Municipals Posted Negative Returns During the Week

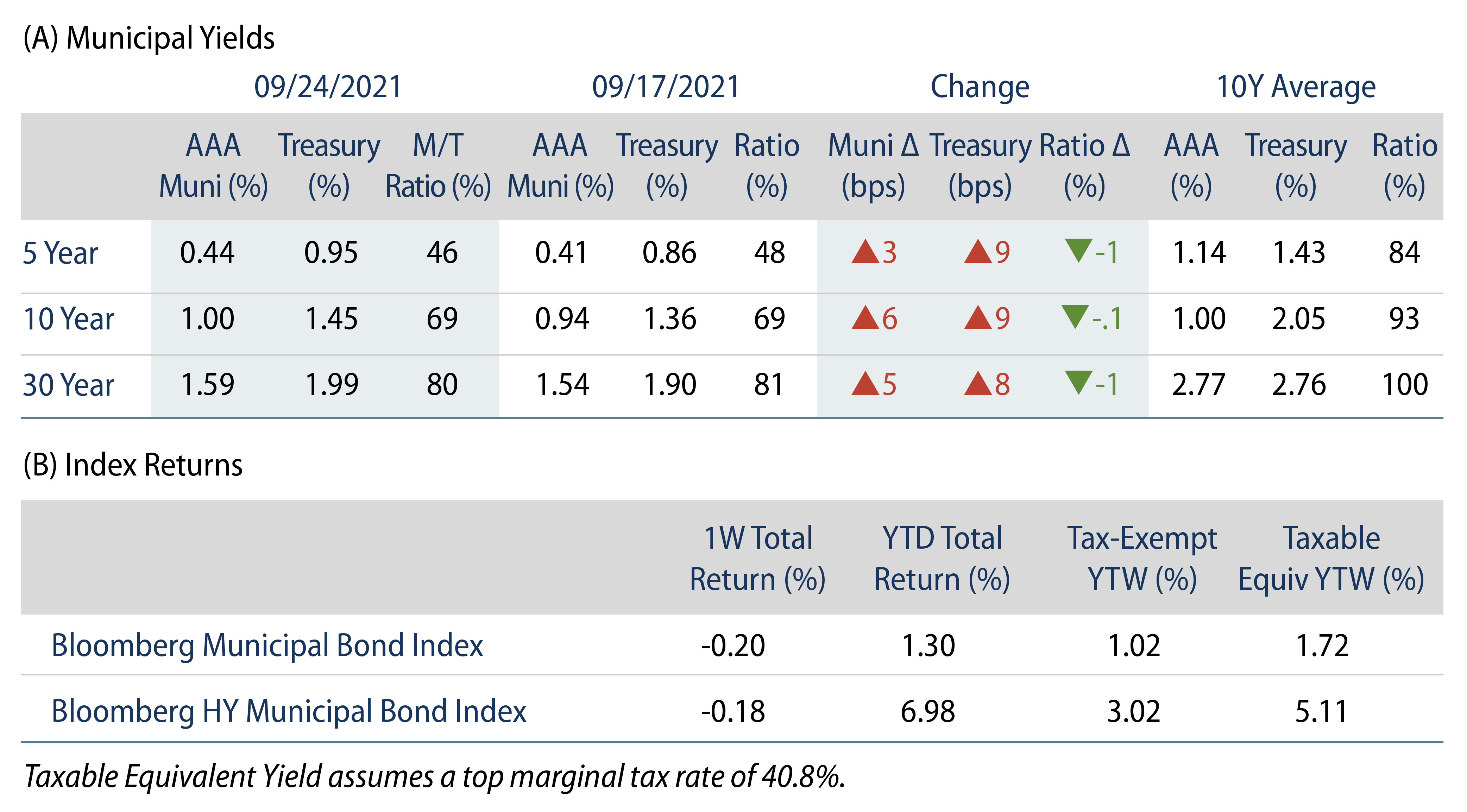

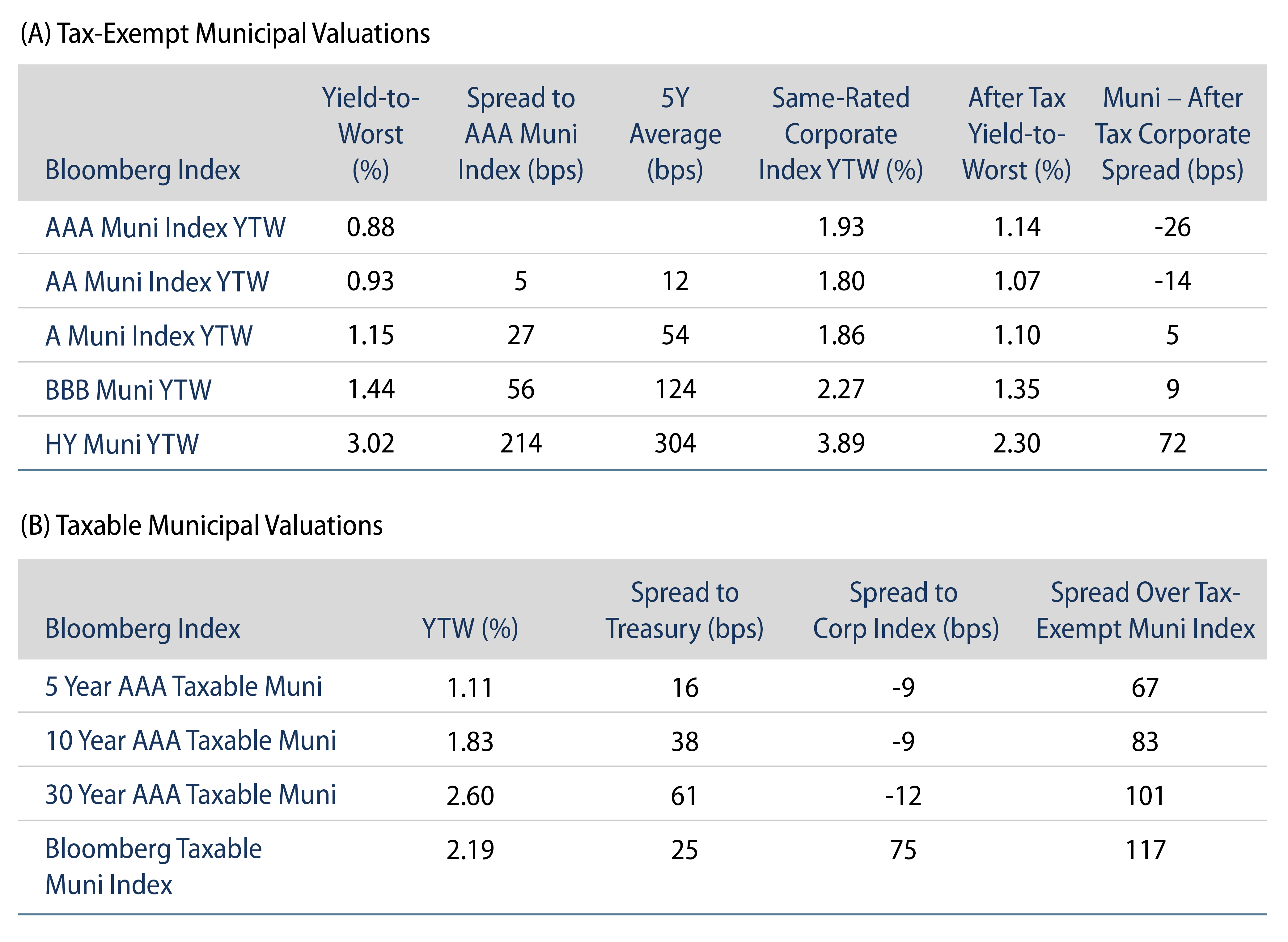

US muni yields increased 3 to 6 bps across the curve, trailing Treasuries higher. The Bloomberg Municipal Index returned -0.20%, while the HY Muni Index returned -0.18%. Technicals remained strong, as municipal mutual fund demand continued to override higher new-issue volumes. This week we check in on the states’ usage of federal stimulus spending.

Technicals Remain Supportive

Fund Flows: During the week ending September 22, municipal mutual funds recorded $1.2 billion of net inflows. Long-term funds recorded $1.1 million of inflows, high-yield funds recorded $408 million of inflows and intermediate funds recorded $212 million of inflows. Municipal mutual funds have now recorded inflows 70 of the last 71 weeks, extending the record inflow cycle to $150 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $88 billion.

Supply: The muni market recorded $9.9 billion of new-issue volume during the week, down 22% from the prior week. Total issuance YTD of $335 billion is 4% higher from last year’s levels, with tax-exempt issuance trending 14% higher year-over-year (YoY) and taxable issuance trending 20% lower YoY. This week’s new-issue calendar is expected to increase to $11.4 billion of new issuance. The largest deals include $1.9 billion state of Hawaii and $1.8 billion Golden State Tobacco Securitization Corp. transactions.

This Week in Munis—Checking in on Stimulus Spending

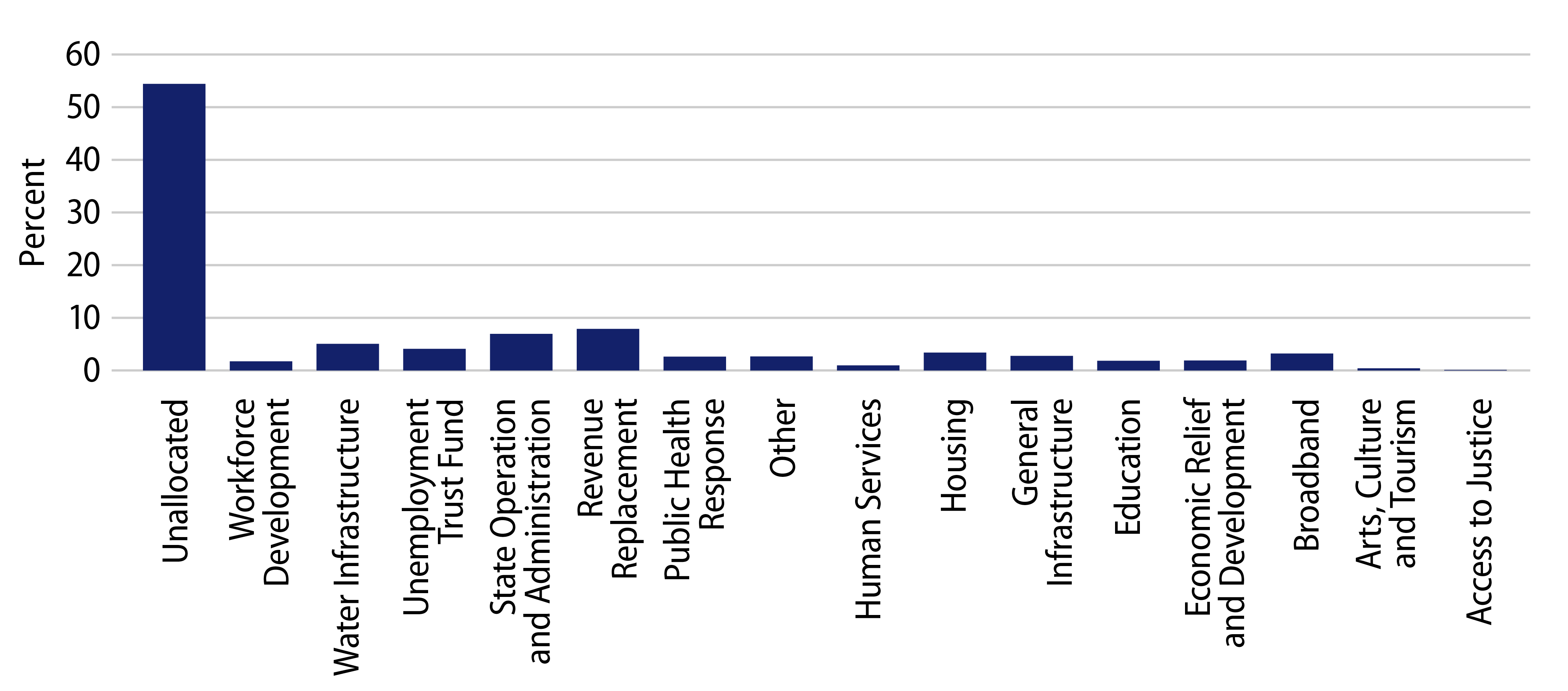

The American Rescue Plan Act (ARPA) allocated $195.3 billion in aggregate funds to all of the states, which must be spent by the end of 2026. So far, 46% of total funding has been earmarked for spending, with the largest amounts going to revenue replacement ($15 billion), followed by administration and operations ($13 billion) costs.

Not surprisingly, states vary in how much of their funding has been allocated to date. California and New York have allocated all their ARPA funds. California will use 32% of its dollars to replace lost revenues, followed by housing and broadband expenditures. California may be using these funds to help solve two of its well-known social problems that were exacerbated by the pandemic: affordable housing and lack of connectivity throughout its largely rural geography. New York has not yet broken down its fund usage.

New York and California’s treatment of stimulus funds is contrasted by the state of Texas which has not allocated any of its $15 billion ARPA funds, but it is providing for localities through the separately established Coronavirus Local Fiscal Recovery Fund. Florida, another conservative state, has appropriated 60% of its ARPA funds while Illinois, a more fiscally challenged state, still has 84.5% of its ARPA funds available.

Certainly, ARPA funds have supported the outlook for municipal credit, as state median rainy-day fund balances are projected to reach 8.3% in fiscal-year 2022, just shy of pre-pandemic levels and well above the 1.6% seen during the Great Recession. Given that 2021 state tax revenues fared better than expected, ARPA funding may be used to help solve challenges that are allowable under the legislation, rather than simply replace lost revenue. Certain states that not have not allocated their full proportions of aid have also advocated that these funds support infrastructure initiatives, a provision that was included in the Senate-approved infrastructure bill currently sitting in Congress. Given the potential for the Covid delta variant to slow the economic recovery, it is prudent to leverage ARPA funding to build reserves, and we continue to monitor potential positive downstream impacts of federal funds on infrastructure entities in states with excess unallocated ARPA funding.