KEY TAKEAWAYS

- We believe that slow and steady progress will be required to succeed in the fight against Covid-related economic challenges.

- The ramping up of fiscal spending proposals has recently turbo-charged fears of higher growth and inflation, but we believe sustainable inflation above the Fed’s 2% goal is still likely many years away.

- Our view is that the recent rate increases have overshot the underlying fundamentals.

- For those suspecting that there will be both bumps along the road and further long-term challenges, the usefulness of strategic portfolio diversification remains paramount.

The new Chinese lunar year is “the year of the Ox.” And this is appropriate for our view that the path out of the current Covid-related economic challenges will be one of steadfast but slow progress. This view, which we have characterized as a long hard slog, was perceived as very optimistic last spring when Covid uncertainty presented meaningful downside risks. With the successful introduction of vaccines, our confidence improved measurably that this long and difficult journey would be successful. And that was certainly an optimistic view relative to most market expectations. Today, though, many markets have leapt past our view, pricing in outcomes that essentially herald an all-clear. The message of “the reflation trade” is that not only that our problems will be behind us, but also that the secular journey to greater growth and prosperity is assured.

Why then, given our optimism about ultimate success, are we having trouble fully embracing this euphoric market construct? One reason is that we think the cyclical challenges of an arguably 10% unemployment rate and a virus as deadly as Covid deserve a healthy risk premium. This is despite our base case that the second half of the year should see very strong GDP prints as the world economy reopens. The more important challenge for us is the ongoing tension between cyclical and secular forces. Yes, the business cycle will show a lovely bounce. It will need to in order to get back to the pre-Covid trend growth lines. But remember, pre-Covid growth rates had failed to generate target inflation for 10 years even with exceptionally low short-term interest rates. More important is the question about this cyclical bounce: is it a one-off? How many times do you emerge from a yearlong global lockdown?

The secular challenges that have kept US and global growth to a moderate pace (at best) over the last several decades still remain in place. The stagnation of Western societies’ middle-class wages, which has undermined economic and political confidence, is unlikely to reverse. Demographic challenges remain. Global debt burdens have become spectacularly worse. The small and medium-sized business destruction not seen since the Great Depression may take years to replace.

We are optimistic regarding the battle against Covid. We are optimistic about a cyclical GDP recovery this year. But we are cautious about extrapolating those developments into a presumption of a higher secular trend rate of growth or inflation.

Treasury Market Mayhem

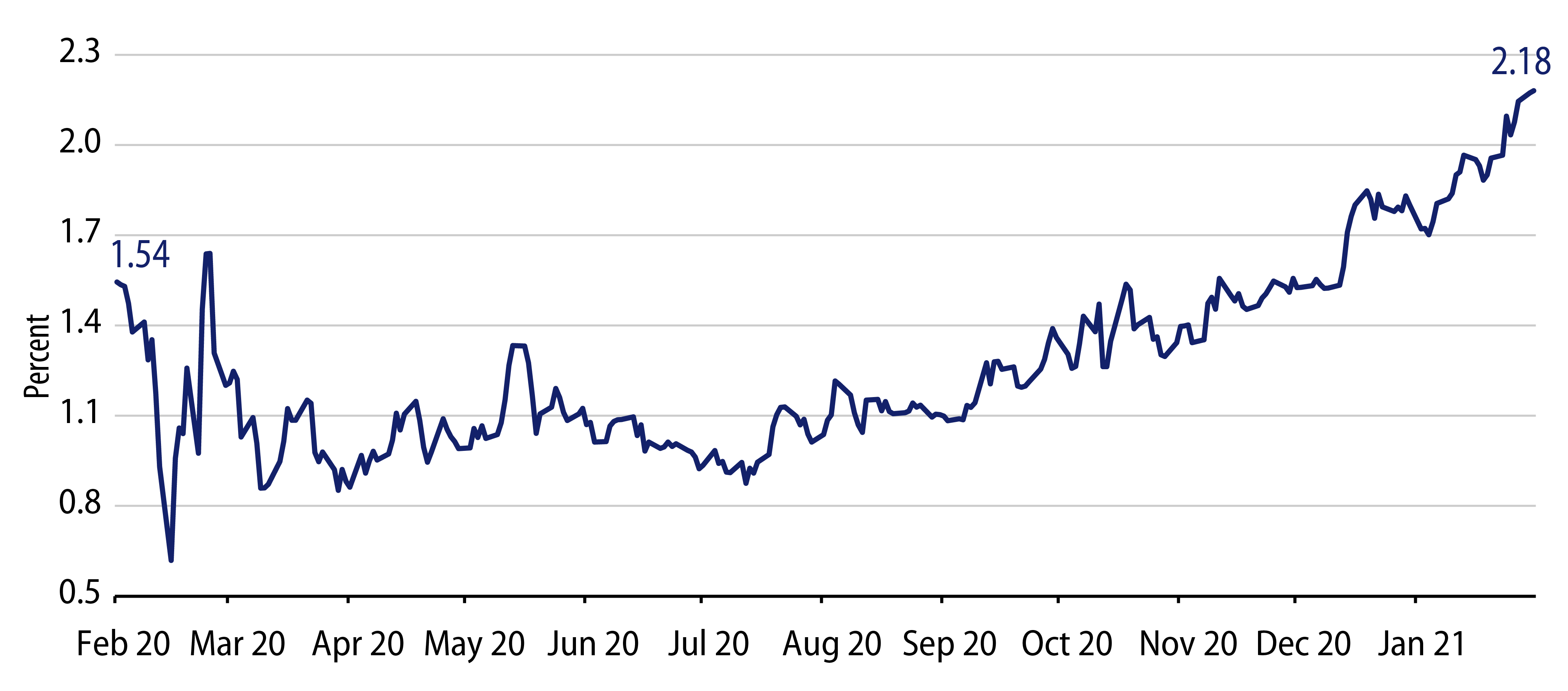

In a similar vein, the growing global enthusiasm for a pronounced pickup in growth has put acute pressure on US Treasury bonds. Our portfolio construction process leans heavily on utilizing Treasuries as a hedge against the downside risk, which can and have threatened our spread-product-heavy portfolios. A key to the efficacy of such a hedge is an understanding of the path of central bank policy, along with the long-term trend in inflation fundamentals. Presently, though, the ramping up of fiscal spending proposals has turbo-charged fears of higher growth and inflation. Treasury yields have gone well above pre-Covid levels. The yield increases have started to put pressure on other spread products as well.

We are firmly in the camp that rates have overshot the fundamentals. Cyclically, one could debate how much growth fiscal spending will generate. In terms of lifting the secular growth or inflation rate, the evidence in developed countries over the last several decades has actually suggested the opposite result.

Our approach to Treasury valuation has always been framed by long-term growth and inflation trends. The challenge of regaining, let alone exceeding, our previous secular growth rate is a very high hurdle. We find ourselves in accord with the Federal Reserve (Fed), which continues to insist that while achievable, generating trend inflation on a sustained basis is many years away. Indeed, Fed Vice Chair Richard Clarida has importantly noted that this goal is an “aspiration.”

On a forward basis, Treasury bonds are already higher in yield than they were at the beginning of last year before the pandemic caused the Fed to cut short rates by 150 basis points.

This return to an even higher interest rate structure presents a straightforward illustration of the difficulty in contrasting cyclical improvement with secular extrapolation. The current forward five-year interest rate implies the Fed will have hiked rates above its 2019 starting level. But will the Fed actually proceed with a serious tightening program in a few years’ time? Fed officials are currently very explicit that this is not in the cards. Could they be so wrong that full employment and sustained above-trend inflation are both firmly in place? And with debt loads at very challenging levels, after this round of rate increases expected by the market, should we then presume a stronger long-term level of secular growth?

This is the current tension. The cyclical outlook is good, and improving. The secular growth and inflation headwinds remain firmly in place. Should a portfolio that is overweight spread product designed for a meaningful global recovery go short Treasury duration as well? If one has complete confidence in the reflation trade, then perhaps. For those with a less clear crystal ball or those suspecting that there will be both bumps along the road and further long-term challenges, the usefulness of strategic portfolio diversification remains paramount.