KEY TAKEAWAYS

- This Western Asset paper is an update of our original publication from February 2020.

- On September 2, 2013, the Basel Committee on Banking Supervision and the International Organization of Securities Commissions released the global framework for margin requirements for “non-cleared derivatives.”

- Initial margin (IM) requirements apply to entities if their average aggregate notional amount in OTC derivatives breach an annually decreasing threshold.

- The most broadly used OTC derivative at Western Asset is FX forwards, the most common fixed-income tool used in the marketplace to hedge currency.

- In April 2020, regulatory authorities announced a one-year delay to the final two implementation phases of UMR, respectively, due to disruptions caused by the COVID-19 pandemic.

- Western Asset continues to be an active member of various industry working groups in an effort to help influence uncleared margin regulation and understand its impact.

The financial industry continues to adapt and evolve in order to comply with new and ever-changing regulatory requirements, many of which were written in response to the great financial crisis. These requirements—led by the Dodd-Frank Act out of the US and the European Market Infrastructure Regulation (EMIR) out of Europe—continue to present challenges for brokers, banks, asset managers and their clients. One of the more challenging requirements in the last few years has been the uncleared margin rules (UMR) for derivatives that are not subject to central clearing.

On September 2, 2013, the Basel Committee on Banking Supervision (BCBS) and the International Organization of Securities Commissions (IOSCO) released the global framework for margin requirements for “non-cleared derivatives.” The requirements set forth in the UMR apply to OTC derivatives that are not cleared through a central counterparty, such as certain swaps, swaptions, non-deliverable forwards (NDFs) and OTC options. “Physically settled FX” were originally included in the European rules, but were removed as an in-scope derivative instrument. However, while physically settled FX forwards are not subject to UMR, they are taken into account when deciding whether an entity must post initial margin (IM) for other instruments. Variation margin requirements were introduced in 2016 and 2017, and have been fully implemented at Western Asset.

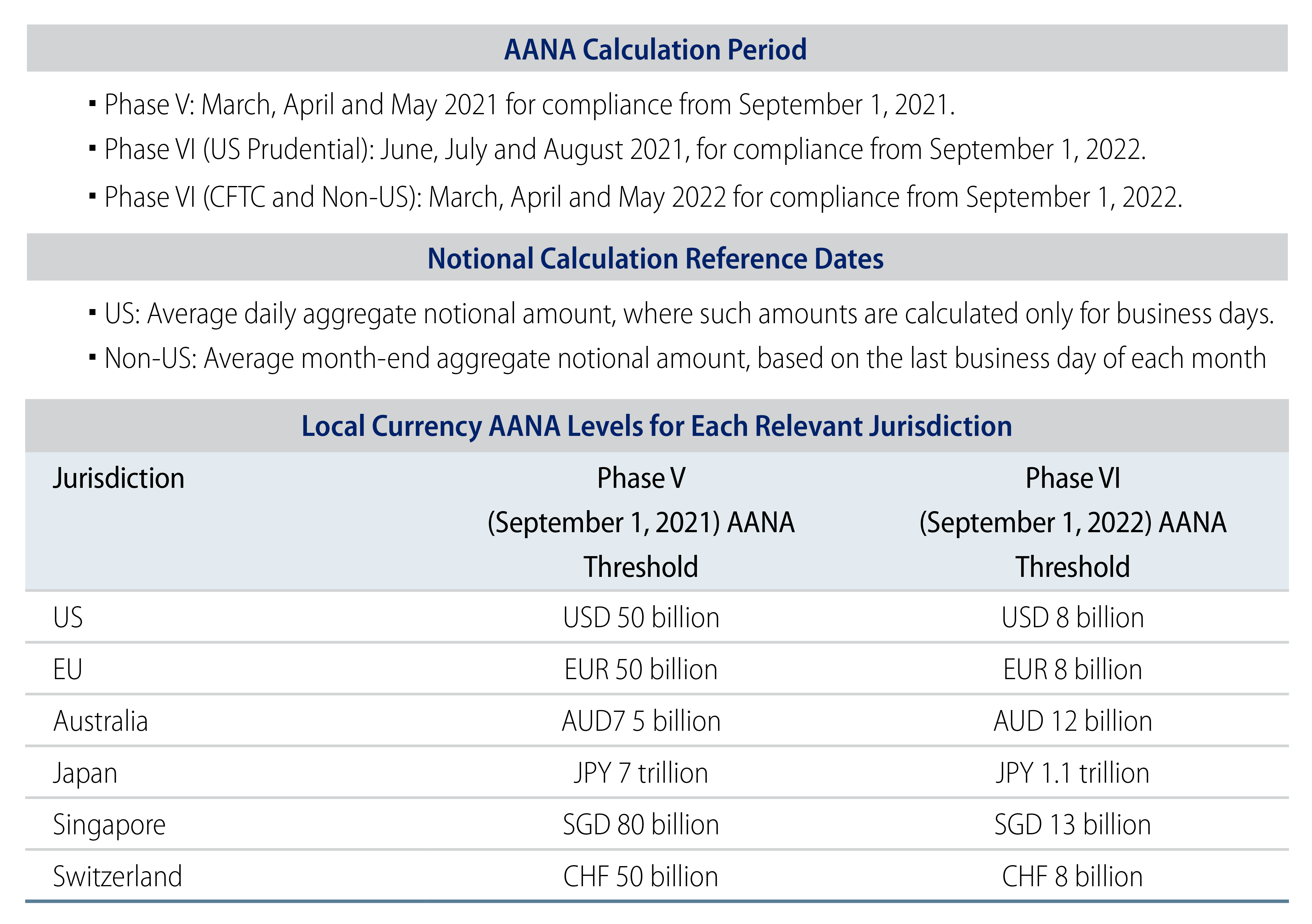

IM requirements were outlined in a phased approach. Basically, entities would be in scope for the IM requirement if their average aggregate notional amount (AANA) in OTC derivatives breached an annually decreasing threshold. AANA is calculated differently depending on a client or counterparty’s jurisdiction.

In April 2020, regulatory authorities announced a one-year delay to the final two implementation phases of UMR, respectively, due to disruptions caused by the COVID-19 pandemic. See Exhibit 1 for an updated summary of the various AANA calculation methods by jurisdiction for the upcoming phases (for most Western Asset clients, the US and/or EU rules will govern).

There is one relief from the AANA calculation. If an entity is in scope based on the AANA calculation, then documentation, custodial and operational requirements do not need to be in place unless the IM requirement with respect to any single counterparty breaches $50 million under the US rules or €50 million under EU rules. However, this requirement has the same serious challenges in that the threshold is calculated by reference to the entire legal entity (such as a pension plan) and not by individual portfolios.

Why Is This Important to Western Asset’s Clients?

As outlined in the previous section, the next observation (testing) period will be in accordance with the descriptions in Exhibit 1. For example, the Phase V observation period for CFTC-regulated entities (at the group level) will be in March, April and May of 2021. The AANA calculation will be done at the group or legal entity level (e.g., client level) and not by portfolio of an individual asset manager unless the entity’s assets are entirely at one manager. As an example, for a pension plan (i.e., legal entity) with 10 investment managers, uncleared derivatives activity (including FFX) at any of its managers could trigger a requirement for the pension plan to post and receive IM at all of the 10 portfolios. Therefore, in order to carry out accurate calculations for the observation period, let alone implement any IM arrangements, Western Asset would need AANA information from our clients that is not transparent to us today and clients would likely have to get involved in setting up margin arrangements that we discuss in the following section.

An additional challenge is that posted collateral for IM must be held in a segregated account. Currently, two forms of custodial arrangements are available: (1) third-party arrangement or (2) tri-party arrangement. Third-party accounts are segregated accounts that are set up under a trilateral control agreement, and are generally opened at the same custodian as the underlying clients’ investment account. Any movements are then agreed upon with the counterparty, and instructed accordingly by the appointed asset manager. Alternatively, a tri-party arrangement outsources the monitoring and posting of activities to a centralized independent agent. These requirements demand rather onerous administrative arrangements and are especially challenging for clients whose portfolios are managed by more than one manager. This option can also be quite costly.

Why Are Non-Centrally Cleared OTC Derivatives Important?

It is important to note that non-centrally cleared OTC derivatives can have certain advantages over exchange-traded and centrally cleared derivatives. Some derivative types are only available to be traded as non-centrally cleared OTC. In other cases, exchange-traded equivalents are less liquid or less cost-effective in gaining or hedging certain market exposures. Further, OTC derivatives offer investors more flexibility in structure because, unlike the standardized cleared products, they can be tailored or customized to fit specific needs or investment goals. In order to best meet a client’s investment objectives, Western Asset would like to preserve the ability to continue trading these types of OTC derivatives when possible.

The most broadly used OTC derivative at Western Asset is FX forwards, the most common fixed-income tool used in the marketplace to hedge currency. Although they are exempt from posting IM, they do count toward a client’s total notional amount. While non-centrally cleared OTC derivatives have compelling investment merits, Western Asset fully understands that the complexity of establishing a UMR program for non-centrally cleared OTC derivatives may make it simply not feasible.

What Are the Potential Solutions for Western Asset’s Clients That Will Be in Scope for UMR and Want to Continue Using Non-Centrally Cleared OTC Derivatives?

- Discuss collateral management options with Western Asset under the third-party model.

- Engage a tri-party service provider.

- Understand and prepare to negotiate the required documentation for your chosen collateral arrangements.

- Western Asset will be able to monitor and manage all collateral needs for its commingled funds. A client could choose to move into a commingled option if it’s available in the client’s strategy.

- Establish a cap or quota for each of the client’s investment managers on OTC notional derivative exposure.

- Diversify and limit the brokers with whom each manager can trade OTC derivatives.

- This decision may impact performance expectations or make the product more difficult to manage depending on the strategy. The ease and impact of this step will vary considerably by product.

How Is Western Asset Addressing the UMR Issue?

Western Asset continues to be an active member of various industry working groups in order to help influence uncleared margin regulation and understand its impact. We are also preparing to support the new IM requirements through the following initiatives:

- Forging a partnership with an ISDA-approved SIMM (standard IM model) vendor,

- Exploring tri-party models and engaging with providers,

- Increasing collateral management automation through our existing relationships with Cloudmargin and Acadiasoft Marginsphere.

Additionally, one of the original objectives of the regulations for UMR was to push financial entities to clear OTC derivatives. Western Asset has been a big advocate of clearing OTC derivatives; however, challenges remain within the industry where clearing in certain asset classes isn’t yet mature enough, or even offered by the central clearing counterparties (CCPs).

What’s the Next Step?

Given the potential significant administrative challenges of managing IM requirements, if you believe that the account(s) we manage on your behalf may be in scope, or if you have any questions regarding the uncleared margin regulations, please reach out to your Western Asset Client Service representative.