KEY TAKEAWAYS

- The reopening of economies, supported by the announcements of multiple promising COVID-19 vaccines, should be a positive catalyst for sectors such as mortgage and consumer credit, which have lagged other credit sectors in the rebound since March.

- Sentiment toward the asset class was severely impacted by the Covid pandemic; an absence of policy support for the sector relative to other credit sectors contributed to its relative underperformance.

- The combination of better-than-expected fundamentals with extremely depressed valuations suggests significant potential for the asset class to generate strong performance on the back of an improved outlook, particularly given the good news regarding potential vaccines.

- In the residential sector, housing market data has recovered more strongly than expected. By many metrics housing has already experienced a V-shaped recovery, but spreads have lagged due to continued uncertainty and less direct Fed intervention.

- While the commercial sector remains behind other sectors in terms of recovery, and concerns persist over certain subsectors (such as retail and hospitality), momentum is building.

An Uncertain Outlook and Lack of Direct Policy Support Weighed on the Structured Credit Sector

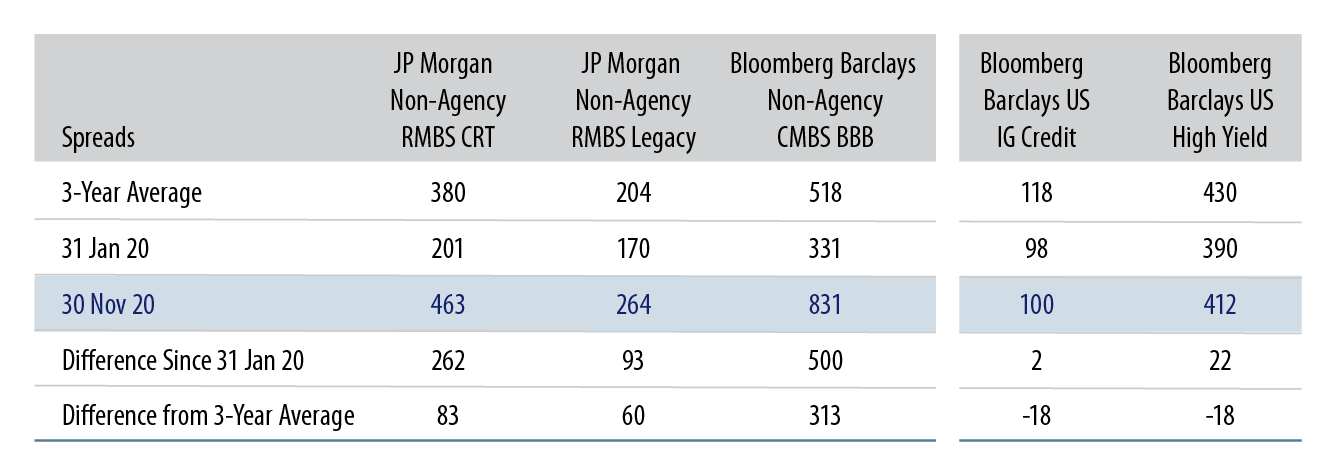

The COVID-19 pandemic fears caused widespread selling of mortgage-backed securities (MBS) and resulted in a severe dislocation between fundamentals and valuations. While spreads remain at wide levels, consumer and US housing fundamentals are strong. From a technical standpoint, mortgage credit (both residential and commercial) has lagged corporate credit in the post-Covid recovery as there has not been explicit policy support from the Federal Reserve (Fed) for much of the structured credit asset class. In corporate credit, the Fed’s purchase programs included significant support for investment-grade-rated securities (down to BBB rated securities) and even “fallen angel” credits in the high-yield segment. Within mortgage and consumer credit markets, only AAA rated conduit commercial MBS (CMBS) and new-issue AAA rated ABS have been supported by the Fed, which has resulted in a more marked compression of spreads in these subsectors. Our team believes there are two main reasons why the strategy has underperformed. First and foremost, the lack of Fed policy support is a key driver of the underperformance we have seen more broadly in the asset class relative to other credit sectors. Additionally, uncertainty over the economic outlook, particularly concerns surrounding the duration and severity of the Covid crisis, has weighed on the market. Exhibit 1 highlights the current spreads of mortgage credit versus corporate credit, which is attractive as spreads remain elevated and provide the potential for spread tightening that should benefit the strategy’s total return.

Residential MBS Prices Fail to Reflect Strong Housing Fundamentals

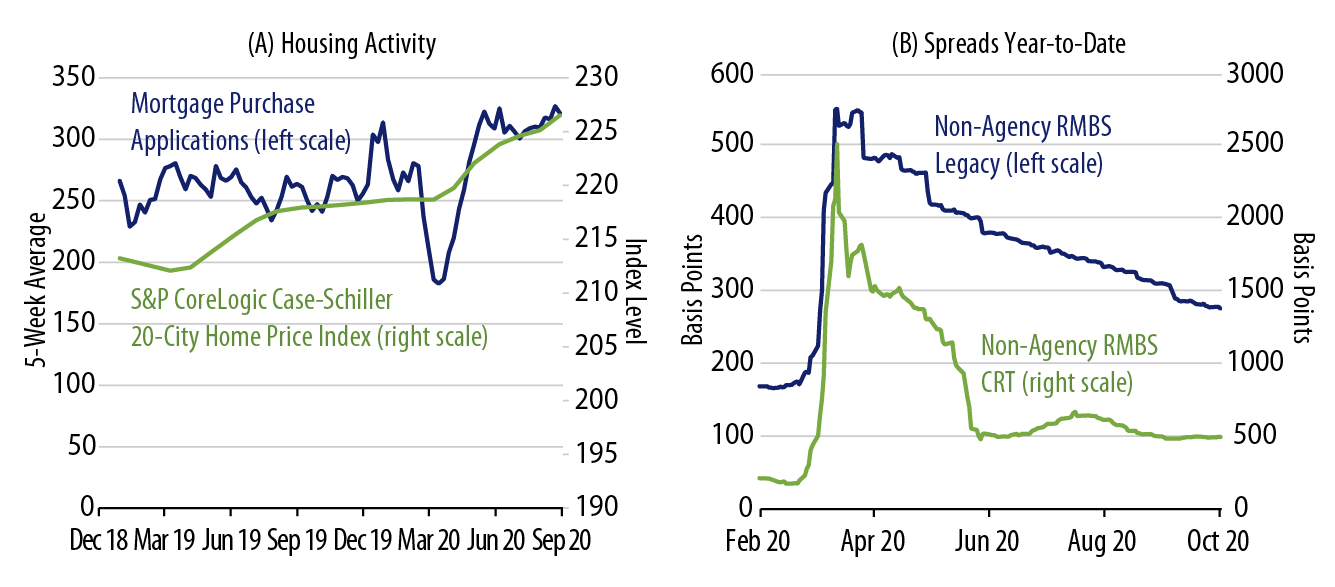

By many metrics, the US housing market has already experienced a V-shaped recovery, but improvements in spread levels have failed to fully reflect this, as highlighted in Exhibit 2. Coming into the COVID-19 crisis, aggregate US consumer fundamentals were in a strong position, with debt as a percentage of income at the lowest level in over a decade. The housing market has seen record low levels of construction, extremely tight credit standards and remains much more highly regulated than in the past. Thirty-year mortgage rates have fallen to the lowest levels in history and are resulting in increased prepayments and improved affordability. This is constructive for mortgage credit and home prices should continue to rise as a result. Mortgage purchase applications have recov- ered the decline seen earlier in the year. The spike in forbearance applications that materialized as the pandemic crisis first unfolded has since come down. Temporary suspension of foreclosures and evictions as well as generous forbearance plans have reduced distressed housing sales pressures. Within residential MBS (RMBS), the team has a focus on more seasoned borrowers with low loan-to-value (LTV) ratios, which allows these securities to withstand even a significant house price decline. However, what materialized this year was actually a continuation of modest, steady house price gains rather than the price declines that were expected.

Commercial Real Estate Is Seeing Momentum Building, Too

While the commercial sector remains further behind in terms of recovery, momentum is also building in this sector. Indeed, the recent news of successful vaccine trials, along with our team’s belief that forceful monetary policy support will continue, should help to propel a meaningful economic recovery and also help the lagging commercial real estate sectors to reopen. Going forward, the team feels that markets will extend their optimism more broadly in these areas too.

There Is a Focus on Large Loan Credit Backed by High-Quality Real Estate

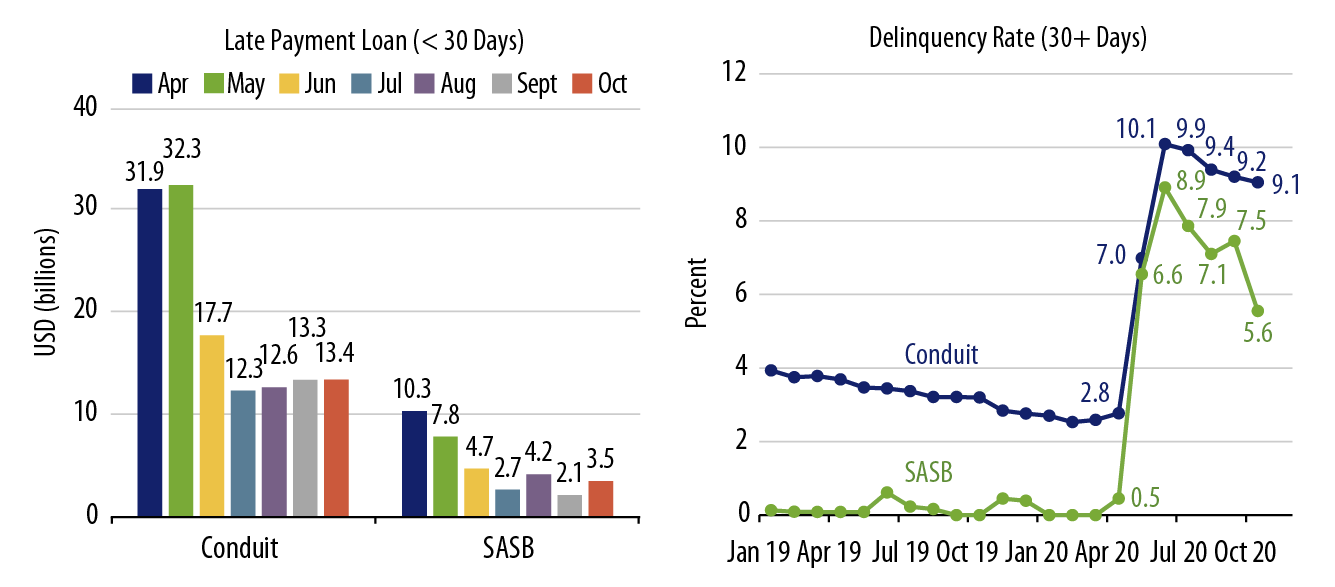

From a credit perspective, our team believes the strategy is strongly positioned with a focus on large loan credit rather than conduit securities. The structured product representative portfolio has approximately one-third of the risk in CMBS with the vast majority of that in large loan credit. Large loan credit is represented by single asset-single borrower (SASB) securities (that result from one large loan to a single borrower—it could be one property or a few properties by the same owner) rather than conduit securities (which hold a diverse set of underlying loans, diverse by region and property type). The benefit of SASB is that the quality of real estate backing these securities is higher than we see with conduit deals (they are typically class A properties) and the operational expertise of the borrower that manages the underlying properties tends to be higher.

The Western Asset Mortgage and Consumer Credit Team spends a lot of time underwriting these deals and pushing for stronger covenants and protections to safeguard investors from this kind of environment. The team continues to see value within the SASB sector that is being severely impacted by the path of the virus. This continued uncertainty is reflected in valuations that are pricing in extraordinary price declines (20%-30%) and permanent impairment in some cases, which is not the team’s base case, especially on the back of the vaccine news.

Concerns Remain Over Subsectors Such as Retail and Hospitality

The COVID-19 crisis has severely impacted the commercial real estate (CRE) market as properties have been forced to shut down, rents are down as some tenants are not paying and owners are facing liquidity challenges in servicing debt. Exhibit 3 highlights that CMBS delinquencies increased significantly following the mandatory shutdowns, ith SASB collateral performing better than conduit MBS. As the economy has been slowly reopening, we have seen improvement in property cash flows and collateral performance. The amount of SASB payments less than 30 days late has steadily decreased over the past seven months, while for conduit securities they still remain elevated.

The hardest-hit sectors have been retail and hotels. Malls have been under pressure for a number of years and the shutdown has forced certain retailers to file for bankruptcy or close stores. Within hospitality, there have been some green shoots in occupancy and revenue that have bounced off their historical lows as the economy reopens. The team is expecting that commercial sectors such as hospitality will take two to three years for cash flows to recover to pre-Covid levels, and during this period borrowers may need to work with lenders on modifications or forbearance requests. The Investment Team has been working with borrowers and servicers, and the general tone of those discussions has been constructive. The vast majority of borrowers have remained current on their loans within the portfolio. The team is not seeing a widespread inability of operators to fund their commercial operations. Almost all deals held in the portfolio have extension options so the team doesn’t see a significant potential for maturity default in the very near term.

The Improved Economic Outlook Should Provide a Boost to the Asset Class

The reopening of economies supported by the release of multiple effective Covid vaccines should be a posi- tive catalyst for sectors such as mortgage and consumer credit, which have lagged other credit sectors in the rebound since March. The combination of better-than-expected fundamentals with extremely depressed valu- ations suggests significant potential for the asset class to generate strong performance. The largest dislocated opportunities are in residential and commercial mortgage credit, which are sectors that have not received the benefit of a Fed backstop. The team believes the sector offers value backed by real assets that benefit from a rising inflation environment and can generate attractive risk-adjusted returns. The holdings in the structured product representative portfolio are secured by assets with low LTV ratios and high-quality borrowers with significant recovery value and low default risk. The team believes the total return potential and diversification benefits will provide value to investors.