Executive Summary

- Traditional sovereign analysis seeks to determine whether a country can grow fast enough to outpace the rate at which it accumulates debt.

- Western Asset combines financial and ESG analysis to form a more nuanced perspective on sovereign creditworthiness.

- While governance practices provide the foundation for development, environmental and social factors can impact economic growth.

- We believe that a country with a proactive and thoughtful approach to managing its ESG risks is much more likely to achieve its economic goals.

- We seek to engage sovereigns to improve their governance practices and implement sustainable policies.

In this brief note, we describe Western Asset’s framework for incorporating environmental, social and governance (ESG) factors into our sovereign analysis. Our goal is to help readers understand how we approach sovereign ESG investing and how ESG can complement “traditional” sovereign investment analysis.

The standard approach to sovereign analysis focuses on debt sustainability. In simple terms, that analysis seeks to determine whether a country can grow fast enough to outpace the rate at which it accumulates debt. Debt basically grows as a result of primary deficits and real-interest rates. GDP growth must outpace this path of accumulation, and hence is a central factor to the analysis. Short-run growth fluctuations move markets, while long-run growth rates are usually heavily assumed. What’s missing from this analysis? Dynamic effects and sustainability.

In other words, a narrow focus on economic growth and short-term policy prescriptions ignores the bigger picture of economic development and sustainability. That’s where political, environmental and social considerations—more generally known as ESG—come into play. At Western Asset, we believe that ESG can augment traditional economic analysis to sovereigns and result in more robust and dynamic investment theses in the sovereign space.

Western Asset’s analysis of ESG factors for sovereigns is based upon the following principles described below.

Sovereign economic growth and stability are critically influenced by the quality of governance.

Governance is defined by the World Bank as the capacity, legitimacy and authority of a state.1 We view these elements as foundational for a sovereign’s growth and development. Prudent fiscal and regulatory policy clearly facilitate sustainable economic growth. But such policies cannot be designed without technically capable leaders, and cannot be implemented without public trust. Institutional credibility in turn is best maintained by financial transparency, due process and containment of corruption.

History has shown that a country with seemingly favorable economic fundamentals can quickly deteriorate due to poor governance practices. Accordingly, we combine financial and governance analysis to form a more nuanced perspective on sovereign creditworthiness.

Environmental and social factors matter because they have consequences for economic development.

The economic impact of extreme weather events needs little explanation. Natural disasters in 2017 resulted in the loss of 10,000 lives and $330 billion in damages worldwide, in comparison with the prior decade average of $170 billion.2 This damage can be particularly crippling in economies with heavy reliance on agriculture, tourism and mining. Meteorological and hydrological events increase the incidence of diseases that are spread through unsanitary water and insect vectors, which in turn elevates medical costs and reduces output of the country’s working population for several years afterwards.3

Less obvious but equally germane to sovereign analysis are the rising greenhouse gas emissions and ongoing incremental changes in temperature, sea level, soil quality and weather patterns across the globe.4 These changes can depress economic growth due to their negative effects on labor productivity and public health. As estimated by the Intergovernmental Panel on Climate Change, such losses could total $2 trillion by the year 2030.5 Even in areas ostensibly unaffected by drought or other weather patterns, rising carbon dioxide levels have a depressing effect on agricultural yield, as there are not only fewer crops to harvest, but the nutritional value of what can be harvested is itself lower.6

Investors should pay heed to environmental and social risks in countries with weaker governance where the state’s ability to respond to shocks is constrained.

Most developing countries face some degree of shortfall when it comes to governance. These countries often exhibit higher levels of migration, underemployment, inequality and marginalization as well. In addition, many of these countries are located in areas that are projected to suffer disproportionately from climate change, with the brunt of the impact falling on residents who already have a lower quality of life.7

The confluence of these elements—weak governance, environmental stress and social strain—results in heightened vulnerability to environmental and social shocks, as such events are more likely to trigger a negative cascade of effects. For example, in the case of a water crisis, if the state is unable to provide adequate resources to its people due to governance failings, its credibility is undermined and its social compact is frayed. This can result in political instability and conflict, particularly if water access is allocated in an unequitable fashion. This instability then further reduces the ability of the state to manage not only the present crisis, but also subsequent financial, environmental and social challenges.

Our ESG analysis focuses on differentiated environmental and social elements that we believe can influence the evolution of the economy.

Sovereign analysts have traditionally considered the role of natural resources in a sovereign’s economy and human capital factors such as level of education and income. Western Asset’s ESG framework goes beyond this, adding environmental and social factors that we believe have direct connections to economic outcomes, as broadly outlined in Exhibit 1. These factors are particularly key when analyzing developing countries, given their nascent fiscal capacity and the many challenges they face across the ESG spectrum. We believe that a country with a proactive and thoughtful approach to managing its ESG risks is much more likely to achieve its economic goals.

Environmental and Social Factors in Western Asset’s Sovereign Analysis

In the environmental category, we consider four elements: water access and management, food security and management, energy access and management, and environmental policies and emissions. We note that these four elements are interrelated; energy and water are requisite inputs into food production, water infrastructure and delivery requires energy, and climate affects the needs and ability of a country to access food, water and energy. Access to water, food and energy are relevant to our analysis because they are not only determinants of public health, but also enable economic growth and productivity. We also consider environmental issues given that climate-related events can challenge and set back development, and structural climate factors can expose countries to risk over time.

In the social category, we consider demographic factors and trends, perceptions of equity, group cohesion, and labor market capacity and structure, including the balance of opportunities across genders and the dynamics created by ethnic divisions. These factors can impact the country’s ability to utilize its human resources and the effectiveness of the state to affect change and facilitate growth.

To maintain a sustainable path of economic growth, developing countries should develop and implement policies to address their environmental and social challenges, which will require global support and financing.

While environmental and social risks are inherent to developing economies, they can be mitigated. Countries can reduce the risk of a destabilizing environmental shock by building infrastructure to advance the living standards of the most vulnerable segments of the population. Social risks can be reduced by investing in the education and well-being of lower-income residents and diversifying employment opportunities within the economy. Ongoing climate risks can be addressed through adaptation policies, emissions reduction strategies and investments in energy-efficient technologies.

These changes must be made mainstream to maximize their effectiveness. In our view, this entails raising awareness and building capacity not just at the sovereign level, but also at the municipal level where institutions can facilitate significant impact. External financing will play a key role in moving these initiatives forward.

Climate change and public health have no boundaries in today’s interconnected world, and strategies to address these issues are most powerful when employed across regions and institutions, rather than in isolation. As providers of external capital and participants in this process, Western Asset seeks to engage sovereigns on the full spectrum of ESG issues. In so doing, we seek to identify improving governance contexts, to allocate toward sustainable policies, and to serve as a stable and constructive partner to borrowing countries as they pursue their individual and distinct paths toward economic development.

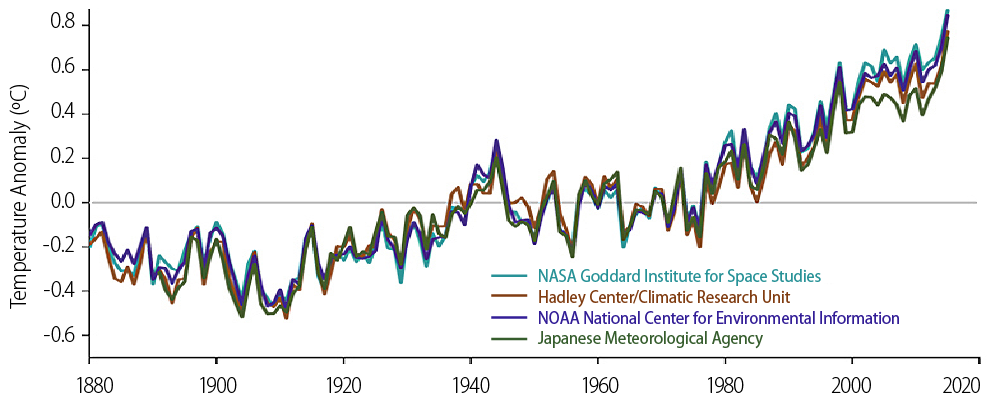

Earth’s Climate Is Warming—A Scientific Consensus

Endnotes

- Guidance for Supporting State-Building in Fragile and Conflict-Affected States: A Tool-Kit, The World Bank Group, http://siteresources.worldbank.org/PUBLICSECTORANDGOVERNANCE/Resources/285741-1343934891414/8787489-1347032641376/SBATGuidance.pdf.

- Facts + Statistics: Global Catastrophes, Insurance Information Institute, https://www.iii.org/fact-statistic/facts-statistics-global-catastrophes.

- Emerging Markets Symposium 2017: Environmental Health in Emerging Markets, 6 July 2017, https://ems.gtc.ox.ac.uk/content/health-and-environment-emerging-markets.

- Scientific Consensus: Earth’s Climate Is Warming, National Aeronautics and Space Administration (NASA), https://climate.nasa.gov/scientific-consensus/.

- IPCC’s 5th Assessment Report, https://www.ipcc.ch/report/ar5/.

- Climate Impacts on Agriculture and Food Supply, United States Environmental Protection Agency, https://19january2017snapshot.epa.gov/climate-impacts/climate-impacts-agriculture-and-food-supply_.html.

- South Asia’s Hotspots: Impacts of Temperature and Precipitation Changes on Living Standards. South Asia Development Matters, 2018, Mani, Muthukumara; Bandyopadhyay, Sushenjit; Chonabayashi, Shun; Markandya, Anil; Mosier, Thomas, World Bank. https://openknowledge.worldbank.org/handle/10986/28723.