Municipal Returns Turn Positive for the Week

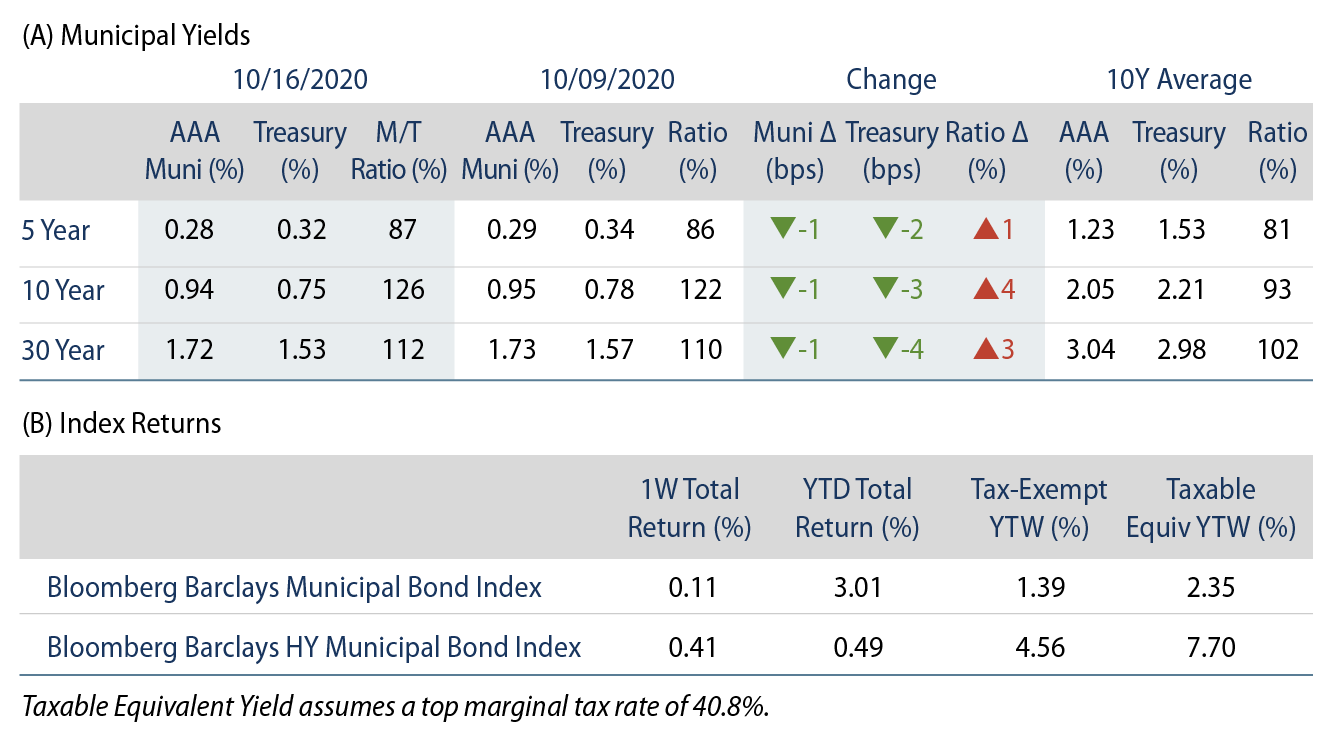

Municipals posted positive returns as yields trailed Treasuries lower. AAA municipal yields declined 1 bp across the curve, trailing Treasuries. The Bloomberg Barclays Municipal Index returned 0.11%, while the HY Muni Index returned 0.41%. This week we evaluate recent post-Covid state tax revenue data.

Municipal Mutual Fund Inflows Turn Positive

Fund Flows: During the week ending October 14, municipal mutual funds recorded $614 million of net inflows, according to Lipper. Long-term funds recorded $171 million of inflows, intermediate funds recorded $14 million of inflows and high-yield funds recorded $84 million of outflows. Municipal mutual fund net inflows YTD total $24.4 billion.

Supply: The muni market recorded $18.3 billion of new-issue volume last week, up 14% from the prior week and marking the largest week of new issuance this year. Issuance of $381 billion YTD is more than 30% above last year’s pace. Taxable municipal issuance remains over three times higher year-over-year (YoY) while tax-exempt issuance is 4.0% higher YoY. We anticipate another heavy week of issuance this week, with approximately $21 billion of scheduled new-issue volume, which is nearly a record for weekly issuance. The largest deals include $2.0 billion taxable Sutter Health and $1.5 billion Alabama Public School and College Authority transactions.

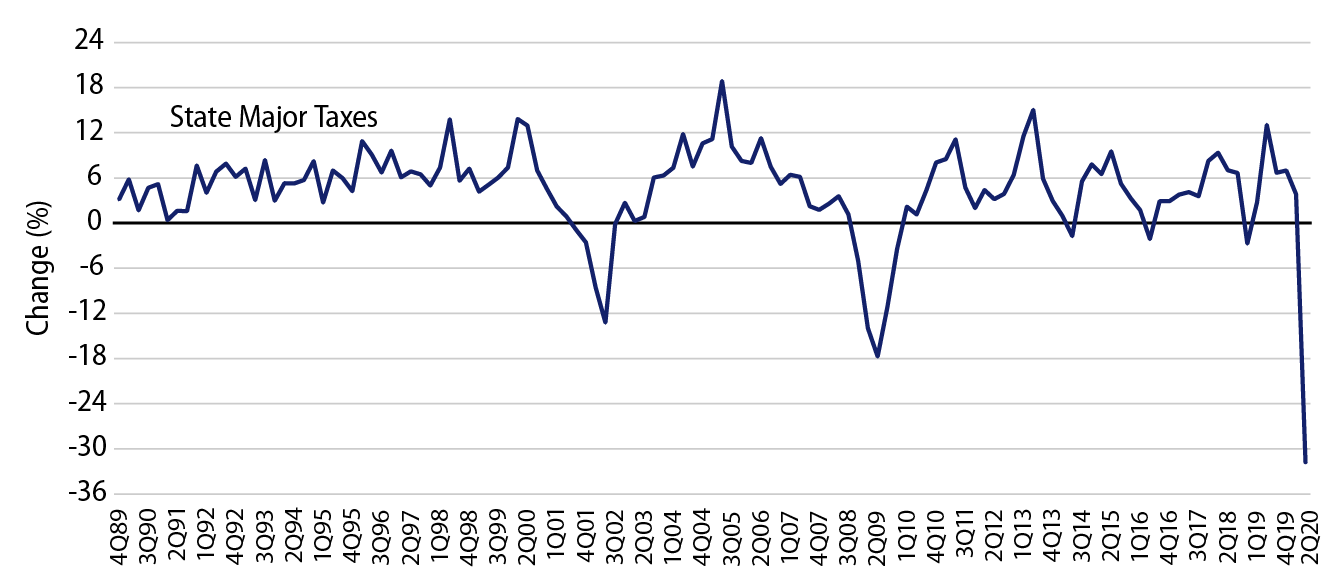

This Week in Munis: State Revenues Sink

State revenue impacts of the pandemic were not realized until 2Q20, coinciding with the last quarter of the fiscal year for the majority of states. In aggregate, income and sales tax collections declined 41% and 17% in 2Q20 vs. 2Q19, respectively, according to US Census data. Despite that this is a dramatic drop, overall tax collections fell only 5.5% in FY2020 as more robust collections in the first three quarters of the year helped absorb later declines, which should be further supported by the inclusion of the delayed tax filing day in 3Q20 data.

While current revenue challenges might appear better than expected given the scope of the shutdowns, state budget gaps remain a significant issue. All but two states are projecting significant increases in Covid-related revenue losses for FY2021 when compared to FY2020, according to a report released this month by the Center on Budget and Policy Priorities (CBPP). Revised FY2020 declines total $44 billion, but are projected to jump to $127 billion in 2021. In addition, more states have revised their revenue expectations lower rather than higher for both fiscal years 2020 and 2021. Massachusetts anticipates the largest negative change in tax revenues and Illinois expects the most improvement in revenue in 2021.

As the economy recovers, employment has ticked up, which improves the outlook for personal income tax collections. Still, we expect high-beta states that are more dependent on volatile taxes to continue to be most susceptible to revenue stress. Strong reserves along with executive budgeting powers will be supportive of most states as they grapple with lower revenues. Overarching all of this, of course, is the continued spread of COVID-19 with new cases continuing to hover around peak levels. Reverting to mandatory business closures could exacerbate state budget gaps and will need to be monitored carefully, particularly in the extended absence of federal aid to state and local governments. Absent federal aid, as budget gaps extend, we are increasingly cautious on the general obligation sector, along with downstream entities that are reliant on state aid which are vulnerable to extended austerity measures that will result from these shortfalls.