Municipals Posted Negative Returns as Yields Moved Higher With Treasuries

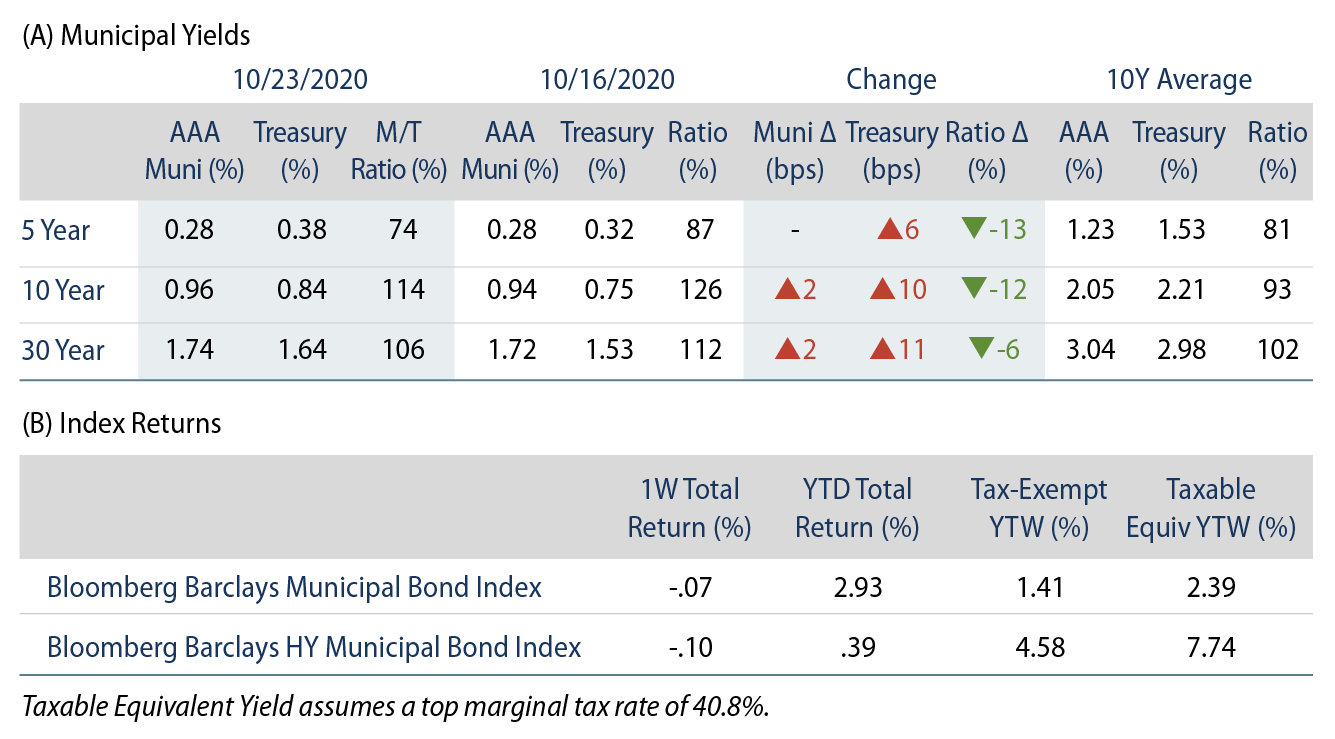

Municipal yields moved higher as Treasuries retreated. AAA municipal yields increased 2 bps across intermediate and long maturities, trailing Treasuries higher. The Bloomberg Barclays Municipal Index returned -0.07%, while the HY Muni Index returned -0.10%. This week we take a look at Illinois in light of its $850 million transaction.

Municipal Mutual Fund Inflows Continue Amid Near-Record Issuance

Fund Flows: During the week ending October 21, municipal mutual funds recorded a third consecutive week of net inflows of $604 million, according to Lipper. Long-term funds recorded $97 million of outflows, intermediate funds recorded $61 million of inflows and high-yield funds recorded $21 million of inflows. Municipal mutual fund net inflows YTD total $25 billion.

Supply: The muni market recorded $19.5 billion of new-issue volume last week, up 4% from the prior week and marking the highest level of new issuance since 2017. Issuance of $397 billion YTD remains over 30% above last year’s pace, driven by taxable issuance which is over 3x last year’s level. We anticipate another elevated week of issuance this week, with approximately $16 billion of scheduled new-issue volume. The largest deals include $1.8 billion Los Angeles Community College District and $1.1 billion Los Angeles Unified School District transactions.

This Week in Munis: Illinois Accesses Market

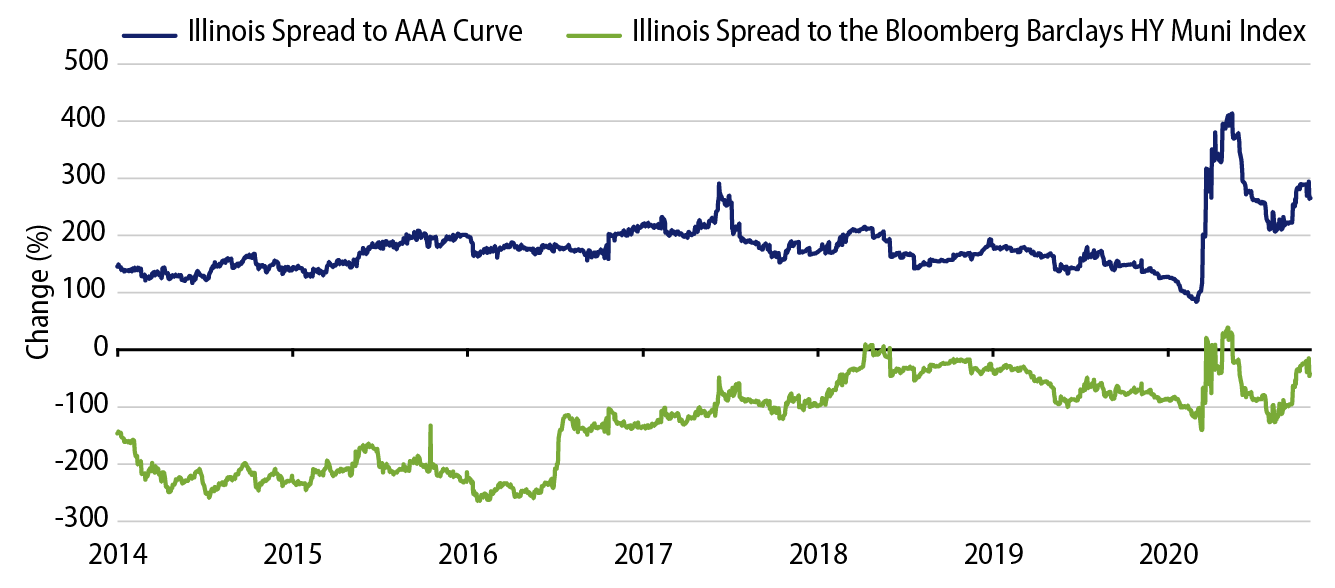

Last week the State of Illinois (rated Baa3/BBB-/BBB- by Moody’s, S&P and Fitch) priced $850 million of general obligation bonds across tax-exempt and taxable transactions in its first transaction since accessing the Fed’s municipal liquidity facility. Tax-exempts priced at 4.40% in 2045, while taxables priced at 3.24% in 2025.

Illinois has well-documented structural budgetary and pension issues that will undoubtedly be further stressed by the current pandemic. Earlier in the year, the state projected a budgetary shortfall of $6.2 billion, over $134 billion of pension liabilities and an unpaid bill backlog exceeding $6.4 billion. The fiscal 2021 budget balance depends on a revision to the tax code that would introduce a progressive tax structure, already passed by the legislature and awaiting constitutional ratification. The budget also depends on $5 billion of federal funds, either from direct stimulus or borrowing through the Fed’s municipal liquidity facility.

The state forecasts base revenues to decline 6%, or $2.4 billion, from 2019. However, monthly comptroller reports suggest tax collections are exceeding this pace, despite the current conditions.

Western Asset has long viewed revenue-backed bonds favorably over general obligation securities, as we believe the former can help investors benefit on a risk-adjusted basis. The COVID-19 pandemic has contributed to spread-widening in the Illinois debt complex, which—considering potential better-than-anticipated revenue collections—could adequately compensate investors for outstanding risks. While we believe the state has the ability to manage through its challenges, it is not likely to be a smooth road due to the political climate. A progressive tax structure for the state is a sound first step to address these challenges and improve the state’s credit profile.