We argue here that the Federal Reserve (Fed) and federal government (feds) have already done as much as they can do to assuage the effects of the COVID-19 economic shutdown. Any monetary element to the COVID-19 crisis has disappeared in the last eight weeks, removing the need for further Fed action. Meanwhile, transfer payments by the feds to individual Americans in March and April alone were sufficient to offset four months’ worth of personal income losses from the shutdown. It is hard to see how further assistance from the “50,000 foot” level of Washington, DC is either necessary or likely to help.

Actions by the Federal Government

We are not saying that no one any longer is suffering economically from the pandemic-related shutdown. Rather, government support already in place is sufficient to assuage the widespread, macro losses families have suffered. The economic suffering remaining is on an individual, micro level, felt by folks who have slipped through the cracks of various government relief programs. More macro programs are not going to help these people. They are better served by either a rebound in the economy or else the “micro” kinds of support that local church and charitable groups are better-suited to provide.

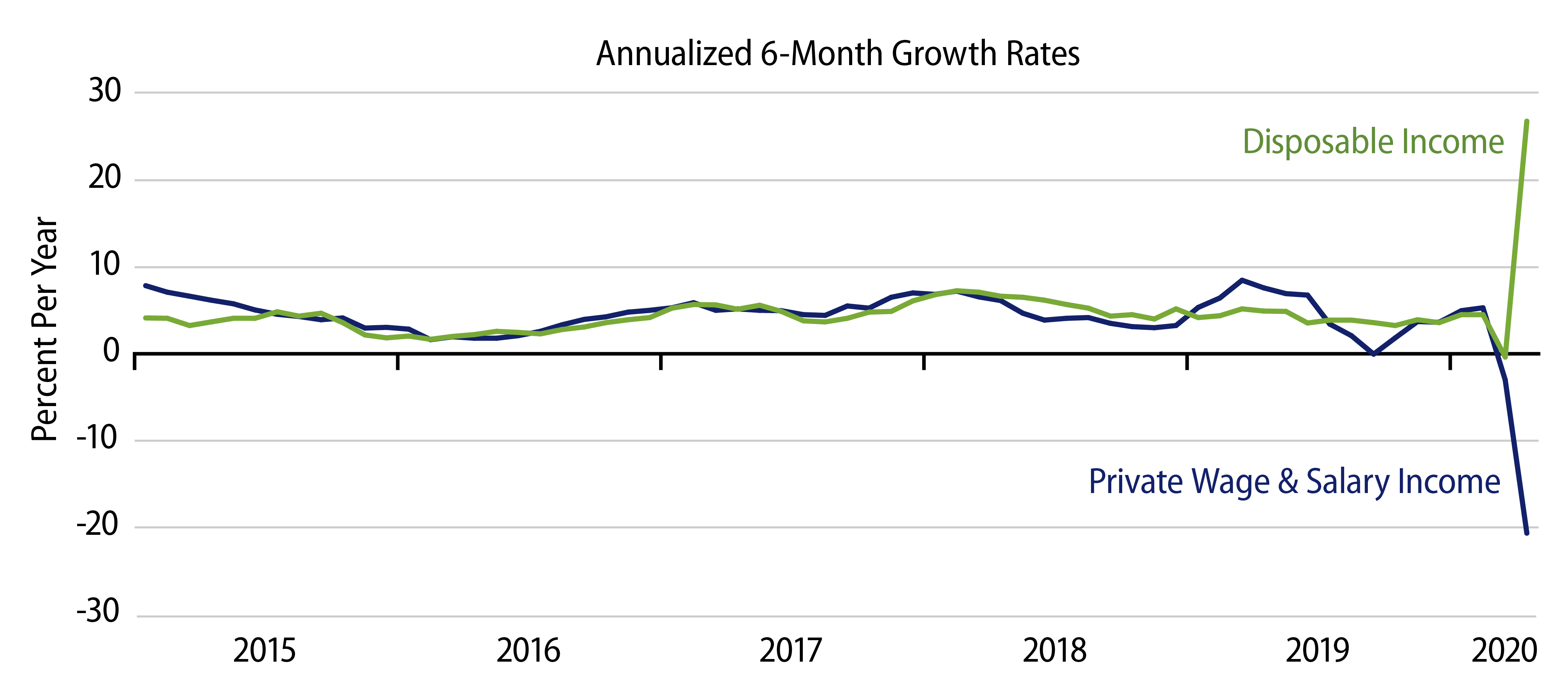

With respect to the “fiscal” issues concerning the feds' non-monetary issues, the case is made by the following chart. Despite the horrific job losses in March and April, and consequent declines in wage income, government relief has already offset those income losses many times over. That is, in March and April, wage income dropped by $332 billion and $740 billion, respectively1. On the other side of the ledger, income from transfer payments (i.e., Social Security checks, welfare checks, unemployment checks, stimulus checks) in March and April rose by $71 billion and $2,999 billion, respectively. Yes, in April, aid from the government was four times larger than wage income losses from the shutdown.

Netting the two effects together, total personal income rose in April by 10.5%, and disposable income rose by 12.9%, despite the staggering losses in jobs and an 8.0% decline in wage income. In the chart, you can see wage income plunging, but disposable income soaring. Remember, these two swings are not offsetting. The wage income plunge is included within the disposable income surge.

Meanwhile, with most stores shut down and depleted shelf stocks for those open, consumption dropped by $1,032 billion in March and by $1,914 billion in April. Personal saving rose by $4,758 billion in March and April combined, with April’s saving rates at an unthinkable 33%.

Survey data show that individuals are using most of their stimulus checks to pay bills, and the media has largely taken this as an indication of the economic need of families. Just as surely, however, it reflects the limited availability of goods to buy and the limited ability of families to get to the stores.

Government policy works in broad brush strokes. With policy already papering over four months of full shutdown losses to families, what more could it or should it do? Further action would be appropriate only if the shutdown were expected to continue into August. And even if the shutdown were to continue or resume, consumers would remain hampered in their ability to spend that largesse anyway. Again, some families are surely falling through the cracks of efforts to date, but there is no reason to think that another round of aid would somehow catch them.

Then There’s The Fed

Of course, the king of broad-brush policies is Fed policy. Monetary policy is the proverbial tide that can lift all boats—if indeed it is lifting and if the boats need lifting. If a boat is chained too tightly to an anchor, a rising tide will risk capsizing it. To transcribe this metaphor, if monetary policy is used to address non-monetary shocks, things can end badly.

Monetary policy is not an effective way of dealing with a labor strike or problems related to a specific industry or a natural disaster. This shutdown is comparable to a natural disaster, except that it was imposed by government, not by nature. (Sure, it was the government’s response to nature, but still government.)

Ten week ago, credit markets had become dysfunctional. That was a monetary problem, and we believe it was appropriate then for the Fed to announce programs to intervene directly into credit markets by buying corporate bonds and lending directly to businesses. However, that announced intention of March 23 was actually not implemented until May 20. By then, dysfunction in credit markets had disappeared.

Sure, credit spreads are still quite elevated, but that is only consistent with the still-depressed state of the economy. Credit spreads appear to be overstating default risks, but trading is occurring in an orderly manner, and bid/ask spreads, while elevated, are not crazy. Credit looks to be an attractive investment, but that doesn’t imply mispricing on a scale sufficient to justify Fed intervention.

It could well be that current market conditions would not have been attained without the calming effects of the Fed’s announced intention in March. In that case, yes, the Fed had to “show the flag” and conduct some actual corporate bond purchases operations to give credence to its March statement. That has been done. With respect to credit market function, we believe the Fed should declare victory and leave its corporate credit facility open but inactive.

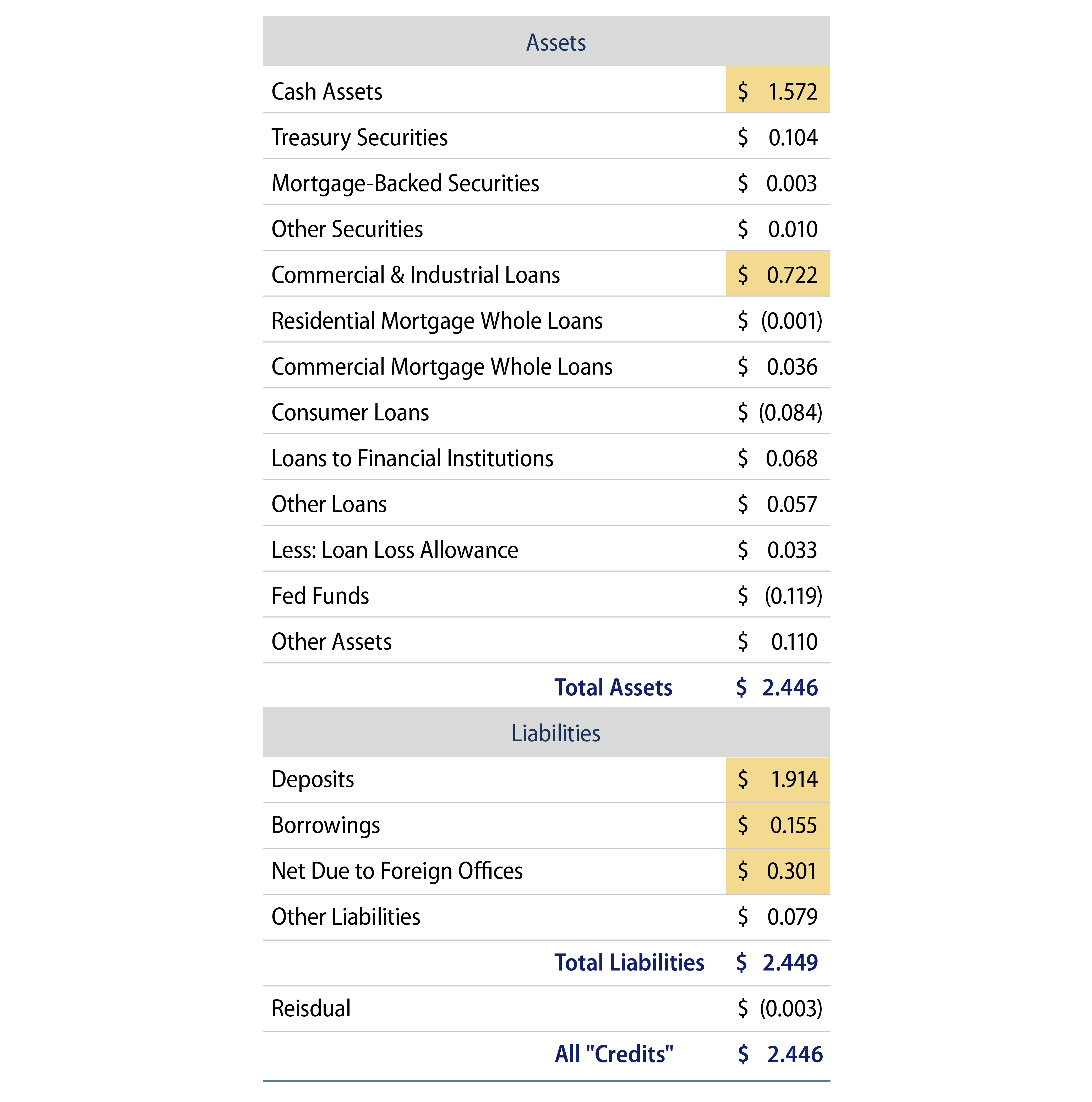

As for the rest of the panoply of recent Fed actions, the vast bulk of it has been of the traditional variety, hardly suited to address the special conditions of the current, government-mandated recession. From 2/26 through 5/27, the Fed had injected $2.9 trillion of new liquidity into the economy. At least $2.7 trillion of that was through purchases of Treasury securities and agency mortgages and liquidity swaps with foreign central banks. Less than $0.1 trillion were through the newly opened special credit facitilities.

Of the $2.9 trillion of liquidity injected, $1.1 trillion went to increased cash holdings of the Treasury and foreign official institutions, and $1.6 trillion went to increased bank reserves. Banks used almost all those funds to boost their own (already ample) cash assets. Thanks to a (temporary?) suspension of capital requirement on them, banks have boosted business loans by $0.7 trillion. Notice, though, in Exhibit 2, that mortgage and consumer loans have grown a big zero during the Fed’s injection.

Overall, it looks as though the Fed’s rising tide is not lifting any boats with a person’s name plastered on the back rather than a business. So, claims that the Fed is engaging in “Modern Monetary Theory,” direct transmission of funds to individuals, are off the mark. Then again, individuals have received ample aid from the federal government.

Banks and corporations are using these funds provided to prevent “sinking,” not to expand spending. Thus, we doubt that the Fed’s action to date will prove inflationary.

Still, the question arises as to what there is left to be done. With credit markets no longer dysfunctional and with the economy suffering a government-mandated shutdown, not a slump engendered by inadequate liquidity or final demand, what monetary factors within the current milieu are there left that would provide appropriate targets for further Fed action?

The Bottom Line

Further action by the Fed or feds will likely be of no value. While further action may not hurt things in the short run, it does leave a bigger mess to clean up later. A wiser Fed Chair might just declare victory and let events take their course. Ditto for Congress. We’ll see whether anyone in DC has the political courage to take this tack.

1All dollar numbers given here are stated on an annualized basis. This is how BEA reports them, and so that makes it easier for you to check my arithmetic via government releases. While using annualized data overstates actual dollar flows by a factor of 12, we do so on both the shutdown hits and the government offsets, so the relative comparison of the two is still valid.