Nowhere in previous publications have we made the claim that positive alpha is easy to generate. Investment managers, however, have shown results over time that reflect the benefits of an active approach to high-yield investing. As we look back on 2020, the year presented a complex, diverse set of circumstances including, among others: the pandemic, transformative technological innovations, changes in consumer behavior and massive stimulus programs. In the first quarter of 2020, the high-yield market (based on the Bloomberg Barclays US High Yield Index) fell close to 13%, with spreads reaching 1,100 bps over Treasuries. But, given the subsequent rally in the following three quarters, high-yield generated a total return of 7.1% for the year and spreads ended 2020 only 24 bps wider from where they began the year. These extreme moves resulted in a standard deviation for the index of approximately 15%—almost 3x higher than the annual average from 2010 to 2020.

Last year’s volatility underscored the benefits of active management, particularly in regard to fixed-income investing. Passive strategies are rooted in the notion that markets are too efficient for active managers to exploit consistently over time. Yet this ignores the obvious fact that markets vary considerably in terms of type, size, diversity and liquidity, which are all important determinants of a market’s complexity and its potential for greater pricing anomalies, instability and technical noise. Over the past decade, passive equity and fixed-income investment vehicles experienced robust inflows given the appeal of buying (what is often assumed to be) inexpensive index performance. As we will highlight, however, there are a number of reasons why we believe passive fixed-income investments have fallen short of their objectives by consistently underperforming the index. These reasons include:

- Index construction criteria that have an overweight bias toward the largest debtors;

- Monthly index rebalancing—prices tend to rise or fall as passive investors are forced to rebalance, whereas active investors seek to anticipate and profit from these swings;

- The inability to exploit off-benchmark opportunities, often foregoing the prospects of enhanced yield or reduced volatility;

- An asymmetric duration risk profile with rates already at historical lows, potentially leading to less yield per unit of duration;

- An inherent liquidity mismatch between the structure of ETFs and their underlying holdings as reflected in the 1Q20 drawdowns;

- Lack of research and resulting structural biases (as provided by active strategies) that target certain factors such as sector/quality/issuer exposures or duration/curve profiles. The energy sector, for example, represents approximately 13% of the high-yield index (as well as JNK, the SPDR Bloomberg Barclays High Yield Bond ETF, and HYG, the iShares iBoxx High Yield Corporate Bond ETF). During March 2020, the sector underperformed the broader high-yield index by 270 bps. An active manager with an underweight energy allocation would have significantly boosted its relative returns from a sector perspective given energy’s relative underperformance; and

- Elevated trading costs/fees associated with structuring passive high-yield ETFs compared to other asset classes.

In addition to these factors, what is often overlooked is the relatively higher management fees associated with passive high-yield ETFs as compared with actively managed strategies.

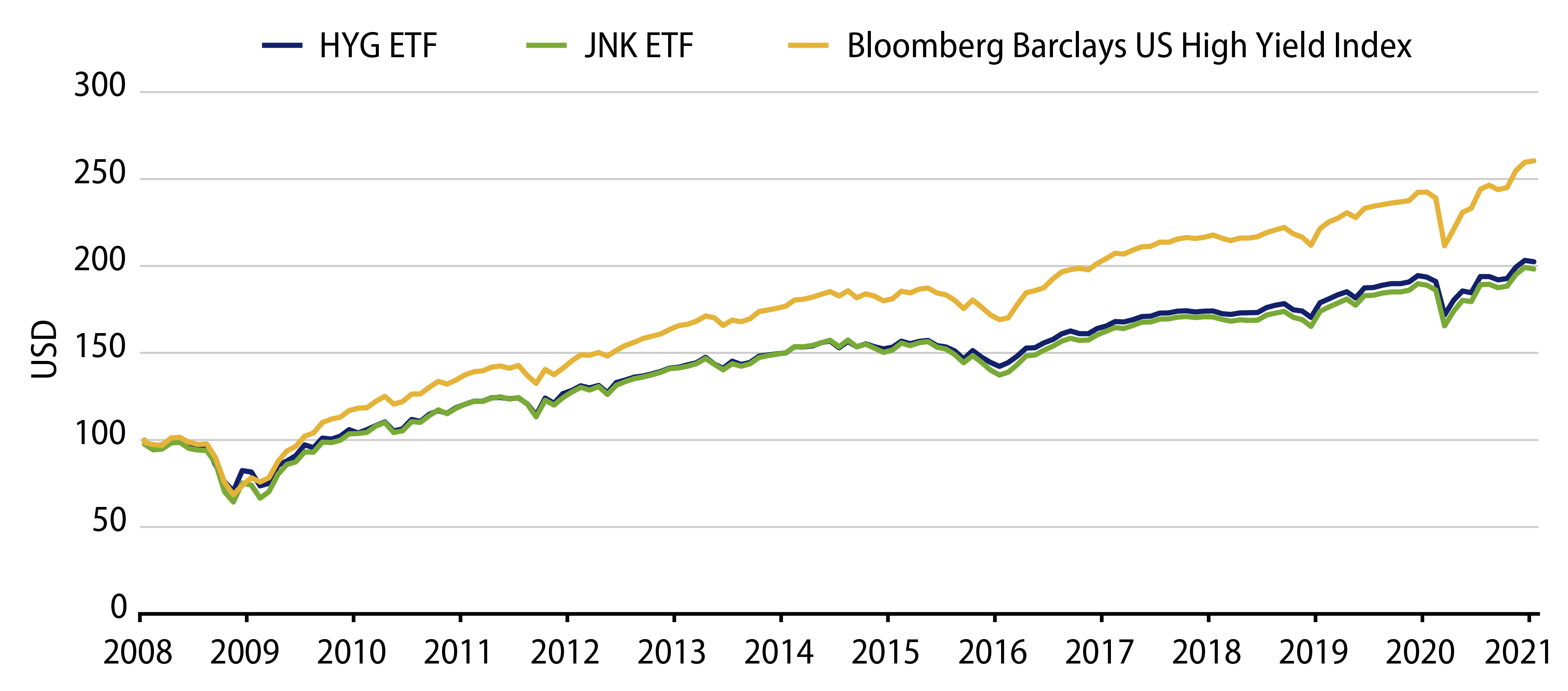

Historical return comparisons between active and passive funds show that a passive approach might make sense for highly liquid and efficient markets such as US large cap equities or US government bonds. But, on the high-yield front, the data tells a very different story. Investors have primarily pursued two passive high-yield vehicles in order to gain exposure—HYG and JNK, which have combined assets of close to $40 billion. Since the inception of both of these vehicles in 2007, they have meaningfully underperformed the Bloomberg Barclays US High Yield Index and the EVestment High Yield Peer Group. On an annualized basis from January 1, 2008 through January 31, 2021, HYG and JNK have underperformed the Bloomberg Barclays Index by 187 bps and 200 bps, respectively (see Exhibit 1). For context, the index has returned 7.6% annually during the period. As a result, passive investors, with the goal of replicating index-like returns, would have foregone more than 25% of the annualized total return. Further, not only did JNK materially underperform the index, it also generated a tracking error in excess of 2%. The significant underperformance and tracking error are unsurprising given the structural issues of ETFs noted earlier. Together, they underscore the benefits of having an active high-yield allocation.

To summarize, we believe actively managed high-yield investment strategies have an inherent advantage over passive strategies. Since our founding nearly 50 years ago, Western Asset has taken a value approach to investment decision-making premised on the view that fixed-income markets often misprice securities. As an active manager, we are well positioned to provide clients with opportunities for stronger risk-adjusted returns compared to relevant indices. We expect more bouts of volatility as markets emerge from the COVID-19 pandemic and, therefore, support active over passive high-yield manager allocations. We believe this positioning will provide investors with greater flexibility to manage risk and harvest value opportunities as they arise.