis, with maturing bonds not being refinanced. Bank debt issuance provides the bulk of investment opportunities in domestic credit markets, and with supply falling, the scarcity value of the outstanding bonds increases. As a result, bank spreads are now trading at levels not seen since before the GFC, and this situation is not looking likely to reverse any time soon.

Banks issue debt across the capital structure, including senior and subordinated debt, alongside hybrid (AT1) capital, and while (for these reasons) senior debt has repriced to levels not seen since before the GFC, spreads on bank subordinated debt have not retraced to the same extent. With the capital position of the domestic banks remaining sound and ongoing support being in place, we feel that subordinated debt spreads have some further consolidation to go, and remain a more attractive part of the capital structure to invest in.

Opportunities in RMBS

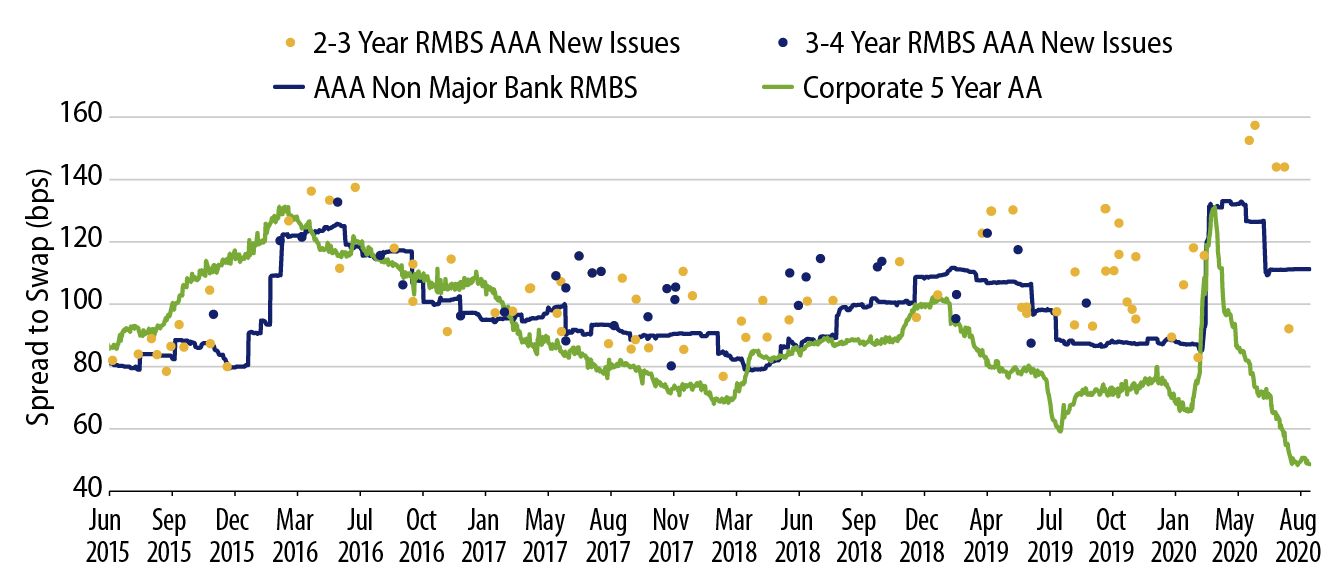

Another sector that has benefitted from the current mix of policies is the domestic residential MBS (RMBS) sector. While lockdowns have led to an increase in the number of households unable to meet their monthly payment commitments, the flow-on effects have been mitigated due to significant regulatory intervention.

The government has acted swiftly to limit the impact of Covid-related arrears on the performance of both home loan providers and the RMBS securities that they issue; all with the aim of avoiding the type of dislocation experienced during the GFC, when the spreads on RMBS blew out significantly wider than corporate credit.

Direct purchasing of both primary and secondary RMBS by the Structured Finance Support Fund (SFSF) and the establishment of the SFSF Forbearance Fund, which is designed to assist non-bank lenders to cover payment shortfalls on loans affected by COVID-19, have led to the RMBS sector being well supported and have reduced the stresses on RMBS structures. This support has allowed lenders to maintain access to funding, and focus on assisting borrowers to manage their way through the crisis, rather than forcing foreclosures on affected borrowers.

In April, we saw the average level of loans in partial or full forbearance rise sharply to around 10% for prime loans and near 20% for non-conforming loans. Encouragingly, we are seeing signs that the sector is repairing as the economy heals, and these forbearance numbers have tracked downward. Unless the stresses increase significantly from here, we expect the structures to remain robust and therefore expect RMBS to perform well. RMBS spreads, like those of bank-subordinated debt, continue to offer significant value for patient investors.

Kangaroo Issuers

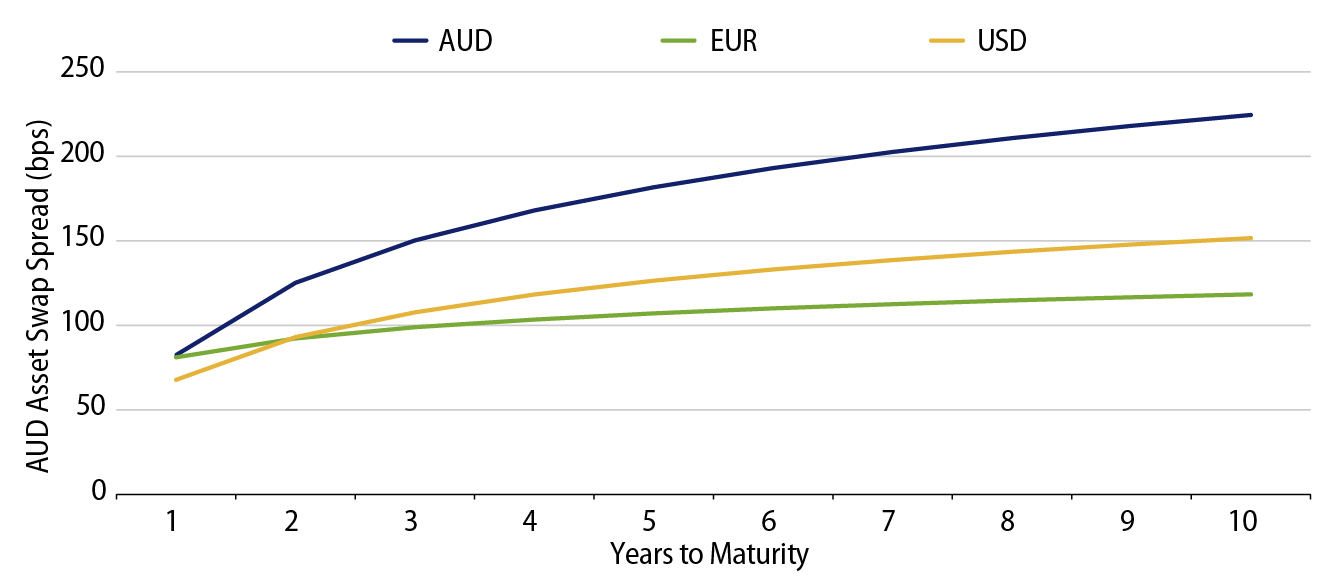

An additional area of opportunity exists for investors in the form of Kangaroo bonds of offshore issuers. These companies primarily issue into the Australian market to diversify their sources of capital, provide a natural hedge for AUD-denominated earnings and for tax efficiency. There are currently many Kangaroo issuers where the AUD-denominated bonds are much cheaper (and yields higher) than the issuers’ USD- and EUR-denominated bonds.

Both the Fed and ECB are explicitly supporting credit markets via their asset purchasing programs. This has acted to reduce significantly the yields on eligible bonds. No such direct policy exists in Australia, leaving the AUD bonds undervalued in comparison to global peers. The longer markets remain flush with liquidity in a yield-starved environment, the greater the likelihood that the yields on bonds issued across all currencies will converge. This presents a compelling opportunity for managers with a global research platform to build early conviction in the most robust Kangaroo names.

We are not out of the woods yet, in terms of either the health or the economic consequences of COVID-19. However, a combination of aggressive monetary, fiscal and regulatory actions have provided the much-needed support to the economy. While this unprecedented level of support does not reduce the need for intensive fundamental analysis—indeed it makes such research even more important—it does provide a series of compelling risk/return opportunities for active managers across segments of the market.