Over the past year, few markets have been more misunderstood or misjudged than US Treasuries (USTs). Since Trump’s return to the White House, the narrative around America’s debt markets has been shaped by one sensational headline after another: ballooning deficits, fiscal dominance, political dysfunction and fears of foreign investor flight. To many, the takeaway seemed simple: run, don’t walk, away from US government bonds.

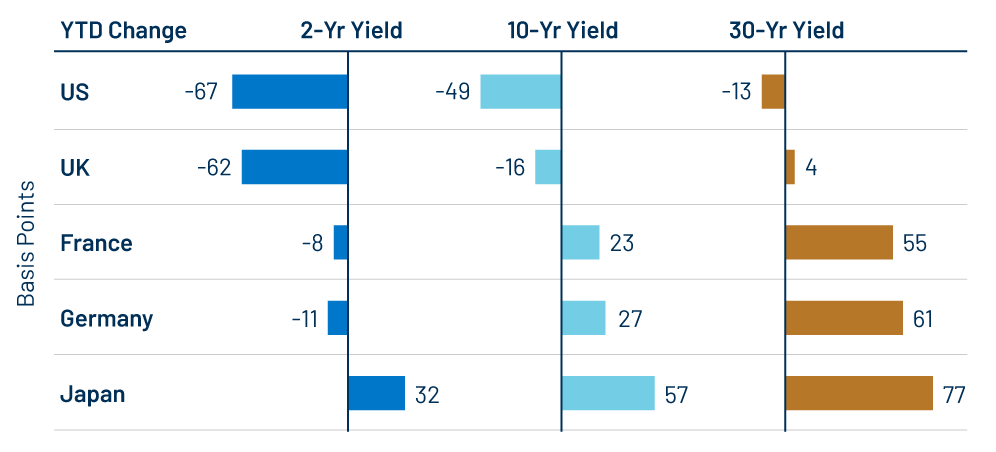

Yet reality has played out quite differently. Far from being the epicenter of crisis, USTs have delivered among the best returns of any major fixed-income market this year, up roughly 6%, with 10-year yields falling nearly half a percentage point to around 4%. That move has lowered borrowing costs for the government, homebuyers and corporations alike, underscoring how quickly sentiment can swing in global bond markets.

At Western Asset, our stance has remained consistently more constructive—not because we ignored the fiscal and political risks, but because we believed the global bond market was overreacting. From the outset, we viewed much of the “sell America” narrative as misplaced. Fears of fading demand for Treasuries were overstated, and despite the noise, US debt has remained resilient, supported by one of the broadest and most liquid investor bases in the world.

A big driver of that conviction has been the underlying fundamentals. Inflation in the US has stayed rangebound as companies absorbed much of the tariff burden rather than fully passing it on to consumers, helping to stabilize prices and sustain growth. Meanwhile, the Federal Reserve’s pivot toward rate cuts has provided a supportive backdrop for UST prices and market liquidity. In short, the macro environment, despite data volatility and headline risk, has not resembled the fiscal doomsday many predicted.

In our earlier work, we argued that much of the fiscal dominance debate was being framed too narrowly. The US fiscal outlook is challenging, but fiscal dominance is not an on/off switch. The country still benefits from an independent central bank, a deep domestic savings pool and a dynamic private sector that can absorb debt issuance in ways few others can. Politics can influence policy, but it does not define the system.

While the US debt and deficit picture remains a concern, especially given the ongoing wrangling over fiscal spending that has once again led to a government shutdown, USTs continue to offer positive real yields and deep, liquid markets. They also benefit from the so-called “exorbitant privilege” that comes with the US dollar’s dominant role in global finance and reserves.

Our analysis earlier this year on trade and capital flows pointed to a more nuanced picture than headlines suggest. Despite persistent geopolitical tension, major foreign holders such as China have not meaningfully reduced their Treasury positions. In fact, foreign investors now hold a record $9.2 trillion of USTs, roughly 30% of the market.1 For all the speculation about de-dollarization, global investors continue to vote with their wallets. US-backed bonds remain the world’s preferred safe-haven asset, and that preference tends to strengthen during periods of uncertainty.

Another often-overlooked factor is the market’s adaptability. Both domestic and international investors have learned to live with larger US deficits and a more volatile policy environment. The resilience of Treasury auctions, steady demand from pensions and insurers, and continued participation by global reserve managers all highlight the enduring depth and diversity of this market.

Of course, risks remain. The Supreme Court’s pending review of tariff legality, a softer dollar and lingering inflation pressures could still unsettle markets. Political headlines will continue to test investor nerves. But as we have said before, fiscal dominance is not destiny. The US retains unmatched capacity to fund itself in its own currency, supported by deep private savings, credible institutions and a transparent policy framework that still commands global trust.

If there’s one lesson from 2025 so far, it’s that sentiment can shift far faster than the fundamentals that truly drive bond markets. Consensus pessimism, amplified by politics and the news cycle, often overlooks the enduring realities of scale, liquidity and credibility that define the Treasury market. While the world was busy writing off America’s debt, yields quietly fell, and investors who stayed the course were rewarded.

ENDNOTES

1. Bloomberg, November 2, 2025, “Treasuries Rally Is Proving Trump’s ‘Sell America’ Critics Wrong.”