KEY TAKEAWAYS

- Western Asset believes a holistic perspective is invaluable to help frame the risks associated with this rapidly developing situation.

- While we remain optimistic that global growth will remain on a positive trajectory, we acknowledge the possibility that a further escalation of trade tensions could have deeper consequences for the global economy and financial markets.

- A full-blown trade war with China would raise the risk of a US recession; while such a full-blown trade war is still highly unlikely, we do not rule it out entirely.

- While foreign trade is important, it is not a life-and-death aspect of the current US economy, as it would take near-complete disruption of trade flows to threaten recession in the US.

- The initial round of tariffs will likely raise consumer prices. However, its effects are unlikely to be persistent and will likely have almost no impact on Fed policy or long-term inflation.

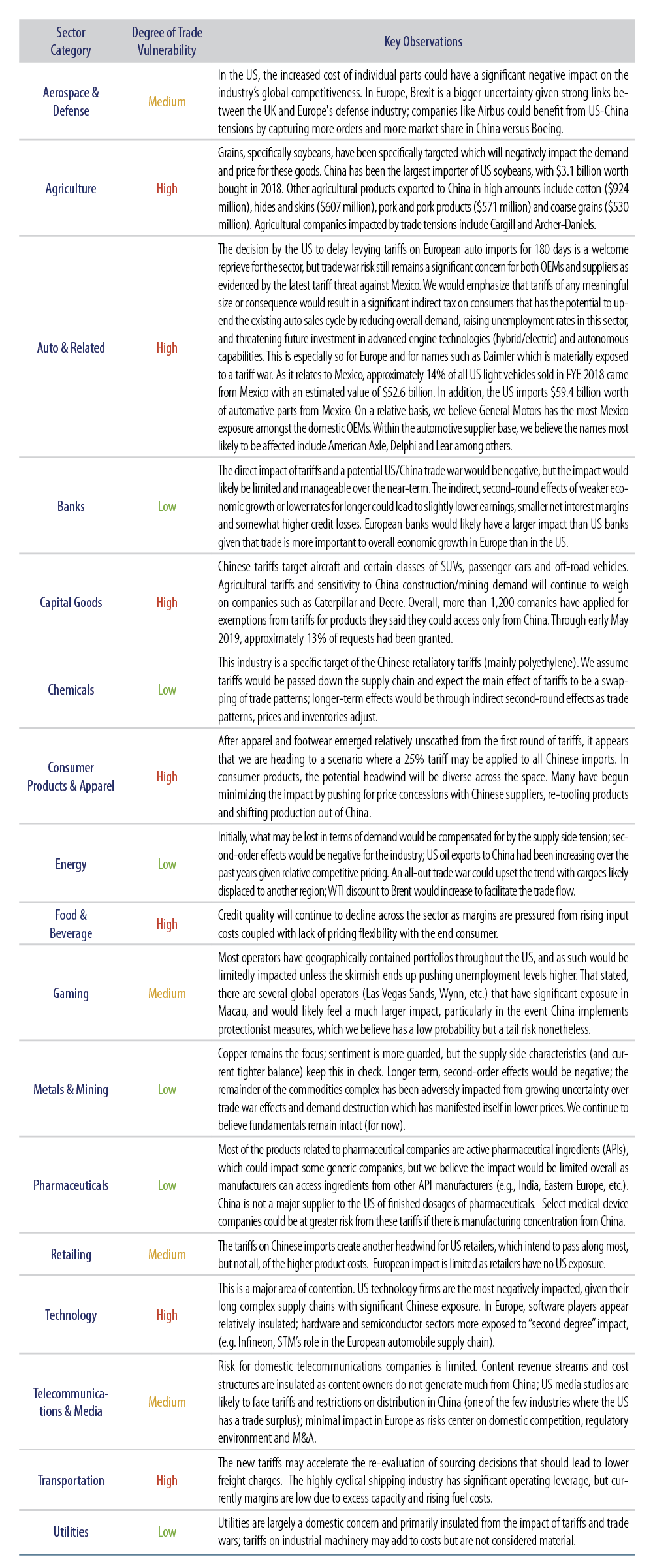

- Since our last report, the list of sectors with a “high” risk rating has expanded to include capital goods and consumer products.

- In this fragile environment, our sector teams globally remain vigilant in monitoring industry developments, revenue and margin trends, management sentiment, and valuations, then position their investments accordingly.

The View From Above

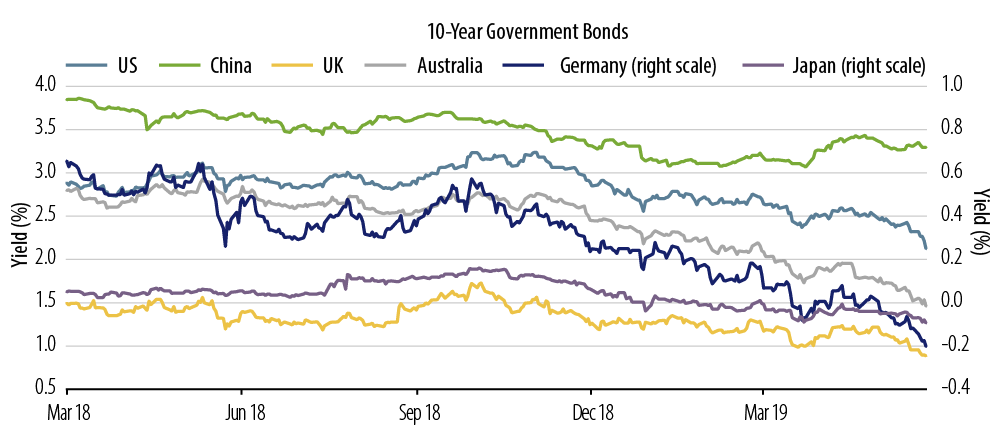

In our 2Q19 Global Outlook, we noted that ongoing trade disputes and a slowdown in China throughout 2018 had conspired to markedly slow global trade activity and materially impact global manufacturing activity, most notably in the eurozone. Global growth concerns have only intensified since then as an initial trade spat between the US and China on technological infringements and industrial policies has now morphed into a broader conflict with the risk of expanding on new fronts (e.g., Europe on agricultural policy and defense spending, and Mexico on immigration). This has resulted in a stronger US dollar, a spike in equity market volatility, wider credit spreads and a sustained decline in global bond yields year to date (Exhibit 1). While we remain optimistic that global growth will remain on a positive trajectory, we acknowledge the possibility that a further escalation of trade tensions (e.g., countermeasures from China) could have deeper consequences for the global economy and financial markets, forcing policymakers to pursue more expansionary policy accommodation.

A pressing question we have fielded from clients is whether the US is at greater risk of a recession in the event of a full-blown trade war with China. According to our Senior US Economist, Mike Bazdarich, a full-blown trade war with China would raise the risk of recession, but such a full-blown trade war is still highly unlikely. Much of what both sides have been doing is posturing: hitting at non-vital trade areas and leaving the more strategic trade interdependencies unharmed. Either or both countries might seriously “up the ante,” but both would suffer.

A trade war with Mexico would not tip the US into recession, either. That stated, the Trump Administration’s attempt to address the US border situation by threatening tariffs on Mexico is troublesome on two counts. First, the threat came shortly after progress on a renegotiation deal with Canada and Mexico. By threatening trade sanctions with Mexico so soon after negotiation of a successful trade deal with them, the Administration can be seen as doing exactly what China is often reputed to do: using a completed deal as a pretext for further negotiations rather than a firm basis on which to conduct business. Second, by mixing trade policy and immigration policy, the Administration is opening a potentially wide door through which trade negotiations have to be conducted, allowing for trade deal contingencies akin to “pork barrel” additions to Congressional legislation. Side demands during a negotiation will only complicate the chances of achieving the meaningful trade reforms that both sides profess to want.

Ultimately, while foreign trade is important, it is not a life-and-death aspect of the current US economy. So, it would take near-complete disruption of trade flows to threaten recession in the US. Our base case belief is that all sides will pull back before we reach such a point. However, in view of recent acrimony and actions on both US-China and US-Mexico trade issues, we cannot categorically rule out such an undesirable outcome.

On the subject of whether an escalation of tariffs could translate to higher inflation in the US, Portfolio Manager John Bellows argued in a recent blog post, Tariffs and Inflation: Not Particularly Worrisome, that while the initial round of tariffs will likely raise consumer prices, its effects are unlikely to be persistent and will likely have almost no impact on Federal Reserve (Fed) policy or long-term inflation. In analyzing how prices and quantities of “major appliances” responded to the 2018 tariffs on washing machines, Bellows notes that the tariff impact was short-lived, as inflation quickly fell back to pre-tariff levels. In fact, prices declined outright in March 2019, and in doing so returned to the pre-tariff pattern, which saw six straight years of price declines. The lack of follow-through on price inflation should not be all that surprising, as the tariff increases have not been repeated (for now) and tariffs have weighed on demand. This implies that there is unlikely to be much, if any, direct impact on the bond market. The more important considerations for the bond market will be any indirect impacts of tariffs, which could stem from changes in financial conditions or changes to the global growth outlook.

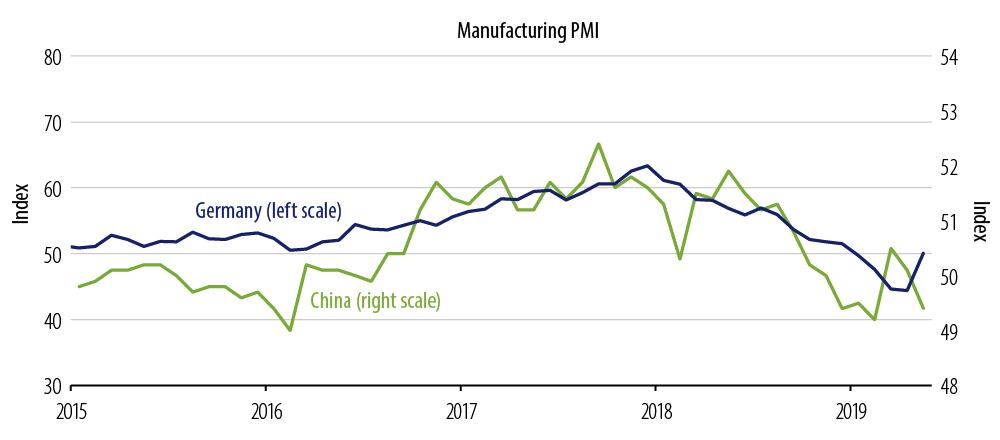

On that note, recent dovish pivots by central banks globally have helped to buffer the impact of existing tariffs and we would expect policymakers to unleash more expansionary measures if needed. So far, China has initiated a wide range of measures intended to stabilize the country’s growth momentum (e.g., reserve requirement cuts, value-added tax reductions, private sector credit programs, etc.). The Fed, the Bank of England and the Bank of Canada have all recently signaled that interest rates are likely to remain on hold while both the European Central Bank and the Bank of Japan telegraphed policy would stay accommodative for longer. More recently, the Reserve Bank of Australia cut its official interest rate to a new record low while the Reserve Bank of India delivered its third successive interest rate cut—in line with the dovish leanings observed across a growing number of emerging market (EM) central banks. We expect this supportive policy backdrop to help shore up business confidence and turn the global manufacturing cycle (led by Germany and China) that has been softening since early 2018 (Exhibit 2).

Regional Views

In the following, we provide our thoughts on the primary areas of focus dominating the discussion of a trade war with the US, China, North America (specifically Mexico) and Europe.

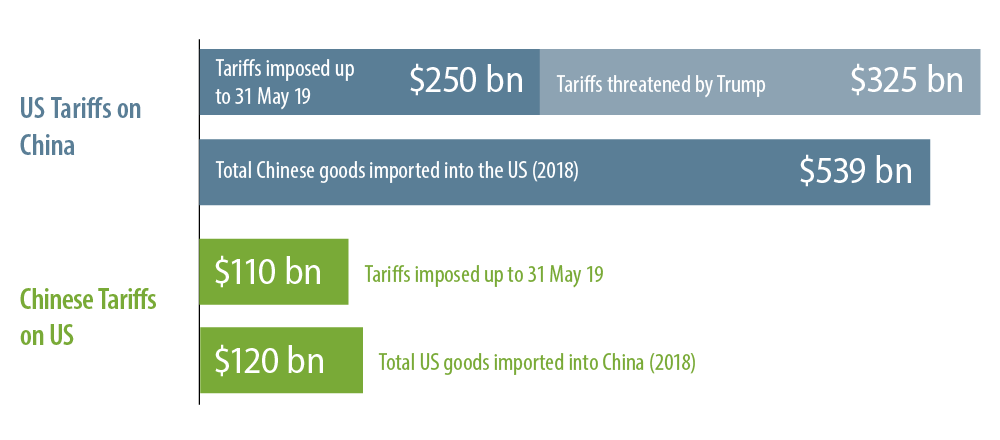

US-China

In a surprising development, the Trump Administration’s most recent tariff threats against China (raising tariffs on Chinese imports to 25% from 10%) have scuttled a trade deal that was to be announced on May 10. Proposed edits to the latest draft of the trade agreement were fraught with disagreements related to intellectual property protection and forced technology transfers. Also, it appears that a key sticking point in the trade negotiations was the US Administration’s insistence on its right to unilaterally re-impose tariffs were China to fail to deliver on its commitments. In our view, any resolution is now likely postponed until 2H19, which only serves to fuel uncertainty on global growth prospects. The Chinese authorities have policy tools at their disposal to navigate cyclical challenges, but these measures have to be weighed against secular constraints that point to a slower pace of expansion over the long run. Importantly, the ripple effects on neighboring Asian and EM countries will likely be felt in an environment that could turn more protectionist.

Europe

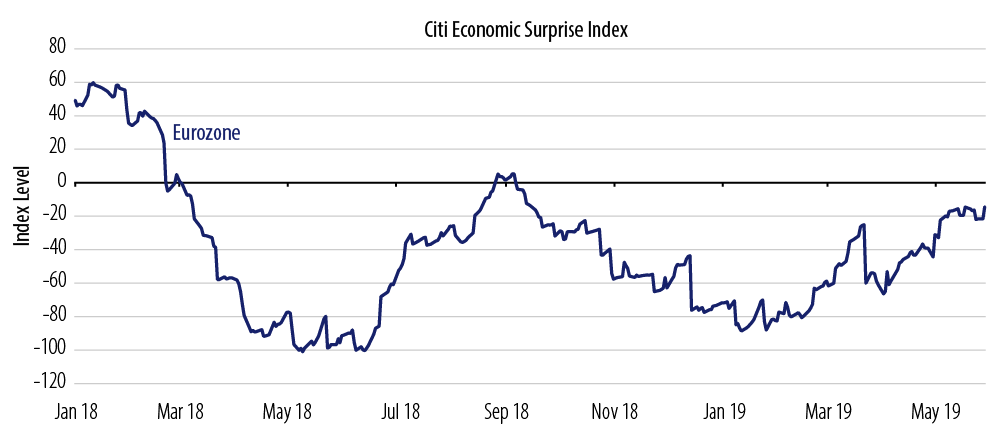

Turning to Europe, the US recently backed away from its threat to apply a 25% tariff on European auto imports by delaying the decision for another six months. While this decision represents a welcome reprieve for markets and the global growth outlook, the possibility of the US opening up a new front in the global trade war has only served to exacerbate the global manufacturing slowdown and weaken eurozone growth momentum given the region’s high export exposure. As highlighted in our recent paper Now Is Not the Time to Turn Bearish on Eurozone Growth, trade as a percentage of GDP is 47% in Germany compared with around 30% for the other three largest economies—Spain, Italy and France—and much higher than that of both China and the US. That stated, we are encouraged by the recent rebound in eurozone service PMI data, which enhances our confidence that the domestic economy will act as a buffer during this period of manufacturing weakness, the ECB’s stated commitment to providing policy accommodation to support the recovery and willingness to act should material downside growth risks emerge, and also by expectations of meaningful fiscal stimulus in 2019, the largest in a decade—led by Germany and France—which should lend further support to eurozone growth (Exhibit 4).

North America

In a surprise turn of events, the Trump Administration announced the imposition of a 5% tariff on all goods entering the US from Mexico effective June 10, and “gradual increases” until the flow of undocumented immigrants across the border is stopped. Tariffs would rise to 10% on July 1, 15% on August 1, 20% on September 1 and 25% by October 1 if Mexico were not to take sufficient action. This development contrasted with what appeared to be an earlier breakthrough as the US reached a deal to lift tariffs on steel and aluminum imports from Canada and Mexico, an agreement that would have put the three nations a step closer to finalizing the United States-Canada-Mexico Agreement (USMCA) in replacement of the 25-year old North American Free Trade Agreement (NAFTA).

While itself less significant than a US-China resolution, the completion of the USMCA would have helped business confidence and helped to avoid what could be a potential hit to Canada and Mexico. However, the surprise tariff threat against Mexico increases the uncertainty regarding a near-term ratification of the USMCA. It comes at a time when the Mexican and Canadian governments are presenting the USMCA to their governing bodies for ratification, and in advance of a push here in the US to consummate the deal.

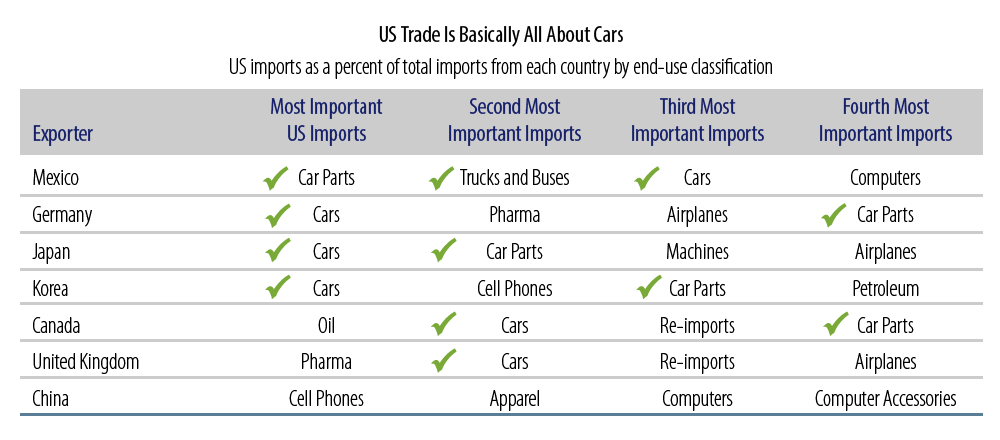

For Canada, the biggest factor impacting Canadian trade this past year has been pipeline capacity for crude oil production in Western Canada. The lifting of steel and aluminum tariffs was a welcome development but by itself would have only a modest stimulus effect for the national economy. For Mexico, an already challenging outlook (1Q19 contraction and recent ratings decisions by Moody’s and Fitch) now appears to have hit another stumbling block. Given the disruptive nature of tariffs across US and Mexican companies (specifically for the auto sector as highlighted in Exhibit 5), we suspect the US business community will be forceful on this issue as it was during the USMCA negotiations. Unlike the bipartisan hawkishness toward China in the US, there is bipartisan support for US-Mexico trade relations.

The View from the Frontline

As underscored in our last paper on this topic, Trade Wars in the 21st Century: Perspectives from the Frontline, the untested nature of a trade war across today’s sophisticated supply chains, the inability to model the degree of trade restrictions imposed worldwide, any monetary and fiscal stimuli subsequently adopted across countries, and the unpredictability of the latest news all render futile any attempts at quantifying industry-level impacts with any precision. Rather than embracing a (mostly abstract) top-down approach to assessing trade war risk, we believe aggregating views from an issuer-level perspective to identify industry-level vulnerabilities can be a useful and informative tool for investors. Exhibit 6 highlights our broad assessment of trade war vulnerability across all the major sectors. Since our last report, the list of sectors with a “high” risk rating has expanded to include capital goods and consumer products.

Staying Optimistic, Yet Cautious

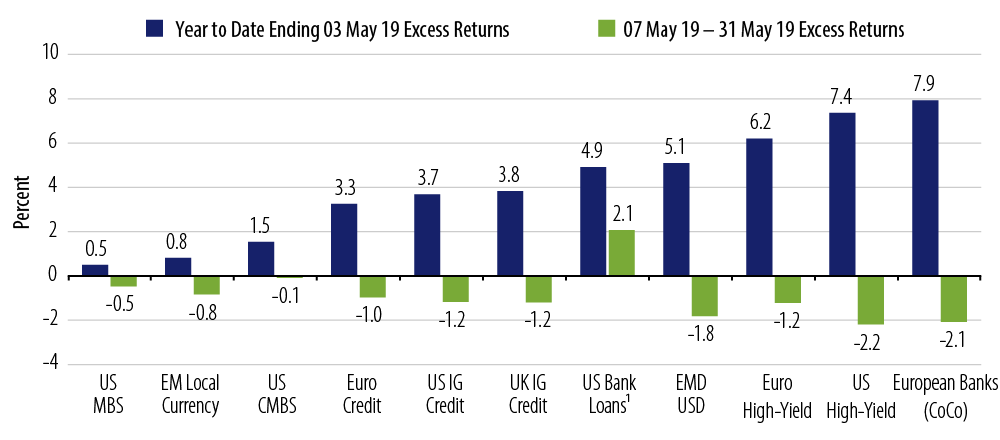

In his 2Q19 Market Commentary, Western Asset CIO Ken Leech noted that expectations for continued spread sector outperformance have been upended by the resurgence of “hard Brexit” fears, the Fed’s intransigence in changing its policy stance and a flare-up in trade war concerns that now threaten the global growth outlook. Indeed, prior to the Trump Administration’s threat to raise tariffs on China on May 5, 2019, the rally across global credit markets had been exceptional (Exhibit 7).

With the latest tariff threat against Mexico, the potential impact of a full-blown trade war on markets has become increasingly binary: on one hand, any surprise breakthrough or a negotiated détente on trade discussions would presumably provide some support for spread sectors. On the other, should the US put into place tariffs on remaining imports from China and then open new fronts in the global trade war, it is not unreasonable to expect a stronger US dollar in the short-term (which would roil EM countries), materially wider spreads across credit markets and lower developed market bond yields, as markets price in the prospect of weaker growth and inflation as well as more policy accommodation by the major central banks.

In this fragile environment, our sector teams globally remain vigilant in monitoring industry developments, revenue and margin trends, management sentiment, and valuations, then position their investments accordingly. Any decision to add or reduce exposure in the face of trade war-related risks remains driven very much by individual issuer views—the better diversified a company is geographically, by segment and in terms of supply chains, the more scope it has to address trade threats.

Based on our top-down view and bottom-up assessments of trade war risk, our broad market and dedicated investment-grade and high-yield credit portfolios maintain an overweight exposure to banks (with an emphasis on the strongest US and European banks across the capital structure given stable to improving fundamentals, benign technicals and attractive valuations), energy (focused mainly on US oil-directed E&P as well as pipeline and midstream credits) and metals & mining (principally copper-related names based on the fundamental backdrop)—all sectors that exhibit a lower sensitivity to tariffs—complemented by a long US duration position, as it remains the best diversifying hedge in a period of growing uncertainty.