Insurance Asset Management - Customized Solutions

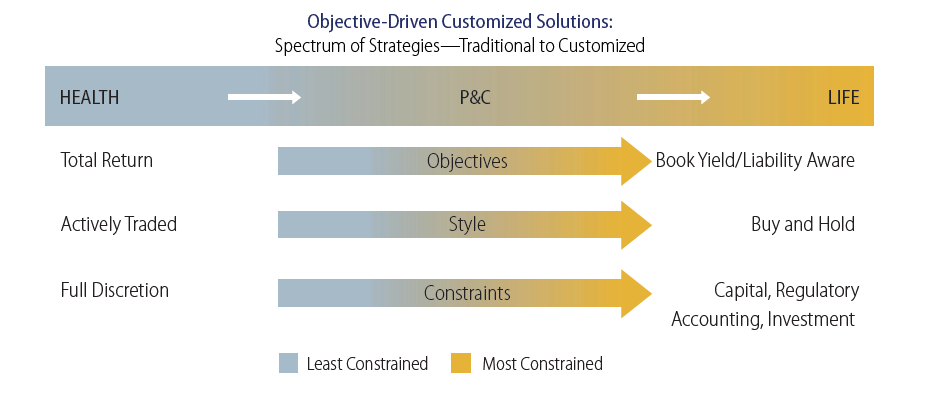

- Investment strategies are customized based on clients’ unique objectives and constraints.

- Robust optimization tools target client-specific metrics (e.g., volatility, capital efficiency, yield, liability hedging and gain/loss budgets).

- Sector teams actively contribute to clients’ individual investment outlooks and provide sub-sector/issue selection expertise to the Insurance Team.

Western Asset has regulatory expertise in several regulatory regimes, including:

- Solvency II

- Life and General Insurance Capital (LAGIC)

- US National Association of Insurance Commissioners (NAIC) Risk-Based Capital

- Basel III

- S&P Risk-Based Insurance Capital Model

- Singapore Risk-Based Capital II

- China C-ROSS and Hong Kong Risk-Based Capital

- Swiss Solvency Test (SST)

- Canada: Life Insurance Capital Adequacy Test (LICAT for life insurers) and Minimum Capital Test (MCT for P&C insurers)

Portfolio Optimization

Achieve an optimal balance between the multiple objectives that insurance companies consider in the management of their business, including risk-adjusted after-tax returns, capital efficiency, income preferences, liquidity requirements, realized gain/loss constraints, underwriting and regulatory constraints, etc.

Customized Benchmarks

Creation of benchmarks that are tailored to reflect a company’s liability profile and risk preferences, as well as regulatory, rating agency and other management considerations.

Asset Allocation

Analysis to establish long-run sector allocations that produce an appropriate risk/return profile for capital supporting a product or company.

Tail-Risk Management

Portfolios constructed to protect against downside risk in stressed economic environments.

Scenario-Based Risk Budgeting

Determine permissible active management exposures to spreads and rates versus customized benchmarks. Employs stress tests to sectors and rates to determine potential losses in well-defined stress scenarios.

Insurance Accounting

GAAP, statutory and IFRS accounting and reporting capabilities in partnership with Clearwater Analytics.

Insurance Case Studies

Case Study 1: Solvency II Expertise Benefits Multinational InsurerCase Study 2: A Capital Efficient Solution for BOLI Assets

Our Insurance Team

Frank Beardsley

Head of Insurance at Western Asset

Theresa M. Veres

Head of Insurance Portfolios at

Western Asset